Global Confectionery Market By Type (Sugar confectionery , Chocolate , and Gum), By Application (Wedding , and Festivals), By Region and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2019–2028

- Published date: May 2021

- Report ID: 22184

- Number of Pages: 320

- Format:

- keyboard_arrow_up

Report Overview

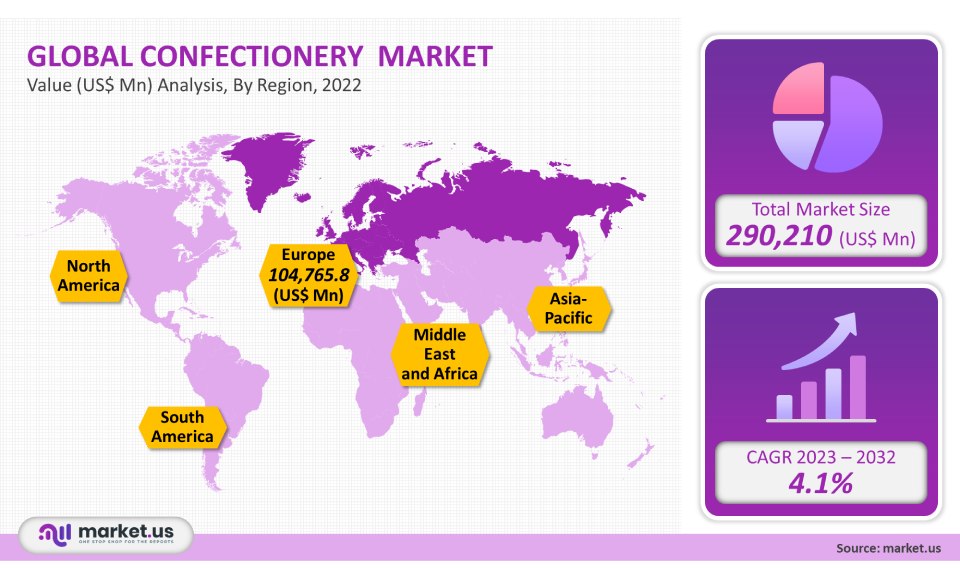

The global confectionery market is estimated to reach US$ 290,210 million in 2021. This number will increase at a compound annual growth rate of 4.1% between 2023-2032.

Global Confectionery Market

Product Analysis

The market share for chocolate was more than 45% in 2021. This segment is expected to expand at a CAGR of 4.2% between 2023-2032. This is due to the growing demand for chocolate products and their increased consumption by all ages to satisfy their taste buds. Compared to all other confectionery products, chocolate is the most consumed per capita. The market is set to grow due to increased demand for organic and premium chocolate products during the forecast period.

Sugar confectionery is projected to grow at 4.9% between 2023 and 2032. Market growth is expected to accelerate due to consumers changing lifestyles and eating habits. Market growth will also be driven by the increasing middle-class population and growing disposable income. The rising trend in e-commerce is expected to propel this segment over time.

Distribution Channel Analysis

In 2021, 75% of the global confectionery industry’s market was held by offline channels. For consumer goods, groceries, and confectionery products like chocolate, consumers prefer to shop offline. Easy access to and the ability to search for confectionery products via stores will likely drive segment growth. In the coming years, the offline segment will see a rise in demand for chocolate, cookies, ice cream, and other confectionery products.

The online market will experience the fastest growth, with a CAGR of 5.2% between 2023-2032. Recent years have seen significant growth in internet penetration, which has led the world to e-commerce. These products are offered by many manufacturers on their websites, as well as through e-commerce platforms. This will in turn drive market growth for the next few years.

Key Market Segments

Product

- Chocolate

- Sugar Confectionery

- Cookies

- Ice Cream

Distribution Channel

- Offline

- Online

Market Dynamics

Market growth will be supported by the expanding food and beverage industries across the globe, and the increasing per capita consumption of these products. Market growth is also driven by the desire of consumers to gift these products and the rapid urbanization around the world. Aside from this, confectionery products in emerging markets are more popular due to their attractive packaging and continuous development.

Market growth is driven by changing consumer behavior and dietary pattern. Recent years have seen a rise in demand for confectionery products made from natural ingredients. Dohler reports that around half of all confectionery product buyers want healthier options made with at least 60% natural components. Market demand is expected to rise due to increased demand for sugar-free confectionery in developed economies.

There are many confectionery product manufacturers that offer a wide variety of products like chocolate or chewing gum and sweets. The market is experiencing a surge in investment from key market players in marketing campaigns, promotional activities, and social media marketing. The quality of these products is expected to be maintained by governments in the U.S.A, U.K, China, India, and the U.K. The federal guidelines and rules are published to ensure that products meet the highest standards of hygiene for consumption.

The COVID-19 pandemic resulted in transportation disruptions and a temporary suspension of raw material supplies. There will be opportunities for market players due to increased demand for organic and natural chocolate after the pandemic. In the coming years, the market should experience healthy market growth.

Regional Analysis

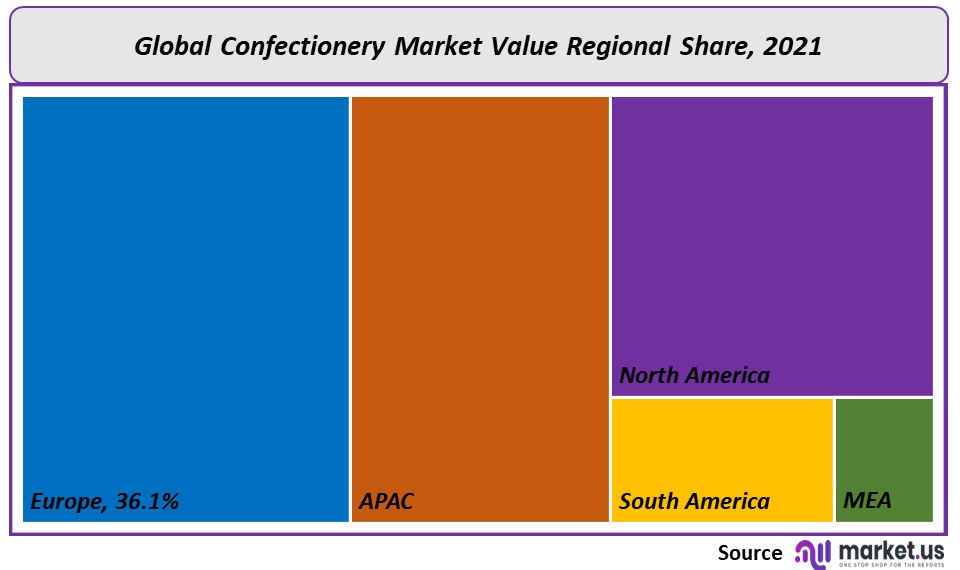

Europe contributed 36.1% to the global market share in 2021. The market’s growth is being driven by the growing popularity and demand for chocolate confectionery items. Market growth is being driven by the growing preference of consumers for organic and natural products with added value. The market is also growing due to the constant changes in consumers’ eating habits and lifestyles.

The Asia Pacific is the fastest-growing region and will see a 5.0% annual growth rate between 2023-2032. Japan, India, China, and China are all big consumers of confectionery. This will increase regional demand. The region will also experience an accelerated growth rate due to growing disposable incomes and a rising population.

Key Regions and Countries covered іn thе rероrt:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

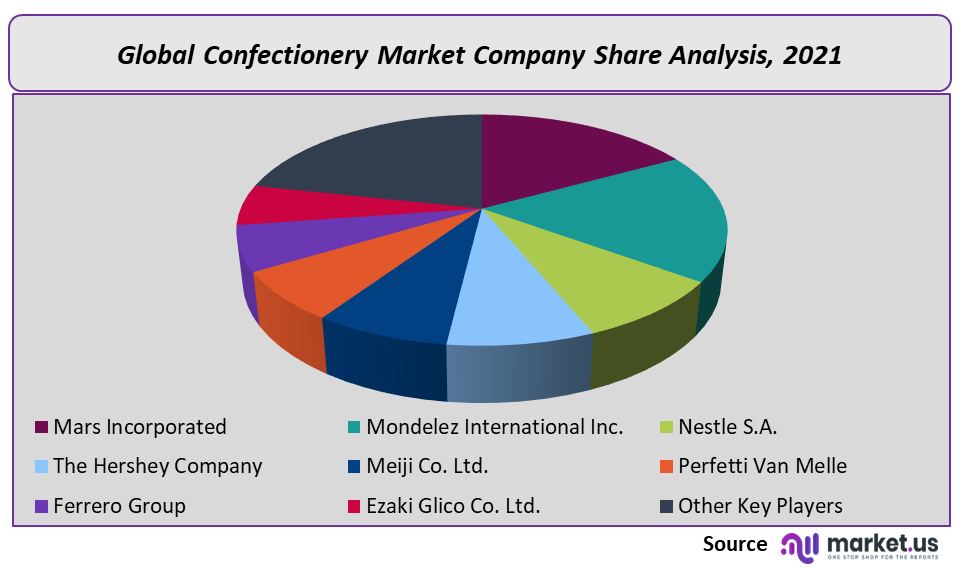

Market Share Analysis

Diverse manufacturers and suppliers will focus on logistic development and strengthening their distribution channels to grow and expand their businesses. The key market players are investing more in marketing campaigns, promotional activity, and social media marketing to increase their geographic presence around the world. These efforts are expected to increase the product’s acceptance rate by consumers across the globe.

Key Market Players

These are the main players in the global confectionery market:

- Mars Incorporated

- Mondelez International Inc.

- Nestle S.A.

- The Hershey Company

- Meiji Co. Ltd.

- Perfetti Van Melle

- Ferrero Group

- Ezaki Glico Co. Ltd.

- Other Key Players

![Confectionery Market Confectionery Market]()

- Mars Incorporated

- Mondelez International Inc.

- Nestlé S.A Company Profile

- The Hershey Company

- Meiji Co. Ltd.

- Perfetti Van Melle

- Ferrero Group

- Ezaki Glico Co. Ltd.

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |