Global Automotive Noise, Vibration & Harshness Materials Market By Product (Engineering Resins, Molded Rubber, Foam Laminates, Metal Laminates, Film Laminates, Molded Foam and Other products), By Application (Damping and Absorption), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Oct 2021

- Report ID: 13953

- Number of Pages: 349

- Format:

- keyboard_arrow_up

Automotive Noise and Vibration Market Overview:

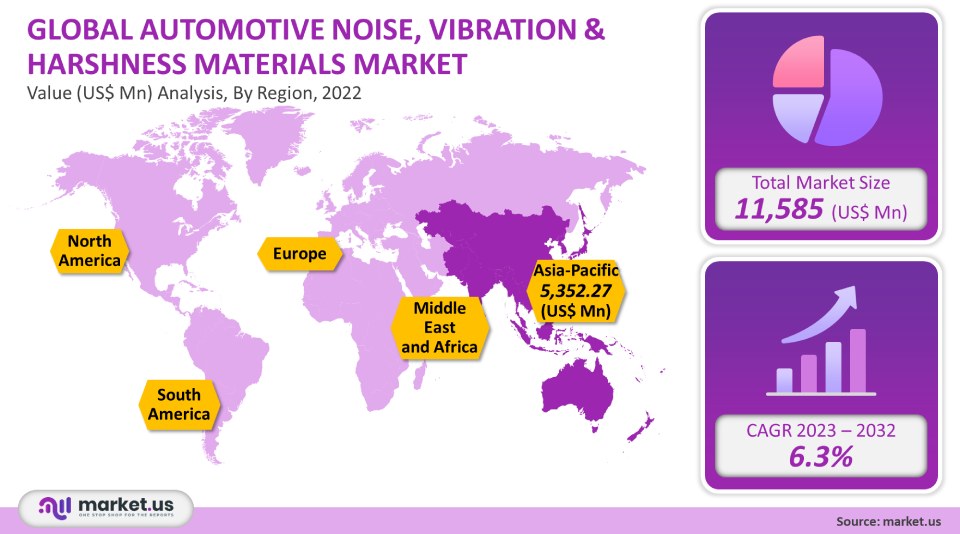

The global automotive noise and vibration market was worth USD 11,585 million in 2021 and is expected to grow at a CAGR of 6.3%. Globally, the key to market growth will be an increase in the production and usage of heavy and big commercial trucks in various end-use sectors.

Vibration, noise, and harshness can affect the durability of automobiles and cause passenger discomfort. These noises can also be reduced with the use of NVH reducer materials. Manufacturers are increasing their focus on noise control and acoustic management in passenger cars and commercial vehicles. This helps to improve the fuel economy, decrease cabin sounds, and increase durability. These are just a few of the many benefits that the product offers. The industry is expected to continue growing due to changes in consumer preference.

Global Automotive Noise, Vibration & Harshness Materials Market Scope:

Product analysis

Foam laminates were the dominant product category in 2021, accounting for 40% of total revenue. This category also experienced the fastest growth during the forecast period. In the coming nine years, the key driver for this segment’s growth is likely to be the increased use of foam laminates in passenger and commercial vehicles for floor and door insulation. A growing demand for foam laminates in the vehicle roof lining, cushioning and padding is expected to be a benefit, due to their lightweight and flexibility.

In terms of market income, the molded rubber product category came in second place to foam laminates for NVH reduction in automobiles. Due to the widespread usage of molded rubber for sealing and lining solutions, this market saw significant growth. The main factor driving expansion in this market over the projection period is the growing use of synthetic rubber goods for friction and noise absorption and damping due to their higher strength, flexibility, density, and high stability.

Film laminates accounted only for a tiny share of the market revenue. The segment is expected to grow at 4.4% per year over the forecast. Segment growth can be driven by increased use of film laminates on glass and windows for air-borne sound dampening. Additionally, this segment will benefit from the rising demand for accessorization to soundproof and improve car aesthetics.

Lightweight materials are used in automobiles to assist reduce overall vehicle weight, which improves vehicle durability and fuel efficiency even further. It is anticipated that the market demand for light-weight and thin foam laminates, films, molded rubber, and molded foam products for NVH reduction in automobiles will be driven by the presence of strict regulations and standards firm particular car weights, especially for commercial vehicles in Europe and North America.

Application Analysis

Due to the growing consumer awareness, there has been a paradigm shift in the product’s demand. In 2021, noise and friction absorption, which accounted for about 59 percent of total revenue, emerged as the leading application segment.

The usage of noise absorption products in automobiles has expanded due to the growing significance of a comfortable and quiet travel experience through the removal of cabin noises and frictions. Additionally, as consumer preferences shift toward equipping their vehicles with audio systems, there is a greater need for noise damping and absorption products in cars to improve the functionality of the audio systems. In the upcoming years, the aforementioned elements are anticipated to fuel category demand expansion. It is anticipated that India and China will account for greater consumption.

Кеу Маrkеt Ѕеgmеntѕ:

By Product

- Foam Laminates

- Metal Laminates

- Engineering Resins

- Molded Rubber

- Film Laminates

- Molded Foam

- Other products

By Application

- Damping

- Absorption

Market Dynamics:

The contribution of the global automobile industry to the world GDP is substantial. Its strong automotive sectors in major regions, including North America, Europe, Asia-Pacific, and Europe, are key drivers for growing automobile production. The increasing automobile sector, along with technological advancements, is responsible for the rapid increase in automotive NVH product sales.

The growing demand in emerging markets for automobiles due to rapid urbanization increased disposable incomes, and changing lifestyles directly affect the demand for noise control products in vehicles.The demand for aftermarket services has seen rapid growth in the past few years. This includes repairs & maintenance and replacement parts. The forecast period will see a rise in demand for these products due to the growing market for replacement automobile parts and accessories for soundproofing.

The industry’s growth is being driven by the introduction of active sound control systems in cars. These systems cater to changing consumer tastes towards safety and comfort as well as changing regulatory frameworks.The industry value chain includes raw materials suppliers, manufacturers converters distributors and end customers. The industry dynamics are dominated by converters. They provide final products like foam laminates or molded rubber parts and many other things. The industry participants sell the products to the customers directly by using their brands or to third-party retailers.

Regional Analysis:

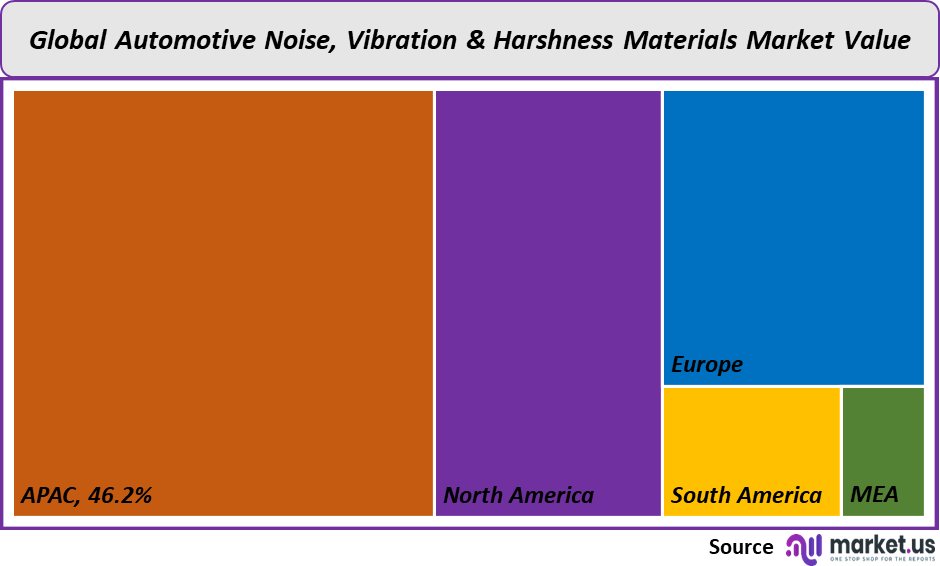

Nearly 46.2% of total market revenues in 2021 came from the Asia Pacific. In recent years, emerging economies such as India, Indonesia, and China have experienced strong and better economic growth. This region has seen a rising population and a higher living standard which has led to a greater demand for automobiles. Consumers prefer cars with higher ride quality and safety.

China stands as the largest producer of automobiles. It has seen significant urbanization due to its economic and industrial growth. The migration of rural people to urban areas has become a growing trend and is associated with higher incomes. A rise in the number of passenger cars has been due to changing lifestyles and higher disposable incomes.

North America was second only to Asia in terms of auto production growth, with a nearly 5% annual increase. The success of the industry is expected to be influenced by key domestic manufacturers and strict rules regarding fuel economy. In the future, product demand will be positively affected by a high supply of raw materials such as rubber and engineering polymers.

Key Regions and Countries covered іn thе rероrt:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Market Share & Key Players Analysis:

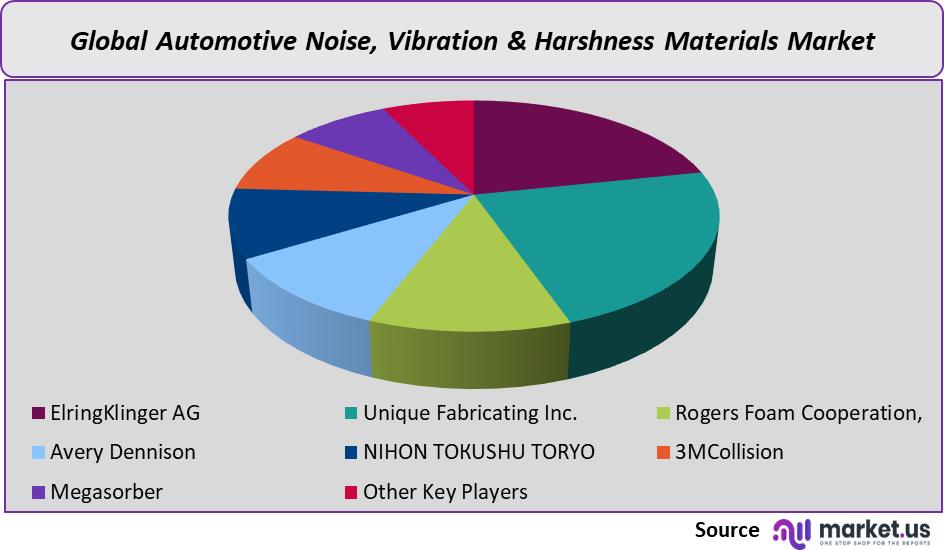

A large number of vendors in the automotive NVH market makes it highly competitive. There is also a high potential to differentiate prices and products. ElringKlinger AG. Unique Fabricating Inc Rogers Foam Cooperation Avery Dennison. These are the key industry participants.

For industry leaders to be competitive, key strategies include application development and customized products. These industry players are also executing mergers, and acquisitions, with the aim of diversifying their product, ranges and gaining market shares. These are the major players in the global Automotive Noise, Vibration & Harshness Materials industry.

Маrkеt Кеу Рlауеrѕ:

- ElringKlinger AG

- Unique Fabricating Inc.

- Rogers Foam Cooperation,

- Avery Dennison

- NІНОN ТОКUЅНU ТОRYО

- 3МСоllіѕіоn

- Меgаѕоrbеr

- ЅТР

- Неnkеl

- Nіttо Dеnkо Соrр

- Other Key Players

For the Automotive Noise, Vibration & Harshness (NVH) Materials Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

Q: What is the size of the Automotive Noise, Vibration & Harshness Materials market in 2021?The Automotive Noise, Vibration & Harshness Materials market size is US$ 11,585 million in 2021.

Q: What is the projected CAGR at which the Automotive Noise, Vibration & Harshness Materials market is expected to grow at?The Automotive Noise, Vibration & Harshness Materials market is expected to grow at a CAGR of 6.3% (2023-2032).

Q: List the segments encompassed in this report on the Automotive Noise, Vibration & Harshness Materials market?Market.US has segmented the Automotive Noise, Vibration & Harshness Materials market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Product, market has been segmented into Molded Rubber, Metal Laminates, Foam Laminates, Film Laminates, Molded Foam, Engineering Resins and Other products. By Application, the market has been further divided into Absorption and Damping.

Q: List the key industry players of the Automotive Noise, Vibration & Harshness Materials market.ElringKlinger AG, Unique Fabricating Inc., Rogers Foam Cooperation, Avery Dennison, NІНОN ТОКUЅНU ТОRYО, 3МСоllіѕіоn, Меgаѕоrbе and Other Key Players, are the key vendors in the Automotive Noise, Vibration & Harshness Materials market

Q: Which region is more appealing for vendors employed in the Automotive Noise, Vibration & Harshness Materials market?APAC accounted for the highest revenue share of 46.2%. Therefore, the Automotive Noise, Vibration & Harshness Materials industry in APAC is expected to garner significant business opportunities over the forecast period.

Q: Name the key areas of business for Automotive Noise, Vibration & Harshness Materials?The US, China, Japan, India, Brazil, Germany, UK, France, Italy, Spain, etc., are key areas of operation for Automotive Noise, Vibration & Harshness Materials Market.

Q: Which segment accounts for the greatest market share in the Automotive Noise, Vibration & Harshness Materials industry?With respect to the Automotive Noise, Vibration & Harshness Materials industry, vendors can expect to leverage greater prospective business opportunities through the foam laminates from product segment, as this area of interest accounts for the largest market share.

![Automotive Noise, Vibration & Harshness (NVH) Materials Market Automotive Noise, Vibration & Harshness (NVH) Materials Market]() Automotive Noise, Vibration & Harshness (NVH) Materials MarketPublished date: Oct 2021add_shopping_cartBuy Now get_appDownload Sample

Automotive Noise, Vibration & Harshness (NVH) Materials MarketPublished date: Oct 2021add_shopping_cartBuy Now get_appDownload Sample - ElringKlinger AG

- Unique Fabricating Inc.

- Rogers Foam Cooperation,

- Avery Dennison

- NІНОN ТОКUЅНU ТОRYО

- 3МСоllіѕіоn

- Меgаѕоrbеr

- ЅТР

- Неnkеl

- Nіttо Dеnkо Соrр

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |