Global Alcohol Ingredient Market By Product (Yeast, Enzymes, Colorants, Flavors & Salts and Other Products), By Application (Beer, Spirits, Wine and Other Applications), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Jul 2022

- Report ID: 58381

- Number of Pages: 361

- Format:

- keyboard_arrow_up

Alcohol Ingredients Market Overview:

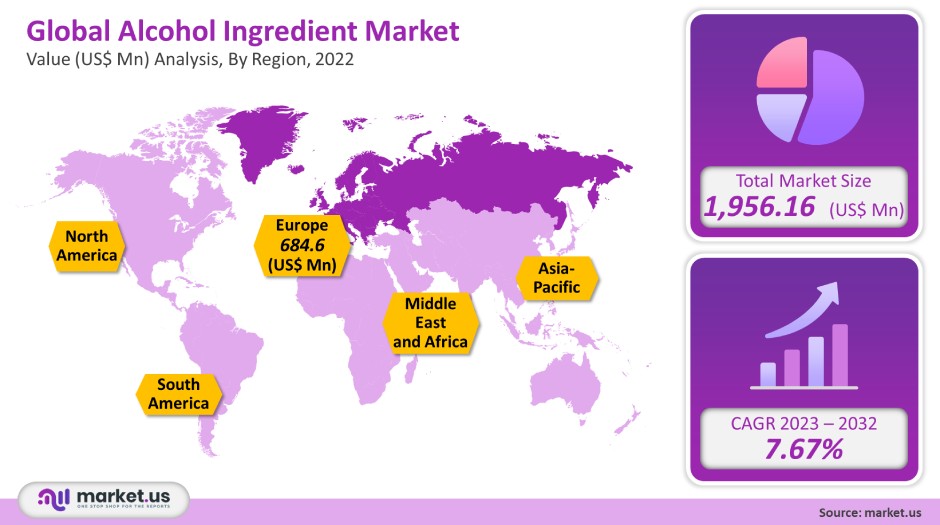

Global alcohol ingredients market was worth USD 1,956.16 million in 2021. It is expected to grow at a 7.67% CAGR from 2022-2032.

Global Alcohol Ingredients Market:

Product Analysis

Flavors and salts made up 43.2% of 2021’s global market. Flavors & Salts are gaining popularity due to the growing demand for flavored beverages such as wine, whisky, and flavored beer. In the last few years, the number of flavors has increased due to the increasing use of fruit flavors. This segment is experiencing significant growth in Europe, including France and the U.K. The United States, Spain, the Netherlands, and Jamaica are major exporters of flavored spirits. Vanilla, honey, chocolate, and watermelon are some of the most popular flavors.

Another important ingredient is yeast. It is used to ferment alcohol to convert sugar into ethanol, and carbon dioxide. The availability of yeast to make alcoholic beverages will be affected by the increased consumption of yeast as a raw ingredient for functional drinks, including probiotic beverages.

Application Analysis

Beer production is dominated by cereal grains, yeast, and hops. The beer industry has seen a rise in awareness of the many health benefits that it offers. It is rich in vitamins, natural antioxidants, and proteins. These nutritional properties prevent Cardiovascular Diseases (CVDs), kidney stone formation, and high cholesterol, and help muscle rebuild.

The craft beer market has seen substantial growth in the last few years. Craft beer accounts for 23% of the U.S. beer market in terms of its sales. In 2021, the U.S. Alcohol and Tobacco Tax and Trade Bureau issued 1,252 new permits. Anheuser-Busch Inbev, MillerCoors, LLC, Constellation, Heineken USA, and Pabst Brewing are the major brewers in the United States.

Key Market Segments:

By Product

- Yeast

- Enzymes

- Colorants

- Flavors & Salts

- Other Products

By Application

- Beer

- Spirits

- Wine

- Other Applications

Market Dynamics:

The rising global alcohol consumption is a key driver of product demand. Market growth is also being driven by the rapid adoption of western culture in emerging regions such as the Asia Pacific and rapid urbanization.

It is expected that the largest consumer base for the alcohol industry will remain the young population. The National Health Interview Survey of the U.S. found that 35.6% of Americans aged 18-24 and 34.3% of those aged 25-44 had at least one day of heavy drinking in 2021. Similar to the U.K., young drinkers have increased dramatically in comparison to other age groups between 2023 and 2032.

This market has seen a significant increase in the number of bars, clubs, and breweries. The number of bars and pubs has increased globally over the last few years. These bars have become a popular place for socializing, particularly among millennials.

This industry is also thriving because of the rising demand for craft beer. North Carolina has more than 250 breweries. The majority are located in the southern part. Some of the most well-known breweries are Asheville and Charlotte, Durham, Greensboro, and the Raleigh area.

The industry’s growth has been aided by the rising popularity of beer tourism. The countries such as New Zealand and Australia have promoted craft beer for economic development. Because these beers come in unique flavors because of the exclusive ingredients found in New Zealand, Wellington is an important market.

Industry leaders are expected to continue to face major obstacles from anti-alcohol campaigns. These campaigns have led to a rise in health consciousness among consumers over the last few years. Additionally, the increased taxation and regulation of the alcohol industry by the government are expected to reduce the production output. This will in turn limit market growth in the future.

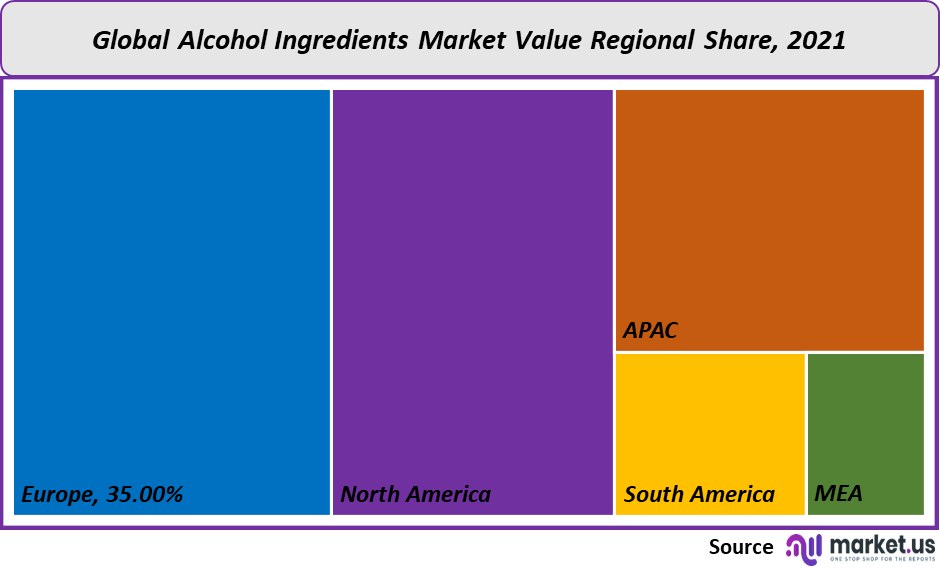

Regional Analysis:

Europe was the dominant market and held 35%. The region is experiencing rapid growth in the alcohol industry. Europe is home to more than half the world’s wine production. With major producers, it is the largest global exporter of alcohol. Europe’s key markets include Germany, France, and the U.K.

The largest wine consumers are France, Italy, and Spain. The largest beer consumers are Germany, the U.K., and Ireland. Russia, Poland, and Ukraine consume a lot of vodkas. Lager holds the largest percentage of all beer types. Craft beer has been growing in popularity over the years.Asia Pacific will see the fastest CAGR of 8.1% between 2023 and 2032. The market is driven by the rising purchasing power of consumers from developing countries like China, Taiwanese, India, South Korea, and Myanmar. China is the largest market, owing to increased product demand, especially in urban areas. The most preferred category of alcohol is wine in this region.

Key Regions and Countries covered іn thе rероrt:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

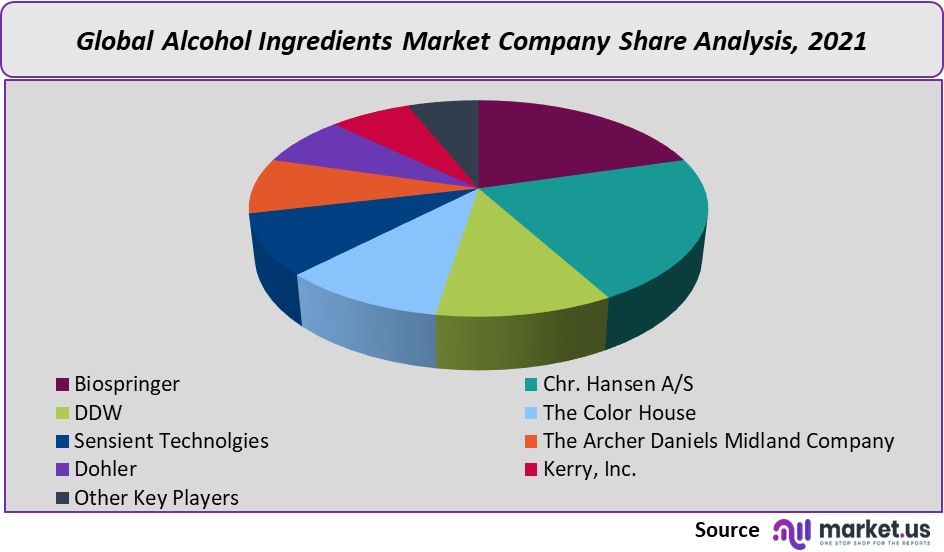

Market Share Analysis:

To maintain market share, companies must innovate through product innovation. Alcopop, a brand of flavored alcoholic beverages, was introduced by The Coca-Cola Company in Japan in March 2018. This product has a range of alcohol levels, ranging from 3% to 8 percent.

Key Market Players:

- Biospringer

- Chr. Hansen A/S

- DDW

- The Color House

- Sensient Technolgies

- The Archer Daniels Midland Company

- Dohler

- Kerry, Inc.

- Other Key Players

For the Alcohol Ingredient Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

Q: What is the size of the Alcohol Ingredients market in 2021?The Alcohol Ingredients market size is US$ 1,956.16 million in 2021.

Q: What is the projected CAGR at which the Alcohol Ingredients market is expected to grow at?The Alcohol Ingredients market is expected to grow at a CAGR of 7.67% (2023-2032).

Q: List the segments encompassed in this report on the Alcohol Ingredients market?Market.US has segmented the Alcohol Ingredients market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Product, market has been segmented into Yeast, Enzymes, Colorants, Flavors & Salts and Other Products. By Application, the market has been further divided into Beer, Spirits, Wine and Other Applications

Q: List the key industry players of the Alcohol Ingredients market?Biospringer, Chr. Hansen A/S, DDW, The Color House, Sensient Technolgies, The Archer Daniels Midland Company, Dohler, Kerry, Inc. and Other Key Players are engaged in the Alcohol Ingredients market.

Q: Which region is more appealing for vendors employed in the Alcohol Ingredients market?Europe is expected to account for the highest revenue share of 35%. Therefore, the Alcohol Ingredients industry in Europe is expected to garner significant business opportunities over the forecast period.

Q: Name the key areas of business for Alcohol Ingredients?The US, China, Japan, India, Brazil, Germany, UK, France, Italy, Spain, etc. are key areas of operation for Alcohol Ingredients Market.

Q: Which segment accounts for the greatest market share in the Alcohol Ingredients industry?With respect to the Alcohol Ingredients industry, vendors can expect to leverage greater prospective business opportunities through the Flavors & Salts Alcohol Ingredients segment, as this area of interest accounts for the largest market share.

![Alcohol Ingredient Market Alcohol Ingredient Market]()

- Biospringer

- Chr. Hansen A/S

- DDW

- The Color House

- Sensient Technolgies

- The Archer Daniels Midland Company

- Dohler

- Kerry, Inc.

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |