Global Commercial Payment Cards Market By Card Type (Purchase Card, Business Card, And Other Cards), By Application (Small Business Card And Large Business Card), By Region and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2019–2028

- Published date: Apr 2022

- Report ID: 21609

- Number of Pages: 275

- Format:

- keyboard_arrow_up

Market.us announces publication of its most recently generated research report titled, “Global Commercial Payment Cards Market by Card Type (Purchase Card, Business Card, Travel and Entertainment Card and Other Cards), By Application (Small Business Card and Large Business Card), and by Region – Global Forecast to 2028.”, which offers a holistic view of the global Commercial Payment Cards market through systematic segmentation that covers every aspect of the target market.

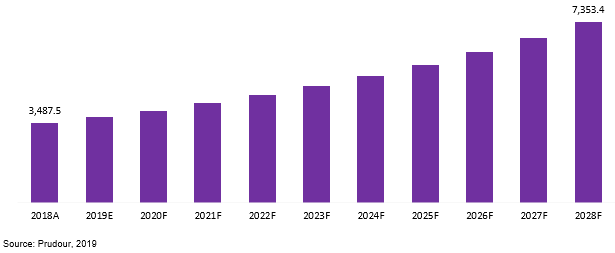

The global Commercial Payment Cards market is projected to be US$ 3,742.1 Mn in 2019 and is projected to reach US$ 7,353.4 Mn by 2028 at a CAGR of 7.7%.

A commercial card is a credit card allotted by companies for their employees to purchase on behalf of their organization. These cards are issued as co-branded cards with retailers; commercial cards assist businesses to manage their expenses by collecting all charges made by employees into a single place. Commercial cards are issued through a financial institution. This kind of partnership allows companies to earn rewards and discounts for purchases they were already going to make at the co-branded company. Commercial cards come in different variations; one is corporate credit card and small-business credit cards.

trending_up Total Revenue in 2018$ 3,742.1 Mn

trending_up Market CAGR of the Next Ten Years7.7%

no_encryption Market Value (US$ Mn), Share (%) and Growth Rate (%) Comparison 2012-2028Purchase this report or a membership to unlock the market value (US$ Mn), share (%) and growth rate (%) comparison for this industry.- By Type

- By Region

- By Application

no_encryption Leading Companies Financial HighlightsPurchase this report or a membership to unlock the leading companies financial highlights for this industry.trending_up Market Revenue of the Next Ten Years$ 7,353.4 Mn

Commercial Payment Cards and solutions help large corporations, midsize companies, small businesses, and government entities. Card provider companies’ solution streamlines procurement and payment processes, manage information and expenses (such as travel and entertainment) and reduce administrative costs. There are different types of card offerings, including travel, small business debt, and credit card, purchasing, and other cards.

Global Commercial Payment Cards Market Revenue (US$ Mn), 2018–2028

Snowballing number of corporate card service providers in Europe is one of the major factors driving the growth of the commercial payment cards market in this region.

However, increased card frauds along with security breaches and identity theft are some significant risks which might hamper the target market in the future. Nonetheless, the increasing popularity of other payments solutions and digital commerce in the picture is expected to boost the market growth for many years.

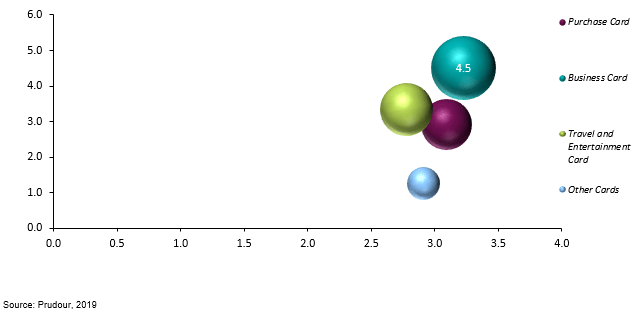

Global Commercial Payment Cards market is segmented based on Card type, application, and region. Based on Card type, the market is segmented into Purchase Card, Business Card, Travel and Entertainment Cards and Other Cards. The Business Card segment accounts for the majority share and is expected to register the highest growth over the forecast period. Based on application, the market is segmented into Small Business Card and Large Business Card. The Large Business Card segment accounts for a majority share in the global Commercial Payment Cards market.

Global Commercial Payment Cards Market by Card Type, 2018

Based on the region, the market is segmented into North America, Europe, APAC, South Americ, and Middle East Africa. The APAC accounts for the majority share in the global Commercial Payment Cards market and is expected to register the highest growth rate over the forecast period.

The research report on the global Commercial Payment Cards market includes profiles of some of the major companies such as JPMorgan Chase & Co, Bank of America Corporation, Citigroup Inc., Wells Fargo & Company and Barclays PLC.

Key Market Segments:

Type

- Purchase Card

- Business Card

- Travel and Entertainment Cards and Other Cards

Application

- Small business card

- Corporate card

Key Market Players included in the report:

- JPMorgan Chase & Co

- Bank of America Corporation

- Citigroup Inc.

- Wells Fargo & Company and Barclays PLC

For the Commercial Payment Cards Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

![Commercial Payment Cards Market Commercial Payment Cards Market]() Commercial Payment Cards MarketPublished date: Apr 2022add_shopping_cartBuy Now get_appDownload Sample

Commercial Payment Cards MarketPublished date: Apr 2022add_shopping_cartBuy Now get_appDownload Sample - JPMorgan Chase & Co

- Bank of America Corporation

- Citigroup Inc.

- Wells Fargo & Company and Barclays PLC

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |