Global Copper Foil Market By Product (Electrodeposited Copper Foil, and Rolled Copper Foil), By Application (Circuit Boards, Batteries, Electromagnetic Shielding, and Other Applications), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Nov 2021

- Report ID: 15669

- Number of Pages: 222

- Format:

- keyboard_arrow_up

Copper Foil Market Overview:

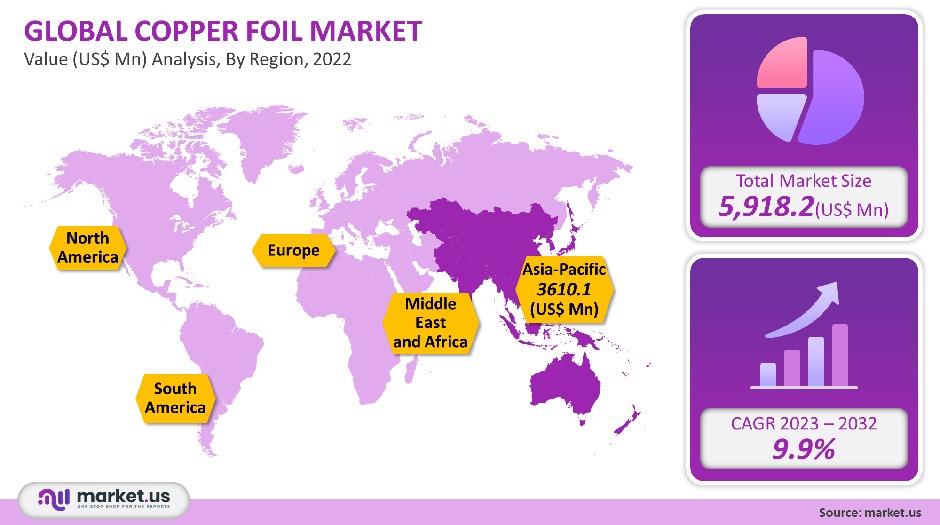

Many electronic devices and digital devices use copper foil, such as printed circuit boards. Thereby, the global market for copper foil was valued at USD 5,918.2 million in 2021. It is expected to grow at a 9.9% CAGR between 2023 and 2032.

Due to increased internet penetration, indirect growth is likely to continue as the market grows. Internet usage is rising rapidly in developed and developing nations, which has led to growth in the demand for laptops, tablets, mobile devices, and computers. In emerging countries such as India, cheap data plans, greater bandwidth availability, and increased awareness due to government programs help bridge the digital gap.

Global Copper Foil Market Scope:

Type Analysis

The market can be divided into Rolled Copper Foil and Electrodeposited Copper Foil. The largest global copper foil market is electrodeposited copper foil. It is anticipated to grow at a CAGR of 9.4% in the years to come. This is due to technological advancements in metal-based manufacturing and industries such as electronics vehicles, smartphones, and electromagnetic shielding.

Application Analysis:

PCB manufacturers use Copper Clad Laminates (CCL), as well as prepare to produce multi-layered PCBs. CCL uses a thin layer of copper foil in the lamination for preparation. These Copper Clad Laminates products then get used in the final products, including mobile communications, radios, television, mobiles, and other electronic devices.

The top emerging segment in the application is the circuit boards with a market share of 59.0% in 2021. Copper foil can be utilized as an electrolytic material. It is deposited on the printed circuit board’s base. It can attach to several substrates like metals or insulating material and has low surface oxygen. The electronic grade copper foil is used in calculators, batteries, and air conditioners.

Batteries offer great potential for decarbonizing transport and power system. From 2023 to 2032, the battery application segment is expected to grow at an 11.5% rate in revenue and volume.

Copper foil is seeing a significant increase in demand for electric, and hybrid vehicles and energy storage. There is an increase in the number of electronic vehicles being used in different countries, including China, the U.S.A., and European countries. The International Energy Agency reports that the global stock of electric vehicles grew by 63% to more than 5 million.

Key Market Segments:

By Product

- Electrodeposited Copper Foil

- Rolled Copper Foil

By Application

- Circuit Boards

- Batteries

- Electromagnetic Shielding

- Other Applications

Market Dynamics:

China is a global leader in electronics production and will continue to do so for many years. China manufacturers low-order single, multi-layer, and double PCB products in a large volume. As such, China country accounts for over 50% of all PCB production worldwide. This is expected to increase the demand for products of copper foil in the coming years.

The short-term impact of tighter regulations on small and medium-sized PCB manufacturers is expected to be significant. The regulations require specific requirements to be met for each Type of Application, except for military and aerospace applications. This is expected to improve the market position of leading Chinese players.

The market for global copper foil is being held back by the lack of high-quality copper future supply and the availability of aluminum foil to replace copper foil.

The growth of the Chinese electronic industry is primarily due to the strong domestic market and supportive government policies. There are also avenues that can be used for the international transfer of technology. It is expected that the country will continue to see strong demand for electronic components and industrial electronics.

Regional Analysis

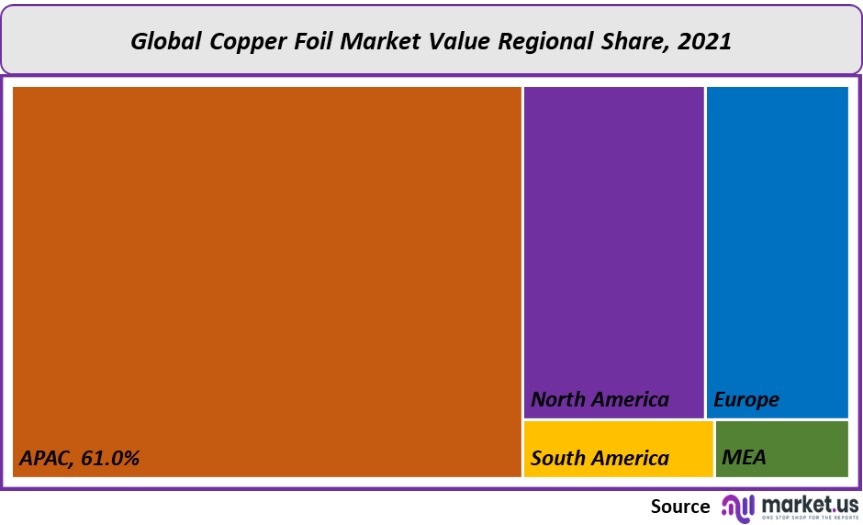

The Asia Pacific accounted for the largest market share, with 61%, in 2021. It is expected to keep its position throughout the estimated period. China, South Korea, Japan, India, and Japan are critical drivers of the market. Due to incentives offered by China, Asia Pacific is the dominant region in the PCB manufacturing sector. One of the reasons is China’s high manufacturing capacity & low labor wage.

North America’s volume is expected to increase at 9.4% during the forecast period. The U.S. market’s increasing electric vehicle penetration will likely drive demand for copper foil products. America is home to many of the world’s most prominent electric vehicle producers, like Tesla Inc. This company was responsible for more than 75% of all-electric cars sold in 2021.

European demand will grow as a result of the growing demand for hybrid and electric vehicles and energy storage. Europe occupies a leading position in the market for electric vehicles. Regional market growth can also be aided by the rapid deployment of the new registration for electric buses. These registrations rose in Europe from 0.91 million in 2018 up to 1.99 Mn in 2019, according to the International Energy Agency.

Key Regions and Countries covered in the report:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

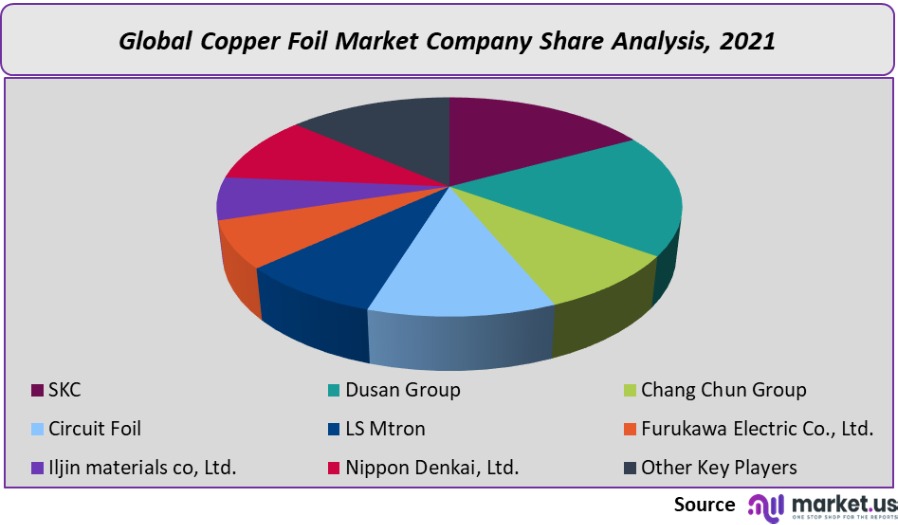

Market Share & Key Players Analysis:

Market players tend to use joint ventures and mergers & acquisitions as their key strategies. Over the next few years, small and medium-sized companies will be acquired by large companies to have the most significant market share. In addition, the top players are investing in new factories and increasing their production capacity to improve their competitiveness.

Dusan Corp. has announced that a new copper foil production plant will be built in Hungary for battery applications. This plant, which will have an additional capacity for copper foil of 50,000 tons, is expected to be in operation by 2021. It can produce enough copper foil to produce approximately 2.2 million electric vehicles. The following players dominate the copper foil market:

Market Key Players:

- SKC

- Dusan Group

- Chang Chun Group

- Circuit Foil LS Mtron

- Furukawa Electric Co., Ltd.

- Iljin materials co, Ltd.

- Nippon Denkai, Ltd.

- Mitsui Mining & Smelting

- Jinbao Electronics

- XJ Nippon Mining & Metal Products

- Other Key Players

For the Copper Foil Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

Q: What is the Copper foil market size in 2021?A: The Copper foil market size is US$ 5,918.2 million for 2021.

Q: What is the CAGR for the Copper foil market?A: The Copper foil market is expected to grow at a CAGR of 9.9% during 2023-2032.

Q: What are the segments covered in the Copper foil market report?A: Market.US has segmented the Global Copper Foil Market Value (US$ Mn) Analysis by Region, 2022 market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). The market has been segmented into Electrodeposited Copper Foil and Rolled Copper Foil by Type. By Application, the market has been further divided into Circuit Boards, Batteries, Electromagnetic Shielding, and Other Applications.

Q: Who are the key players in the Copper foil market?A: SKC, Dusan Group, Chang Chun Group, Circuit Foil, LS Mtron, Furukawa Electric Co., Ltd., Iljin materials co, Ltd., Nippon Denkai, Ltd., and Other Key Players are the key vendors in the Copper Foil market

Q: Which region is more attractive for vendors in the Copper foil market?A: APAC is expected to account the highest revenue share of 61.0% among the other regions. Therefore, the copper foil market in APAC is expected to garner significant business opportunities for the vendors during the forecast period.

Q: What are the key markets for Copper foil?A: Key markets for Copper foil are India, China, Japan & Others.

Q: Which segment has the largest share in the Copper foil market?A: In the copper foil market, vendors should focus on grabbing business opportunities from the electrodeposited copper foil segment as it accounted for the largest market share in the base year.

![Copper Foil Market Copper Foil Market]()

- SKC

- Dusan Group

- Chang Chun Group

- Circuit Foil LS Mtron

- Furukawa Electric Co., Ltd.

- Iljin materials co, Ltd.

- Nippon Denkai, Ltd.

- Mitsui Mining & Smelting

- Jinbao Electronics

- XJ Nippon Mining & Metal Products

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |