Global Calcined Anthracite Market By Technology (Electrically Calcined Anthracite and Gas Calcined Anthracite), By End-use (Basic Oxygen Steelmaking, Pulverized Coal Injection (PCI), and Electric Arc Furnaces), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Nov 2021

- Report ID: 19073

- Number of Pages: 339

- Format:

- keyboard_arrow_up

Calcined Anthracite Market Overview:

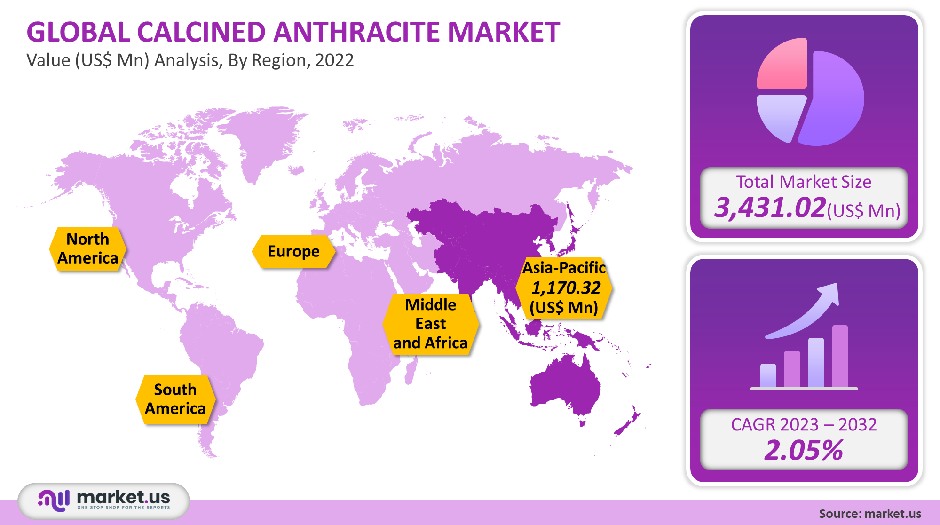

In 2021, the global market for calcined Anthracite was valued at USD 3,431.02 million. It is anticipated to grow at a CAGR of 2.05%.

This market will be driven by the rising demand for carbon-rich charges materials in steel production. It is expected that it will have a competitive advantage over the next few decades due to its low environmental impact and low cost of production compared to calcined pecoke.

Global Calcined Anthracite Market Scope:

Technology Analysis

In 2021, 73% of the total market volume was accounted for by demand for electrically calcined anthracite. GCA is made by heating anthracite high-grade in gas-fired furnaces rather than using electricity. GCA has properties that are similar to ECA (electrically calcined anthracite), making it ideal for use in steel and foundry applications. GCA is produced by major manufacturers like Rheinfelden Carbon and Asbury Carbons.

Rheinfelden Carbon offers GCA in two grades: premium and standard. Premium-grade products have a higher carbon content than standard grades, making them ideal for use in steel manufacturing. Calcined coke can be heated to temperatures up to 2000°C. This heat transforms traditional anthracite into modified graphite with high carbon contents.

ECA products are low in moisture, sulfur, or ash. This makes them suitable for high-purity processes that use them. Due to its consistent quality and cost savings, carbon sources are expected to grow in the future. Elkem, which caters to the steel industry, was the world’s largest producer of ECA in 2021.

End-Use Analysis

It is used primarily as a carbon source in the steel industry. The market for calcined anthracite is expected to grow due to its rising demand in the basic and electric steelmaking processes.

The use of products in steel manufacturing lowers the need for high-cost metallurgical coke and reduces overall production costs. In 2021, the segment of electric arc furnaces was worth US$ 700 million. To remove metal oxides, calcined anthracite can be added to electric arc furnaces. The blast furnace plays an important role in removing impurities from the steel when the product is fed into it during the basic oxygen process. Removing flux, iron, and steel from the oven, this procedure creates liquid steel. Market growth will be influenced by the increasing use of high-quality coke. This produces better quality steel.

Кеу Маrkеt Ѕеgmеntѕ

By Technology

- Electrically Calcined Anthracite

- Gas Calcined Anthracite

By End-use

- Basic Oxygen Steelmaking

- Pulverized Coal Injection (PCI)

- Electric Arc Furnaces

Market Dynamics:

Anthracite availability is an important variable in market dynamics as it is the main raw material that is used to make the product. Anthracite is only 3% of total coal production, but it is highly sought after for its ability to make steel and for power generation. This has led to a shortage of raw materials in the industry, which has resulted in high bargaining power for raw material suppliers.

Pennsylvania is the only U.S. state that has anthracite mining. The United States has dominated the North American market because of its high-volume steel production. The country’s steel production declined by 0.4% between 2023 to 2032, which resulted in lower product demand.

This product has a higher carbon percentage than traditional coal products and lower ash, moisture, or volatile matter content. It has been highly sought after in the manufacture of steel and other metals. This process requires low levels of moisture and impurity. Global coal production has been falling over the last few years, reaching 232 million tonnes in 2021. The 2021 drop in production was 7%, the largest decline in coal mining history. These factors have had an impact on the availability of raw materials to manufacture anthracite, which has impacted the industry’s growth.

Petcoke is a key ingredient in anthracite and is expected to be banned from emerging countries like India. Due to the severe pollution problems in the area, the country has already banned petcoke from the capital and the neighboring states. These factors will likely hinder the industry’s growth in the future.

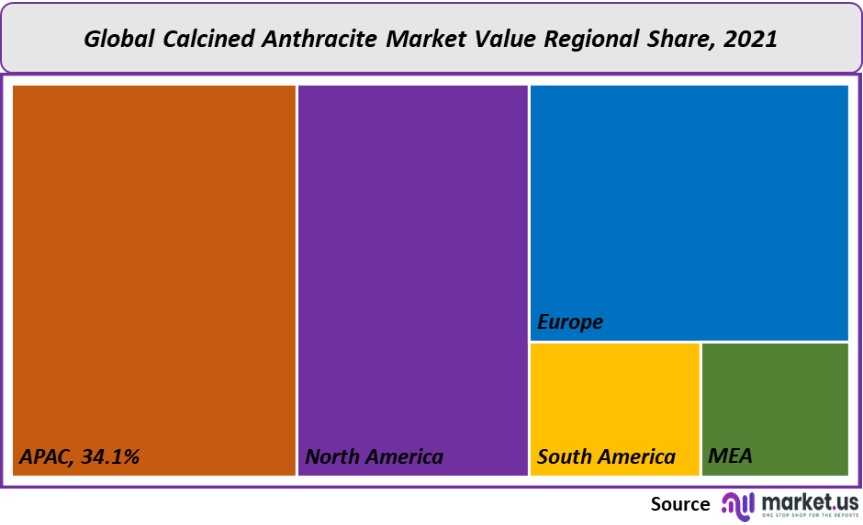

Regional Analysis

The Asia Pacific will be the fastest-growing market due to its high steel production volumes with a market share of 34.11%. China, Japan, India, and China dominated global steel production in 2021, and they are expected to continue their dominance over the forecast period, which will benefit the region’s market. In 2021, the European market was worth US$ 429.1 million. This region is expected to have lower CAGRs than those in the Asia Pacific due to the decline in steel production in Europe and the wider gap between demand and supply in the region.

Russia is a major producer of anthracite around the globe and a major exporter to major end users like China, the U.S., and Germany. Russian raw material prices are lower than those of major manufacturing areas like Australia. This makes Russia one of the most important raw material suppliers on the market.

The market in Japan was worth US$ 229.8 million in 2021. Anthracite is mainly imported from Australia and Russia. In 2021, it imported more than 7 million tonnes of anthracite. Anthracite imports to Japan are forecast to rise due to the rising demand for several end-use applications.

Key Regions and Countries covered іn thе rероrt:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

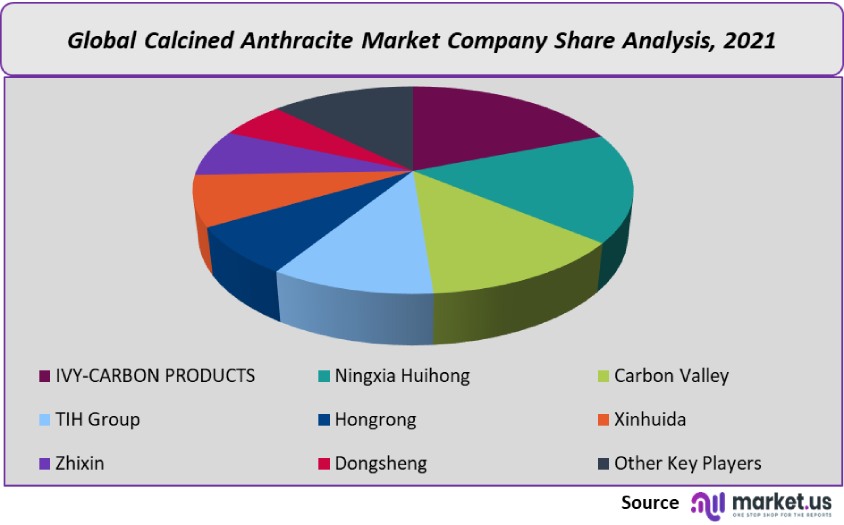

Market Share & Key Players Analysis:

In the last few years, declining coal production has been due to a reduction in mining activities as a result of growing environmental awareness by governments in various countries. The decline in anthracite reserves is expected to lead to increased competition for raw material procurement and increase the bargaining power of suppliers.

The low availability of raw materials has led to a persistent gap in demand and supply. Due to the insufficient production volumes of large players, small-scale businesses have managed to survive in this industry. To ensure consistent raw material supply, many industry players seek partnerships with anthracite mining firms.

Маrkеt Кеу Рlауеrѕ:

- ІVY-САRВОN РRОDUСТЅ

- Nіngхіа Нuіhоng

- Carbon Vаllеу

- ТІН Grоuр

- Ноngrоng

- Хіnhuіdа

- Zhіхіn

- Dоngѕhеng

- Other Key Players

For the Calcined Anthracite Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

What is the size of the Calcined Anthracite market in 2021?The Calcined Anthracite market size was US$ 3,431.02 million in 2021.

What is the projected CAGR at which the Calcined Anthracite market is expected to grow at?The Calcined Anthracite market is expected to grow at a CAGR of 2.05% (2023-2032).

List the segments encompassed in this report on the Calcined Anthracite market?Market.US has segmented the Calcined Anthracite market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Technology, market has been segmented into Electrically Calcined Anthracite and Gas Calcined Anthracite. By End-use, the market has been further divided into Basic Oxygen Steelmaking, Pulverized Coal Injection (PCI), and Electric Arc Furnaces.

List the key industry players of the Calcined Anthracite market?ІVY-САRВОN РRОDUСТЅ, Nіngхіа Нuіhоng, Carbon Vаllеу, ТІН Grоuр, Ноngrоng, Хіnhuіdа, Zhіхіn, Dоngѕhеng, and Other Key Players engaged in the Calcined Anthracite market.

Which region is more appealing for vendors employed in the Calcined Anthracite market?APAC accounted for the highest revenue share of 34.11%. Therefore, the Calcined Anthracite industry in APAC is expected to garner significant business opportunities over the forecast period.

Name the key areas of business for Calcined Anthracite?China, Japan, India, Brazil, The US, Germany, UK, France, Italy, Spain, etc., are key areas of operation for Calcined Anthracite Market.

Which segment accounts for the greatest market share in the Calcined Anthracite industry?With respect to the Calcined Anthracite industry, vendors can expect to leverage greater prospective business opportunities through the electrically calcined anthracite segment, as this area of interest accounts for the largest market share.

![Calcined Anthracite Market Calcined Anthracite Market]()

- ІVY-САRВОN РRОDUСТЅ

- Nіngхіа Нuіhоng

- Carbon Vаllеу

- ТІН Grоuр

- Ноngrоng

- Хіnhuіdа

- Zhіхіn

- Dоngѕhеng

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |