Global Agricultural Adjuvants Market By Type (Activator Adjuvants and Utility Adjuvants), By Application (Herbicides, Insecticides, Fungicides, and Others), By Crop (Cereal & Grains, Oilseeds & Pulses, Fruits & Vegetables, and Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Oct 2021

- Report ID: 14787

- Number of Pages: 254

- Format:

- keyboard_arrow_up

Agricultural Adjuvants Market Overview:

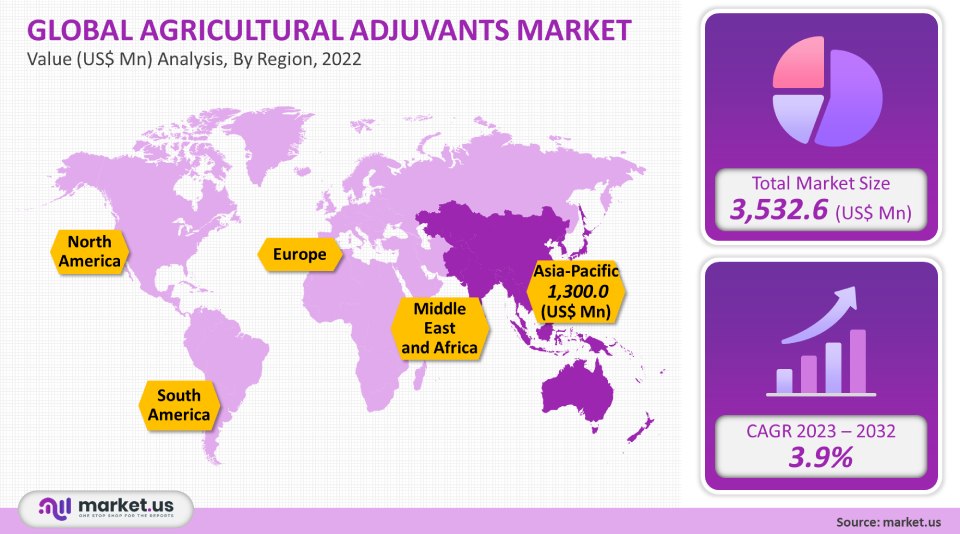

Global market for agricultural adjuvants was valued at USD 3,532.6 million in 2021. The market is forecast to grow at a compound annual growth rate (CAGR) of 3.9% between 2023-2032.

Global Agricultural Adjuvants Market:

Type Analysis

The global market share for agricultural adjuvants in 2021 was 70% led by the activator adjuvants category. Due to their availability and low cost, they are often used extensively in agrochemicals.

These activator adjuvants can be surfactants and oil carriers. Surfactants are most often recommended adjuvants to herbicides, mainly for water-soluble and systemic herbicides.

Because of the increased use of pesticides to reduce unwanted things in the cropland, the utility adjuvants segment will grow at a 3.5% CAGR over the forecast period. There are many types available depending on the purpose of the utility adjuvant. There are several key utility adjuvants, including compatibility agents. Drift control agents, buffering, and water conditioning agents.

Application Analysis

In 2021, 48.6% of global revenue was contributed by herbicides to the market for agricultural adjuvants. In the agricultural sector, herbicides are a common pesticide. They can be used for controlling weeds, as well as other undesirable plants. FAO reports that more than 2,000,000 tons of herbicides were used worldwide in 2019.

Insecticide sales are expected to increase at a rate of 4.7% during the forecast period. This is due to increased demand for many crops like cereals, grains, and fruits. They have been proven to be effective in preventing pest attacks from early germination in many crops.

Crop Analysis

Globally, 38.9% of agricultural adjuvants revenue was contributed by the cereal and grains market. Cereals are the most popular crop class, with the majority of them being consumed in the Asia Pacific. There is a growing need for agricultural adjuvants due to the rising consumption of cereals and grains, including wheat, rye corn, oats, and sorghum in other regions. Agrochemicals, as well as non-ionic surfactants, should be used for grains and cereals.

Over the forecast period, fruits and vegetable sales are expected to grow at a 4.9% annual growth rate. This can be attributed to the increased demand for fresh vegetables in the global market due to increasing health consciousness. The Horticultural Statistic at A Glance 2018 reports that fruit production increased from 74.9 million tons to 97.4 million tons from 2010-11 to 2017-18. The production of vegetables also increased from 133.7 million tons to 184.4 million tons between 2010-11, 2017-18.

Key Market Segments:

Type

- Activator Adjuvants

- Utility Adjuvants

Application

- Herbicides

- Insecticides

- Fungicides

- Others

Crop

- Cereal & Grains

- Oilseeds & Pulses

- Fruits & Vegetables

- Others

Market Dynamics:

This market growth is expected to be driven primarily by the increasing demand for effective insecticides around the world. The demand for agricultural adjuvants has also increased due to the increasing use of pesticides in agriculture to increase crop yield and productivity. Different types of adjuvants can be combined with pesticides for various purposes, including increased pesticide penetration, better wetting, and better retention.

A major driver of the market for agricultural adjuvants is the increasing demand for food products and beverages worldwide. The market is driven by farmers who are trying to increase their crop yields and produce more food. Because adjuvants contain chemicals and Petrochemicals, they can go through various chemical processes that produce toxic gases and wastes. While adjuvants can be beneficial to crops, they can have adverse effects when consumed.

Various regulatory authorities, including the Registration, Evaluation, Authorization, and Restriction for Chemicals (REACH) and Environmental Protection Agency (EPA), address them by mapping and monitoring toxicity emissions within acceptable levels. Markets are primarily restricted by the regulations on agricultural adjuvants that are imposed by different authorities in different countries. From 2005 to 2017, Brazil’s regulation of adjuvants was identical to that for agrichemicals, which was regulated under Law 7,802 and Decree 4,074. The Ministry of Agriculture, Livestock and Supply is now addressing Brazil’s problem with agricultural adjuvants.

Green adjuvant demand is expected to rise in the near future. The growth of green adjuvants is due to consumers’ growing focus on health and well-being. In the U.S., consumers are increasingly inclined to eat organically produced food. Companies are working to develop bio-based, eco-friendly adjuvants, such as modified vegetable oils, organo-modified Siloxanes, and methylated Seed Oil, among other things.

Regional Analysis:

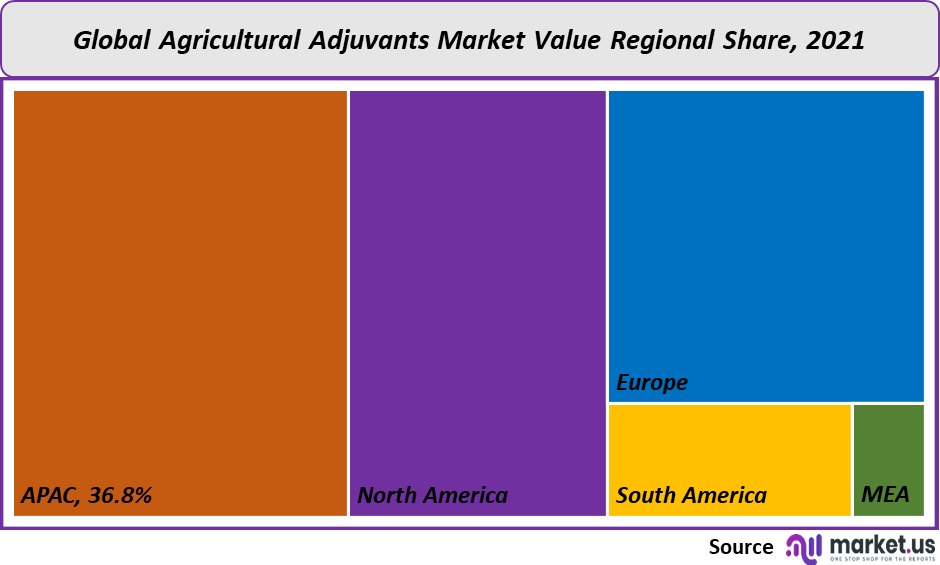

The Asia Pacific dominated global agricultural adjuvants markets and held a 36.8% share in global revenue for 2021. This was due to many factors such as increasing demand for improved crops, rising population, and the presence of large arable countries. The agricultural sector is the main driver of the region’s per capita income. The area’s total arable surface is shrinking due to increased urbanization and industrialization. Agriculturists, therefore, choose agrochemicals that increase yield and productivity. Major contributors to regional market expansion are China, India, and Japan.

According to the Organization for Economic Co-operation and Development and Food and Agricultural Organization, Asia Pacific is the world’s largest producer of agricultural commodities. Up to 53% of the world’s agricultural products and fish production will come from the Asia Pacific by 2032.

North America is projected to expand at a revenue-based growth rate of 2.7% over the forecast time. This can be explained by the increased focus on agriculture activities in countries like Canada and the U.S. It is expected that the adoption of new techniques, such as precision farms, will increase the demand in the region for agrochemicals.

Key Regions and Countries covered іn thе rероrt:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

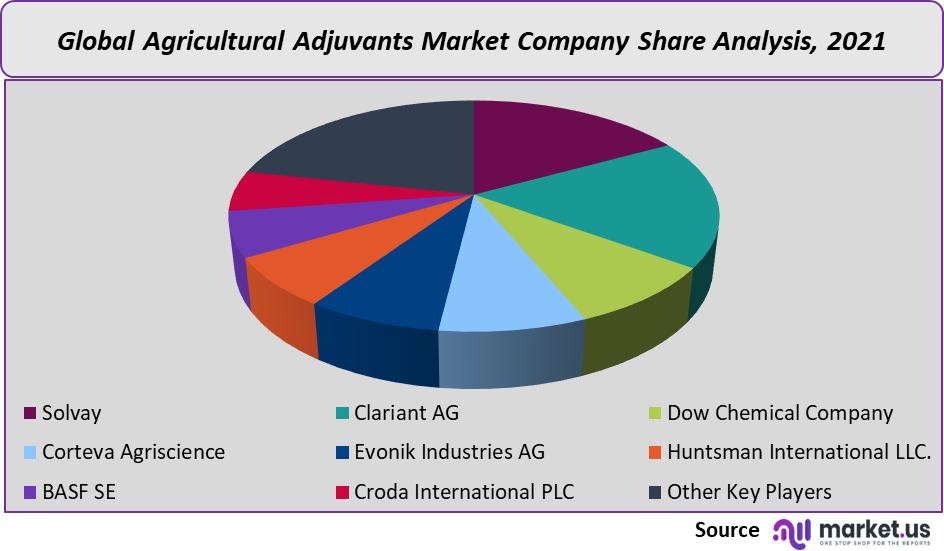

Market Share Analysis:

Because of the large number of local and Tier-I players, the market for agricultural adjuvants can be highly competitive. There are many manufacturers in this market that offer agricultural adjuvants. These include utility and activity adjuvants. They can be used for a variety of applications like herbicides or insecticides. There are many factors that influence the market’s competitiveness, including product quality, innovation, sustainability, and corporate reputation.

The key strategies of market players are innovation, product launches, geographic expansion, expansion of distribution networks, joint ventures, and mergers & acquisitions. These strategies help them to increase their market share and strengthen their market position. Clariant AG, for example, launched NBP in May 2020. It is a new formulation of polar aprotic solvent to be used in agricultural adjuvants Genagen formulations.

Key Market Players:

The market leader in agricultural adjuvants is:

- Solvay

- Clariant AG

- Dow Chemical Company

- Corteva Agriscience

- Evonik Industries AG

- Huntsman International LLC.

- BASF SE

- Croda International PLC

- Other Key Players

For the Agricultural Adjuvants Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

Q: What is the size of the Agricultural Adjuvants market in 2021?The Agricultural Adjuvants market size was US$ 3,532.6 million in 2021.

Q: What is the projected CAGR at which the Agricultural Adjuvants market is expected to grow at?The Agricultural Adjuvants market is expected to grow at a CAGR of 3.9% (2023-2032).

Q: List the segments encompassed in this report on the Agricultural Adjuvants market?Market.US has segmented the Agricultural Adjuvants market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Type, market has been segmented into Activator Adjuvants and Utility Adjuvants. By Application, the market has been further divided into Herbicides, Insecticides, Fungicides, and Others. By Crop, market has been segmented into Cereal & Grains, Oilseeds & Pulses, Fruits & Vegetables, and Others.

Q: List the key industry players of the Agricultural Adjuvants market?Solvay, Clariant AG, Dow Chemical Company, Corteva Agriscience, Evonik Industries AG, Huntsman International LLC., BASF SE, Croda International PLC, and Other Key Players engaged in the Agricultural Adjuvants market.

Q: Which region is more appealing for vendors employed in the Agricultural Adjuvants market?Asia Pacific is accounted for the highest revenue share of 36.8%. Therefore, the Agricultural Adjuvants industry in Asia Pacific is expected to garner significant business opportunities over the forecast period.

Q: Name the key areas of business for Agricultural Adjuvants?U.K., Italy, China, Japan, India, Australia, Brazil, and Argentina are key areas of operation for Agricultural Adjuvants Market.

Q: Which segment accounts for the greatest market share in the Agricultural Adjuvants industry?With respect to the Agricultural Adjuvants industry, vendors can expect to leverage greater prospective business opportunities through the activator adjuvants segment, as this area of interest accounts for the largest market share.

![Agricultural Adjuvants Market Agricultural Adjuvants Market]() Agricultural Adjuvants MarketPublished date: Oct 2021add_shopping_cartBuy Now get_appDownload Sample

Agricultural Adjuvants MarketPublished date: Oct 2021add_shopping_cartBuy Now get_appDownload Sample - Solvay

- Clariant AG Company Profile

- Dow Chemical Company

- Corteva Agriscience

- Evonik Industries AG

- Huntsman International LLC.

- BASF SE Company Profile

- Croda International PLC

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |