Global Medical Tubing Market By Product (Polyvinyl Chloride, Silicone, Polycarbonates, and Other Products), By Application (Biopharmaceutical Laboratory Equipment, Bulk Disposable Tubing, Catheters, Drug Delivery Systems, and Other Applications), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Oct 2021

- Report ID: 13298

- Number of Pages: 351

- Format:

- keyboard_arrow_up

Medical Tubing Market Overview:

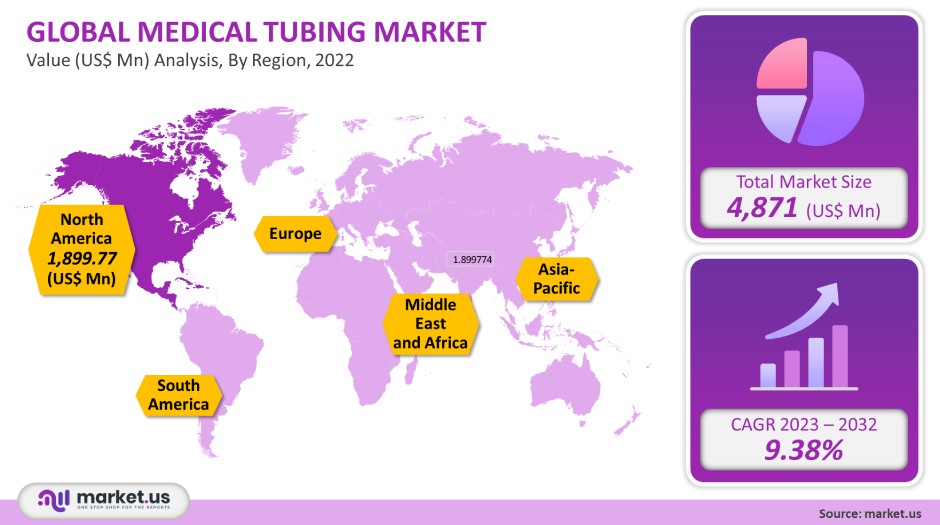

The global market for medical tubing was valued at USD 4,871 million in 2021. This market is expected to grow at a 9.38% CAGR, between 2023-2032.

Products will see a rise in demand due to the increasing incidences of respiratory diseases like lung cancer, asthma, and pneumonia. It is an integral component of respirators that allow for breathing.

A recent COVID-19 epidemic has seen an increase in hospitalizations, which led to high demand for products that can improve patient care. Medical tubing is an essential component of medical devices and is therefore highly sought after in ICUs.

Global Medical Tubing Market Analysis

Product Analysis

The Polyvinyl Chloride market segment dominated the market and represented more than 31% of the global revenue share for 2021. PVC-based medical products are in high demand because of the increasing acceptance of single-use, pre-sterilized medical equipment.

PVC can be sterilized by irradiation or ethylene oxide. PVC is transparent, biocompatible, and chemical-resistant. It is the preferred material for medical tube manufacturing.

The use of polyolefins in diameter medical tube devices is a common one. This requires materials that have both strength and flexibility. They can also be used in a variety of catheter applications such as dilators or lumen liners.

Silicone is expected to grow at 8.7% annually between 2023-2032, according to estimates. Silicone medical tubing is used to make feed tubes, medical implants, and catheters in areas where biocompatibility matters.

Silicone medical tubing is used extensively in medical devices because it offers sealing and fluid transfer properties that are not possible with other materials.

As they can be sterilized using most major methods such as electron-beam and gamma radiation, the demand for plastic carbonates continues to grow. This allows the device manufacturer a wide range of options for choosing the most cost-effective method for their product.

Application Analysis

In 2021, bulk disposable tubing dominated the market and accounted for a significant percentage of global revenue. Bulk disposables include surgical instruments and urological products. Over the forecast period, the segment will see significant growth due to increased focus on the prevention and treatment of infection in patients.

Catheters, which are made from medical-grade material, are narrow tubes that can be used in a variety of medical applications. They are used to treat or perform surgeries. Because of the increasing numbers of patients with chronic conditions, which require hospitalization, the demand has increased for catheters.

The segment of drug delivery systems is expected the most rapid CAGR, at more than 9%, between 2023 and 2032. Diverse types of drug delivery systems, including respiratory, injectable, or connected use medical tubes for drug delivery to the intended location.

Rapid growth is occurring in the demand for diagnostic equipment to detect and prevent disease early. The demand for blood collection tubes and pneumatic tubes is expected to be high over the forecast period. Over the forecast period, the market is expected to grow because of the constant supply of laboratory equipment.

Key Market Segments

By Product

- Polyvinyl Chloride

- Silicone

- Polycarbonates

- Fluoropolymers

- Polyolefins

- Other Products

By Application

- Biopharmaceutical Laboratory Equipment

- Bulk Disposable Tubing

- Catheters

- Drug Delivery Systems

- Other Applications

Market Dynamics

The COVID-19 disease spread quickly in the U.S. in 2020. This resulted in a significant increase in hospitalizations and a shortage of beds in clinics and hospitals. Due to the increasing incidence of COVID-19, a disease that affects the lungs and can cause pneumonia, there is a growing demand for medical tubing.

The rising awareness about hospital-acquired infections and increasing concerns regarding the spread of such diseases are expected to increase the demand for disposable medical products. The increasing number of partnerships and joint ventures among companies in the medical device industry is expected to increase the global reach for disposable medical devices, thereby boosting the market growth.

Because medical tubes are used in medical procedures such as angioplasty, endoscopy, and drug delivery, they have become smaller. For surgical instruments and fluid delivery devices, microtubes are an integral component. Medical tubing will continue to be competitive as there is great pressure on companies in this industry to produce high-quality products.

Plastics are used in medical tube production, including conduits for collecting biopsy samples and vascular catheters. Plastic medical tubes are becoming more popular in medical devices.

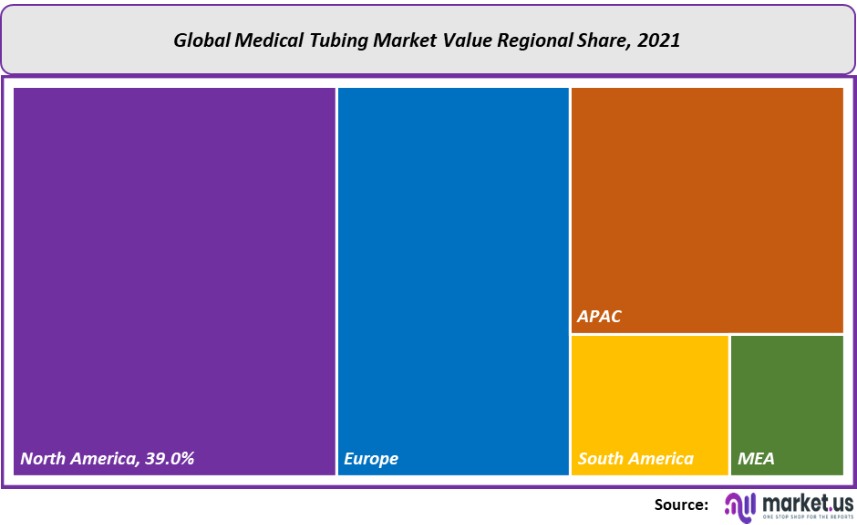

Regional Analysis

North America was the largest market in 2021, accounting for 39% of global revenue. North America is expected to continue its lead position in the future, due to the low U.S. R&D tax credit. Additionally, a variety of SMEs or large companies are promoting innovation in the healthcare industry to offer new treatments and devices as well as healthy lifestyles.

Europe’s established medical infrastructure and growing healthcare expenditures will drive product demand. Market growth is expected to be boosted by steady demand for diagnostic equipment and minimally invasive devices that use medical tubes. The Asia Pacific, however, is projected to be the fastest-growing regional market in the forecast period of 2023-2032.

This market growth can be attributed to the growing demand for better healthcare. Manufacturers of medical equipment have been forced to develop innovative ways to reach a broad range of patients.

The U.S. is transferring more medical technology into the Central & South American regions. This has led to a strong market. To encourage local manufacturing, Argentina has placed restrictions on the import of medical devices. This is expected to increase the growth potential for the local manufacturers.

Key Regions and Countries covered іn thе rероrt:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

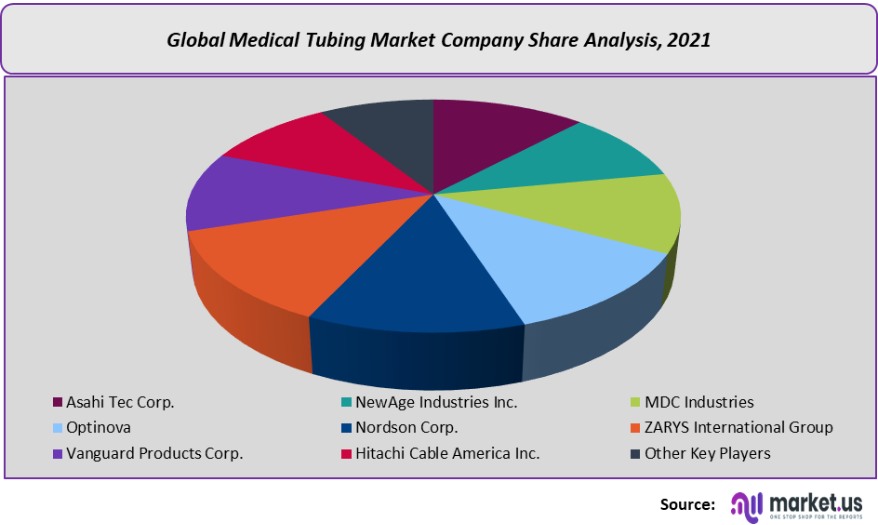

Market Share & Key Players Analysis:

Major manufacturers are now focusing their efforts on expanding or building new production facilities to meet the increasing demand for various healthcare applications. Optinova opened a new Pennsylvania manufacturing plant in November 2020. It covers 95,000 ft2 and features over 20 extrusion machines.

Manufacturers are also seeking to open service and applications offices in different locations worldwide in order to increase their customer base. Vanguard Products Corp. has opened an engineering support and applications office in China, which was done in order to expand its consumer base in the Asia Pacific.

Маrkеt Кеу Рlауеrѕ:

- Asahi Tec Corp.

- NewAge Industries Inc.

- MDC Industries

- Optinova

- Nordson Corp.

- ZARYS International Group

- Vanguard Products Corp.

- Hitachi Cable America Inc.

- Other Key Players

For the Medical Tubing Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

Q: What is the size of the Medical Tubing market in 2021?A: The Medical Tubing market size is estimated to be US$ 4,871 million in 2021.

Q: What is the projected CAGR at which the Medical Tubing market is expected to grow at?A: The Medical Tubing market is expected to grow at a CAGR of 9.38% (2023-2032).

Q: List the segments encompassed in this report on the Medical Tubing market?A: Market.US has segmented the Medical Tubing market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Product, market has been segmented into Polyvinyl Chloride, Silicone, Polycarbonates, Fluoropolymers, Polyolefins, and Other Products. By Application, the market has been further divided into Biopharmaceutical Laboratory Equipment, Bulk Disposable Tubing, Catheters, Drug Delivery Systems, and Other Applications.

Q: List the key industry players of the Medical Tubing market?A: Asahi Tec Corp., NewAge Industries Inc., MDC Industries, Optinova, Nordson Corp., ZARYS International Group, Vanguard Products Corp., Hitachi Cable America Inc., and Other Key Players are engaged in the Medical Tubing market.

Q: Which region is more appealing for vendors employed in the Medical Tubing market?A: North America is accounted for the highest revenue share of 39%. Therefore, the Medical Tubing industry in North America is expected to garner significant business opportunities over the forecast period.

Q: Name the key areas of business for Medical Tubing?A: The US, China, Japan, India, Brazil, Germany, UK, France, Italy, Spain, etc. are key areas of operation for Medical Tubing Market.

Q: Which segment accounts for the greatest market share in the Medical Tubing industry?A: With respect to the Medical Tubing industry, vendors can expect to leverage greater prospective business opportunities through the Polyvinyl Chloride Medical Tubing segment, as this area of interest accounts for the largest market share.

![Medical Tubing Market Medical Tubing Market]()

- Asahi Tec Corp.

- NewAge Industries Inc.

- MDC Industries

- Optinova

- Nordson Corp.

- ZARYS International Group

- Vanguard Products Corp.

- Hitachi Cable America Inc.

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |