Global Agricultural Fumigants Market By Product Type (1,3 Dichloropropene, Chloropicrin, Methyl Bromide, Metam Potassium, and Other Product Type), By Form (Solid, Liquid, and Gas), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Nov 2021

- Report ID: 20427

- Number of Pages: 246

- Format:

- keyboard_arrow_up

Agricultural Fumigants Market Overview:

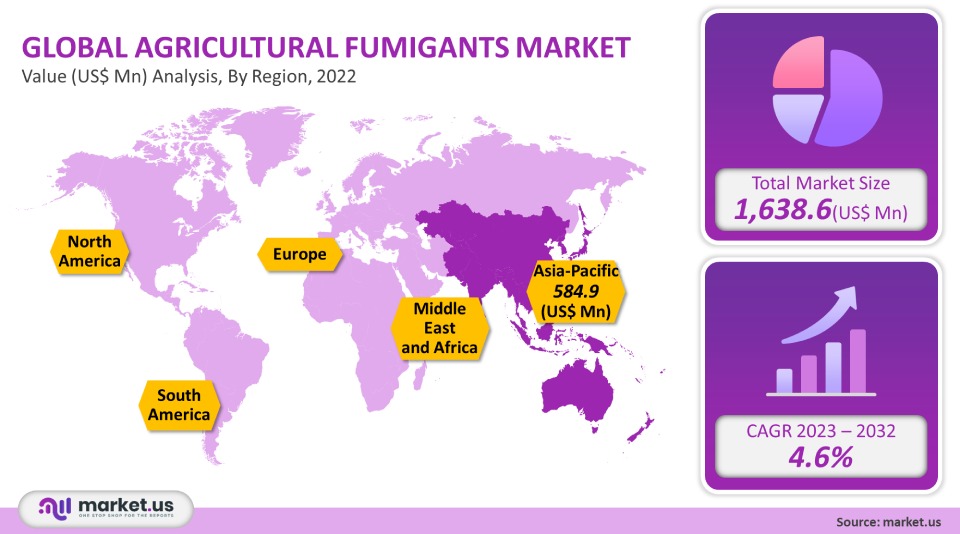

In 2021, the global agricultural fumigants market was valued at USD 1,638.6 million. The market is expected to grow at a compound annual rate (CAGR of 4.6%) between 2023 and 2032.

The growth is driven by evolving requirements regarding crop protection techniques, post-harvest practices, and other factors.

Global Agricultural Fumigants Market Scope:

Product Analysis

1,3-dichloropropene, an essential fumigant, is a viable substitute for Bromomethane. It has a lower vapor pressure and higher kHz, as well as higher degradation rates. It also has a higher sorption coefficient than 1,3-dichloropropene. Higher sorption coefficients eventually make the compound more stable in the soil.

Despite its potential for causing human health problems, phosphate is the fastest-growing product worldwide. This product is both toxic and flammable, so only authorized personnel should apply it. For best results, phosphate should only be applied for a prolonged period of time and in tightly sealed houses. It is best to apply phosphate based on the area being treated, not the quantity of the commodity. This practice is strictly prohibited in areas that aren’t completely sealed as they can cause severe damage to humans and animals in the surrounding.

Form Analysis

The market for agricultural fumigants can be divided into three types based on their form: liquid, solid, and gas. To control pests and insects, the solid form can be used in powder, pellets, and tablets. Because it is easy to use and can be sprayed, this form is considered the safest. It is considered to be comparatively safer for the environment in most parts of the world.

Liquids can be used to kill insects and molds. They can be applied to the desired area with standard sprayers. The applicator can decide the volume of solvent to be dispersed. This type of fumigation is generally considered to be the safest if it is done in enclosed areas or outdoors.

Gaseous forms are typically applied in enclosed chambers that have a gas-proof cover to prevent gas leakage into the environment. This is also called space fumigation. It is done with care to limit gaseous dispersion into the surrounding environment because they contain substances such as methyl bromide, which can cause ozone depletion. They effectively kill termites, insects, nematodes, and weeds.

Кеу Маrkеt Ѕеgmеntѕ:

By Product Type

- 1,3 Dichloropropene

- Chloropicrin

- Methyl Bromide

- Metam Potassium

- Other Product Type

By Form

- Solid

- Liquid

- Gas

Market Dynamics:

As the number of grain and cereal losses due to improper storage has increased, the importance of the post-harvest period for many grains and cereals is increasing. A report by the World Health Organization states that more than one-third of food is lost or wasted due to inadvertent storage.

The ability to reduce the losses mentioned could help lower the pressure on agriculture to supply the growing population’s dietary needs. It is also expected that it will reduce the exploitation of other sustainable natural resources. This problem is especially acute in developing countries, where farmers have limited access to storage information. This results in higher crop losses at the post-harvest stage.

Increased demand for infrastructure has led to encroachment on agricultural lands, which in turn has increased the difficulty of food supply. Reduced agricultural lands have put increased pressure on existing natural resources. There were two ways to meet growing food demand: increase land under cultivation or increase agricultural productivity. Both of these options are possible, but the nature of the solution will vary depending on where it is being grown. Increasing agricultural productivity is the best way to tackle the problem.

To keep farmers in the know about the many practices that increase productivity, education programs are offered to developing countries. To prevent infestation losses, fumigants can also be used. There are several warning signs for fumigants currently on the market. Fumigation involves placing fumigants inside an enclosed container and keeping it closed for at least four hours. Fumigant substances can seep into the air and cause respiratory diseases. Side effects can include nausea, vomiting, secretion of salivary glands, and coughing. This will likely act as a restraining agent for the market.

Regional Analysis:

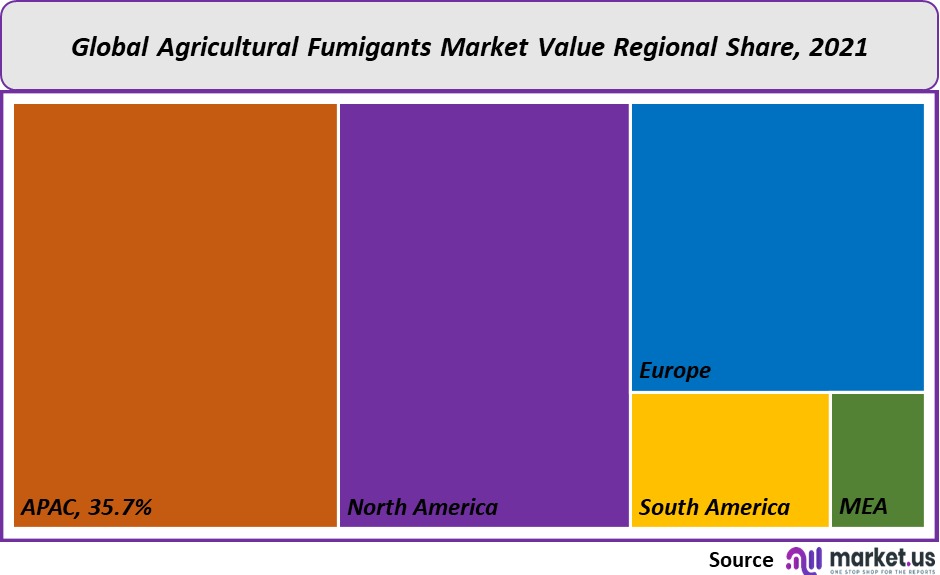

Asia Pacific market for agricultural fumigants is expected to be the largest. However, the Asia Pacific market is accounted for over 35.7% of revenue share and also growing at the highest rate of CAGR. The Asia Pacific was the biggest consumer of agricultural fumigants for 2021. This is due to the favorable climatic conditions that allow for high levels of pest and insect outbreaks in warehouses and other storage areas. Farmers use agricultural fumigants in order to avoid losses after harvest.

North America is the world’s largest agricultural hub. FAO reported that corn was the most popular crop in the region, with an annual production of more than 400 million tons. The Nature Conservancy is one of many conservancies that works with farmers in North America. They work with them to develop scientific strategies for increasing agricultural productivity growth by reducing nutrient run-off by 20% while also educating them about sustainable grazing practices.

Given the abundance of agriculture-based economies, the Asia Pacific region offers huge opportunities for the expansion of the fumigants sector. In the last decade, the demand for wheat, maize, and rice has quadrupled. This has led to an increase in pesticides and fertilizers used for the protection of cultivated crops as well as safe storage in warehouses. This has also led to an increase in greenhouse gas emissions. The Asia Pacific Department of Food and Agriculture Organization established stringent regulations to address the environmental damage caused by these chemicals.

Key Regions and Countries covered іn thе rероrt:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

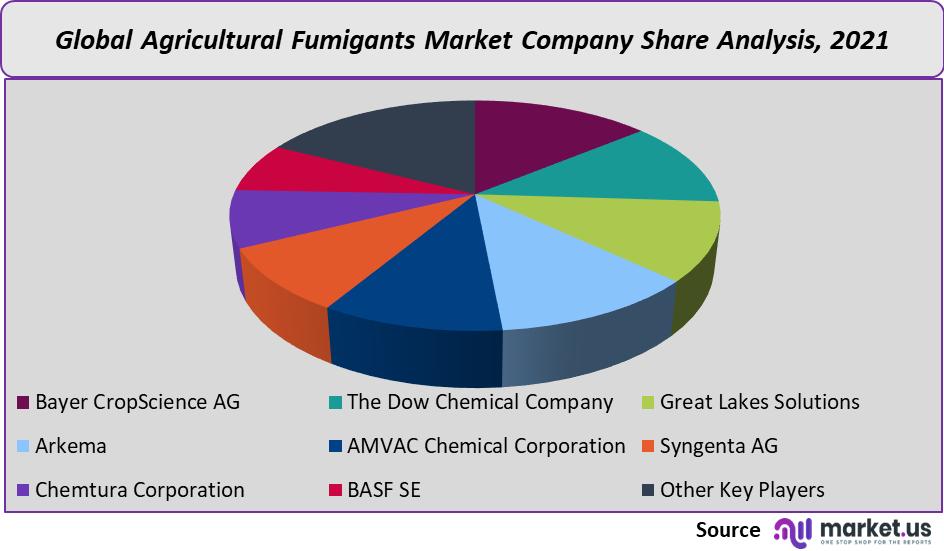

Market Share & Key Players Analysis:

The major regional markets are North America and the Asia Pacific. The market’s success is largely dependent on the country in which the products are grown and the laws that govern them. These products are expected to be in demand due to the increasing population of the Asia Pacific. They play an important role in improving agricultural productivity. It is expected that the Asia Pacific industry will grow if there are more manufacturers from India and China.

The suppliers are an essential component of the value chain because they bridge the gap between manufacturers and reduce unnecessary expenditure. Because they are intermediaries for farmers in remote regions, suppliers can help expand the supply chain. Manufacturers are primarily focused on expanding their product reach to help strengthen their regional dominance.

Маrkеt Кеу Рlауеrѕ:

- Bayer CropScience AG

- The Dow Chemical Company

- Great Lakes Solutions

- Arkema

- AMVAC Chemical Corporation

- Syngenta AG

- Chemtura Corporation

- BASF SE

- Trinity Manufacturing Inc.

- Arysta LifeScience Limited

- Novozymes

- Other Key Players

For the Agricultural Fumigants Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

Q: What is the size of the agricultural fumigants market in 2021?The Agricultural fumigants market size is US$ 1,638.6 million in 2021.

Q: What is the projected CAGR at which the Agricultural fumigants market is expected to grow at?The Agricultural fumigants market is expected to grow at a CAGR of 4.6% (2023-2032).

Q: List the segments encompassed in this report on the Agricultural fumigants market?Market.US has segmented the Agricultural fumigants market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Product Type, the market has been segmented into 1,3 Dichloropropene, Chloropicrin, Methyl Bromide, Metam Potassium, and Other Product Type. By form, the market has been further divided into, Solid, Liquid, and Gas.

Q: List the key industry players of the Agricultural fumigants market?Bayer CropScience AG, The Dow Chemical Company, Great Lakes Solutions, Arkema, AMVAC Chemical Corporation, Syngenta AG, Chemtura Corporation, BASF SE, and Other Key Players engaged in the Agricultural Fumigants market.

Q: Which region is more appealing for vendors employed in the Agricultural fumigants market?APAC is expected to account for the highest revenue share of 35.7%. Therefore, the Agricultural Fumigants Technology industry in APAC is expected to garner significant business opportunities over the forecast period.

Q: Name the key areas of business for Agricultural fumigants?India, China, The US, Canada, the UK, Japan, & Germany are key areas of operation for the Agricultural Fumigants Market.

Q: Which segment accounts for the greatest market share in the Agricultural fumigants industry?With respect to the Agricultural fumigants industry, vendors can expect to leverage greater prospective business opportunities through the 1,3-dichloropropene segment, as this area of interest accounts for the largest market share.

![Agricultural Fumigants Market Agricultural Fumigants Market]() Agricultural Fumigants MarketPublished date: Nov 2021add_shopping_cartBuy Now get_appDownload Sample

Agricultural Fumigants MarketPublished date: Nov 2021add_shopping_cartBuy Now get_appDownload Sample - Bayer CropScience AG

- The Dow Chemical Company

- Great Lakes Solutions

- Arkema SA Company Profile

- AMVAC Chemical Corporation

- Syngenta AG

- Chemtura Corporation

- BASF SE Company Profile

- Trinity Manufacturing Inc.

- Arysta LifeScience Limited

- Novozymes

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |