Global Biodefense Market By Product (Anthrax, Botulism, Smallpox, Nuclear/Radiation, and Other Products), By Application (Civilian, and Military), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Nov 2021

- Report ID: 21643

- Number of Pages: 302

- Format:

- keyboard_arrow_up

Biodefense Market Overview:

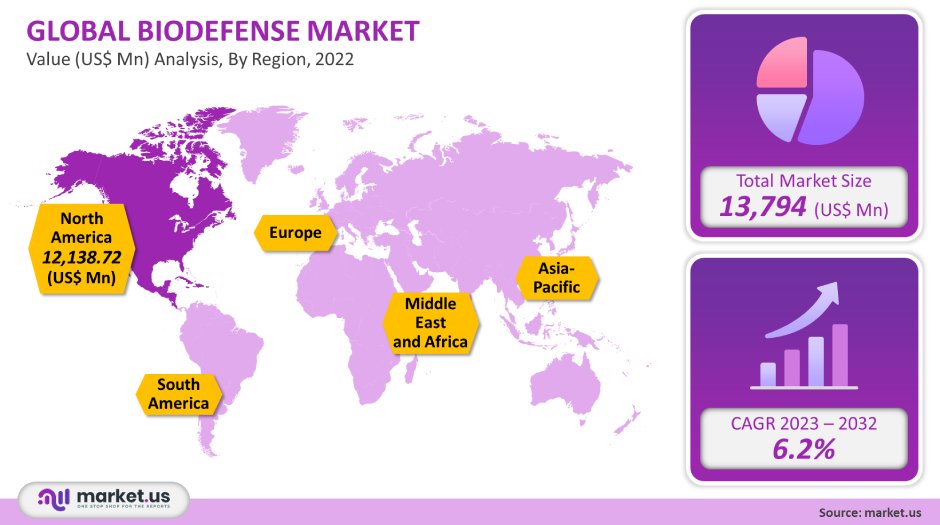

The global biodefense market is estimated to be worth USD 13,794 million in 2021 and will grow at a compound annual growth rate of 6.2% between 2022-2032.

Biodefense is the combination of medical and military measures to restore biosecurity to a country from biological toxins or infectious agents. These agents can be used with the intent to kill, infect, or incite biological warfare. Agents that are used to inflict bioterrorism can include living organisms like bacteria, viruses, molds, and toxins.

These agents can also be used to deliberately infect and kill people to cause social and economic chaos. Market forces for biodefense include favorable U.S. government initiatives, increasing investment from private parties, increased government funding and focus on biodefense strategies, as well as growing prevalence of agents like the Zika Virus, Ebola Virus, and Flu.

Global Biodefense Market Analysis:

Product Analysis:

The market for biodefense was dominated by the anthrax segment, which held the largest revenue share with 30% in 2021. It is expected that the segment will see a substantial CAGR in the future. Bacillus Anthracic is gram-positive bacteria that causes anthrax.

These spores are most commonly preferred because they can be easily released into an environment by being placed in food, water, or powder. They can survive for long periods in the environment, and they are easy to find in nature.

Anthrax bacteria, which can be easily transmitted from one person to another, is classified as a Tier-1 biological agent according to NCBI. This means that it has the potential to have major health consequences for the public. Project Bio-Shield has funded major vaccine development funds for countermeasures against anthrax. Many companies have anthrax vaccines in clinical trials.

The market for other products will have the second-highest CAGR during the forecast period. Viral hemorrhagic disease, brucellosis, cholera, and influenza are all included in the other segment.

The National Institute of Allergy and Infectious Diseases, (NIAID), has a Vaccine Research Centre. This Centre works on VHF vaccines since 2003 to protect against Ebola and Marburg. The U.S. Department of Defense has given a contract to the University of Texas at San Antonio for the development of a vaccine that will combat tularemia.

Tularemia is a highly infectious disease that can lead to death. Many countries have seen an increase in Zika and Ebola virus infections recently. Therefore, many companies are competing for vaccines.

Application Analysis:

Due to terrorist organizations’ increasing biological threats to civilians, the revenue CAGR for the civilian segment will be rapid. Many terrorist organizations disrupt society.

As a majority of the population is civilians, there is a major threat or damage to the civil sector. That’s why governments are creating civilian biodefense strategies for civilians and conducting research activities to help protect the civilian population against such biological attacks.

As a result, many research institutions are engaged in civilian biodefense research. Avian influenza is a potentially lethal virus that can be introduced intentionally or naturally by terrorists. NIAID’s civilian biodefense research, for example, is part of its larger portfolio on emerging and reemerging infections.

The U.S. Department of National Institutes of Health(NIH), and Health and Human Services (HHS) placed a strong emphasis on initial advances in medical countermeasures against terrorist attacks from infectious diseases and radiation exposure. This is a significant factor that will drive segment revenue growth during the forecast period.

Key Market Segments:

By Product:

- Anthrax

- Botulism

- Smallpox

- Nuclear/Radiation

- Other Products

By Application

- Civilian

- Military

By Application:

- Civilian

- Military

Market Dynamics:

In the last decade, technological advances in genetic engineering and technology have made it possible for these viruses to be modified. Biodefense is a vital aspect of international affairs because these organisms are easy to obtain.

Botulism, anthrax, and other biological agents have been used to cause economic vandalism and act as carriers for bioterrorism. These situations had led to the creation of biodefense policies, treaties, and biodefense legislations to counter biological threats and reduce risks.

They also help prepare for, respond and recover from bio-incidents. The National Institute of Infectious Disease has played a crucial role in developing medical products and strategies that counter bioterrorism. It also conducts continuous research to treat, prevent and cure infectious diseases, naturally occurring or not.

To support emergency response and increase preparedness, many governments have collaborated with international partners. Merck has approved the safe use of an experimental single-dose Ebola vaccination [rVSV ZEBOV GP] by the World Health Organization.

About 250,000 people who are at high risk for Ebola had been vaccinated by the World Health Organization and DRC MoH. Many companies, such as Ology Bio services or Bavarian Nordic, are carrying out research about the Zika virus and Ebola in countries that have low medical infrastructure and research capabilities.

Project Bio Shield Act is a strategic move to increase funding for the development, procurement, and use of medical countermeasures against biological and chemical warfare agents. The rising incidence of infectious diseases and other factors are expected to increase the growth of the biodefense market.

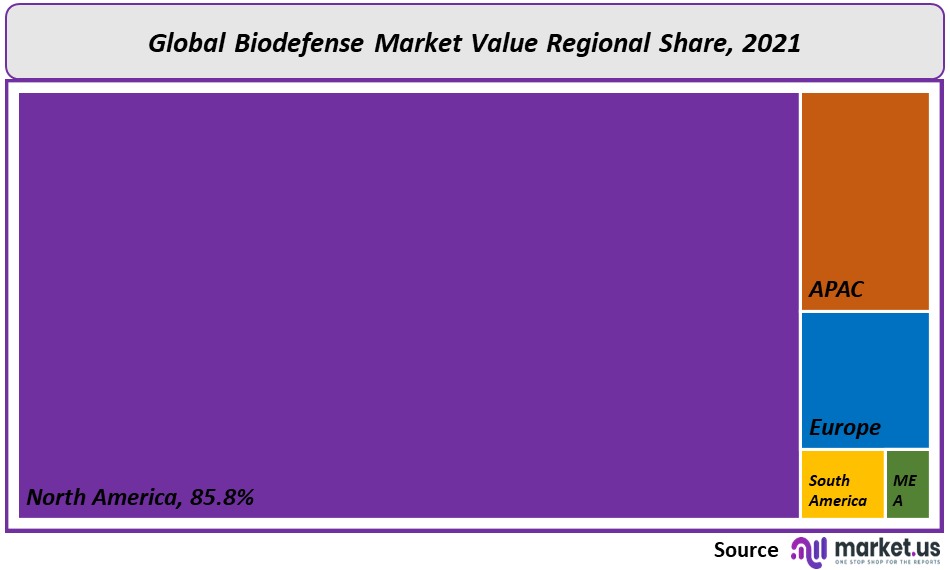

Regional Analysis:

North America dominated biodefense markets and was responsible for the largest revenue share, 85.8%, in 2021. This region is expected to experience significant growth over the forecast period.

This is due to the high level of federal funding, technological advancements, and increasing awareness among the populace. It is also favorable for the market that major players are located in this area. The National Biodefense Strategy aligns with the 2021 National Security Strategy.

The strategy’s goals are to detect and contain bio-threats right at their source, foster and support biomedical innovations, and improve emergency responses in the case of biological epidemics. This is what is driving the region’s biodefense market.

APAC will see the highest expected CAGR in biodefense over the forecast period. This is due in part to the increased investments in R&D and the growing threat of biodefense-related biological materials. Japan and Australia are two of the largest markets for biodefense in Asia.

They have established vaccine production facilities. Its market position is also helped by the country’s sophisticated healthcare infrastructure. China and India are expanding their R&D capabilities in order to address biological threats. China is second after the U.S. in terms of R&D spending.

Кеу Regions and Countries covered іn thе rероrt:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Market Share & Key Players Analysis:

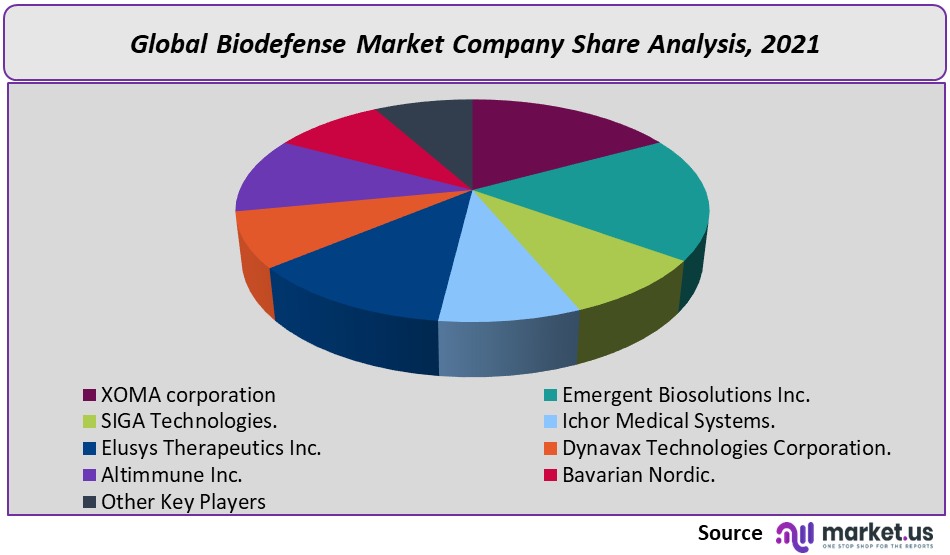

The biodefense market is extremely competitive. Market players are competitive due to the rapid adoption and use of advanced technology for developing vaccines.

Strategic collaborations are becoming increasingly popular with key players to obtain bulk orders and increase sales volume in emerging economically viable regions. Numerous companies are joining forces to jointly develop drugs and bring their products to the market faster for biodefense.

Ichor Medical Systems Inc., which is a private biotech company, announced that it had entered into an agreement for collaboration and research with AstraZeneca. This agreement covers the development and clinical evaluation of plasmid genome constructs. Ichor will receive both annual and upfront payments under the terms. Additionally, milestones for development will be covered.

Маrkеt Кеу Рlауеrѕ:

- XOMA corporation

- Emergent Bio Solutions Inc.

- SIGA Technologies.

- Ichor Medical Systems.

- Elusys Therapeutics Inc.

- Dynavax Technologies Corporation.

- Altimmune Inc.

- Bavarian Nordic.

- Other Key Players

Frequently Asked Questions (FAQ)

What is the Biodefense Market size in 2021?The Biodefense Market size is $ 13,794 million in 2021.

What is the CAGR for the Biodefense Market?The Biodefense Market is expected to grow at a CAGR of 6.2% during 2023-2032.

What are the segments covered in the Biodefense Market report?Market.US has segmented the Global Biodefense Market Value (US$ Mn) Analysis by Region, 2022 market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Product, market has been segmented into anthrax, botulism, smallpox, nuclear/radiation, and other products. By Application, market has been further divided into civilian and military.

Who are the key players in the Biodefense Market?XOMA corporation, Emergent Bio Solutions Inc., SIGA Technologies., Ichor Medical Systems., Elusys Therapeutics Inc., Dynavax Technologies Corporation., Altimmune Inc., Bavarian Nordic., and Other Key Players

Which region is more attractive for vendors in the Biodefense Market?North America accounted for the highest revenue share of 85.8% among the other regions. Therefore, the Biodefense Market in North America is expected to garner significant business opportunities for the vendors during the forecast period.

What are the key markets for Biodefense?Key markets for Biodefense are US, China, Japan, India, Brazil, Germany, UK, France, Italy, Spain, etc.

Which segment has the largest share in the Biodefense Market?In the Biodefense Market, vendors should focus on grabbing business opportunities from the anthrax product segment as it accounted for the largest market share in the base year.

![Biodefense Market Biodefense Market]()

- XOMA corporation

- Emergent Bio Solutions Inc.

- SIGA Technologies.

- Ichor Medical Systems.

- Elusys Therapeutics Inc.

- Dynavax Technologies Corporation.

- Altimmune Inc.

- Bavarian Nordic.

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |