Global Kaolin Market By Type (Type1, and Type2), By Application (Paper Industry, Concrete, Plastics, Agriculture, and Others), By Region and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Apr 2022

- Report ID: 28707

- Number of Pages: 359

- Format:

- keyboard_arrow_up

Kaolin Market Overview:

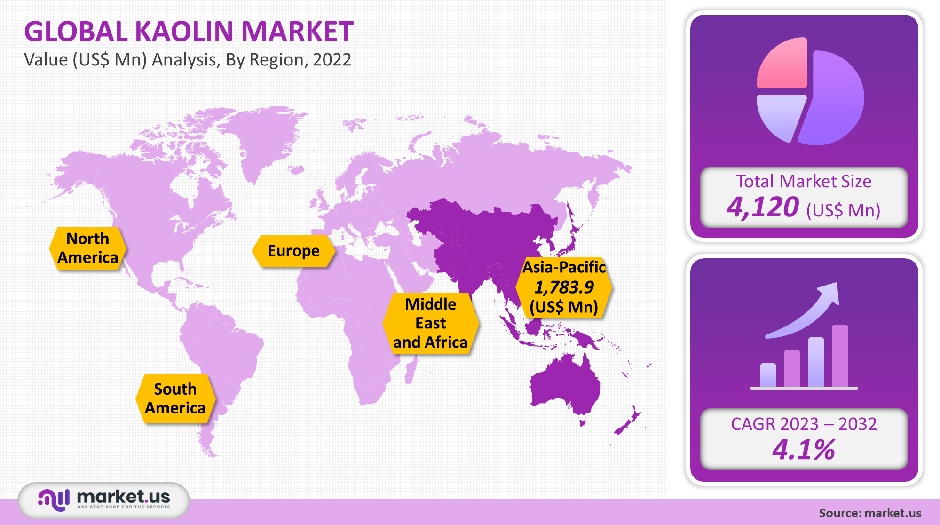

The global kaolin market was valued at USD 4,120 Million in 2021. It is expected to grow at a CAGR, of 4.1% between 2022 and 2032.

With progress in construction activities across the globe, the market is showing signs that it is recovering. This has opened up material demand for products like paints & coatings, ceramics, and others. The kaolin vendors saw a significant drop in new orders during the first half of FY 2021.

Global Kaolin Market Scope:

Application Analysis

The market was dominated by paper, which accounted for nearly 39.1% of the volumetric share in 2021. The appearance of paper is improved by using a Kaolin coating.

It can be applied to a variety of papers, including gloss, smoothness, and brightness. The product also enhances paper’s printability by increasing ink absorption, ink pigment retention, and lower tinting tendencies. These factors are what has helped it to gain a large market share within the paper industry.

Ceramics will be the second most important application segment, with a compounded annual growth rate close to 4.6%. This is based on the projected volume.

Ceramic manufacturing is seeing a rise in popularity due to its characteristics, including fine particle size, chemical and absorption properties, white burning feature, high fusion temperature, and chemical inertness. These properties make it ideal for the manufacture of bone china and porcelain.

In 2021, paints and coatings represented a 6.2% market share. Paints & coatings in the construction industry will continue to be a major driver of market growth for kaolin. Market growth will be positive in the near future if the product is used to improve the performance of paints.

This includes better suspension properties, faster dispersion, corrosion resistance, superior water resistance, and reduced viscosities. Rubber will be the fifth-largest market, with a volumetric percentage of almost 2.1% by 2021.

This segment will lose market share due to the emergence of substitutes during the forecast period. In recent years, calcined products have gained popularity for the production of heavy-duty insulation rubber. This directly impacts the penetration of Kaolin in this specific application segment.

Key Market Segments:

By Application

- Paper

- Ceramics

- Paint & Coatings

- Fiberglass

- Plastic

- Rubber

- Pharmaceuticals & medical

- Cosmetics

- Other Applications

Kaolin Market Dynamics:

The United States is one of the most important producers of kaolin in the world. According to the United States Geological Survey (USGS), the product’s production volume has been declining continuously from 2017 to 2021, according to the USGS stats.

The widespread disruption brought about by COVID-19 led to a drop in production volume of nearly 9.7%, especially in 2021. The lockdown initiation also caused a significant drop in downstream demand for the product, with key sectors like paper, ceramics, and rubber all experiencing a negative trend.

The pandemic of COVID-19, and work-from-home policies, had a devastating impact on the domestic paper industry. Due to remote working, the consumption of writing and printing paper fell significantly in FY 2021.

This downgraded demand caused havoc on the production side. Between 2019 and 2021, the U.S. saw a decline in writing and printing paper volumes by almost 7%.

The consumption side saw a slowdown in construction activity during Q2 FY 2020, which drained the demand for plastic & paints and ceramic, plastic, and related products.

This directly affected the new orders for kaolin and related products. Despite these slow consumption trends, the domestic market space showed signs of improvement from the fourth quarter of FY 2020 largely due to the full resumption of industrial and construction activities.

The country’s infrastructure investment and jobs act will likely open up new opportunities in the construction sector.

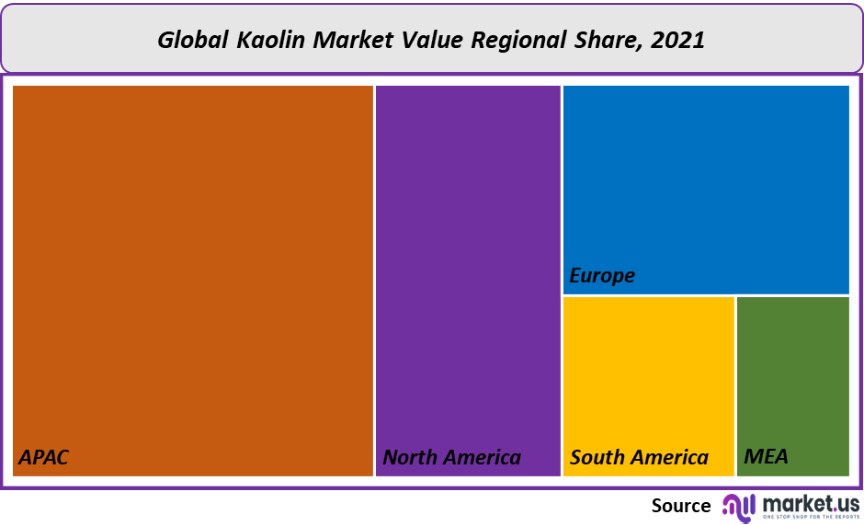

Kaolin Market Regional Analysis

The Asia Pacific was the region with the largest share, with more than 43.3% in 2021. Asia Pacific’s rapid industrialization and economic development have fueled the growth of the kaolin market. This region will experience the fastest growth rate over the forecast period.

The major contributors to regional market space growth are countries like South Korea, India, Malaysia, and China.

In 2021, Europe will be the second-largest regional space. Coronavirus, which was discovered in 2020, had a significant impact on regional economic growth. In FY 2020, the regional key countries, including Spain, Germany, Italy, and Spain, saw lower industrial output.

The product’s dynamics were directly affected by the slow growth of industrial output. In 2021, there were signs of improvement in regional growth.

Nevertheless, the ongoing conflicts in the region (Russia Ukraine war) and rising energy prices will likely limit regional growth during the forecast period.

In 2021, North America accounted for nearly 13.4% of the region’s revenue. According to projections, the U.S. government’s current drive to develop green energy sectors will play a major role in driving demand for kaolin-related products.

Vendors in North America will likely see new opportunities due to the increased use or utilization of ceramic and ceramic-based fused in the regional solar sector.

The Middle East and Africa region will experience a compound annual growth rate of close to 3.5% in volume over the forecast period. Positive developments in regional economic conditions, as well as improvements in supporting policies and norms, will drive Middle East’s construction industry to grow within the expected timeline.

In 2021, the region was able to complete projects worth USD 135.7 million, compared with USD 110.0 million in 2020. This strong momentum in regional construction market spaces is expected to help the development of the kaolin industry.

Key Regions and Countries covered in the report:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

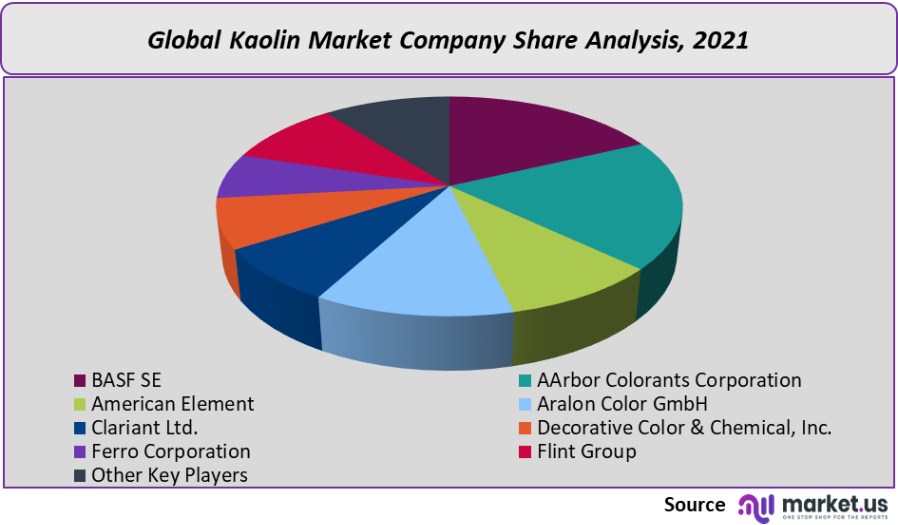

Market Share & Key Players Analysis:

Due to the economic disruption caused by COVID-19, vendors in this market space were still under tremendous pressure.

Due to the transportation restrictions and lockdowns, new orders and shipments were immediately affected. The partial utilization rate and low work staff meant that the mine output was affected in most cases.

To avoid further losses, the manufacturers are focusing mainly on maintaining liquidity to keep their business afloat. In FY 2020, vendors saw a decrease in new orders.

This led to a negative trend in financial revenue earnings. Trade opportunities were also reduced due to partial port closures around the world.

The majority of industry participants announced a price increase in FY 2021, which improved the situation. The following are some of the most prominent players in the kaolin market.

Маrkеt Кеу Рlауеrѕ:

- BASF SE

- AArbor Colorants Corporation

- American Element

- Aralon Color GmbH

- Clariant Ltd.

- Decorative Color & Chemical, Inc.

- Ferro Corporation

- Flint Group

- Heubach GmbH

- Kama Pigments

- Other Key Players

For the Kaolin Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

Q: What is the Kaolin market size?A: The Kaolin market size is $ 4,120 million for 2023-2032.

Q: What is the CAGR for the Kaolin market?A: The Kaolin market is expected to grow at a CAGR of 4.1% during 2023-2032.

Q: What are the segments covered in the Kaolin market report?A: Market.US has segmented the Global Kaolin Market Value (US$ Mn) Analysis by Region, 2022 market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By application, market has been segmented into paper, ceramics, paint & coatings, fiber glass, plastic, rubber, pharmaceuticals & medical, cosmetics, other applications.

Q: Who are the key players in the Kaolin market?A: BASF SE, AArbor Colorants Corporation, American Element, Aralon Color GmbH, Clariant Ltd., Decorative Color & Chemical Inc., Ferro Corporation, Flint Group, Heubach GmbH, Kama Pigments, and Other Key Players

Q: Which region is more attractive for vendors in the Kaolin market?A: APAC is expected to account the highest revenue share of 43.3% among the other regions. Therefore, the Kaolin market in APAC is expected to garner significant business opportunities for the vendors during the forecast period.

Q: What are the key markets for Kaolin?A: Key markets for Kaolin are South Korea, Japan, India, Malaysia and China.

Q: Which segment has the largest share in the kaolin market?A: In the kaolin market, vendors should focus on grabbing business opportunities from the paper segment as it accounted for the largest market share in the base year.

![Kaolin Market Kaolin Market]()

- BASF SE

- AArbor Colorants Corporation

- American Element

- Aralon Color GmbH

- Clariant Ltd.

- Decorative Color & Chemical, Inc.

- Ferro Corporation

- Flint Group

- Heubach GmbH

- Kama Pigments

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |