Global Ferrochrome Market By Product Type (High carbon, Medium carbon, Low carbon), By Application (Stainless steel, Other steels), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Nov 2021

- Report ID: 18241

- Number of Pages: 365

- Format:

- keyboard_arrow_up

Ferrochrome Market Overview:

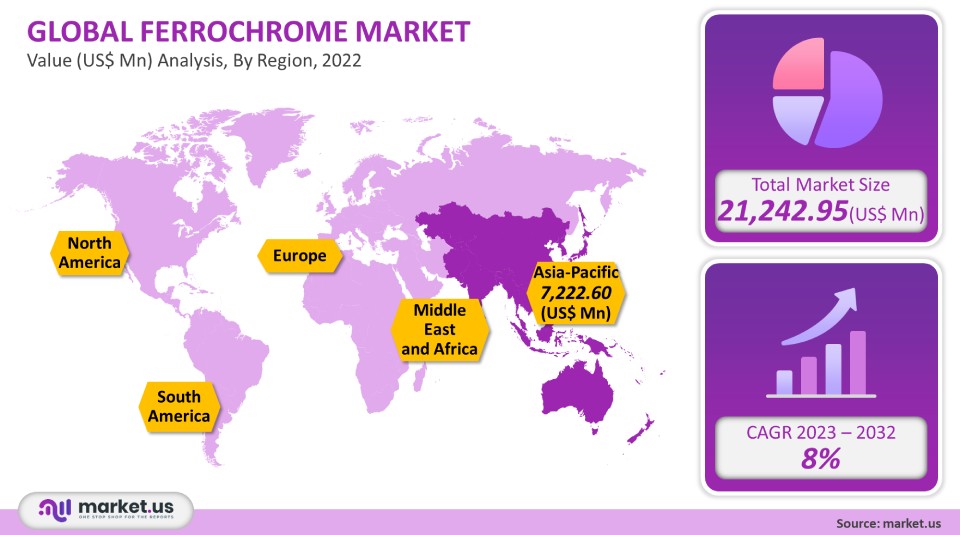

In 2021, global Ferrochrome sales reached USD 21,242.95 million. They are projected to grow at an 8% CAGR between 2023- 2032.

The global increase in stainless steel production is driving the market’s growth. Ferrochrome (FeCr) is an iron compound that is added to stainless steel to enhance its appearance and protect it from corrosion. The minimum FeCr content in stainless steel is 10%, while the average is 16%. The main source of Ferrochrome is stainless steel, so its dynamics are crucial in determining FeCr supply and demand.

Global Ferrochrome Market Scope:

Product type analysis

In 2021, high carbon ferrochrome, HC FeCr (85.5% market share) dominated the market. HC FeCr’s dominant position is due to its lower prices and greater availability of reserves than any other products. Stainless steel producers are heavy consumers of this product Low carbon ferrochrome (LCFr), which is a revenue-generating metal, will experience a 4.5% CAGR between 2019 and 2030.

Although LC FeCr is also used in stainless steel it has its main uses for carbon & tool steels. Steel producers use low-carbon ferrochrome in the final stages to increase the amount of chrome without changing the carbon levels.

Application analysis

With a value share of 80.4%, stainless steel was the most popular product. FeCr is used primarily to reduce oxidation of improving the product’s aesthetic appearance. For the above purposes, there is no substitute for ferrochrome in stainless steel applications as of 2018. The demand for these products is expected to continue growing in the future.

Ferrochrome can also be added to high-strength steels, low alloy, engineering, and tool steels. In terms of revenue, the FeCr consumption in these products will grow at a 3.2% CAGR from 2019 to 2030. This product is used to add hardness, wear resistance, or toughness. Most alloy steels are used in the construction and building industry.

Кеу Маrkеt Ѕеgmеntѕ:

By Product Type

- High carbon

- Medium carbon

- Low carbon

By Application

- Stainless steel

- Other steels

Market Dynamics:

Stainless steel production around the world is driving the market’s growth. The Asia Pacific is being driven by the rising production of stainless steel from China and India. Ferrochrome is an important material in the production of stainless steel because it resists corrosion. It has beautiful looks. According to the International Stainless Steel Forum, Asia’s melting plant production of stainless steel has increased to 34.901 million metric tons in 2018 from 25,361 000 metric tons in 2012.

Increasing foreign investment and increasing manufacturing activities are the two main drivers of the stainless steel industry. Foreign investment is important for various manufacturing industries, such as construction, heavy machinery, and consumer goods. According to the United Nations Conference on Trade and Development, the rate of inward foreign direct investment (FDI), in Asia was 9.1% in 2017. This rate is the highest of all regions. FeCr production is very energy-intensive. It will take approximately 4,500 kWh to produce one ton of the product. This is in addition to 2.5 tons of chromite. Globally, the current method of production is carbothermic melting and reduction of chromite by submerged electric furnaces.

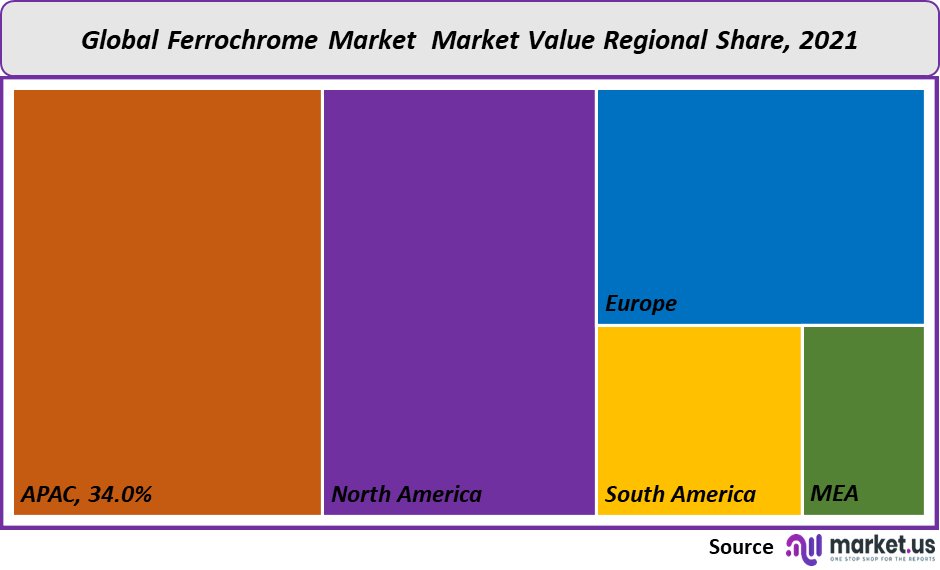

Regional Analysis:

The Asia Pacific market was dominant in 2021, with a 34% value share. This dominance can be explained by the region’s large stainless steel production. According to ISSF estimates in 2018, Asia produced more stainless steel than 68%. China accounted for 52.6%. India, which is a large producer of stainless steel, is another potential market.

From 2021 to 2032, Europe will see a 4.3% CAGR in terms of its revenue. Europe is home to large numbers of automobile and component manufacturers in Germany as well as a significant aerospace manufacturing sector in France. As many components of automobiles are made from stainless, there is a lot of domestic stainless steel production. To increase domestic steel production, the government has instituted protectionist policies. This is another indication of the current trend. This is a positive sign for the FeCr market as it will likely lead increase in demand.

North America is a larger market for ferrochrome than Canada or Mexico. Due to falling stainless Steel imports, the U.S. will likely increase its stainless steel production. However, increased demand from domestic producers may cause rising prices for stainless steel to have a negative impact on its production. This uncertainty could have an adverse impact on the sector’s ferrochrome industry.

Central & South America are being driven by Brazil’s rising production of stainless and specialty steel. Brazil was ranked 10th in exports for 2017. It is a major steel exporter worldwide. Brazil’s domestic vendors can benefit from favorable policies to increase stainless steel production. This in turn helps to boost ferrochrome consumption.The rising production of stainless steel and specialty steel in Brazil is driving the Central & South American markets. Brazil is a major exporter of steel globally and was ranked 10th for exports in 2017. Beneficial policies for Brazilian domestic vendors are key to boosting stainless steel production, which in turn contributes to ferrochrome consumption.

Key Regions and Countries covered іn thе rероrt:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

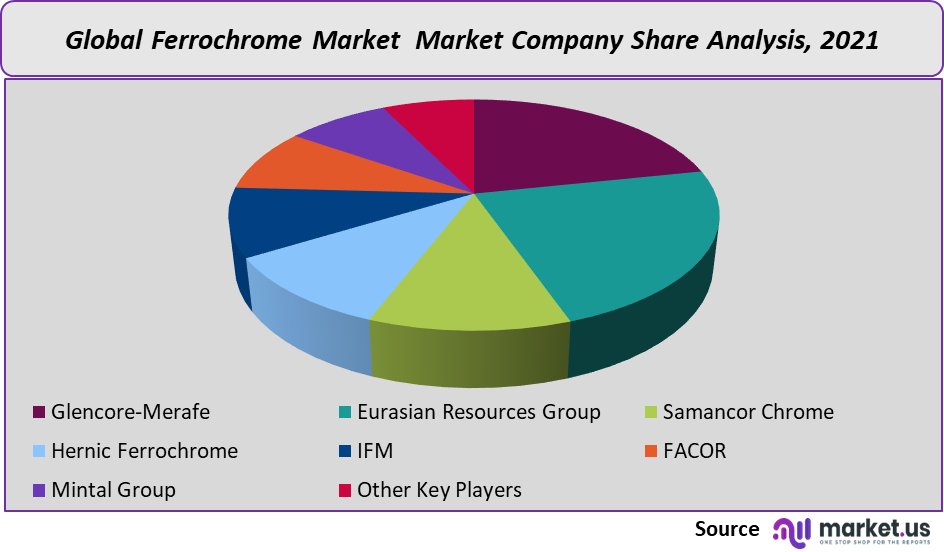

Market Share & Key Players Analysis:

China is the biggest supplier and consumer of FeCr, which is why China dominates the global ferrochrome market. China’s suppliers are independent, unorganized smelters that source chromite ore from other countries, such as India, South Africa, and Turkey, to make ferrochrome.

South Africa, Turkey, and India are the main destinations for suppliers from countries other than China. The outside supply landscape is stable in nature. Many of the companies outside China are integrated in nature, producing FeCr from their own chromite mines. Glencore (South Africa), Samancore Chrome, Jindal Steel & Power Ltd. India, and TNC Kazchrome JSC Kazakhstanstan are some of the most prominent outside China manufacturers.

Маrkеt Кеу Рlауеrѕ:

- Glеnсоrе-Меrаfе

- Еurаѕіаn Rеѕоurсеѕ Grоuр

- Ѕаmаnсоr Сhrоmе

- Неrnіс Fеrrосhrоmе

- ІFМ

- FАСОR

- Міntаl Grоuр

- Other Key Players

For the Ferrochrome Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

Q: What is the size of the Ferrochrome market in 2021?The Ferrochrome market size is estimated to be US$ 21,242.95 million in 2021.

Q: What is the projected CAGR at which the Ferrochrome market is expected to grow at?The Ferrochrome market is expected to grow at a CAGR of 8% (2023-2032).

Q: List the segments encompassed in this report on the Ferrochrome market?Market.US has segmented the Ferrochrome market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Product Type, market has been segmented into High carbon, Medium carbon, Low carbon. By Application, the market has been further divided into Stainless steel, Other steels.

Q: List the key industry players of the Ferrochrome market?Glеnсоrе-Меrаfе, Еurаѕіаn Rеѕоurсеѕ Grоuр, Ѕаmаnсоr Сhrоmе, Неrnіс Fеrrосhrоmе, ІFМ, FАСОR, Міntаl Grоuр, Other Key Players engaged in the Ferrochrome market.

Q: Which region is more appealing for vendors employed in the Ferrochrome market?APAC is expected to account for the highest revenue share of 34%. Therefore, the Ferrochrome market in APAC is expected to garner significant business opportunities over the forecast period.

Q: Name the key areas of business for Ferrochrome?China, India, South Africa and Turkey are key areas of operation for Ferrochrome Market.

Q: Which segment accounts for the greatest market share in the Ferrochrome industry?With respect to the Ferrochrome industry, vendors can expect to leverage greater prospective business opportunities through the high carbon Ferrochrome segment, as this area of interest accounts for the largest market share.

![Ferrochrome Market Ferrochrome Market]()

- Glеnсоrе-Меrаfе

- Еurаѕіаn Rеѕоurсеѕ Grоuр

- Ѕаmаnсоr Сhrоmе

- Неrnіс Fеrrосhrоmе

- ІFМ

- FАСОR

- Міntаl Grоuр

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |