Global Baby Drinks Market By Product Type (Baby Formula, Juice, Electrolyte), By Distribution Channel (Supermarket & Hypermarket, Pharmacies, Online), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Jul 2022

- Report ID: 57853

- Number of Pages: 299

- Format:

- keyboard_arrow_up

Baby Drinks Market Overview:

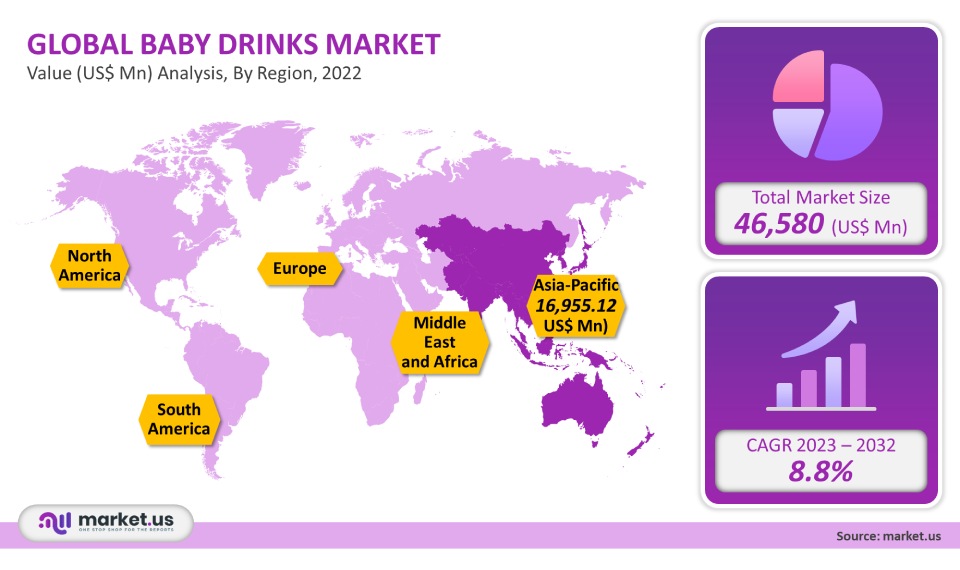

In 2021, the global market for baby drinks accounted for USD 46,580 million with CAGR 8.8%.

The increase in working mothers worldwide is responsible for the rise of the global baby drinks market. Additionally, market growth is being supported by the rising number of households able to afford baby drinks.

Global Baby Drinks Market Scope:

Product Type analysis

According to the product, baby formula demand is high in the Asia Pacific, especially in China. New Zealand’s dairy producers supply about 80% to 90% of China’s milk powders. China is looking for alternative suppliers in Europe and the United States due to its growing demand for infant formula. It is also expanding its reliability network. China’s infant formula is the largest in APAC and it is expected to grow steadily. This is a contributing factor to the future growth of the baby drinks industry.

British mothers are more likely to use follow-on formulas than American mothers. They prefer human milk substitutes right from the beginning. Aptamil has a variety of follow-on formulas that include Pronutra ADVANCE, which contains a combination of ingredients induced by vitamin D. Working mothers are slowly shifting to organic baby products due to growing awareness of organic products. Organic milk formula is one example. Nestlé’s NAN Organic 3 premium organic milk drink is designed for toddlers.

Distribution Channel analysis

Consumers trust pharmacists to sell baby nutrition products because of safety concerns. Due to strict regulations about stocking and selling medically approved baby drinks, pharmacists make up the majority of sales. Consumers can also seek help from pharmacists, which is a plus. According to India E-pharmacy Outlook 2024 report, there are currently over 850,000 independent pharmacies in India that can cater to only 60% of domestic demand. There are many opportunities to open more pharmacy shops to supply the increasing demand for baby products.

Over the next few decades, the segment of supermarkets/hypermarkets will experience a CAGR in excess of 8.8%. Major companies offer a wide range of baby drinks in supermarkets and hypermarkets. The sales strategies, such as buy one, get 1, and complimentary products, attract more customers. Baby drinks are in high demand and this is expected to lead to an increase in sales.

Кеу Маrkеt Ѕеgmеntѕ

By Product Type

- Electrolyte

- Baby Formula

- Juice

- RTD

- Concentrate

By Distribution Channel

- Pharmacies

- Supermarket & Hypermarket

- Online

Market Dynamics:

More than 45% of women worldwide are employed in salaried positions. This is why most young women are looking for non-traditional jobs. India’s GDP is expected to grow by US$ 700 billion if there is an increase in women’s participation by 10%. That’s roughly 1.4%. This is expected to increase the demand for baby foods to feed infants.

According to the product, baby formula is expected to gain popularity among consumers. It targets infants aged 0-3 years. Due to its similar nutritional structure, infant formula is a good substitute for human breastmilk. There are many options for baby formula, including liquid, powder, and ready-to-eat forms.

The market is driven by the rising adoption of baby beverages in many countries. For example, the U.S. government supports WIC (a special supplemental nutrition program for women, infants, and kids). Companies also use their marketing methods to increase sales in Asia. As sales representatives, the companies advertise on the radio and in the newspapers. They also give free samples of baby products, particularly baby formula, to mothers and service providers who use healthcare facilities or “milk nurses”.

Many factors influence consumer purchase decisions, including the nutritional content, safety standards, and price. These factors are being considered by manufacturers who strive to offer high-quality products with the highest nutrition levels. The preference for online shopping is increasing as consumers are more comfortable with the availability and convenience of a wider range of baby drinks.

According to the United States Federal Food, Drug, and Cosmetic Act, infant formula manufacturers must meet certain requirements in order to be able to sell their products in America. These standards stipulate that infant formula must contain all 29 necessary components to ensure infant nutrition.

China’s Food Safety Law (amended in the last three years) regulates infant formula. The 2008 melamine scandal led to around 30,000 infants developing kidney stones and other complications from the intake of adulterated infant food. Therefore, China’s government has established strict regulations for infant formula production and marketing.

Regional Analysis

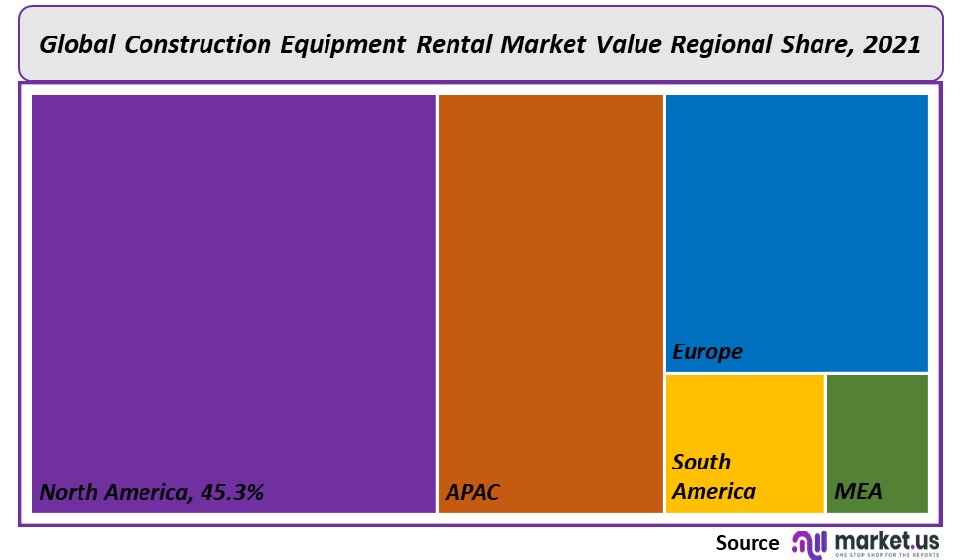

The Asia Pacific has a high demand for infant formula and baby drinks with a market share of 36.4%. The forecast period will see a CAGR of 16.0%. The region’s large customer base, combined with the growing number of women in this region, will drive up demand for baby formulas over the forecast period.

The presence in North America of key players such the Kraft Heinz Company and Abbott as well as Mead Johnson and Company LLC are expected to see significant growth. They are active in product development, as well as in innovative marketing campaigns that use both offline and digital formats to increase product sales.

Concerns about the availability of quality nutrition in baby drinks are driven by the rising number and working women in the area. But, parents are becoming more concerned about their child’s health and well-being. This is why specialty milk has been in high demand. The forecast period will see baby drink sales rise.

Key Regions and Countries covered іn thе rероrt:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Market Share & Key Players Analysis:

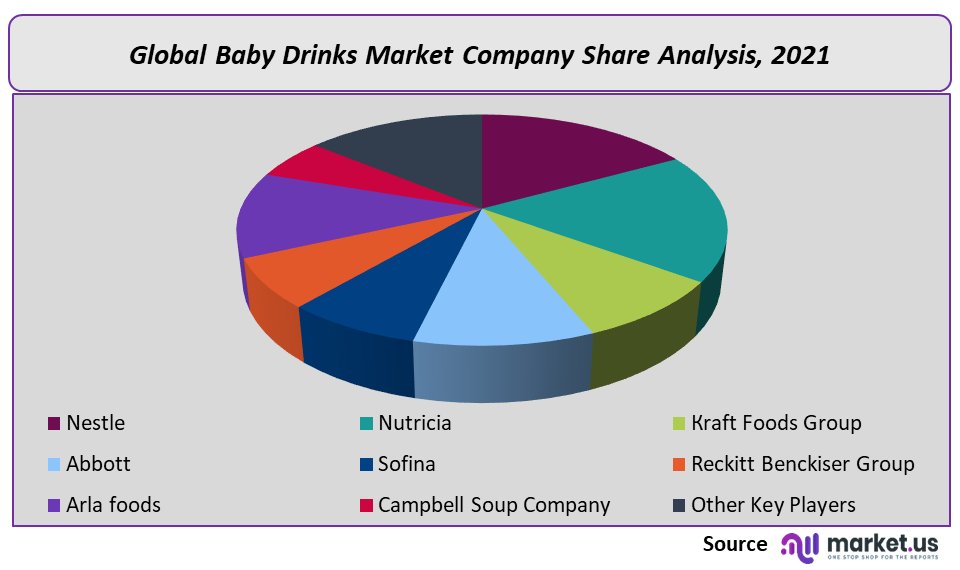

There has been significant consolidation in the global baby drink market, which has created a situation where four multi-national companies are dominant. The market’s top companies are responsible for more than 50% of global revenue. They do this by launching new products and making regular changes to enhance the nutritional content of their products.

Arla Foods Ingredients, for instance, has developed a comforting formula optimized for infant formula. It contains alpha-lactalbumin. This product is inducible with the highest level of protein found within human milk. Alpha-lactalbumin has a strong amino acid composition and is considered to be a key ingredient for formulas that have low nutrition levels. Some key players are:

Маrkеt Кеу Рlауеrѕ:

- Nestle

- Nutricia

- Kraft Foods Group

- Abbott

- Sofina

- Reckitt Benckiser group

- Arla Foods

- Campbell Soup Company

- Other Key Players

For the Baby Drinks Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

![Baby Drinks Market Baby Drinks Market]()

- Nestlé S.A Company Profile

- Nutricia

- Kraft Foods Group

- Abbott Laboratories

- Sofina

- Reckitt Benckiser Group PLC Company Profile

- Arla Foods A.M.B.A Company Profile

- Campbell Soup Company Profile

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |