Global Vendor Risk Management Market By Solution (Vendor Information Management, Contract Management, and Other Sources), By Deployment Mode (Cloud, and On-premises), By Enterprise Size (SMEs, and Large Enterprises) By End-Use (BFSI, IT & Telecom and Other End-Uses), and by Region and Companies Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032.

- Published date: Jul 2022

- Report ID: 58652

- Number of Pages: 219

- Format:

- keyboard_arrow_up

Vendor Risk Management Market Overview:

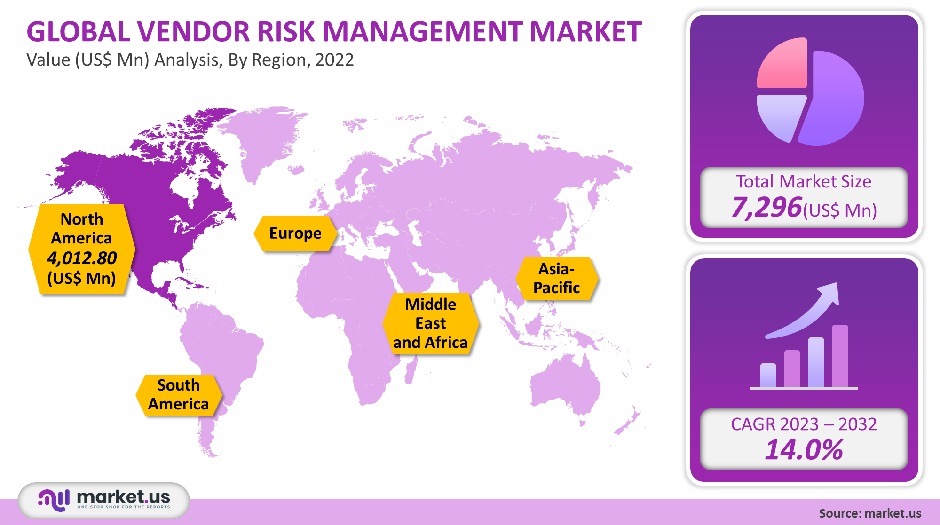

In 2021, the global vendor risk management market was valued at USD 7,296 million. It is expected to grow at a CAGR of 14.0% between 2023 and 2032.

To achieve their business goals, enterprises are heavily dependent on third-party vendors located in diverse geographic locations. Enterprises often find it difficult to collaborate with vendors because they can bring different risks that could damage their business processes and objectives. Enterprises should adopt vendor risk management to reduce and eliminate these risks.

Global Vendor Risk Management Market Scope:

Solution Analysis

Vendor risk management is a growing market driven by enterprises’ increasing use of vendor management solutions to manage complex vendor ecosystems. In the future, there will be many opportunities for stakeholders due to the increasing demand for vendor management solutions in highly regulated industries such as manufacturing, banking & finance, and healthcare. Market growth is being slowed by the dependence of organizations upon manual and traditional processes for managing risks.

Organizations faced many difficulties managing vendors during the COVID-19 crisis. Industries like energy, banking and finance, and banking and finance saw a decrease in vendor risk management solutions. However, the risks associated with vendors rose due to the crisis. The healthcare, life sciences, IT, and telecommunications industries saw a rapid rise in the adoption of these solutions. The pandemic is expected to moderately affect the global market.

To optimize product delivery, enterprises hire vendors who are located far away. This increases the complexity of the supply chain. In many cases, disruptions are more likely as a result.

Enterprises are now focusing on advanced solutions to create vendor ecosystems that facilitate supplier-supplier relationships and simplify management. This is driving the market. There has been a significant increase in vendor risk management solutions adoption. It can be tedious for organizations to manage multiple vendors through both manual and non-formal processes.

Vendor risk management solutions are a solution that allows enterprises to evaluate the risks associated with different vendors.

Vendor risk management solutions also help identify critical issues related to products and solutions. It reduces the time and effort required for organizations to evaluate vendor performance on the basis of time accuracy, solution delivery time, quality of product, and product delivery. Organizations are seeing an increase in production rates due to effective vendor risk management. This is contributing to market growth.

Many organizations around the globe rely heavily on manual processes to assess the risks of vendor dependence. These organizations are not aware of the importance of vendor risk management solutions for reducing vendor risks. Their reluctance to implement these solutions is a hindrance to market growth.

Deployment Mode Analysis

Cloud-based deployment accounted for 85.0% of the total revenue in 2021. This segment has a large revenue share due to its growing benefits to enterprises, including self-solution, scalability, and affordability. The market is expected to grow at a rapid pace over the forecast period due to the increasing use of hybrid cloud solutions, which can be used by enterprises to improve business operations, cost optimization, and resource usage. It also allows for application modernization. The market will be driven by the increasing interest in cloud-based solutions for modernizing existing IT infrastructures.

Due to increasing data security concerns, the on-premise segment was second in revenue share in 2021. This allowed enterprises to choose to use on-premise solutions. Enterprises are more inclined to use cloud-based deployment because of cost constraints and lack of knowledge. Many organizations in emerging countries lack the technical skills necessary to use cloud-based platforms. This has also contributed to the segment’s growth.

Enterprise Size Analysis

In 2021, the large enterprise segment has a large market share due to its improved collaboration, flexibility, and lower operating costs. It also has a quicker time to market. The segment’s growth is also being driven by the increasing need for large companies to manage dispersed suppliers and vendors around the globe.

The segment has also seen a significant increase in large-scale spending on technological innovations. Large enterprises that have large supply chains often require multiple vendors to effectively manage. This is why vendor risk management solutions are in high demand.

Over the forecast period, the segment Small & Medium Enterprises will be the fastest growing. This segment is expected to grow due to the increasing number of start-ups in emerging markets like China, India, and Latin America, as well as their interest in advanced technology.

The segment will also be driven by an increase in government support for the development and promotion of the SME sector in different countries. Market growth is also expected to be driven by the increasing preference of SMEs for cloud-based, cost-effective solutions in the future.

End-Use Analysis

In 2021, the manufacturing segment was responsible for the high revenue share. This large market share is due to the increasing demand for vendor risk management solutions that can efficiently manage increased risks related to vendors in terms of compliance, finance, and quality.

Organizations can also adopt advanced solutions such as vendor risk management to improve their business operations and decrease risks due to the increasing digital transformation.

Manufacturing companies have more vendors than other industries for many products and services. This industry is in high demand for vendor risk management solutions to manage the risk associated with many vendors. It has fueled the sector’s growth.

Key Маrkеt Ѕеgmеntѕ

By Solution:

- Vendor Information Management

- Contract Management

- Financial Control

- Compliance Management

- Audit Management

- Quality Assurance Management

- Other Sources

By Deployment Mode:

- Cloud

- On-premises

By Enterprise Size:

- SMEs

- Large Enterprises

By End-Use:

- BFSI

- IT & Telecom

- Retail & Consumer Goods

- Manufacturing

- Other End-Uses

Market Dynamics

Vendor Risk Management is a growing market driven by enterprises’ increasing use of vendor management solutions to manage complex vendor ecosystems. In the future, there will be many opportunities for stakeholders due to the increasing demand for vendor management solutions in highly regulated industries such as manufacturing, banking & finance, and healthcare. Market growth is being slowed by the dependence of organizations upon manual and traditional processes for managing risks.

Organizations faced many difficulties managing vendors during the COVID-19 crisis. Industries like energy, banking and finance, and banking and finance saw a decrease in vendor risk management solutions. However, the risks associated with vendors rose due to the crisis. The healthcare, life sciences, IT, and telecommunications industries saw a rapid rise in the adoption of these solutions. The pandemic is expected to moderately affect the global market.

To optimize product delivery, enterprises hire vendors who are located far away. This increases the complexity of the supply chain. In many cases, disruptions are more likely as a result.

Enterprises are now focusing on advanced solutions to create vendor ecosystems that facilitate supplier-supplier relationships and simplify management. This is driving the market. There has been a significant increase in vendor risk management solutions adoption. It can be tedious for organizations to manage multiple vendors through both manual and non-formal processes.

Vendor risk management solutions are a solution that allows enterprises to evaluate the risks associated with different vendors.

Vendor risk management solutions also help identify critical issues related to products and solutions. It reduces the time and effort required for organizations to evaluate vendor performance on the basis of time accuracy, solution delivery time, quality of product, and product delivery.

Organizations are seeing an increase in production rates due to effective vendor risk management. This is contributing to market growth. Many organizations around the globe rely heavily on manual processes to assess the risks of vendor dependence. These organizations are not aware of the importance of vendor risk management solutions for reducing vendor risks. Their reluctance to implement these solutions is a hindrance to market growth.

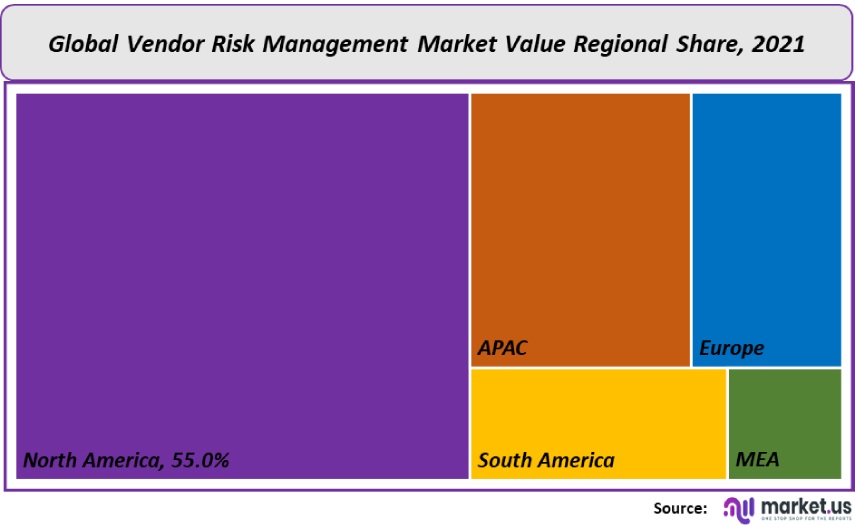

Regional Analysis

With a market share of 55.0%, North America was dominant in the global market in 2021. This large market share is due to enterprises’ increasing dependence on vendor risk management solutions to manage vendors’ risks. There are also global market leaders that offer several solutions at reasonable prices and increased spending by local businesses on risk management solutions.

The Asia Pacific will be the fastest-growing region during the forecast period. Market growth is expected to be driven by the rapid increase in disposable incomes and an increasing number of SMEs in China and South Korea. The market will be driven by the increasing demand for digital transformation in remote areas of the region as well as increased awareness among enterprises about the benefits of vendor risk management.

Key Regions and Countries covered in the rероrt:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Key Companies & Market share:

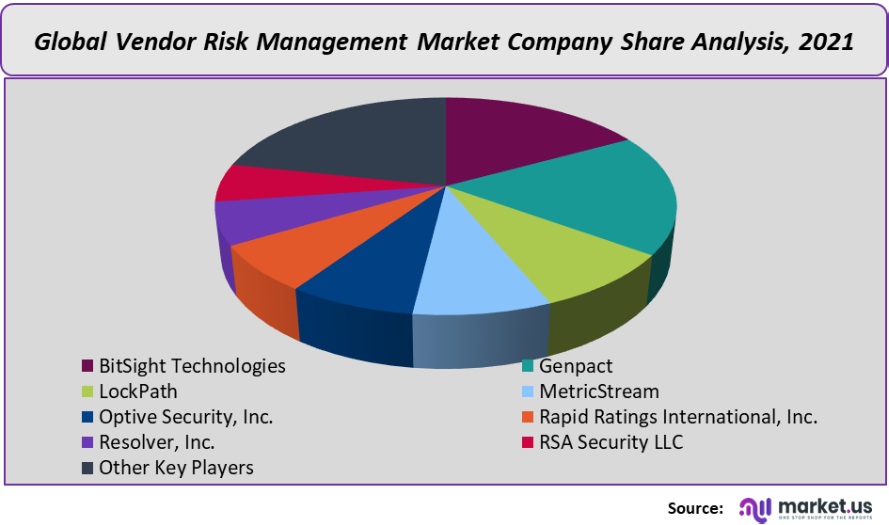

Industry players will be able to access emerging markets quickly and improve their technological capabilities by launching new products and upgrading existing products. Origami Risk, for example, announced in October 2021 that it has developed an online solution to assist businesses with their vendor risk management and productivity. Prevalent, Inc. also introduced Vendor Intelligence Network, Third-Party Risk Management Platform in November 2021. This platform empowers enterprises with vendor risk visibility and transforms static vendor profiles into dynamic risk intelligence.

Partnerships, collaborations, and strategic alliances will also be key to the growth of market companies. SecZetta, a solution provider, partnered with Prevalent, Inc. in November 2021 to integrate vendor intelligence insights from Prevalent’s platform into SecZetta’s Third-Party Identity Risk Solution. This was to improve product capabilities and to support their digital transformation initiative.

Key Маrkеt Рlауеrѕ іnсludеd in the rероrt:

- Bitsight Technologies

- Genpact

- LockPath

- MetricStream

- Optive Security, Inc.

- Rapid Ratings International, Inc.

- Resolver, Inc.

- RSA Security LLC

- Other Key Players

For the Vendor Risk Management Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

Q: What is the Vendor Risk Management market size in 2021?A: The Vendor Risk Management market size is US$7,296 Million in 2021.

Q: What is the CAGR for the Vendor Risk Management market?A: The Vendor Risk Management market is expected to grow at a CAGR of 14.0% during 2023-2032.

Q: What are the segments covered in the Vendor Risk Management market report?A: Market.US has segmented the Global Vendor Risk Management Market Value (US$ Mn) Analysis by Region, 2022 market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Deployment Mode, market has been segmented into Cloud, and On-premises. By Enterprise Size, market has been further divided into SMEs, and Large Enterprises. By Solution, market has been further divided into Vendor Information Management, Finance Control, Audit Management, Compliance Management, Quality Assurance Management, and Contract Management. By End-Use, market has been further divided into BFSI, Retail and Consumer goods, IT and Telecom, Manufacturing, and other end-uses.

Q: Who are the key players in the Vendor Risk Management market?A: BitSight Technologies, Genpact, LockPath, MetricStream, Optive Security, Inc., Rapid Ratings International, Inc., Resolver, Inc., RSA Security LLC, and other key players.

Q: Which region is more attractive for vendors in the Vendor Risk Management market?A: North America accounted for the highest revenue share of 55.0% among the other regions. Therefore, North America Vendor Risk Management market is expected to garner significant business opportunities for the vendors during the forecast period.

Q: What are the key markets for Vendor Risk Management?A: Key markets for Vendor Risk Management are US, China, Japan, India, Brazil, Germany, UK, France, Italy, Spain, etc.

Q: Which segment has the largest share in the Vendor Risk Management market?A: In the Vendor Risk Management market, vendors should focus on grabbing business opportunities from the cloud based segment as it accounted for the largest market share in the base year.

![Vendor Risk Management Market Vendor Risk Management Market]() Vendor Risk Management MarketPublished date: Jul 2022add_shopping_cartBuy Now get_appDownload Sample

Vendor Risk Management MarketPublished date: Jul 2022add_shopping_cartBuy Now get_appDownload Sample - Bitsight Technologies

- Genpact Ltd. Company Profile

- LockPath

- MetricStream

- Optive Security, Inc.

- Rapid Ratings International, Inc.

- Resolver, Inc.

- RSA Security LLC

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |