Global Biodiesel Market By Feedstock (Vegetable Oils and Animal Fats), By Application (Fuel, Marine, Automotive, Power Generation, Agriculture, and Other Applications), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Apr 2022

- Report ID: 18999

- Number of Pages: 274

- Format:

- keyboard_arrow_up

Biodiesel Market Overview:

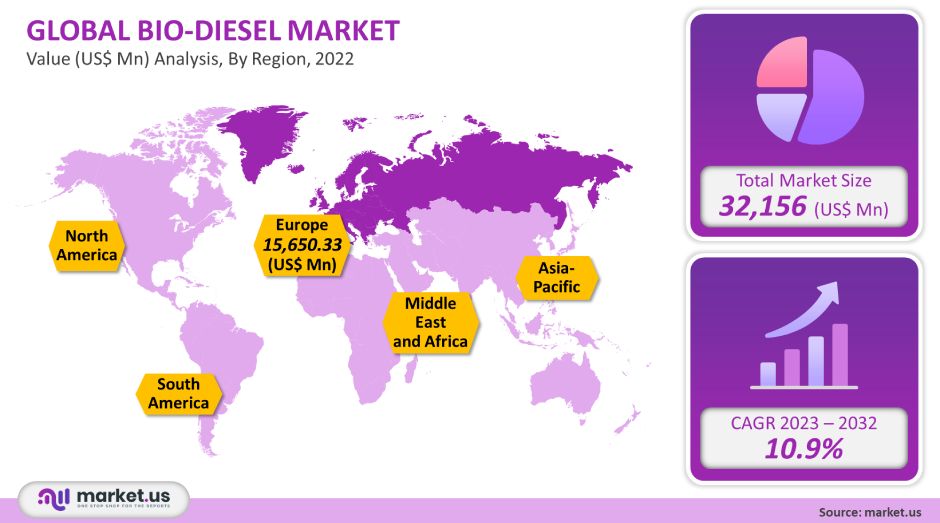

The global biodiesel industry was valued at USD 32,156 million in 2021. This market is expected to grow at a 10.9% CAGR between 2022-2032.

The biodiesel substitute is renewable and clean-burning. It can be used without any modifications to existing diesel engines. It is made from a variety of biodiesel, including a growing number of vegetable oils, animal fats, and agricultural feedstock.

Market growth is expected to be driven by the rising demand for biodiesel as an alternative to traditional fossil fuels in power generation, and automotive applications. Due to the many dealers and suppliers in the market, it is highly fragmented.

Global Biodiesel Market Analysis:

Feedstock Analysis:

Vegetable oil accounted for the highest revenue share in 2021. The availability of feedstock and the cost of raw materials can vary by region. It is expected that palm oil will be a major market feedstock. This oil has been extensively used in biodiesel production in countries such as Indonesia and Thailand.

Indonesia and Thailand dominated palm oil production. They accounted for more than 80 percent of total production. Most of the product was also used in biofuel production. For biofuel production, the European countries depended heavily on feedstock imports from Asian countries.

Application Analysis:

The fuel application segment held a significant revenue share in 2021. As it emits fewer Volatile Organic Compounds (VOCs) than other fuels like diesel, this fuel will be a boon to the industry.

It is non-toxic and biodegradable.This product will be used in the marine sector and will grow at a substantial CAGR over the forecast period. The growth in the agricultural sector, along with the increased use of mechanization, will drive demand for the product in agricultural applications during the forecast period.

To reduce GHG emissions, governments all over the world are continually trying to adopt renewable power sources. Accordingly, the demand for the product is expected to increase at a rapid CAGR from 2023-to 2032.

Key Market Segments:

By Feedstock:

- Vegetable Oil

- Soybean Oil

- Canola Oil

- Corn Oil

- Palm Oil

- Other Vegetable Oils

- Animal Fats

- Poultry

- White Grease

- Tallow

- Other Animal Fats

By Application:

- Fuel

- Marine

- Automotive

- Power Generation

- Agriculture

- Other Applications

Market Dynamics:

The gap between demand and supply due to insufficient production capacity and large R&D opportunities in feedstock selection for product fabrication is expected to create new market players.

This market is driven by the increasing demand for environmentally friendly fuels that are fully combustion able and can lower Greenhouse Gas (GHG) emissions.

Biodiesel is compatible with existing diesel engines, which is another reason for the market. The rising population and subsequent increase in vehicles and other industries using biodiesel are expected to also boost demand.

Biodiesel, which emits less GHG, is highly sought after by the automotive industry. Accordingly, there will be a rise in U.S. demand over the forecast.

The U.S. is the country with the highest soy production. After being crushed, soybeans are used as a feedstock to produce biodiesel. After crushing soybean oil, which accounted for 360ml of the total 857 million pounds of feedstock, corn oil and canola oil were the next largest.

India, China, Brazil, and other developing countries have plans to replace 15-25% of total fossil-based fuels with biodiesel in transportation.

Additionally, there is a rising preference for biofuels replacing fossil fuels that are associated with higher GHG emissions. This is driving demand growth in these countries.

COVID-19 had an effect on the demand for biodiesel during the first half. The coronavirus epidemic caused the demand to drop.

Market growth is also expected to be supported by the rising demand for eco-friendly and GHG emission-reducing gas. The market will continue to grow due to government assistance such as subsidies or imposing mandates.

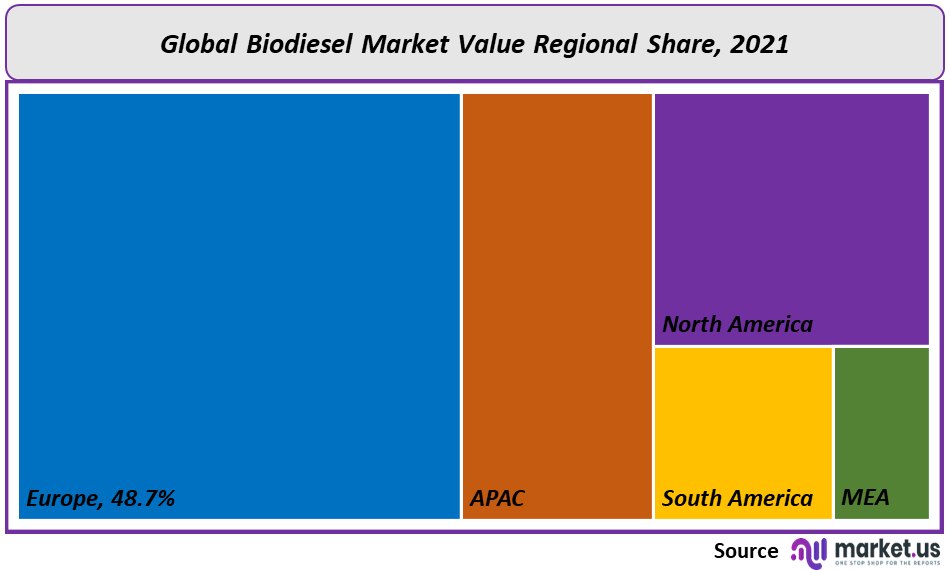

Regional Analysis:

Europe represented 48.7% of the global market share in 2021. Because of its acceptance of the product early in the region and the government’s emphasis on replacing carbon-emitting sources with bio-based, it has historically been the largest market.

Biodiesel is made from the most popular feedstock in Europe. Germany accounts for the largest share of European countries’ feedstock production. This is why the region has a high product demand.

The expected rise in regional consumption is expected to fuel the overall market growth during the forecast period. Asia Pacific is expected to see a substantial CAGR from 2023 through 2032. Thailand is expected to be one of the fastest-growing countries, with a growing demand for diesel-powered vehicles in the region.

Production is expected to increase which will in turn propels market growth for the forecast period. But, palm oil is also used by the food industry which will limit the market growth. Market growth will be driven by government initiatives to promote green fuels and less dependence on crude oil.

Кеу Regions and Countries covered іn thе rероrt:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Market Share & Key Players Analysis:

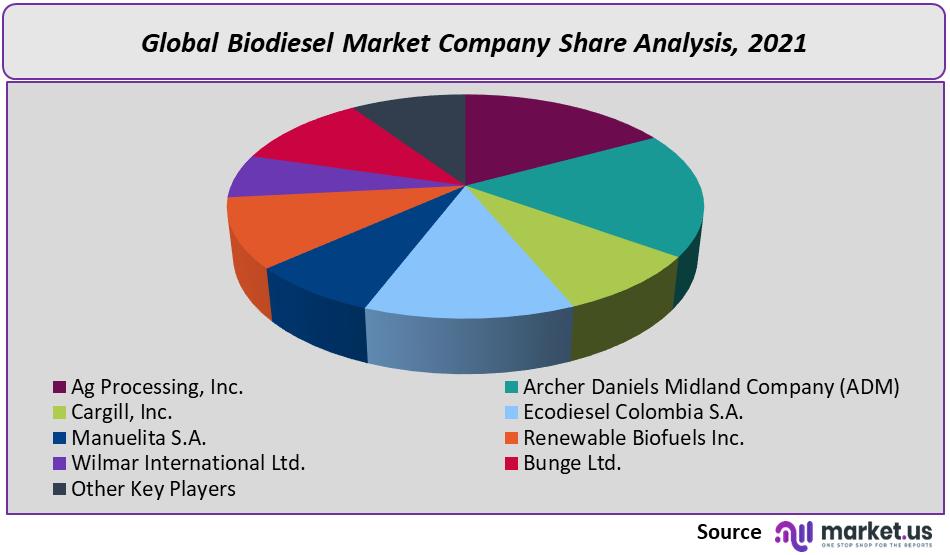

The strong presence of large manufacturers makes the industry highly competitive. Ports are near the production sites of these companies, which makes it possible to deliver fuel efficiently.

This has resulted in lower transportation costs, which should increase profit margins for participants over the period. In order to sustain their market presence, existing producers are expected to finance the expansion of their production capabilities and geographic reach.

Key Market Players:

- Ag Processing, Inc.

- Archer Daniels Midland Company (ADM)

- Cargill, Inc.

- Eco diesel Colombia S.A.

- Manuelita S.A.

- Renewable Biofuels Inc.

- Wilmar International Ltd.

- Bunge Ltd.

- Other Key Players

Frequently Asked Questions (FAQ)

Q: What is the Biodiesel market size in 2021?The Biodiesel market size is $32,156 million in 2021.

Q: What is the CAGR for the Biodiesel market?The Biodiesel market is expected to grow at a CAGR of 10.9% during 2023-2032.

Q: What are the segments covered in the Biodiesel market report?Market.US has segmented the Global Biodiesel Market Value (US$ Mn) Analysis by Region, 2022 market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Feedstock, market has been segmented into vegetable oil, and animal fats. By Application, market has been further divided into fuel, marine, automotive, power generation, agriculture, and other applications.

Q: Who are the key players in the Biodiesel market?AG Processing, Inc., Archer Daniels Midland Company (ADM), Cargill Inc., Ecodiesel Colombia S.A., Manuelita S.A., Renewable Biofuels Inc., Wilmar International Ltd., Bunge Ltd., and Other Key Players.

Q: Which region is more attractive for vendors in the Biodiesel market?Europe accounted for the highest revenue share of 48.7% among the other regions. Therefore, the Biodiesel market in Europe is expected to garner significant business opportunities for the vendors during the forecast period.

Q: What are the key markets for Biodiesel?Key markets for Biodiesel are US, China, Japan, India, Brazil, Germany, UK, France, Italy, Spain, etc.

Q: Which segment has the largest share in the Biodiesel market?In the Biodiesel market, vendors should focus on grabbing business opportunities from the vegetable oil feedback segment as it accounted for the largest market share in the base year.

![Biodiesel Market Biodiesel Market]()

- Vegetable Oil

- Ag Processing, Inc.

- Archer Daniels Midland Company (ADM)

- Cargill, Inc.

- Eco diesel Colombia S.A.

- Manuelita S.A.

- Renewable Biofuels Inc.

- Wilmar International Ltd.

- Bunge Ltd. Company Profile

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |