Global Bauxite Market By Product (Refractory Grade, Metallurgical Grade, and Other Products), By Application (Alumina Production, Cement, Refractory, and Other Applications), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Aug 2022

- Report ID: 38384

- Number of Pages: 243

- Format:

- keyboard_arrow_up

Bauxite Market Overview:

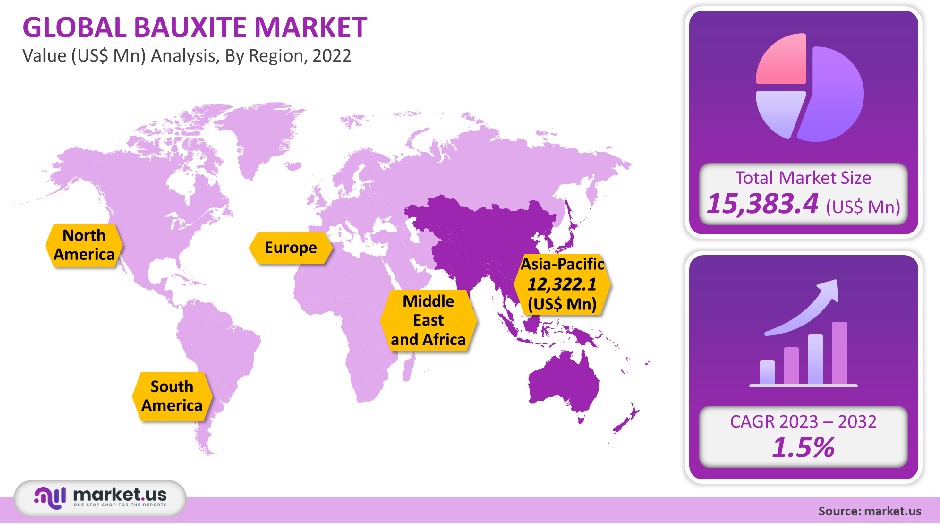

The market for Bauxite in the global marketplace was worth USD 15,383.4 million in 2021. It is projected to grow at a CAGR, of 1.5% between 2023 and 2032.

Aluminum demand will be driven by favorable government policies and increased investment in the production of lightweight cars. This trend is expected to be fruitful for the industry’s growth over the forecast period. Volvo Cars made a decision to invest in aluminum mega casting.

Mega casting is worth US$ 1,110 million. It makes production more efficient and lowers environmental impact.

Global Bauxite Market Analysis

Product Analysis

In 2021, the highest revenue share was held by the metallurgical grades at 80%. The forecast period will witness an increase in demand for the product from many industries like automotive & transport, packaging, construction, building, and other industries.

Revenue growth for the refractory grades is expected to be 2.0% during the forecast period. The product is resistant to cracking, spalling, chemical reactions, and other psychological or physical effects. It is ideal for making combustion linings for boilers and furnace parts.

Over the forecast period, there will be an increase in investments in refractory production facilities. Harbison Walker International, a top supplier of refractory goods, made US$ 25 million investments to set up a facility for manufacturing and distribution.

Application Analysis

Alumina production had a significant revenue share in 2021. Alumina is made from bauxite. It is used widely in various industries due to its high chemical stability in different environments.

Refractory is a key application segment of the market. It is a material used in a furnace to protect it from high temperatures and a corrosive environment. There are many industries that use refractories. These include steel glass, clay, and cement.

Cement is another segment of the market. It is expected that the segment will experience rapid growth over the forecast period. The bauxite residual has been used to produce Portland cement clinkers. The main countries using bauxite in their cement sectors are Russia and India.

Manufacturers are working with the cement industry to produce cement from bauxite residuals. Vedanta Aluminum, India, made the decision to partner with the cement sector in order to use their bauxite residual for manufacturing cement.

Key Market Segments

By Product

- Refractory Grade

- Metallurgical Grade

- Other Products

By Application

- Alumina Production

- Cement

- Refractory

- Other Applications

Market Dynamics

The U.S. has the largest share in the North American market for bauxite. Market growth is expected to be affected by increased aluminum and cement production. According to the Aluminum Association in the United States, aluminum will be used by most automakers to increase its value.

The automotive industry is seeing a rise in demand for aluminum flat-rolled goods. This has led to increased production capacity and a consequent increase in demand for bauxite. Novelis Inc. announced in October 2021 its plans to invest US$30 million in Oswego’s aluminum flat-rolled product manufacturer.

According to the U.S. Geological Survey, cement production rose to 93 million tons in 2021 from the 89 million tons it produced in 2020. According to the USGS, the growth in bauxite production and increased demand for aluminum across various industries are projected to be a major factor in the market’s expansion over the forecast period.

In the automotive sector, magnesium alloy and carbon fiber are the main substitutes for aluminum. Magnesium alloys are more machinable and have better dent resistance. This is why they are so popular. They also protect against electromagnetic radiations and damp vibrations. These attributes are expected to adversely impact market growth in the future.

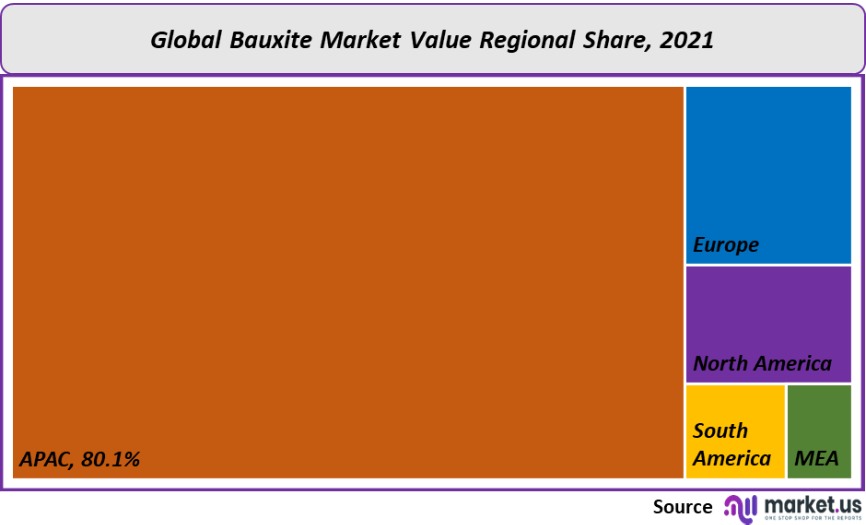

Regional Analysis

The Asia Pacific had a revenue share of 80.1% in the global market in 2021. Bauxite demand is expected to rise due to the growing use of aluminum in EVs and packaging. Bajaj Auto announced in December 2021 that it would invest US$ 40 million to construct an Indian EV plant. The plant is expected to produce 500,000 EVs each year.

The second-largest market share, in terms of revenue, was held by Europe in 2021. The region is investing heavily in decarbonizing, increasing the use of aluminum in lightweight mobility, making packaging more efficient, and increasing its usage of aluminum in construction. This trend has seen an increase in bauxite consumption.

North America is predicted to experience the fastest growth during the forecast period. The region’s large population, robust construction industries, large-scale automotive plants, and other infrastructure developments, are driving the demand for alumina. This will further benefit the bauxite market in the forecast period.

Key Regions and Countries covered іn thе rероrt:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Market Share & Key Players Analysis:

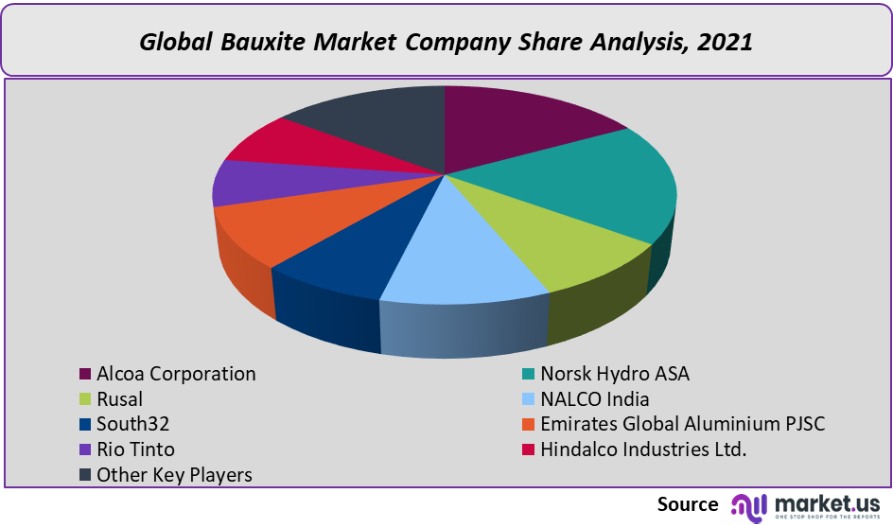

Market leaders compete primarily on quality, price, and proximity to customers. They also have strategically located long-term resources of bauxite in Australia, Guinea, and Brazil which are the largest worldwide reserves.

To stay ahead of their competition, they invest in capacity expansions, mergers, and acquisitions as well as aggressive R&D activities. South32 purchased an additional stake in Mineracao Rio do Norte (MRN). This is the company that runs Brazil’s largest bauxite mining operation.

Маrkеt Кеу Рlауеrѕ:

- Alcoa Corporation

- Norsk Hydro ASA

- Rusal

- NALCO India

- South32

- Emirates Global Aluminium PJSC

- Rio Tinto

- Hindalco Industries Ltd.

- Other Key Players

For the Bauxite Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

Q: What is the size of the Bauxite market in 2021?A: The Bauxite market size is US$ 15,383.4 million in 2021.

Q: What is the projected CAGR at which the Bauxite market is expected to grow at?A: The Bauxite market is expected to grow at a CAGR of 1.5% (2023-2032).

Q: List the segments encompassed in this report on the Bauxite market?A: Market.US has segmented the Bauxite market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Product, the market has been segmented into Refractory Grade, Metallurgical Grade, and Other Products. By Application, the market has been further divided into Alumina Production, Cement, Refractory, and Other Applications.

Q: List the key industry players of the Bauxite market?A: Alcoa Corporation, Norsk Hydro ASA, Rusal, NALCO India, South32, Emirates Global Aluminium PJSC, Rio Tinto, Hindalco Industries Ltd., and Other Key Players are engaged in the Bauxite market

Q: Which region is more appealing for vendors employed in the Bauxite market?A: APAC is expected to account for the highest revenue share of 80.1%. Therefore, the Bauxite industry in APAC is expected to garner significant business opportunities over the forecast period.

Q: Name the key areas of business for Bauxite?A: The US, India, China, Canada, UK, Japan, & Germany are key areas of operation for the Bauxite Market.

Q: Which segment accounts for the greatest market share in the Bauxite industry?A: With respect to the Bauxite industry, vendors can expect to leverage greater prospective business opportunities through the Metallurgical Grade segment, as this area of interest accounts for the largest market share.

![Bauxite Market Bauxite Market]()

- Alcoa Corporation

- Norsk Hydro ASA

- Rusal

- NALCO India

- South32

- Emirates Global Aluminium PJSC

- Rio Tinto Plc Company Profile

- Hindalco Industries Ltd.

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |