Global Meat Substitutes Market By Source (Plant-based Protein, Soy-based, Mycoprotein, and Other Sources), By Distribution Channel (Retail and Foodservice), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Oct 2021

- Report ID: 14305

- Number of Pages: 262

- Format:

- keyboard_arrow_up

Meat Substitutes Market Overview

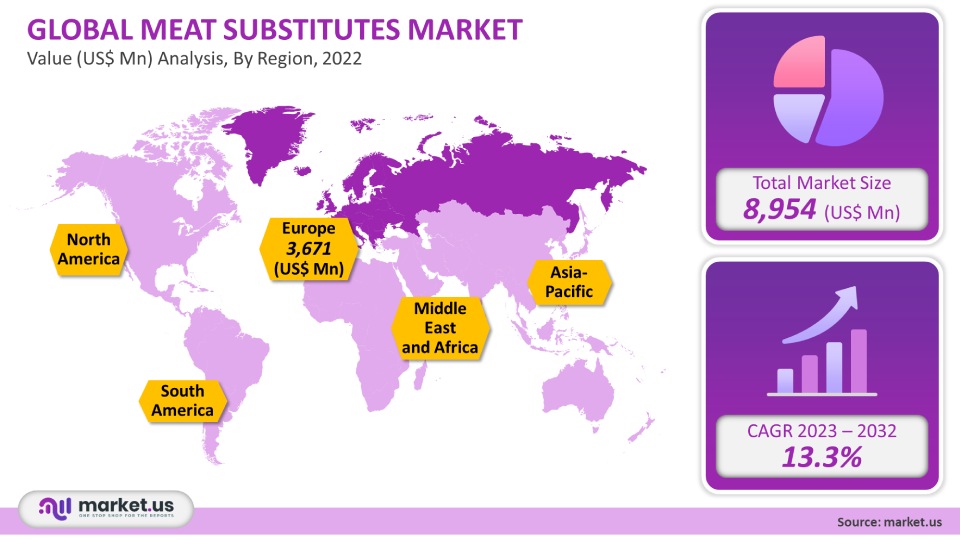

The valuation of the global meat substitutes market was USD 8,954 million in 2021. This market is expected to grow at a CAGR of 13.3% between 2023-2032. Because of its negative impact on the environment and animal welfare, intensive animal husbandry is being criticized by certain sections of society. There have been diets that restrict or eliminate animal products. This should help to expand the market for meat replacements. Due to the rising awareness of consumers about their health, the COVID-19 epidemic has dramatically impacted traditional meat consumption.

Global Meat Substitutes Market Analysis

Source Analysis

In 2021, 36% of revenue was held by the plant-based protein category. This trend is expected to continue over the forecast period. The growth of this market is due to a shortage of meat in different parts of the world, environmental issues, and a desire for healthier eating habits. For daily protein, plant-based patties are a great option. Well-heeled young people and wellness seekers are driving this trend. Plant protein and mycoprotein products have the same texture, taste, and nutritional characteristics as meat but are made from non-animal sources. To increase their functionality, target plant proteins are hydrolyzed from plants. Plant protein is combined with other components like flour, food adhesives, and plant-based oils for a meat texture. The price of protein inputs for plant-based meat is reasonable and plentiful. The market is dominated by meat substitutes made with plant-based protein sources.

Mycoprotein will see the highest CAGR between 2023-2032. Consumers prefer mycoprotein food because it contains more nutrients such as fiber which can help control blood sugar and cholesterol. Mycoprotein also makes you feel fuller than animal proteins such as chicken. This helps prevent weight gain and excess eating. Mycoprotein is also rich in essential amino acids and rare in other protein sources. Quorn is a mycoprotein brand that offers high-protein, healthy meals. The only meat options for vegetarians and vegans were mushrooms, cottage cheese, and soya pieces. The versatility and texture of jackfruit have made it a popular newcomer to the market. Jackfruit is often referred to by its unique characteristics as a superfood for its numerous nutritional benefits. Wakao Foods in India has been serving jackfruit-based burger patties and stir-fries for meat-eaters.

Distribution channel Analysis

The retail segment accounted for a significant revenue share in 2021. This includes all retail outlets, including supermarkets, convenience stores, hypermarkets, departmental stores, mini-markets, and supermarkets. These stores offer discounts and other offers that consumers love. Most of these brands launch their products through major supermarket chains such as Walmart and Target to reach maximum consumers. Between 2023 and 2032, the CAGR for food service is 8%. This includes outlets such as restaurants, hotels, or lounges. There have been lockdowns all over the globe due to the COVID-19 epidemic.

These channels have resulted in a decrease in sales. The reopening and socialization of economic activities worldwide, which focuses on parties and socializing, will likely boost sales through these distribution channels. Global food service is driven by the increasing demand for customized and innovative food menu options. Consumers can customize their meals according to their financial, dietary, and taste preferences.

There is a huge demand for plant proteins. Many retailers offer plant-based protein products, and many restaurants have introduced plant-protein menu innovations. All consumers, vegetarians, non-vegetarians, and flexitarians worldwide are enthusiastic about innovative products like meat-like plant protein hamburgers or plant-based meal kits. The enthusiastic response of manufacturers to this trend benefits consumers in two ways. First, availability and price obstacles decrease as more plant-based protein products are sold in specialty, conventional supermarkets, and foodservice outlets.

Key Market Segments

By Source

- Plant-based Protein

- Soy-based

- Mycoprotein

- Other Sources

By Distribution Channel

- Retail

- Foodservice

Market Dynamics

Consumers have been less inclined to consume animal products due to the increased risk of animal-borne disease. Consumer awareness about plant-based meat substitutes is growing rapidly. This is due to their health benefits, such as preventing digestive issues, non-communicable illnesses, obesity, and other ailments. Consumers are becoming more cautious about their health because of increased obesity and other diseases like diabetes and heart disease. This is expected to increase the demand for meat substitutes.

Global demand for products derived from plants is driven by consumer awareness. The health benefits associated with cholesterol-free protein are another important factor driving the growth of these products across different regions. Two things have contributed to the enormous growth of the market for meat substitutions: customer concerns and the ability of producers to produce meat alternatives with superior flavor, texture, or mouthfeel. Gen Z and Millennials drive demand for this industry. This is often fueled by concerns for animal welfare and climate change. This category has seen many manufacturers partner with brands.

In December 2021, Next Meats partnered with Vegan Meat India to introduce meat-free products. The diverse product range offers consumers more variety and new flavors while meeting their dietary needs. For many reasons, consumers who aren’t vegetarians or vegans are now exploring plant-based alternatives, such as better nutrition, body management, and animal welfare.

Customers are looking for trusted third-party certificates on packages. Producers of meat substitutes offer products that have transparent labels. This labeling shows whether the product is non-GMO, gluten-free, or vegan. The market for meat substitutes will expand because of increasing consumer demand for plant-based products and substantial investment in new product innovation.

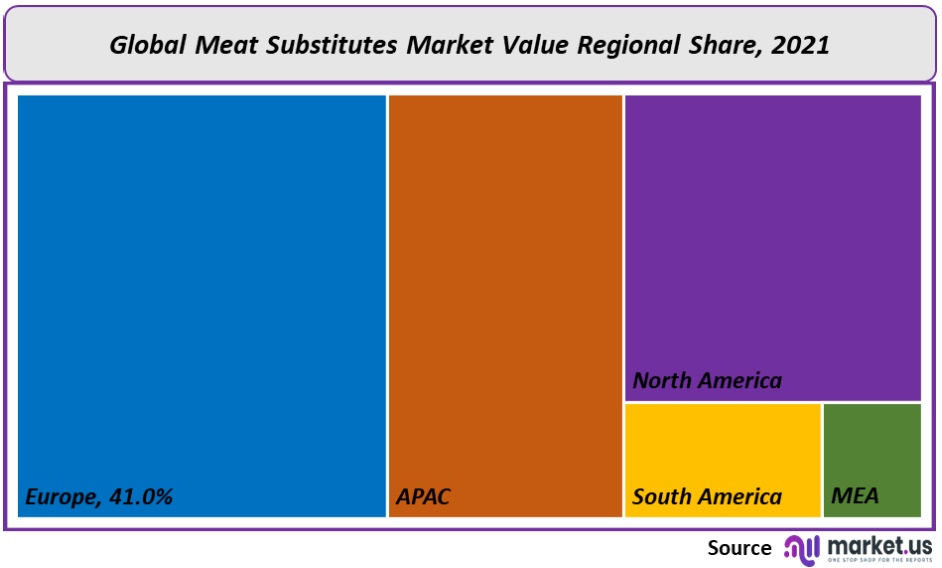

Regional Analysis

Europe was the market leader in meat substitutes, accounting for 41% of the total revenue share in 2021. Both young and old consumers are putting a lot of demand on the region. This is due to an increasing vegan and flexitarian population and increased awareness about animal welfare. The rise of well-known processors has made it possible for Germans to consume meat substitutes on par with Americans. McDonald’s, a major player in the meatless market, has partnered with Nestle to provide a vegan hamburger in Germany.

The Asia Pacific is expected to see an 8.2% increase in the demand for meat substitutes between 2023-2032. Australia and China account for the largest part of this region. These countries are seeing an increase in such products because of their health consciousness and social media influence. As people shift from animal protein to a more plant-based diet, the demand for high-quality substitutes has skyrocketed. Previously, vegan and vegetarian alternatives were limited and often made with unhealthy, highly processed ingredients. The COVID-19 pandemic has made Asian consumers more concerned about food safety and health. They are changing their diets to lead healthier and more sustainable lives. Asia offers a lot of potential for tasty, new foods that customers will want as their first choice.

Key Regions and Countries covered іn thе rероrt:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

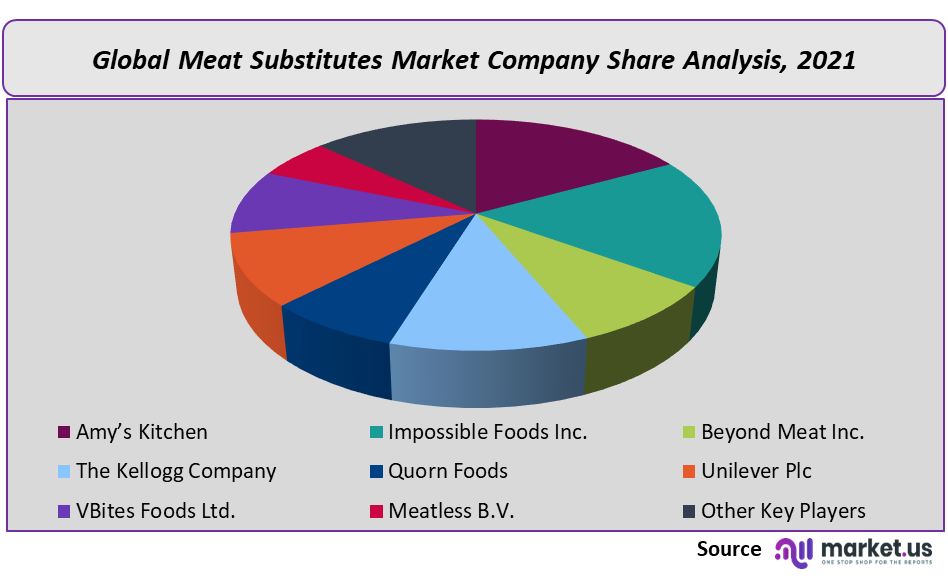

Market Share & Key Players Analysis:

The market for meat replacements is dominated by companies specializing in meat substitutes. It is still developing, and there are new entrants to the market. Other key players in this market plan to launch their products because of rising animal-borne disease rates. These are just a few of the many initiatives that were taken.

Next Meats Japan, based in Japan, joined forces with Vegan Meats India, an Indian food tech startup, to launch meat replacements in India. The company will set up a manufacturing plant and a laboratory in India. ITC Ltd, for instance, launched plant-based meat products in India in December 2021 in anticipation of the growing demand for vegetarian and vegan food options in India. KFC launched Beyond Fried Chicken, a range of plant-based meats in different locations worldwide, in January 2022.

Маrkеt Кеу Рlауеrѕ:

- Amy’s Kitchen

- Impossible Foods Inc.

- Beyond Meat Inc.

- The Kellogg Company

- Quorn Foods

- Unilever Plc

- VBites Foods Ltd.

- Meatless B.V.

- Other Key Players

For the Meat Substitutes Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

What is the size of the Meat Substitutes Market in 2021?The Meat Substitutes Market size is US$ 8,954 million in 2021.

What is the projected CAGR at which the Meat Substitutes Market is expected to grow at?The Meat Substitutes Market is expected to grow at a CAGR of 13.3% (2023-2032).

List the segments encompassed in this report on the Meat Substitutes Market?Market.US has segmented the Meat Substitutes Market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Source, the market has been further divided into Plant-based Protein, Soy-based, Mycoprotein, and Other Sources. By Technology, the market has been further divided into RFID and Barcode. By Distribution Channel, the market has been further divided into Retail and Foodservice.

List the key industry players of the Meat Substitutes Market?Amy’s Kitchen, Impossible Foods Inc., Beyond Meat Inc., The Kellogg Company, Quorn Foods, Unilever Plc, VBites Foods Ltd., Meatless B.V., and Other Key Players are engaged in the Meat Substitutes market.

Which region is more appealing for vendors employed in the Meat Substitutes Market?Europe is expected to account for the highest revenue share of 41%. Therefore, the Meat Substitutes industry in Europe is expected to garner significant business opportunities over the forecast period.

Name the key areas of business for Meat Substitutes?The US, India, China, Canada, UK, Japan, & Germany are key areas of operation for the Meat Substitutes Market.

Which segment accounts for the greatest market share in the Meat Substitutes industry?With respect to the Meat Substitutes industry, vendors can expect to leverage greater prospective business opportunities through the plant-based protein segment, as this area of interest accounts for the largest market share.

![Meat Substitutes Market Meat Substitutes Market]()

- Amy’s Kitchen

- Impossible Foods Inc.

- Beyond Meat Inc.

- The Kellogg Company

- Quorn Foods

- Unilever Plc Company Profile

- VBites Foods Ltd.

- Meatless B.V.

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |