Global Cellular IoT Market By Component (Software and Hardware), By Type (2G, 3G, 4G, 5G, NB-IoT, LTE-M, and NB-LTE-M), By End-use (Agriculture, Automotive & Transportation, Energy, and Other End-Uses), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Jul 2022

- Report ID: 52510

- Number of Pages: 222

- Format:

- keyboard_arrow_up

Cellular IoT Market Overview:

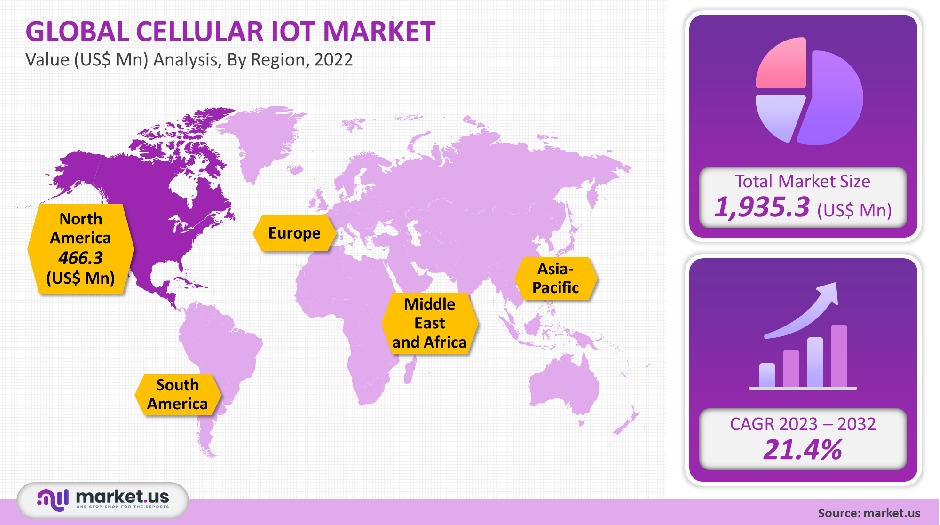

The global cellular IoT market was worth USD 1,935.3 million in 2021. This market is expected to grow at a CAGR of 21.4% over the forecast period.

The market’s key functions are ubiquitous mobility, resilient networks, robust security, and strong growth. The increasing demand for IoT platforms in different verticals will be aided by the requirement to connect low-power, high-density, and affordable devices on a large scale.

Global Cellular IoT Market

Component Analysis

Due to the high number of devices deployed, the hardware segment holds a large share in the overall IoT market. The cellular technology can also be used to address IoT use cases that requires large deployments of sensors or nodes. It can be easily augmented by local network connections. In 2021, the hardware market accounted for over 65%.

The software segment can be further divided into signal processing and device management. In the future, the signal processing sub-segment will gain momentum. The signal processing segment will grow steadily in the future, despite the fact that the infrastructure for cellular connections has been in place. However, a software update would be required to enable new LTE bands to become available. Over the forecast period, the software segment will grow at a remarkable CAGR of 23.3%.

Type Analysis

Based on technology, the market can be divided into 5G, 3G, and 4G. 2G accounted for the largest share of the market in 2021 in terms of revenue, as it offers low-cost modem options and certifications. 2G will likely lose ground as IoT and machine-to-machine standards continue to evolve and offer more efficient cellular services.

NB LTE-M and LTE-M technologies are expected to be commercialized before the end of 2022. They are also expected to expand rapidly in industrial uses. While 5G technology is still being defined, it is expected to grow at the fastest rate as it can cater to many different applications and provide high bandwidth for high-speed applications.

End-use Analysis

Mobile technologies are likely to gain popularity in applications that require large deployments and higher-density end-point connections. This is why industries like energy, utilities, and manufacturing will reap the greatest benefits. In 2021, the energy sector held 21.0% of the market and this share is expected to increase in the future.

It is essential to make the most of new technologies like IoT, cloud, and big data. This can be achieved by making cost-effective and efficient use of sensor networks. These advantages have led to rising demand for smart city applications. This application is expected to grow at a rate of 23.8% during the forecast period.

Key Market Segment

Component

- Software

- Hardware

Type

- 2G

- 3G

- 4G

- 5G

- NB-IoT

- LTE-M

- NB-LTE-M

End-use

- Agriculture

- Automotive & Transportation

- Energy

- Consumer Electronics

- Environment Monitoring

- Healthcare

- Smart Cities

- Retail

- Other End-Uses

Market Dynamics

There are many solutions available that use broadband connections to transmit machine-to-machine information. LTE technology is the backbone of this communication network. The key to the increasing IoT demand for cellular networks is the “massive” adoption of LTE technology and technological innovations within the IoT ecosystem. This is not all. The ability to use local connectivity and networking technologies such as Bluetooth and Wi-Fi will have a significant impact on the solutions’ ability to address a wide range of IoT uses.

The growth of cellular networks is expected to be driven by emerging applications such as fleet management, automotive connectivity, healthcare device connectivity, wearables, and vehicle connectivity. They are also used in many other applications such as personnel traffic pattern monitoring, smart metering, weather monitoring systems, and infrastructure security systems.

Many industry players across the value chain are actively supporting the increasing penetration of cellular technology to be the superior connectivity standard. These initiatives are attracting a lot of interest from industry players, such as chip and module manufacturers, IoT solution providers, carriers, and infrastructure providers. Collaborations are the key to the adoption of broadband technology within the IoT ecosystem.

Market growth may be limited by factors such as fragmentation or strong competition from LPWAN technology, such as LoRA, SigFox, and SigFox. However, many efforts to standardize the industry as well as emerging venues for cellular IoT will help to ensure that the technology continues to thrive over the next few years.

Regional Analysis

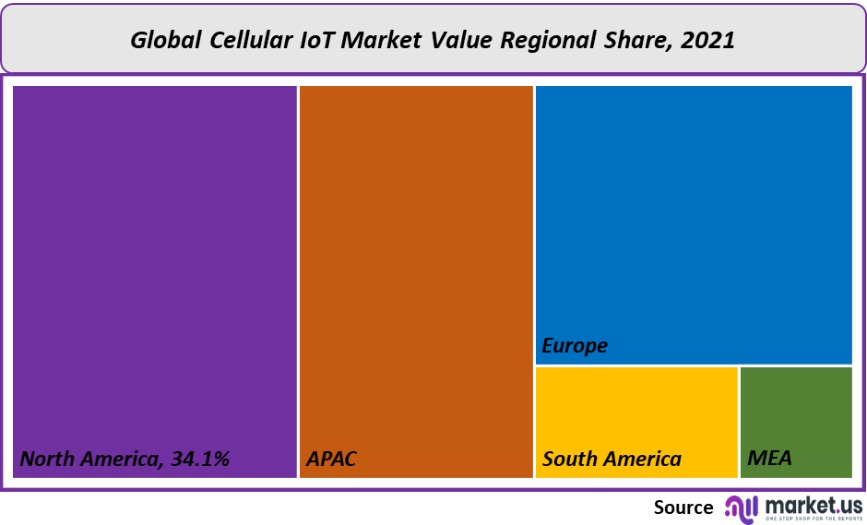

North America is expected market share of 34.1%, to be the largest market for IoT implementations, with component manufacturers and solution vendors aggressively seeking out projects. The rapidly evolving technology landscape and the ability of industries to use smart and connected products from their inception are key factors driving the region’s success.

The European region is also expected to see a significant increase in revenue and a healthy growth rate over the forecast period. The application will see the greatest growth in the Asia Pacific due to its cellular connectivity. Market growth will be driven by the increasing population, the high demand for consumer goods, and the recent proliferation of disruptive technology in industrial applications.

Key Regions and Countries covered іn thе rероrt:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Market Share Analysis

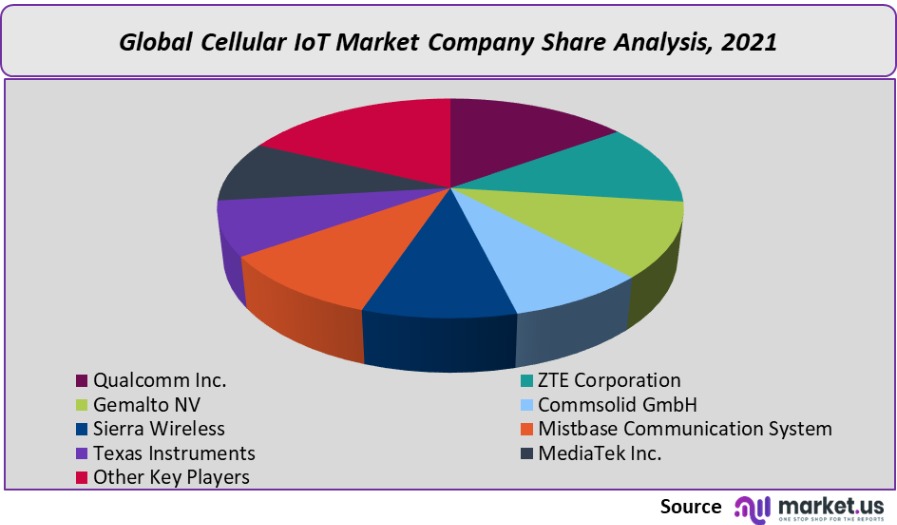

Key market players have taken numerous initiatives to standardize and increase the use of cellular IoT in new applications. This is the key factor in the industry.

Many industry associations and working groups have been created to promote the widespread adoption of machine-to-machine technology, including NB-IoT and LTE-M. Interesting is the involvement of all stakeholders, from component manufacturers to service providers, to promote these technologies.

Market Key Players

Among others, the prominent players include

- Qualcomm Inc.

- ZTE Corporation

- Gemalto NV

- Commsolid GmbH

- Sierra Wireless

- Mistbase Communication System

- Texas Instrument

- MediaTek Inc.

- Sequans Communications

- and Telit Communications PLC

- among others.

For the Cellular IoT Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

Q: What is the cellular IoT market size in 2021?A: The cellular IoT market size is US$ 1,935.3 million for 2021.

Q: What is the CAGR for the cellular IoT market?A: The cellular IoT market is expected to grow at a CAGR of 21.4% during 2023-2032.

Q: What are the segments covered in the cellular IoT market report?A: Market.US has segmented the Global Cellular IoT Market Value (US$ Mn) Analysis by Region, 2022 market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Component, market has been segmented into Hardware, Software. By Type, market has been further divided into 2G, 3G, 4G, LTE-M, NB-LTE-M, NB-IoT, 5G. By End-use, market has been segmented into Agriculture, Automotive & Transportation, Consumer Electronics, Energy, Environment Monitoring, Healthcare, Retail, Smart Cities and Other End-Uses.

Q: Who are the key players in the cellular IoT market?A: Qualcomm Inc., ZTE Corporation, Gemalto NV, Commsolid GmbH, Sierra Wireless, Mistbase Communication System, Sequans Communications, Texas Instruments, MediaTek Inc., and Telit Communications PLC, Other Key Players are the key vendors in the cellular IoT market.

Q: Which region is more attractive for vendors in the cellular IoT market?A: North America accounted for the highest market share of 34.1% among the other regions. Therefore, the cellular IoT market in North America is expected to garner significant business opportunities for the vendors during the forecast period.

Q: What are the key markets for cellular IoT?A: U.S., Canada, UK, Germany are key areas of operation for cellular IoT market.

Q: Which segment has the largest share in the cellular IoT market?A: In the cellular IoT market, vendors should focus on grabbing business opportunities from the hardware segment as it accounted for the largest market share in the base year.

![Cellular IoT Market Cellular IoT Market]()

- Qualcomm Inc.

- ZTE Corporation

- Gemalto NV

- Commsolid GmbH

- Sierra Wireless

- Mistbase Communication System

- Texas Instrument

- MediaTek Inc.

- Sequans Communications

- and Telit Communications PLC

- among others.

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |