Global Furfural Market By Process (Chinese Batch Process, Quaker Batch Process, and Rosenlew Continuous Process), By Raw Material (Sugarcane bagasse, Corn cob, Rice husk, and Sunflower hull), By End-use (Pharmaceuticals, Agriculture, Food & Beverage, Paints & Coatings, and Refineries), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Oct 2021

- Report ID: 14818

- Number of Pages: 378

- Format:

- keyboard_arrow_up

Furfural Market Overview

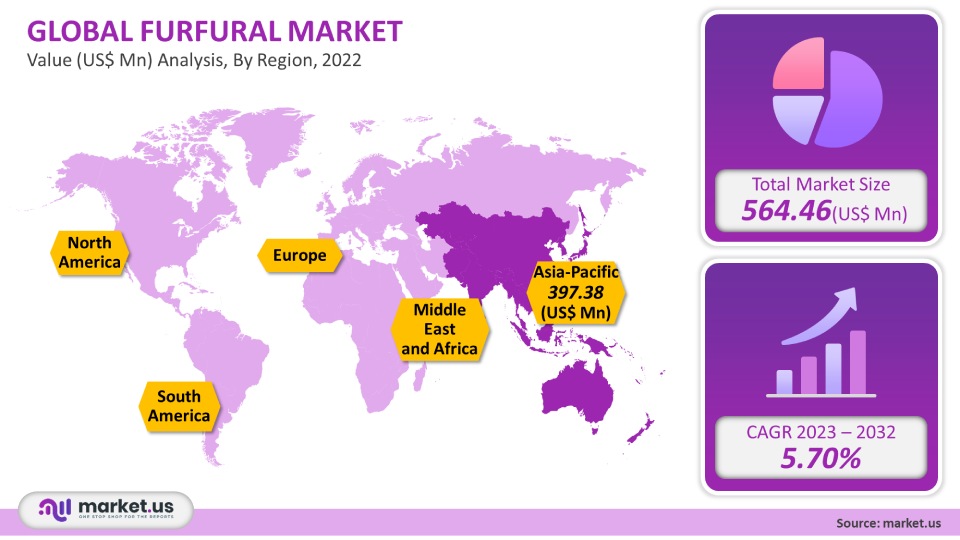

The global furfural market accounted for US$ 564.46 million in 2021. It is projected to grow at a CAGR of 5.70% between 2023 to 2032. Environmental concerns are likely to develop, increasing demand for solvent applications. Due to the COVID-19 pandemic, the market saw a decline in 2020. Due to social distancing and lockdowns, there was a decrease in production. Furfural production was also affected by disruptions in the supply chain and logistic facilities.

Global Furfural Market Scope:

Process analysis

The global market can be further divided by processes into the Quacker batch, Chinese batch, Rosenlew continuous, and Chinese batch processes. The largest process segment, the Chinese batch process, accounted for 83% of global revenue in 2021. This process is a major part of China’s manufacturing sector. While the Quaker batch process may be the oldest, others are modified versions. The main distinction between the Rosenlew continuous process and the Quaker batch process is the employment of sulfic acid as a catalyst in the former process while not being necessary for the latter. The Rosenlew continuous process, which is simple and requires little maintenance, is also the most reliable. This process is not recommended for small and medium-sized manufacturers. It uses large quantities of steam and has low production yields, leading to high production costs. Because it is cheap, most Chinese batch processes are preferred by manufacturers.

Raw Material analysis

The global market can be divided into several segments based on raw materials. These include corncob and sugarcane bagasse. With a share of more than 71.3%, the corncob raw material segment led the global market in 2021. Because of its extensive use in furfural production, it is expected to maintain its dominant position for the next few years. Corncob has the highest yield, making it the most desired raw material for production. Corncob can also be used as a biomass feedstock to create renewable energy.

Sugarcane bagasse can be a significant byproduct of the agro-industrial sector. Sugarcane bagasse is easily available at a low price in many sugarcane-processing facilities, such as sugar mills or independent distilleries. The high sugarcane production in Brazil, India, China, Thailand, Thailand, Thailand, and Pakistan means a lot of bagasse available in these countries. You can use a gas-fired boiler to increase bagasse production in sugar mills. Bagasse storage is complicated and expensive. A furfural unit should be placed near a sugar mill.

End-use analysis

The global market can be further divided by end uses into paints & coatings and pharmaceuticals. Food & beverages, agriculture, paints and coatings, pharmaceuticals, and food & drink are all examples. Refineries held a dominant market share in revenue, with more than 51.01% in 2021. Its high use as a solvent in petroleum refineries, specialty adhesives, and Lubricants is responsible for this high market share. Furfural is widely used in the agrochemical sector as an insecticide, nematicide, and fungicide. It is an active ingredient of many nematicides, such as crop protectors and guards. It is also used in horticulture as a weed killer.

It is a contact insecticide that is mechanically incorporated into the soil or moved during irrigation. It can be used in relatively low concentrations. It is an agrochemical and relatively harmless. Furfural is used in the synthesis and construction of pharmaceutical building blocks. The Drug Products Database lists Furfural as an active ingredient in veterinary medicines. Due to high investment and growing production, the demand for many health products will increase.

Кеу Маrkеt Ѕеgmеntѕ

By Process

- Chinese Batch Process

- Quaker Batch Process

- Rosenlew Continuous Process

- Other Process

By Raw Material

- Sugarcane bagasse

- Corn cob

- Rice husk

- Sunflower hull

- Other Raw Materials

By End-Use

- Pharmaceuticals

- Agriculture

- Food & Beverage

- Paints & Coatings

- Refineries

- Other End-uses

Market Dynamics:

Furfural is widely used in many end-use industries such as foundry, agriculture, and paints. It can also be used as an intermediate or a solvent. Over the forecast period, the growing construction industry is expected to increase the demand for various refractory materials, including ceramics and bricks. Due to the diminishing supply of fossil fuels, the rising demand for sustainable products is also expected to drive the demand.

Furfural production today is characterised by old manufacturing technologies, high steam consumption, and high acid usage. This results in a very low product yield. Many companies are now focusing on developing new processes that reduce energy consumption and increase product yields during purification. Manufacturers tend to use a combination of the best biomass and chemical techniques, which can result in significant reductions in operational costs.

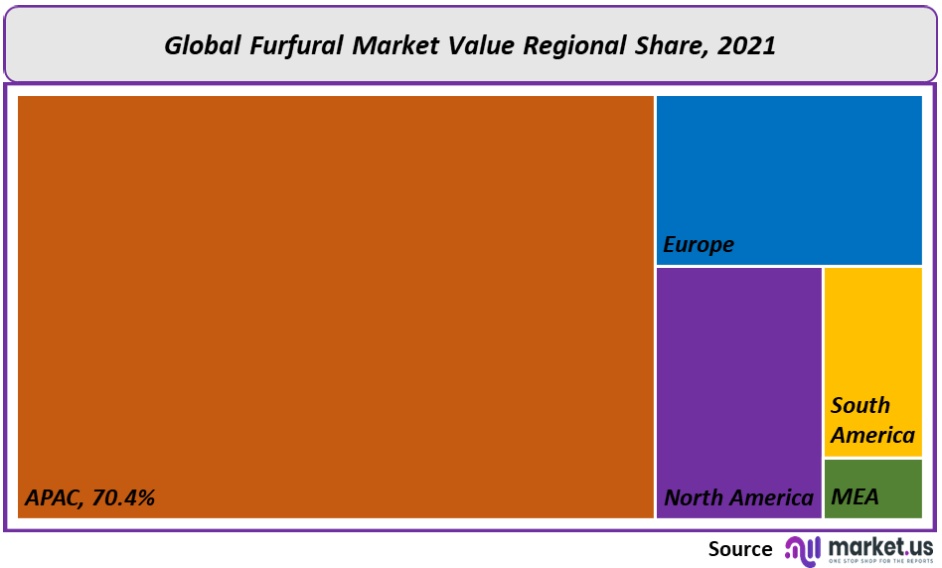

Regional Analysis

The Asia Pacific was the dominant region, with a market share of over 70.4% by 2021. This is due to high furfural production in the region, particularly in China, and growth in many end-use industries such as agriculture, food & drink, pharmaceutical, and refinery. Due to the growing product demand from the chemical and foundry sectors, Asia Pacific will see the highest CAGR between 2023 to 2032. China was the Asia Pacific’s dominant market in 2021. China’s high demand for furfuryl alcohol and its growing production drive product consumption. Many small-scale producers dominate China’s market.

Key manufacturers use corncobs in China as a primary feedstock. They also use the Chinese batch process to produce their products. China accounts for over 81.1% of global production. The development of the pharmaceutical and food industries over the past decade has contributed to Europe’s market growth. Furfural is mainly produced in Austria, Slovenia, and Italy. It is also imported from other countries in the region. The product is used in Europe as a flavoring agent in various foods, such as frozen dairy, baked goods and gravies, candies and meat products, beverages, and desserts. Shortly, the market will be driven by the increasing use of furfural in meat products, baking, and the expanding bakery sector in France and Italy.

Key Regions and Countries covered іn thе rероrt:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

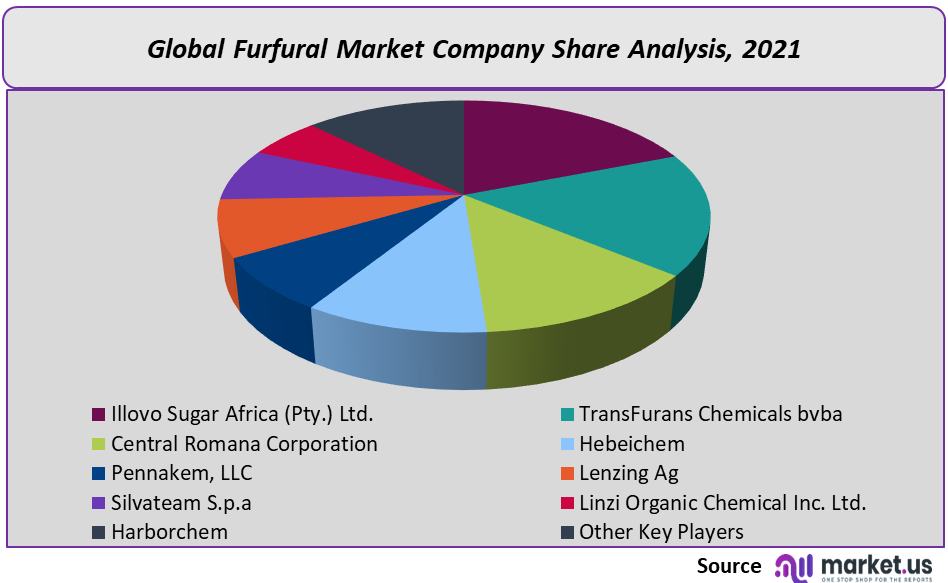

Market Share & Key Players Analysis:

This market is somewhat fragmented, with many small- and mid-sized manufacturers accounting for most of the global share. The market is characterized by integrated manufacturing across the entire value chain. Large manufacturing facilities are a hallmark of top companies. They also engage in research and development. Illovo Sugar Africa (Pty.) Ltd. is integrated throughout the value chain. The sugarcane bagasse is used for production. The company also manufactures furfuryl alcohol.

Маrkеt Кеу Рlауеrѕ:

- Illovo Sugar Africa (Pty.) Ltd.

- TransFurans Chemicals bvba

- Central Romana Corporation

- Hebeichem

- Pennakem, LLC

- Lenzing Ag

- Silvateam S.p.a

- Linzi Organic Chemical Inc. Ltd.

- Harborchem

- Other Key Players

For the Furfural Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

What is the size of the Furfural market in 2021?The Furfural market size is US$ 564.46 million in 2021.

What is the projected CAGR at which the Furfural market is expected to grow at?The Furfural market is expected to grow at a CAGR of 5.70% (2023-2032).

List the segments encompassed in this report on the Furfural market?Market.US has segmented the Furfural market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Process, market has been segmented into Chinese Batch Process, Quaker Batch Process, and Rosenlew Continuous Process. By Raw Material, market has been segmented into Sugarcane bagasse, Corn cob, Rice husk, and Sunflower hull. By End User, the market has been further divided into Pharmaceuticals, Agriculture, Food & Beverage, Paints & Coatings, and Refineries.

List the key industry players of the Furfural market?Illovo Sugar Africa (Pty.) Ltd., TransFurans Chemicals bvba, Central Romana Corporation, Hebeichem, Pennakem, LLC, Lenzing Ag, Silvateam S.p.a, Linzi Organic Chemical Inc. Ltd., Harborchem, and Other Key Players engaged in the Furfural market.

Which region is more appealing for vendors employed in the Furfural market?APAC accounted for the highest revenue share of 70.4%. Therefore, the Furfural industry in APAC is expected to garner significant business opportunities over the forecast period.

Name the key areas of business for Furfural?China, India, Japan, U.K., Germany, France, Italy, Spain, U.S., Canada, Mexico, are key areas of operation for Furfural Market.

Which segment accounts for the greatest market share in the Furfural industry?With respect to the Furfural industry, vendors can expect to leverage greater prospective business opportunities through the Chinese batch process segment, as this area of interest accounts for the largest market share.

![Furfural Market Furfural Market]()

- Illovo Sugar Africa (Pty.) Ltd.

- TransFurans Chemicals bvba

- Central Romana Corporation

- Hebeichem

- Pennakem, LLC

- Lenzing Ag

- Silvateam S.p.a

- Linzi Organic Chemical Inc. Ltd.

- Harborchem

- Other Key Players

- Nestlé S.A Company Profile

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |