Global Pulse Oximeter Market By Type (Fingertip, Handheld, and Other Types), By End-Use (Hospitals & Other Healthcare Facilities, and Homecare), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Nov 2021

- Report ID: 16112

- Number of Pages: 377

- Format:

- keyboard_arrow_up

Pulse Oximeter Market Overview:

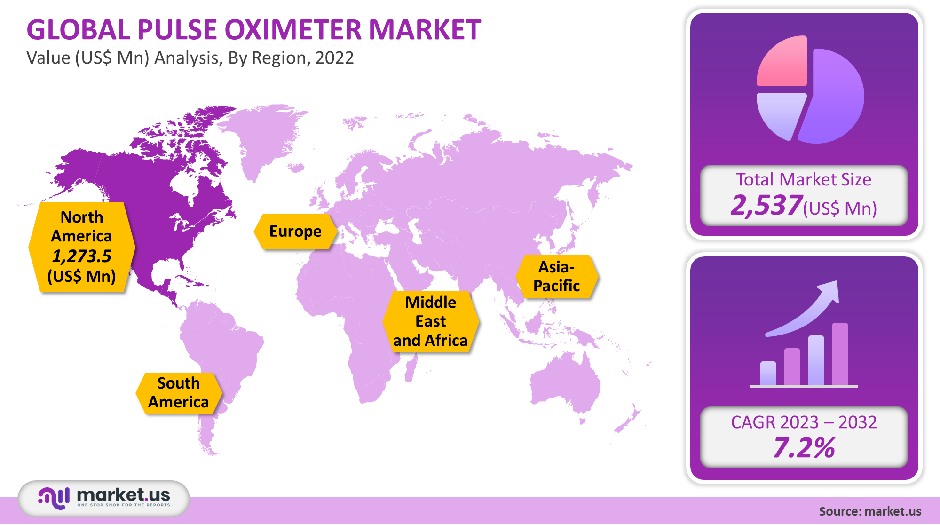

The global pulse oximeter market was worth USD 2,537 million in 2021. It is projected to grow at a 7.2% compound annual growth rate, between 2023 and 2032.

The market is expected to grow due to increased awareness about pulse oximeters’ applications in COVID-19 management, and the increasing prevalence of target illnesses.

Global Pulse Oximeter Market Scope:

Type Analysis

The market leader in pulse oximeters was the handheld segment, which accounted for 41.2% of the total revenue in 2021. These oximeters can be used in emergency situations and are therefore a major driver of the market. The course of treatment can be affected by the patient’s oxygen saturation. Market growth is expected to increase with an increase in stroke cases and surgeries over the forecast period.

The segment will be driven by technological advancements in oximeters. Products are more efficient because they have additional features like Bluetooth, large memory, an alarm system, and easy data transfer. To stay competitive in the market, industry players create new products that include additional features. Due to the COVID-19 pandemic, fewer people have access to hospitals and medical services. Manufacturers are developing telehealth products that can be used to replace these medical services.

Tyto Care, a Telehealth company, launched a fingertip pulse oximeter in 2021. It connects to the TytoCare device through a cable. This allows for remote monitoring by clinicians and logging of test results to patients’ EHR.

End-Use Analysis

Hospitals and other healthcare facilities dominated the pulse-oximeter market. They accounted for the largest share of revenue at 83.1% in 2021, due to an increase in emergency room visits and surgeries.

Residents in long-term care facilities are more at risk for COVID-19 infection. They are continuously monitored by their doctors and checked for vital respiratory parameters. The COVID-19 pandemic is likely to lead to an increase in the demand for pulse oximeters at long-term care facilities and home healthcare Centers.

Homecare is expected to grow in the future due to increasing awareness about the importance of monitoring oxygen levels. Because they can track and store oxygen levels, fingertip pulse oximeters can be affordable and efficient for home care. This can reduce the chance of a patient being readmitted to the hospital.

Spot-checking can be a great way to check for COPD or CHD. Self-monitoring allows patients to actively take control of their own health. As the population ages, the prevalence of cardiac and chronic pulmonary conditions will increase. This will increase the demand for monitoring devices such as pulse oximeters in homes.

Кеу Маrkеt Ѕеgmеntѕ

By Type

- Fingertip

- Handheld

- Other Types

By End-Use

- Hospitals & Other Healthcare Facilities

- Homecare

Market Dynamics

Market growth is expected to be boosted by the availability of new products, and high unmet needs in less-developed and developing economies. The U.S. has made pulse oximetry mandatory in 43 states. It is now being used in newborn screening. This technology is becoming more popular in other countries because of its applications in the detection and treatment of Congenital Heart Diseases (CHD), and other cardiac and respiratory conditions.

Over the forecast period, the market will be driven by the increasing prevalence of target diseases like asthma, hyperlipidemia and hypertension, ischemic conditions, diabetes, cardiac arrhythmia, sleep-disordered breathing, and COPD. For the diagnosis and treatment of COVID-19 patients, high-quality pulse oximeters are essential.

As most companies work at half of their production capacity, this will pose challenges to the supply and manufacturing chains of pulse oximeters. Trade restrictions in highly affected countries will likely limit timely distribution. Manufacturers are working to supply adequate quantities of handheld and fingertip pulse oximeters to countries that have the greatest need. COVID-19 cases continue to rise at an alarming rate.

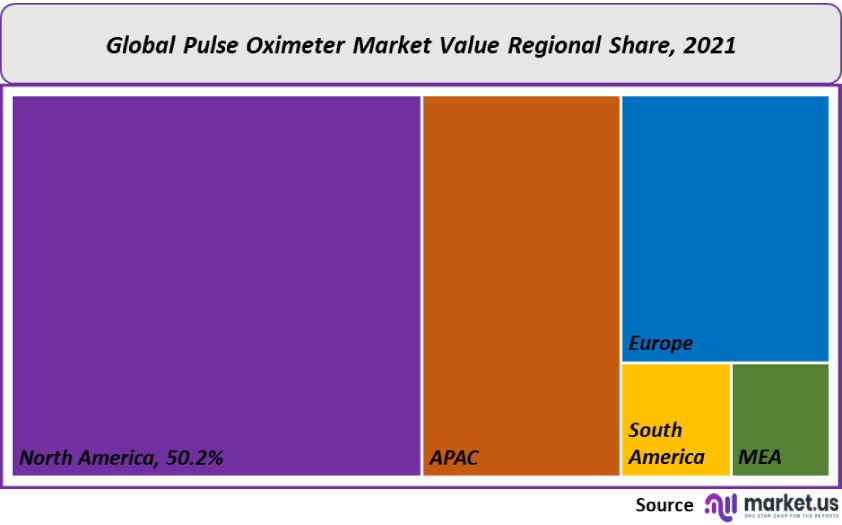

Regional Analysis

North America was the dominant market for pulse oximeters and had the largest revenue share at 50.2% in 2021. This is due to increased awareness about the importance of monitoring the respiratory vitals of the general population. Medicare considers the use of a pulse oximeter supplementary and it is usually reimbursed alongside a primary service.

A pulse oximeter can be used for outpatients or patients who prefer to stay at home. It is reimbursed only after documentation has been provided. Market growth will be supported by a strong reimbursement infrastructure. To help in the management of the pandemic, health organizations have been updating medical practitioners with COVID-19 research.

In interim clinical guidance, published February 2021 by CDC, the CDC stated that pulse oximeters may have sub-optimal accuracy for patients with dark skin.

All medical device manufacturers will be affected by recent European regulatory changes. Modifications in labeling requirements or changes in regulations pertaining to the distribution of medical devices may slow down approval. However, these factors may have benefits for approved products such as improved quality and fewer product recalls.

Market players in the Asia Pacific are beginning to recognize the potential of this region and are creating new products that can be used by developing countries. Masimo India launched Rad-97 Pulse-CO oximeter in 2017. This product was designed to increase CHD screening in neonates. Even though the Asia Pacific has a somewhat declining birth rate, there are still a lot of infants being born each day. This creates a large target population to support CHD.

Key Regions and Countries covered іn thе rероrt:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

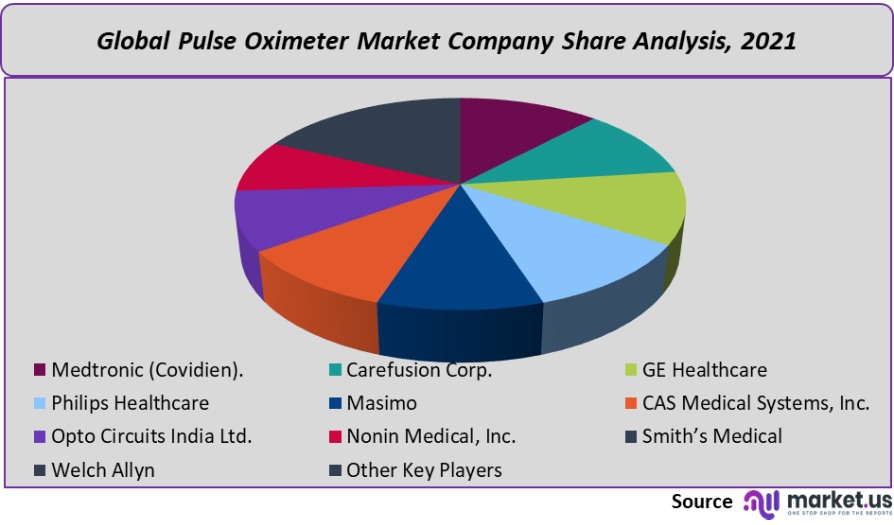

Market Share & Key Players Analysis:

The market is fragmented due to the presence of many regional and global players. The market will use a variety of strategies to increase its market share. These include product launches and acquisitions from major players. Vyaire Medical’s MX40, which is a reusable telemetry connector was commercially made available in the U.S. in 2019. This SpO2 port is compatible with both the Philips 9-pin pulse oxygen meter sensor and Masimo LNCS pulse oxygen meter.

Key industry players are also seeking other important initiatives to strengthen their market presence. These include licensing agreements and strategic partnerships. In 2016, the company entered into a partnership agreement with Masimo and voluntarily resigned from any pending lawsuits. These are the major players in pulse-oximeter markets:

Маrkеt Кеу Рlауеrѕ:

- Medtronic (Covidien).

- Carefusion Corp.

- GE Healthcare

- Philips Healthcare

- Masimo

- CAS Medical Systems, Inc.

- Opto Circuits India Ltd.

- Nonin Medical, Inc.

- Smith’s Medical

- Welch Allyn

- Other Key Players

For the Pulse Oximeter Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

What is the size of the pulse oximeter market in 2021?The Pulse oximeter market size is US$ 2,537 million in 2021.

What is the projected CAGR at which the Pulse oximeter market is expected to grow at?The Pulse oximeter market is expected to grow at a CAGR of 7.2% (2023-2032).

List the segments encompassed in this report on the Pulse oximeter market?Market.US has segmented the Pulse oximeter market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Type, the market has been segmented into Fingertip, Handheld, and Other Types. By End-Use, the market has been further divided into Hospitals & Other Healthcare Facilities, Homecare.

List the key industry players of the Pulse oximeter market?Medtronic (Covidien)., CareFusion Corp., GE Healthcare, Philips Healthcare, Masimo, CAS Medical Systems, Inc., Opto Circuits India Ltd., Nonin Medical, Inc., Smith’s Medical, Welch Allyn, and Other Key Players engaged in the Pulse Oximeter Market.

Which region is more appealing for vendors employed in the Pulse oximeter market?North America is expected to account for the highest revenue share of 50.2%. Therefore, the Pulse oximeter industry in North America is expected to garner significant business opportunities over the forecast period.

Name the key areas of business for Pulse oximeter?The US, Canada, UK, India, China, Japan, & Germany are key areas of operation for the Pulse Oximeter Market.

Which segment accounts for the greatest market share in the pulse oximeter industry?With respect to the Pulse oximeter industry, vendors can expect to leverage greater prospective business opportunities through the handheld segment, as this area of interest accounts for the largest market share.

![Pulse Oximeter Market Pulse Oximeter Market]()

- Medtronic (Covidien).

- Carefusion Corp.

- GE Healthcare

- Philips Healthcare

- Masimo

- CAS Medical Systems, Inc.

- Opto Circuits India Ltd.

- Nonin Medical, Inc.

- Smith’s Medical

- Welch Allyn

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |