Global Hydrofluoric Acid Market By Grade (Diluted and Anhydrous), By Application (Fluorinated Derivatives, Fluorocarbon, Metal Pickling, Oil Refining, and Glass Etching), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: May 2021

- Report ID: 22296

- Number of Pages: 301

- Format:

- keyboard_arrow_up

Hydrofluoric Acid Market Overview:

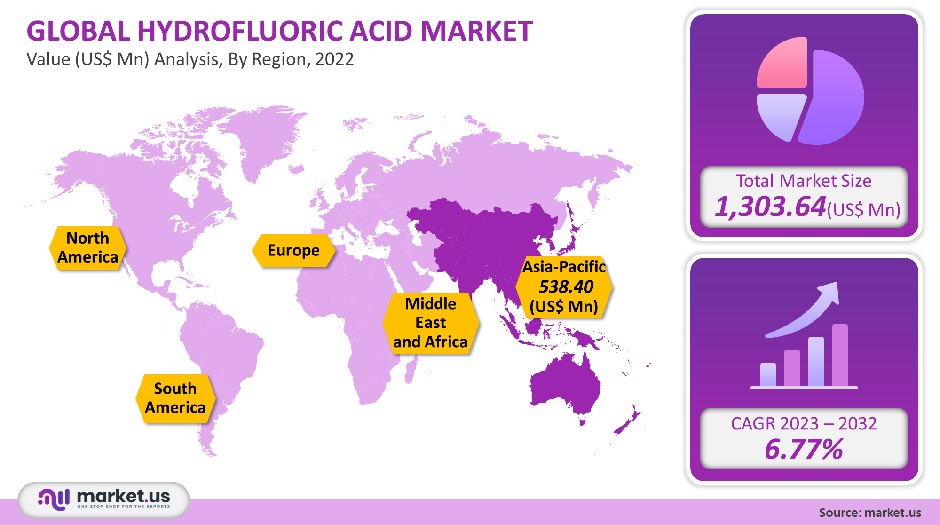

The global hydrofluoric acid market was worth USD 1,303.64 million in 2021. It is expected to grow at a CAGR, of 6.77% between 2023 to 2032.

This is due to increasing product usage in many end-use applications such as oil refining, metal, fluorocarbon, and aluminum refrigerants, metal, hydrocarbons, fluorocarbon, and aluminum. The forecast period will also see a rise in demand for high-grade acid products. The chemical industry uses hydrofluoric acid to produce various fluorine components like fluorides and fluoropolymers.

Global Hydrofluoric Acid Market Scope:

Grade Analysis

With a market share of over 58%, the anhydrous grade segment was the dominant player in the market. This can be ascribed, among other things, to an increase in product inclusion in fluorochemicals, fluoropolymers, and surfactants. It is used in petroleum alkylation as a catalyst. It can also be used in the acidolysis of cysteine-peptides’ benzyl group.

It increases production at lower temperatures which in turn has a positive effect on the demand for anhydrous grades. It is used in stainless steel pickling, glass etching, and quartz purification. It can also be used to remove native silicon dioxide (silicon dioxide) from wafers. Because it can etch silicon compounds, it is often used in research. It is extremely corrosive and toxic to the skin, making it a significant barrier to global market growth.

Inhaling a certain amount of anhydrous acid can cause serious respiratory problems. To ensure worker safety, an acid concentration of 100 mg/m3 is permissible. Domestically, anhydrous hydrofluoric acids are in high demand. It can also be used to clean metal and wheels. This will in turn lead to segment growth over the forecast period.

Application Analysis

Fluorocarbon applications dominated the market in 2021, accounting for more than 55.3% of global revenue. Fluorocarbons are in high demand from refrigerants and air conditioning systems, which has boosted production, particularly in developing countries. Because it is an alternative to ozone-depleting chlorofluorocarbons, hydrofluoric acid is seeing a rise in demand.

It can be used in many applications such as the purification and polishing of graphite, quartz, and ferrosilicon, ceramic production, and metal pickling. It is used to treat metals, removing stains from the surface. The hydrofluoric acid alkylation units are used in petroleum refining to transform alkenes or isobutane, primarily butylene and propylene, into alkylate. This is then used to make gasoline. This product can also be used in the manufacture of aluminum.

The market will grow in the future due to the increasing demand for aluminum products in different industries around the world. Hydrofluoric acid in nature is a toxic and highly corrosive substance. Hydrofluoric acid can have severe side effects on the health if inhaled or directly contacted. These restrictions can reduce the use of industrial-grade hydrofluoric acids, which can further limit product demand.

Кеу Маrkеt Ѕеgmеntѕ

By Grade

- Diluted

- Anhydrous

By Application

- Fluorinated Derivatives

- Fluorocarbon

- Metal Pickling

- Oil Refining

- Glass Etching

- Other Applications

Market Dynamics:

Hydrofluoric-olefins and hydrofluorocarbons are employed as refrigerants all over the world because of their exceptional quality. It’s also used to make aluminum fluoride, which is widely used in many aluminum products. Fluorspar is the main raw material for hydrofluoric acid production. Fluorspar, a natural source of fluorine, can be made artificially or naturally hydrothermal.

Fluorspar is used extensively in the manufacture of gasoline, aluminum, steel, refrigerants, and insulation foams, among other things. To make the product, heat purified fluorspar and concentrated sulfuric acid. The product is then condensed using concentrated sulfuric acid and purified fluorspar.

It is also commonly used in plastic containers because it is highly reactive against the glass and moderately reactive towards metals. It can be sold in different packaging options depending on the amount and needs of the customer, including IBCs, drums, and jerrycans. These containers offer a tailored product and meet the highest safety standards.

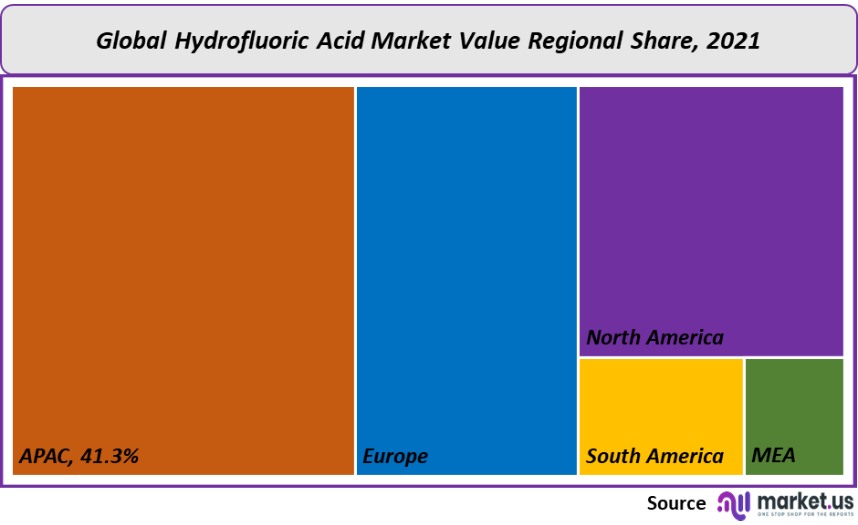

Regional Analysis

With a revenue share exceeding 41.3%, the Asia Pacific region dominated global markets in 2021. This is due to the numerous fluorocarbons manufacturers in the region. This industry will be the fastest growing market during the forecast period. China’s rising demand for electronics and metals is positively impacting product demand. Market growth will be boosted by the increasing use of metal and electronics in civil production, national defense, and industrial industries.

Due to the increased production of fluorochemicals in Europe, the market is expected to grow. North America’s industry is experiencing rapid growth due to increasing imports and R&D efforts to create a more environmentally-friendly product that has the same performance. Hydrofluoric acid manufacturing is important in Central & South America, the Middle East, and Africa areas. However, it is comparatively less popular than other developed regions around the world.

Key Regions and Countries covered іn thе rероrt:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

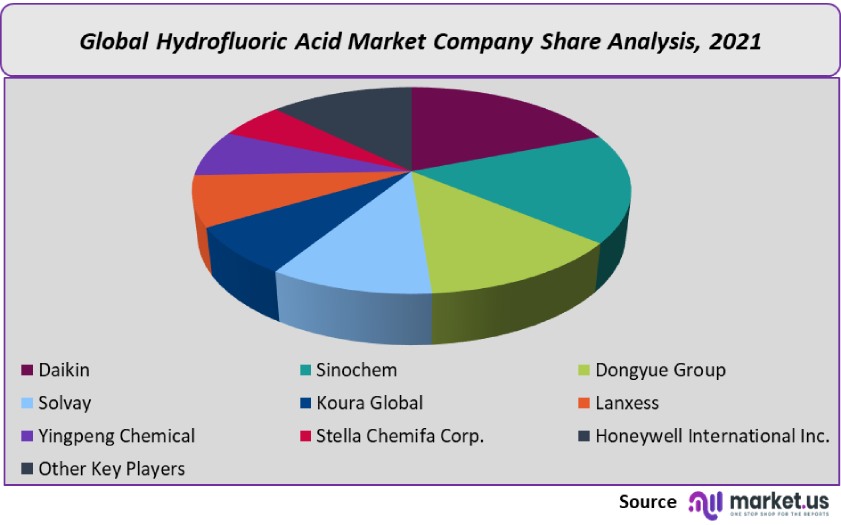

Market Share & Key Players Analysis:

Market competition is heavily influenced by the product mix, the number of sellers, and geographic location. To produce non-toxic products, key manufacturers are involved in R&D. The popularity of online distribution is rapidly growing compared to direct sales.

However, direct sales still have a higher market value because customers can access the products more easily. To increase their presence in the value chain, key industry players are focused on mergers and acquisitions. To reduce operational costs, these players are involved in multiple activities. This includes the production and marketing of the final product.

Маrkеt Кеу Рlауеrѕ:

- Daikin

- Sinochem

- Dongyue Group

- Solvay

- Koura Global

- Lanxess

- Yingpeng Chemical

- Stella Chemifa Corp.

- Honeywell International Inc.

- Other Key Players

For the Hydrofluoric Acid Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

Q: What is the size of the Hydrofluoric Acid market in 2021?A: The Hydrofluoric Acid market size is US$ 1,303.64 million in 2021.

Q: What is the projected CAGR at which the Hydrofluoric Acid market is expected to grow at?A: The Hydrofluoric Acid market is expected to grow at a CAGR of 6.77% (2023-2032).

Q: List the segments encompassed in this report on the Hydrofluoric Acid market?A: Market.US has segmented the Hydrofluoric Acid market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Grade, market has been segmented into Diluted and Anhydrous. By Application, the market has been further divided into Fluorinated Derivatives, Fluorocarbon, Metal Pickling, Oil Refining, and Glass Etching.

Q: List the key industry players of the Hydrofluoric Acid market?A: Daikin, Sinochem, Dongyue Group, Solvay, Koura Global, Lanxess, Yingpeng Chemical, Stella Chemifa Corp., Honeywell International Inc., and Other Key Players engaged in the Hydrofluoric Acid market.

Q: Which region is more appealing for vendors employed in the Hydrofluoric Acid market?A: APAC accounted for the highest revenue share of 41.3%. Therefore, the Hydrofluoric Acid industry in APAC is expected to garner significant business opportunities over the forecast period.

Q: Name the key areas of business for Hydrofluoric Acid?A: China, Japan, India, Brazil, Germany, UK, France, Spain, The US, etc., are key areas of operation for Hydrofluoric Acid Market.

Q: Which segment accounts for the greatest market share in the Hydrofluoric Acid industry?A: With respect to the Hydrofluoric Acid industry, vendors can expect to leverage greater prospective business opportunities through the anhydrous grade segment, as this area of interest accounts for the largest market share.

![Hydrofluoric Acid Market Hydrofluoric Acid Market]()

- Daikin Industries Ltd. Company Profile

- Sinochem

- Dongyue Group

- Solvay

- Koura Global

- Lanxess

- Yingpeng Chemical

- Stella Chemifa Corp.

- Honeywell International Inc.

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |