Business Jet Market By Jet Type(Light, Medium, Large), By Technology(On-demand Service,Ownership) and by Region and Companies Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032.

- Published date: Apr 2022

- Report ID: 30205

- Number of Pages: 337

- Format:

- keyboard_arrow_up

Business Jet Market Overview:

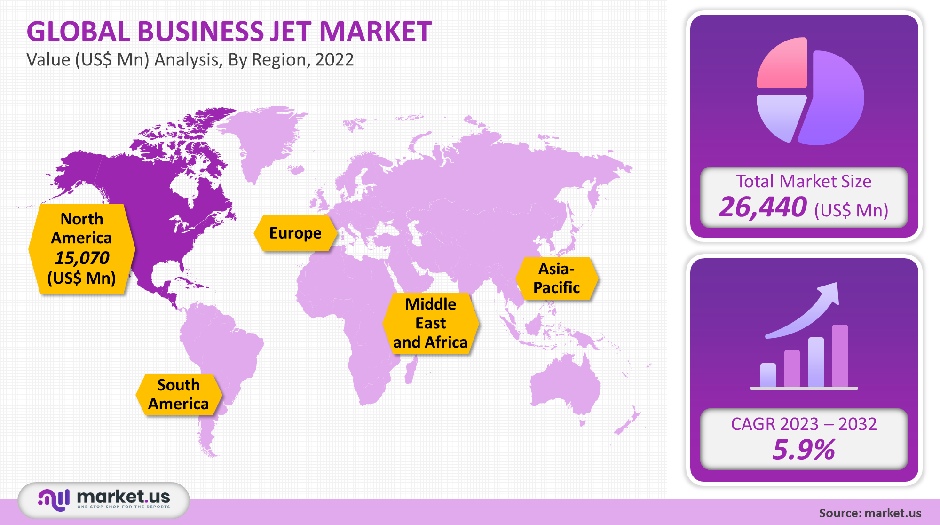

The global market for the business jet was worth USD 26,440 million in 2021. Over the forecast period, the market is expected to grow at a rate of 5.9%.

The growth is expected to be driven by factors such as continued wealth creation in mature markets and the increasing penetration of business aviation into emerging economies. Future developments in aircraft technology are expected to fuel growth.

Due to the convergence of adoption towards mature markets, emerging economies around the world will see an increase in demand for business jets.

Industry players are creating new business models such as fractional ownership which allows customers full ownership of the aircraft, driving overall demand.

Global Business Jet Market Scope:

Type Analysis

In 2021, the light segment accounted for more than 45%. These jets have lower operating costs and a lower purchase price. They also offer an adequate range of short-haul flights.

The introduction of new, versatile models is accelerating growth by stimulating demand and facilitating replacement purchase decisions.

This large segment will see a CAGR in excess of 5% during the forecast period. It is expected to be the fastest-growing segment between 2019 and 2025. These aircraft have many benefits such as comfort in the cabin, speed, and range. This is driving demand.

A number of manufacturers including Bombardier and Dassault Aviation have included large business jets into their portfolios in recent years due to their advantages.

Large business jets can fly longer distances and offer unprecedented flexibility and performance. This will drive segment growth until 2032.

Business Model Analysis

The highest-valued business aircraft ownership was worth more than USD 14 billion in 2021 and generated the most revenue.

Two types of ownership are available: fractional or full ownership. Over the past decade, full ownership has been the preferred option for travelers to support its revenue generation. Fractional ownership, on the other hand, is expected to be the fastest-growing ownership model between 2019 and 2025.

There are many variations to this model, such as the fractional card programs that allow customers to have on-demand access and predetermine the number of flights per year. They don’t have to buy shares.

Global on-demand business aviation services are expected to show the highest CAGR during the forecast period. These services can be sub-divided into air taxis and branded charters.

The industry has seen a steady rise in the number of branded charter operators. These charter operators provide on-demand access to flights and offer competitive pricing for trip-specific trips.

These operators also have a sophisticated infrastructure to carry out operations and implement airline-style scheduling practices to minimize deadhead costs. NetJets Flexjet, Comlux and VistaJet are some of the most prominent charter operators.

They are currently focusing on renewing or expanding their aircraft fleet. These expansions will create demand for more cost-effective options and drive the overall market growth over the forecast period.

Key Market Segments:

By Jet Type

- Light

- Medium

- Large

By Technology

- On-demand Service

- Air Taxis

- Branded Charters

- Jet-card Programs

- Ownership

- Fractional Ownership

- Full Ownership

Market Dynamics:

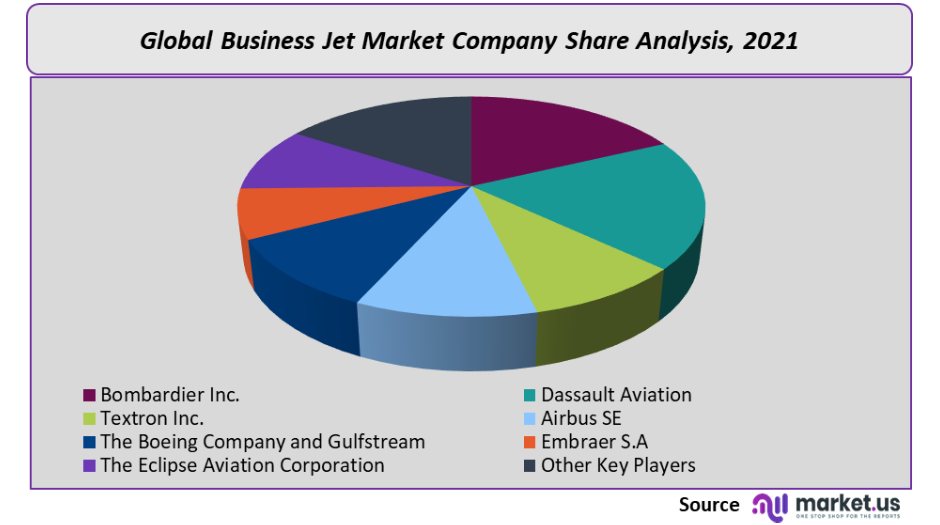

There is a lot of competition in the market for business jets. Only a few companies have a substantial market share. The industry is dominated by a few major players, but there are many start-ups that are focusing on a light business jet. This will likely have a positive impact on the market.

The increasing use of urban air mobility for inter-and intra-city travel has led to a growing demand for these jets. These jets are also used for travel, emergency evacuation, and express parcel delivery by the government and other public authorities.

Another factor driving the market for business jets is the rising popularity of long-range planes in the aviation industry.

These jets provide the best comfort, economy, performance, and convenience, which is why they are in high demand.

In the coming years, revenue generation will be boosted by a rise in high- and ultra-high-net-worth individuals in North America, Europe, Asia Pacific, and Asia. The market is accelerating because operators in fractional ownership and branded charters are seeing an increase in fleet retirement.

Due to the increasing number of passengers, airline travel has become tedious and stressful. Many people prefer business aviation because of its convenience, privacy, comfort, and ease. This increased demand will have an impact on both the supply and the cost.

Numerous business jet operators have expanded their membership programs to meet this demand. These include member plans, preferred charter accounts, and private jet cards.

These membership accounts provide reduced rates, more fleet options, and negligible blackout days.

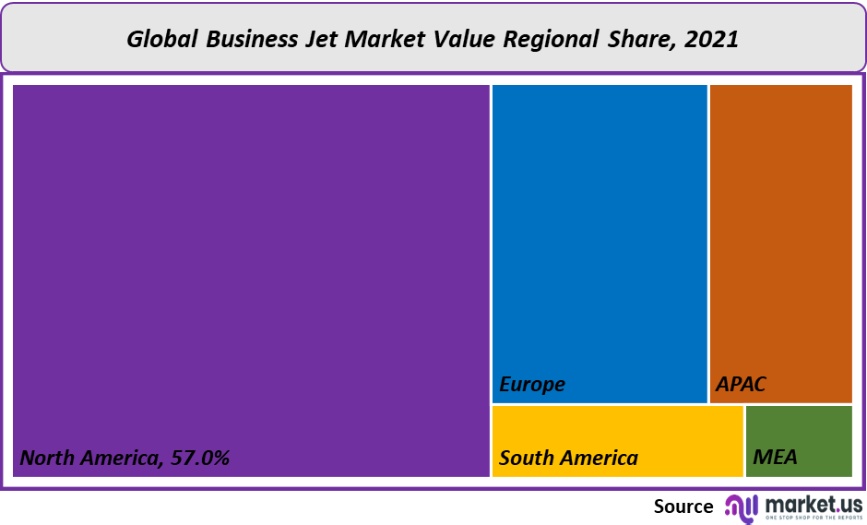

Regional Analysis

North America was the dominant market for business jets in 2021, accounting for over 57% of the total revenue. It is expected to continue its dominance over six years. Due to continuous economic growth in the United States, the region has been the center of business aviation for many decades.

The region’s sales are expected to rise due to the constant increase in demand for replacement and new aircraft.

It is home to the largest regional network of business aviation, which includes manufacturers, suppliers, and fixed-base operators (FBOs). This makes it one of the most profitable regions in business aviation.

The fastest CAGR in the Middle East and Africa will be greater than 6% over ten years. This is primarily due to increased investments in the development and modernization of aviation infrastructure.

Large and medium-sized business jets are needed due to factors such as the long distances between cities and the poor ground transport network.

The market is becoming more lucrative for both operators and aircraft OEMs, particularly in the Middle East.

Key Regions and Countries covered in the report:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Market Share & Key Players Analysis:

Among the market leaders are Bombardier Inc., Dassault Aviation; Textron Inc., Airbus SE; The Boeing Company, and Gulfstream. There are only a few companies that have a significant market share in this highly competitive market.

Small and medium-sized businesses are striving to increase their market share by offering new products and technological advances. Pilatus officially began in February 2018 with the first of six PC-24 deliveries to PlaneSense, a fractional ownership provider.

Honda Aircraft Company also announced the launch of its Honda HA-420 with its first delivery in 2016. More than 90 aircraft were built by the company by 2018.

These are a few prominent players in this business jet industry.

Market Key Players:

- Bombardier Inc.

- Dassault Aviation

- Textron Inc.

- Airbus SE

- The Boeing Company and Gulfstream

- Embraer S.A

- The Eclipse Aviation Corporation

- Hawker Beechcraft Corporation

- Honda Aircraft Company

- Israel Aerospace Industries

- Other Key Players

For the Business Jet Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

Q: What is the Business Jet market size in 2021?A: The Business Jet market size is US$26,440 million for 2021.

Q: What is the CAGR for the Business Jet market?A: The Business Jet market is expected to grow at a CAGR of 5.9% during 2023-2032.

Q: What are the segments covered in the Business Jet market report?A: Market.US has segmented the global business jet market Value (US$ Mn) Analysis by Region, 2022 market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By product type, market has been segmented into Artificial Organ, Artificial Bionics. By technology, market has been further divided into Mechanical bionics, Electronic bionics.

Q: Who are the key players in the business jet market?A: Bombardier Inc., Dassault Aviation, Textron Inc., Airbus SE, The Boeing Company and Gulfstream, Embraer S.A, The Eclipse Aviation Corporation, Hawker Beechcraft Corporation, Honda Aircraft Company, Israel Aerospace Industries, other key players are the key vendors in the Business Jet market.

Q: Which region is more attractive for vendors in the business jet market?A: North America accounted for the highest revenue share of 57.0% among the other regions. Therefore, the Business Jet market in North America is expected to garner significant business opportunities for the vendors during the forecast period.

Q: What are the key markets for Business Jet?A: Key markets for Business Jet are South Korea, Germany, Japan, UK, France, Italy, UAE, US, etc.

Q: Which segment has the largest share in the Business Jet market?A: In the Business Jet market, vendors should focus on grabbing business opportunities from the light segment as it accounted for the largest market share in the base year.

![Business Jet Market Business Jet Market]()

- Bombardier Inc.

- Dassault Aviation

- Textron Inc.

- Airbus SE

- The Boeing Company and Gulfstream

- Embraer S.A

- The Eclipse Aviation Corporation

- Hawker Beechcraft Corporation

- Honda Aircraft Company

- Israel Aerospace Industries

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |