Global Legal Cannabis Market By Source, By Derivative, By Region, and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Aug 2022

- Report ID: 38254

- Number of Pages: 358

- Format:

- keyboard_arrow_up

Legal Cannabis Market Overview:

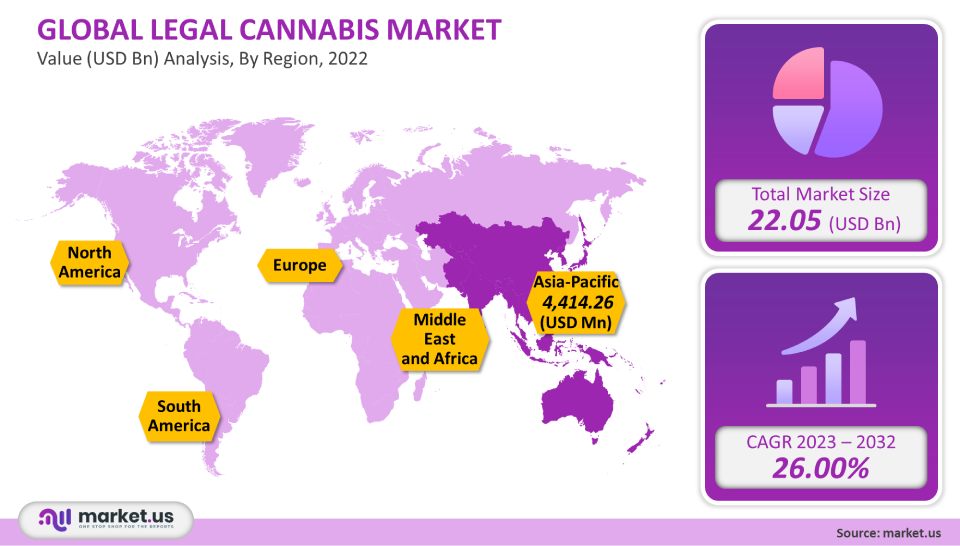

The Legal Cannabis Market size is expected to be worth around USD 222.39 billion by 2032 from USD 22.05 billion in 2022, growing at a CAGR of 26% during the forecast period 2022 to 2032.

Cannabis is mainly categorized into three parts such as cannabis flowers, cannabis leaves, and fresh cannabis plants. Market growth is due to the increasing legalization rate and increased acceptance of cannabis use in the medical sector. Although cannabis has been used medicinally for many years, it is not the first line of treatment. There are many uses for cannabis, based on the research surrounding its medicinal properties.

Cannabis is highly effective as a treatment for chronic pain and nausea due to chemotherapy. Despite being legalized in over two-thirds of states, it is still considered a Schedule I drug by U.S Drug Enforcement Administration (DEA).

Global Legal Cannabis Market Scope:

Source Analysis

The largest revenue share, at over 70.8%, was held by marijuana in 2021. It is expected to experience the fastest growth rate during this forecast period. This segment’s growth can be attributed largely to legalization around the world. Since the pandemic, both recreational and medical marijuana have experienced a significant increase in acceptance and legalization.

The legalization of medical marijuana in many countries, including the U.S., Canada and Italy, the Czech Republic, Croatia, and Australia, is now possible. Many countries have legalized the domestic and international production of marijuana. Ecuador, for example, has legalized marijuana production. Due to the growing demand for cannabis and legal purchases of marijuana and other cannabis products, possession and sale of regulated quantities have been made more permissible.

With the government making laws to legalize cannabis consumption and sale, the black market is gradually shrinking. Although there is still concern about an increase in cannabis consumption, Canada’s legalization saw a 1% growth in marijuana usage in 2020.

The legalization of cannabis has led to a proliferation of jobs and increased cannabis taxes. For example, Colorado now makes more than USD 20 million from the cannabis tax, while California earns about US$ 51 million monthly. Due to the ease of access, recreational cannabis has seen a shift in usage since legalization. For medicinal cannabis patients, there is no cannabis excise tax and use tax on medicinal cannabis.

Derivative Analysis:

CBD was the most popular product in terms of revenue in 2021, with a 65.6% share. This is due to CBD’s efficacy being accepted by both the scientific community as well as by consumers. Studies are ongoing to discover other uses for CBD than those currently listed. CBD has been shown to be effective in the treatment of epileptic seizures, and it is fewer side-effect than traditional medications. CBD has been used to treat anxiety and sleep disorders. However, the long-term effects of CBD on patients have not been established.

Cannabinoids have been shown to be effective in treating PTSD and other types of cancers. They can be used as analgesics, and they may also have anti-stress properties. Over the forecast period, the other segment will experience the fastest growth. This could be because cannabis is now accepted as a pain-relieving drug and for many other purposes.

The demand for cannabis derivative products has increased, and there has been an increase in the number of companies producing them. This is a major factor in the growth of this segment.

Application Analysis

The medical segment had the largest legal cannabis market revenue share of 80% in 2021 and its market growth rate is expected to grow constantly from 2022-2032. Cannabis can be used for many medical purposes. Due to the easy availability of cannabis and economical pricing, patients in these economical regions use marijuana for medical use. The adult use segment is expected to come up as the fastest growing segment between the forecast period 2022-32. The countries like America, and Canada where adult-use cannabis and medical-use cannabis both are legalized.

Key Market Segments:

By Source

- Marijuana

- Hemp

By Derivative

- CBD

- THC

- Other Derivatives

Market Dynamics:

Despite the fact that many uses of cannabis have been documented in past surveys and studies, there are currently no federal laws allowing for its legalization. This means that pharmacists are still cautious about the use of cannabis and will not recommend it to patients, fearing they might violate any federal laws.

The Cannabis industry has seen steady growth due to legalization and legitimization. As medical cannabis demand rises, so are government-approved and designated buying options. The FDA approved medical cannabis, including CBD products, for the treatment of nausea and epilepsy. Based on studies that have been conducted regarding the efficacy and use of medical cannabis, the FDA will consider changing cannabis’ status from a Schedule I drug to a Schedule II drug.

Around 20 states have legalized medical cannabis. Several other countries have also established laws for the decriminalization and legalization of medical cannabis. It has been legalized in several countries, including South America, Australia, Europe, and Australia. These laws are strict on the sale and distribution of cannabis and related products.

The main benefits of making a partnership with international investors include the transfer of technical knowledge and financial capital, which increases production, seed-to-sale tracking, and quality assurance.

There are currently several approval stages for legalizing medical cannabis. Countries like Spain, Portugal, Russia, Ukraine, and Spain have already legalized it, while other European countries are still debating whether to decriminalize it. In California, for medicinal patients, since 2020 California law provides that you can donate free medicinal cannabis products. Although South American countries are more open to medical cannabis, possession, and sale are still illegal. Low acceptance and legalization rates in Asia and the Middle East are two regions that have low rates of legalization.

The overall commercial market for legal cannabis products and related products was affected by the pandemic. Many countries now have legalized cannabis or related products. Many countries are moving quickly to obtain commercially regulated cannabis product approvals. For example, Ecuador has begun plans to legalize cannabis for commercial purposes to boost its economic growth after the pandemic. The number of countries that allow the production of cannabis has increased.

Canada was the first country in the world to legalize cannabis and establish regulatory protocols. Although the current market for cannabis import and export is small, it will change if the pharmaceutical industry becomes more interested in API-grade CBD and an organization such as the WHO, which formulates trade policies about the production, use, and sale of cannabis (import and export).

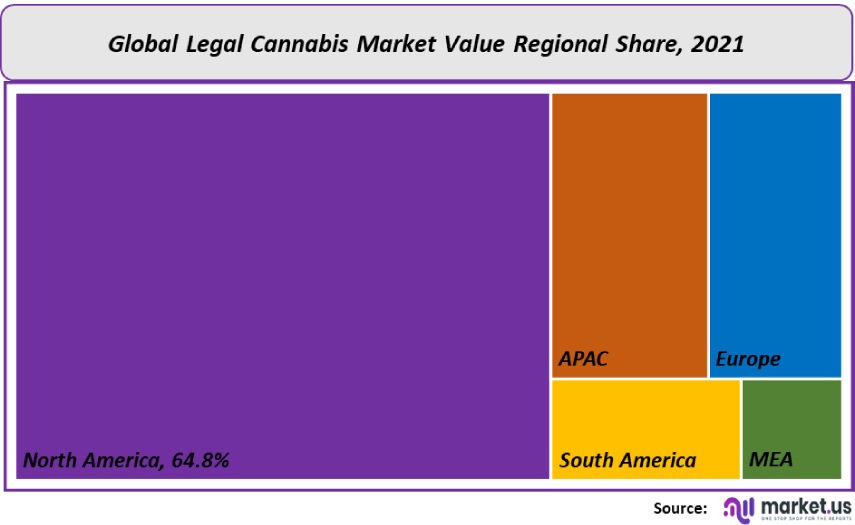

Regional Analysis

North America was the country with the highest revenue share, at 64.8%, in 2021. Due to the laws and policies regarding the cannabis trade, revenue generated is highly regional. It is the largest shareholder in the North American market, with the majority of established companies coming from North America. Canopy Growth and Cur Leaf Holdings are key players. The overall market has grown due to growing demand from consumers. Another reason could be the higher rate of legalization.

Asia is the fastest-growing region despite strict prohibitions on the possession and use of cannabis. This could be due to the increased acceptance of cannabis in different countries within the region. A key driver of the region’s legal market is also the increasing number of clinical trials on cannabis use in various medical conditions. Although recreational marijuana use is still prohibited in many parts of Asia, it is becoming more popular in the region for its medicinal and industrial uses.

Japan has approved clinical trials for CBD compounds. However, possession of recreational cannabis can still be punished by up to five years in prison. With a growing elderly population, Japan will soon become a significant consumer of medical cannabis. China has been cultivating hemp, which is a component of the cannabis plant that can be used to make fibers. It is also used in many beauty products.

Key Regions and Countries covered іn thе rероrt:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Market Share & Key Players Analysis:

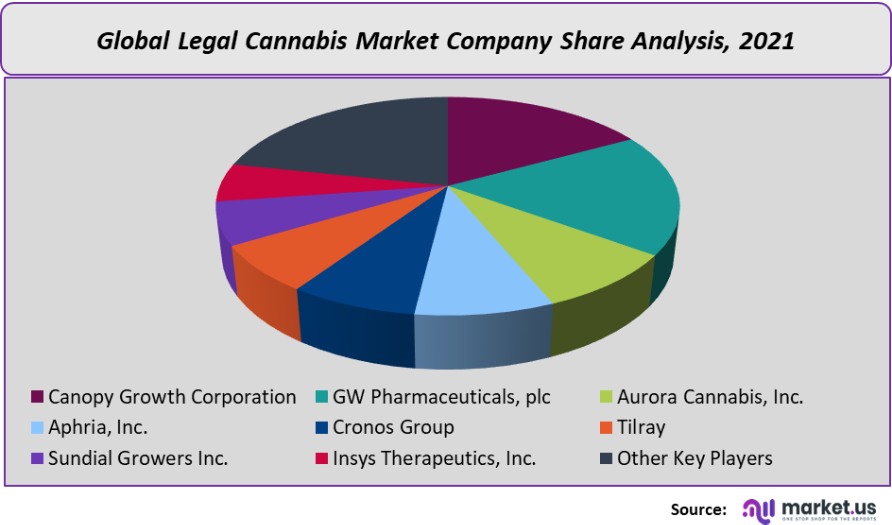

These companies are looking to expand their product ranges, as well as merge and acquisitions with smaller players in the legal cannabis industry. Green Thumbs, for example, is focusing its efforts on cannabis derivatives-based products because they offer higher profit margins. Cur leaf made two significant acquisitions in 2020 to increase its presence in the U.S. cannabis market. The following are some of the most prominent players in global cannabis legal markets:

Маrkеt Кеу Рlауеrѕ:

- Canopy Growth Corporation

- GW Pharmaceuticals, plc

- Aurora Cannabis, Inc.

- Aphria, Inc.

- Cronos Group

- Tilray

- Sundial Growers Inc.

- Insys Therapeutics, Inc.

- The Scotts Company LLC

- VIVO Cannabis Inc.

- Other Key Players

For the Legal Cannabis Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

What is the Legal cannabis market size in 2021?The Legal cannabis market size is US$ 17,500 million for 2021.

What is the CAGR for the Legal cannabis market?The Legal cannabis market is expected to grow at a CAGR of 26% during 2023-2032.

What are the segments covered in the Legal cannabis market report?Market.US has segmented the Global Legal Cannabis Market Value (US$ Mn) Analysis by Region, 2022 market by geography (North America, Europe, APAC, South America, and the Middle East and Africa). By Source, the market has been segmented into Marijuana and Hemp. By Derivative, the market has been further divided into CBD, THC, and Other Derivatives Dietary.

Who are the key players in the legal cannabis market?Canopy Growth Corporation, GW Pharmaceuticals, plc, Aurora Cannabis, Inc., Aphria, Inc., Cronos Group, Tilray, Sundial Growers Inc., Insys Therapeutics, Inc., The Scotts Company LLC, VIVO Cannabis Inc., and Other Key Players are the key vendors in the Global Legal Cannabis market

Which region is more attractive for vendors in the legal cannabis market?North America accounted for the highest annual growth rate of 64.8% among the other regions. Therefore, the legal cannabis market in North America is expected to garner significant business opportunities for vendors during the forecast period.

What are the key markets for Legal cannabis?Key markets for Legal cannabis are India, China, the U.S., South America, Australia, Europe, Australia, and Japan.

Which segment has the largest share in the legal cannabis market?In the Legal cannabis market, vendors should focus on grabbing business opportunities from the Marijuana source segment as it accounted for the largest market share in the base year.

![Legal Cannabis Market Legal Cannabis Market]()

- Canopy Growth Corporation

- GW Pharmaceuticals, plc

- Aurora Cannabis, Inc.

- Aphria, Inc.

- Cronos Group

- Tilray

- Sundial Growers Inc.

- Insys Therapeutics, Inc.

- The Scotts Company LLC

- VIVO Cannabis Inc.

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |