Global Horizontal Directional Drilling Market By Machine Type (Conventional and Rotary Steerable System), By Parts (Rigs, Reamers, Pipes, Bits, and Other Parts), By Application (Offshore and Onshore) By End-Use (Utility, Telecommunication, Oil & Gas Extraction, and Other End-Uses), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Apr 2022

- Report ID: 19160

- Number of Pages: 283

- Format:

- keyboard_arrow_up

Horizontal Directional Drilling Market Overview:

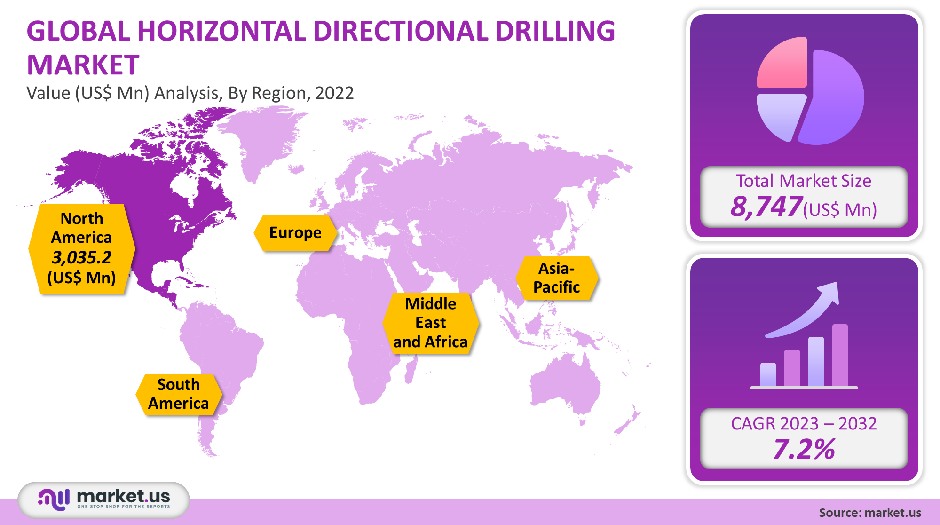

The global horizontal directional drilling market was valued at USD 8,747 Million in 2021. It is estimated to grow at a 7.2% CAGR, between 2023 and 2032.

Horizontal Directional Drilling is a method that accurately drills and back-reams the pipe. This allows drilling operations to be performed without causing collateral damage to subsurface ecosystems. Horizontal directional drilling is being increasingly popularized due to rising concerns about environmental damage from rapid infrastructure development around the world.

Market growth is also being driven by growing utility installations, increased investments in shale-gas development projects, as well as rising expenditures for various telecom developments to provide high-speed connectivity.

Global Horizontal Directional Drilling Market Scope:

Machine Type Analysis

With a revenue share exceeding 71.4%, the Rotary Steerable Systems (RSS) segment was the dominant player in the HDD machines market in 2021. RSS machines use push-and-point-the-bit techniques for precise directional control of drilling. They also make real-time corrections.

RSS is expected to gain popularity due to its ability to improve the ROP, reduce drag and torque, as well smoother borehole production. Service providers also invest in RSS machine upgrades to ensure that they can offer reliable drilling services even in harsh underground conditions.

SMEs still prefer conventional horizontal directional drilling to RSS, but it is more cost-effective than RSS. Conventional machine types are immovable, skid-mounted rigs that require adjustments to their position. Horizontal directional drilling can bore to depths of up to 31,000 feet. It is used for geothermal energy distribution and soil mapping.

Part Analysis

In 2021, the rigs segment accounted for 54.4% of overall market revenue. The main drivers of rig demand are increasing oil and gas production and the telecommunications industry. Numerous technological advances in rig infrastructure have allowed the end-users to perform operations at an extremely high optimization rate.

An automated system integrated into the control system of the rigs guides the equipment to place pipelines for distant entry points and exit points. Rigs can be expensive and need to be maintained for a longer operational life.

Over the forecast period, the pipes segment will record the highest CAGR. High-pressure drilling pipes are a growing industry sector. Because of their high impermeability, High-Density Polyethylene pipes (HDPE) are preferred over concrete or steel pipelines. The HDPE pipes have zero water leakage and are more efficient than Polyvinylchloride pipes (PVC), which can leak from 12% to 22%. Their resistance to corrosion, low weight, and durability are two reasons why HDPE pipes are more popular.

Application Analysis

With a CAGR of approximately 9.4%, the offshore segment is expected to see the most growth. Exploration and production activities will be more extensive due to the largely untapped oil & natural gas reserves. Additionally, offshore oil production is cheaper due to a decline in the average breakeven cost for all non-permitted projects.

Due to their lower infrastructure and maintenance costs, offshore horizontal directional drilling projects are more expensive than onshore projects. Oil price fluctuations are a major factor in the cost of onshore horizontal boring projects. Both the onshore and offshore areas that have heavy fiber optic cables laid by the telecommunications sector to provide 4G/5G networking services are contributing to both segments’ growth prospects.

End-Use Analysis

With a revenue share exceeding 36.4%, the oil and gas extraction segment was the dominant market segment in 2021. Baker Hughes published a report that showed the world’s average oil and gas rig count was up to 1,400. The high market share in the oil and natural gas extraction segment is due to the demand for boring drilling rigs because of the well-established infrastructure. The segment’s dominance is likely to be due to rising oil exploration costs and production activities in unexplored areas.

For the forecast period, the CAGR for the telecommunications segment will be the greatest. To expand their network of optical fiber cables, telecommunication providers are compelled to use newer, more reliable drilling services like horizontal directional drilling. HDD allows conduit and pipe installation to be deployed through holes up to 5 feet in diameter and 6600 feet long for telecom applications offshore. The forecasted growth in the telecommunications segment will be driven by the increasing demand for 4G/5G networks.

Кеу Маrkеt Ѕеgmеntѕ

By Machine Type

- Conventional

- Rotary Steerable System

By Parts

- Rigs

- Reamers

- Pipes

- Bits

- Other Parts

By Application

- Offshore

- Onshore

By End-Use

- Utility

- Telecommunication

- Oil & Gas Extraction

- Other End-Uses

Market Dynamics:

The horizontal directional drilling method has become one of the most preferred trenchless drilling techniques over the last few years. The horizontal boring technique requires less drilling and maintenance. The industry’s growth prospects are dependent on large investments because the equipment required for trenchless boring is more expensive than traditional open-cut methods.

Customers often rent the entire setup from contractors because they are more expensive. Many mid-sized businesses also employ service providers to handle end-to-end projects. Both horizontal directional drilling machine makers and service providers have a strong market position.

The horizontal trenchless technique gained significant popularity since its inception. It can be deployed from one location in a very rough sub-surface, and it can hit multiple target zones. With the advent of disruptive digital technologies such as 3D Earth Models, 3D visualization, and Automation, implementation has been faster, easier, less noisy, and more accessible underground.

These technologies allow engineers, geoscientists, as well as other related personnel, to visualize the bore path more precisely and optimize its Rate of Permeation (ROP). The horizontal trenchless technique has been able to achieve a prominent place in drilling applications in oilfields and offshore.

Horizontal directional drilling can be used for a variety of applications, including the installation and maintenance of utility transmission lines and supply lines as well as communication conduits and cables.

These directional boring workers as well as the general public are at risk from the cross bore technique, which allows for the intersection of multiple pipelines below the surface. This could be due to the inability to see the tracks of drilling activities at sub-surface locations. Explosions can occur when utilities intersect in cross-bore, often resulting in injury or death.OSHA (Occupational Safety and Health Administration) requires directional boring operators to inspect for structures that indicate subversive utility installations before drilling the entry and exit holes at the desired locations. The market is subject to other environmental regulations that aim to reduce the ecological impact of underground construction activities.

Due to strict government lockdown regulations, the COVID-19 pandemic caused a temporary halt to horizontal directional drilling activities at a number of sites across a variety of industries. Oilfields were faced with major operational issues as companies stopped upstream and downstream activities. This resulted in a sharp drop in oil and gas production. Oil prices fell due to a substantial drop in transportation frequency worldwide, following a price war between the U.S. and Saudi Arabia.

The result was a decline in demand for horizontal directional services by the incumbents and the machine industry. The recovery of horizontal directional drilling markets is possible due to the ongoing efforts of world governments to mitigate the effects of the pandemic oil and gas exploration companies.

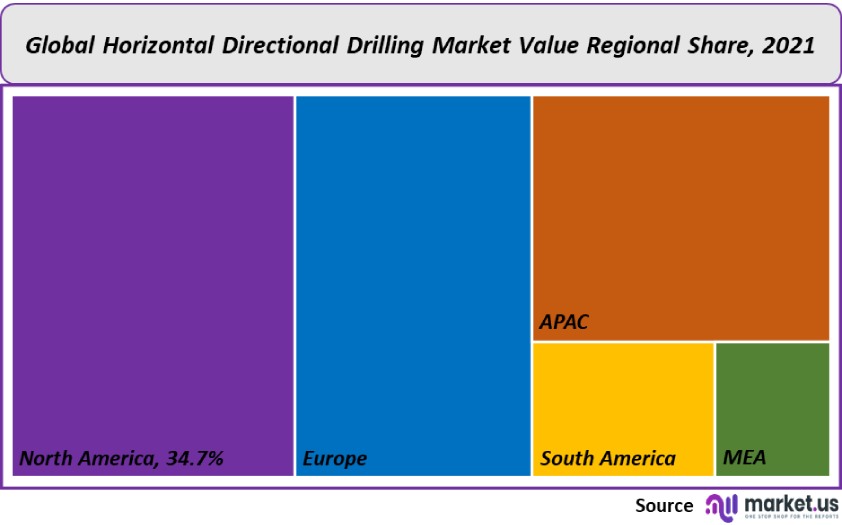

Regional Analysis

Due to oil and gas exploration in the region, North America had the largest revenue share of 34.7% in 2021. The increasing number of infrastructure projects and utility projects in North America is also driving demand for horizontal directional drilling equipment.

Over the forecast period, the Asia Pacific region will record the second-highest CAGR at around 9.9%. China’s national energy infrastructure is shifting towards renewable energy sources to ensure safe, sufficient, and clean energy growth. This has resulted in a rise in large-scale infrastructure projects across the country. This has prompted the adoption of advanced drilling equipment.

Horizontal drilling is also possible using directional boring machines made by Chinese companies. The region is also seeing an increase in investments in its telecommunications sector to deploy 4G/5G networks.

Key Regions and Countries covered іn thе rероrt:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

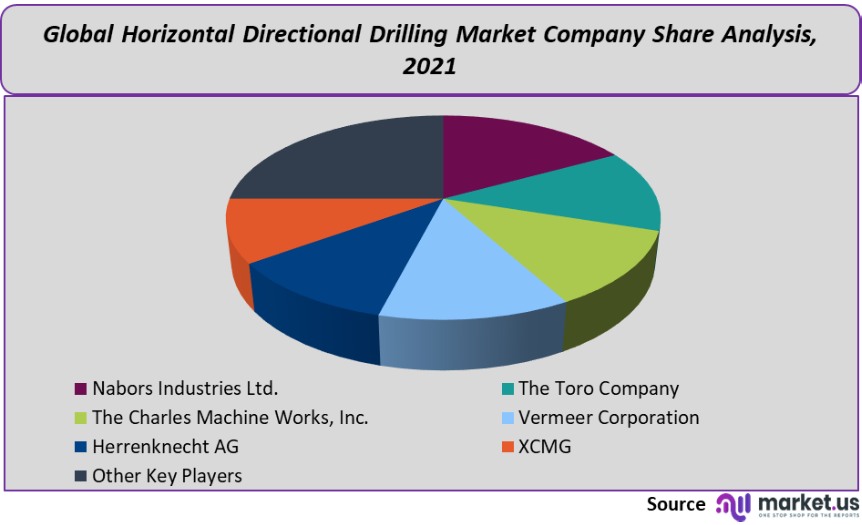

Market Share & Key Players Analysis:

Prominent industry players invest heavily in R&D to help customers optimize boring operations. Charles Machine Works Inc. Company announced the 2019 launch of its ride-on trencher, RT80, with a tier-4 diesel engine producing 74.5 horsepower. This trencher is intended for urban utility jobs.

The delivery of projects on a contractual basis is possible only with the help of HDD service providers. These service providers are responsible to drill operations including inspection, maintenance, and installation. The companies are committed to long-term partnerships with their customers in order to build a sustainable business model.

Telstra Corporation Limited, an Australian-based Telecommunications Company appointed UEA in 2018 to install directional bore telecommunications works along the Indigo West cable network between Singapore, Perth, and Singapore. This alliance was formed to increase communication traffic in Asia’s rapidly growing markets.

These are the main players in the global horizontal drilling industry:

Маrkеt Кеу Рlауеrѕ:

- Nabors Industries Ltd.

- The Toro Company

- The Charles Machine Works, Inc.

- Vermeer Corporation

- Herrenknecht AG

- XCMG

- Other Key Players

For the Horizontal Directional Drilling Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

Q: What is the size of the horizontal directional drilling market in 2021?A: The Horizontal directional drilling market size is US$ 8,747 million in 2021.

Q: What is the projected CAGR at which the Horizontal directional drilling market is expected to grow at?A: The Horizontal directional drilling market is expected to grow at a CAGR of 7.2% (2023-2032).

Q: List the segments encompassed in this report on the Horizontal directional drilling market?A: Market.US has segmented the Horizontal directional drilling market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Machine Type, the market has been segmented into Conventional and Rotary Steerable System. By Parts, the market has been further divided into Rigs, Pipes, Bits, Reamers, and Other Parts. By Application, the market has been further divided into Onshore and Offshore. By End-Use, the market has been further divided into Oil & Gas Extraction, Utility, Telecommunication, and Other End-Uses.

Q: List the key industry players of the Horizontal directional drilling market?A: Nabors Industries Ltd., The Toro Company, The Charles Machine Works, Inc., Vermeer Corporation, Herrenknecht AG, XCMG, and Other Key Players engaged in the Horizontal Directional Drilling market.

Q: Which region is more appealing for vendors employed in the Horizontal directional drilling market?A: North America is expected to account for the highest revenue share of 34.7%. Therefore, the Horizontal directional drilling industry in North America is expected to garner significant business opportunities over the forecast period.

Q: Name the key areas of business for Horizontal directional drilling?A: The US, Canada, UK, India, China, Japan, & Germany are key areas of operation for the Horizontal directional drilling Market.

Q: Which segment accounts for the greatest market share in the horizontal directional drilling industry?A: With respect to the Horizontal directional drilling industry, vendors can expect to leverage greater prospective business opportunities through the rotary steerable system segment, as this area of interest accounts for the largest market share.

![Horizontal Directional Drilling Market Horizontal Directional Drilling Market]() Horizontal Directional Drilling MarketPublished date: Apr 2022add_shopping_cartBuy Now get_appDownload Sample

Horizontal Directional Drilling MarketPublished date: Apr 2022add_shopping_cartBuy Now get_appDownload Sample - Nabors Industries Ltd.

- The Toro Company

- The Charles Machine Works, Inc.

- Vermeer Corporation

- Herrenknecht AG

- XCMG

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |