Global Food Additives Market By Product (Flavors & Enhancers, Sweeteners, Enzymes, Emulsifiers, Shelf-life stabilizers, Fat Replacers, Prebiotics, Probiotics, Dietary Fibers, Others), By Source (Natural and Synthetic), By Application (Bakery & Confectionery, Beverages, Convenience Foods, Dairy & Frozen Desserts, Spices, Condiments, Sauces & Dressings, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Jul 2022

- Report ID: 59082

- Number of Pages: 334

- Format:

- keyboard_arrow_up

Food Additives Market Overview

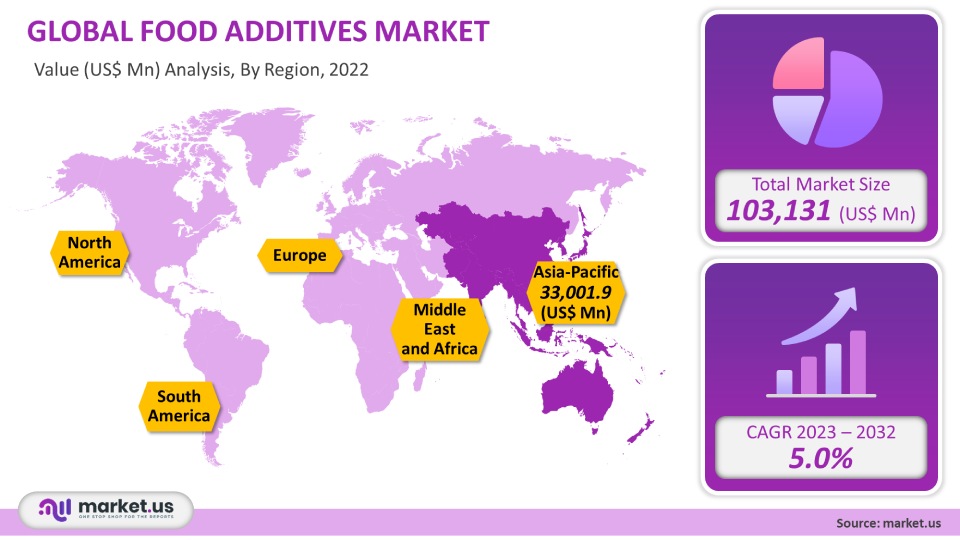

The global market for food additives was worth USD 103,131 million in 2021. It is projected to grow at a CAGR of 5.0% between 2023 and 2032. Food additives are expected to be in high demand because of the need to improve food taste, texture, and appearance. Global growth in the food and beverage industry is the main driver of the market. Due to changing dietary habits, the global consumption of packaged foods and beverages is increasing. This will lead to rising demand for food additives used in food processing to enhance nutrition and quality.

Global Food Additives Market Scope:

Product Analysis

With a market share of over 56.0%, the sweeteners segment was dominant in 2021. The rising awareness about obesity and cardiovascular disease will likely limit the demand for high-calorie sweeteners such as sucrose and high fructose Corn Syrup (HFCS). This will support high-intensity sweeteners like stevia and aspartame and fat substitutes like whey protein or starch.

PepsiCo declared in July 2021 that it would reduce the amount of added sugars in beverages by 25% by 2023 and 50% by 2032. PepsiCo is working to improve the quality of its products by using low-calorie sweeteners. Food and beverage companies are expected to take initiatives to meet the growing demand for high-intensity sweeteners and flavors, fat substitutes, and fat enhancers that improve taste without adding salt or sugar.

Flavors and flavor enhancers can improve the taste and texture of food and beverages. Food and beverage companies have been trying to reduce salt and sugar in their products. This has led to a rise in demand for flavor enhancers, which can increase the flavor of food and beverages without adding salt or sugar. To balance the taste of food or beverages, bitterness suppressors can be used to provide a better mouthfeel. Market players are now focusing on developing enzyme blends that improve the quality and safety of food products. Sabinsa, for example, offers a proprietary blend that includes five enzymes, a-amylase (protease, lipase cellulose, lipase, and a-amylase), protease (lipase), cellulose, and lactase. These enzymes can be used as functional ingredients to support digestion. Emulsifiers can be used to blend two or more immiscible fluids. They are widely used in baking, frozen desserts, dressings, and other food preparations. Ingredion has developed an emulsifier made from chickpeas, which can be substituted for eggs in sauces or dressings. Plant-based emulsifiers allow the preparation and use of vegan mayonnaise, Alfredo sauce, and aioli.

Consumers are increasingly looking for convenient packaged foods that they can grab and go. Food processing companies are now adding shelf-life stabilizers and food preservatives to increase the shelf life of products without compromising quality. The demand for shelf-life stabilizers such as rosemary extract, natamycin, and potassium sorbate has increased due to the rising import-export activity of food products and beverages worldwide.

Due to the COVID-19 epidemic, nutritional and fortified food products will be more important than ever. Food manufacturers will likely include ingredients such as probiotics and probiotics in their products to appeal to consumers.

Anti-caking agents and hydrocolloids are two other products. Bentonite, an anti-caking agent, absorbs excess moisture and prevents the clumping of dry powders like baking powder, cake mixes, and powdered sugar. Hydrocolloids like carrageenan, gellan gum, and meat and poultry products are used extensively as a thickening, gelling, and stabilizing agents.

Source Analysis

With a market share of 82.0%, the natural segment will dominate in 2021. Natural ingredients are safer than chemical ones for consumption by humans. Chemically synthesized sweeteners, flavoring ingredients, and emulsifiers can cause allergies or other health problems, such as cancer.

Due to the rising demand for plant-based ingredients, key players have been increasing their focus on expanding their product portfolio. ADM’s plant-based new, cutting-edge, innovative laboratory was opened in ADM Biopolis, a research hub in Singapore, in April 2021. This increased ADM’s plant-based products, such as flavors and proteins.

Modern Plant-Based Foods Inc. and Real Vision Foods, LLC partnered in August 2021 to produce plant-based meals and bars for cognitive athletes. The natural source segment is expected to grow because of increased demand from beverage and food producers for natural additives.

Synthetic additives are cheaper than natural ones. Synthetic additives can be made without the need to purchase expensive natural raw materials or their lengthy and costly extraction processes. The manufacturing process and cost benefits of synthetic additives will support the growth in this segment over the next few years.

Application Analysis

With a market share of 32.0%, the bakery and confectionery segments dominated in 2021. Many additives such as emulsifiers, sweeteners, and dietary fibers can be used to enhance the quality of confectionery and bakery products. The company sells a variety of bakery enzymes, including Powersoft Cake and POWERBake, as well as POWERFresh and POWERFlex, and enzymes such as xylanase or lipase that can be used to increase dough stability and dough strength, as well to ensure flour quality are robust and tolerable.

Beverages like sports drinks, flavored dairy, flavored water, and other ready-to-drink (RTD) drinks are easy to consume while on the move. They are also easily transportable and can be consumed while driving. The market is seeing new developments in fermented beverages like kombucha or other fermented teas. Global growth is expected to be driven by the increasing demand for non-alcoholic and alcoholic beverages with various flavor options. BLUE CALIFORNIA introduced the Destination Flavors Collection in November 2020 for ready-to-drink (RTD) beverages containing alcohol with a lower sugar level. These flavors are inspired by regional flavors like Catalan Crush and Pacific Blossoms, Thai Treat, Arctic Gem, and California Dreamin.

Convenience foods include instant noodles, ready meals, and savory snacks. Stats NZ reports that New Zealand’s share of total food expenditures in 2020 was 27.23%. This is an increase of 25.55% from September 2017. Consumer preferences will shift to convenience foods that are quicker and easier to prepare due to longer work hours and less time for making food.

Other uses include poultry, seafood, meat products, and oils and fats. Microbial contamination is more common in processed pork, seafood products, poultry meat, and other foods with higher nutritional content. These products require antimicrobial and preservative agents to prevent microbial growth. Food starch hydrocolloids and emulsifiers are often added to enhance the taste and texture of poultry and meat products.

Key Market Segments:

By Product

- Flavors & Enhancers

- Sweeteners

- HIS

- HFCS

- Sucrose

- Others

- Enzymes

- Emulsifiers

- Mono, Di-Glycerides & Derivatives

- Lecithin

- Stearoyl Lactylates

- Sorbitan Esters

- Others

- Shelf-life stabilizers

- Fat Replacers

- Protein

- Starch

- Fat

- Prebiotics

- Probiotics

- Dietary Fibers

- Others

By Source

- Natural

- Synthetic

By Application

- Bakery &Confectionery

- Beverages

- Convenience Foods

- Dairy & Frozen Desserts

- Spices, Condiments, Sauces & Dressings

- Other Applications

Market Dynamics:

Consumers are increasingly choosing to eat a plant-based diet and want to spend more on clean-label products in America. This has led to a rise in food and drink infused with natural ingredients. Ventura Foods, LLC, an American-based company, introduced new plant-based, dairy-free salad dressings in May 2021 under Marie’s brand. It is expected that the product will attract vegan customers in the U.S.

Food and beverage companies are working to reduce sugar, fat, calories, and other calories in their products. Low-calorie sweeteners or fat substitutes will be approved by regulators, which should allow for the production of low-sugar and lower-fat beverages and food products.

In June 2020, the U.S. Food and Drug Administration (FDA) approved Epogee’s plant-based oil, Esterified Propoxylate Glycerol (EPG), as a fat replacement for various food applications. Market growth is supported by the current trend of low-calorie, low-sugar foods and drinks.

Manufacturers are embracing new technologies to increase their productivity and provide high-quality ingredients. For good Ingredients, which are 100% natural and pure, were launched by Firmenich SA in June 2021. The company’s water-based extraction technology is used to extract the extracts without the use of toxic chemicals.

Regional Analysis

Due to many end-use and consumer industries, the Asia Pacific market had the highest revenue share at over 32% in 2021. According to survey results from the Journal of Ethnic Foods in July 2021, around 79.67% of adult Chinese ate fast food. According to the same source, around 77.94% ate baked food, while 22.06% prefer fried food. The Asia Pacific region is expected to benefit from expanding the beverage and food industries in high-populous countries like China, India, and Indonesia.

North American consumers increasingly consume processed foods, including ready-to-eat meals and breakfast products. This is due to the hectic lifestyles of the people in the region.

Europe is projected to grow at a 5.6% CAGR over the forecast period, with rising demand for cakes and pastries, bread-based products, and beverages. The growth of healthy foods and beverages in Europe is expected to be supported by a growing health-conscious population. According to the British Soft Drinks Association, in 2020, low-/no calorie soft drinks contributed to 65.3% of total soft drink sales in the U.K. Low-calorie foods and beverages are getting more popular in the region. This has contributed to the growth and popularity of high-intensity sweeteners, fat replacements, and flavor enhancers.

Key Regions and Countries covered in the report:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

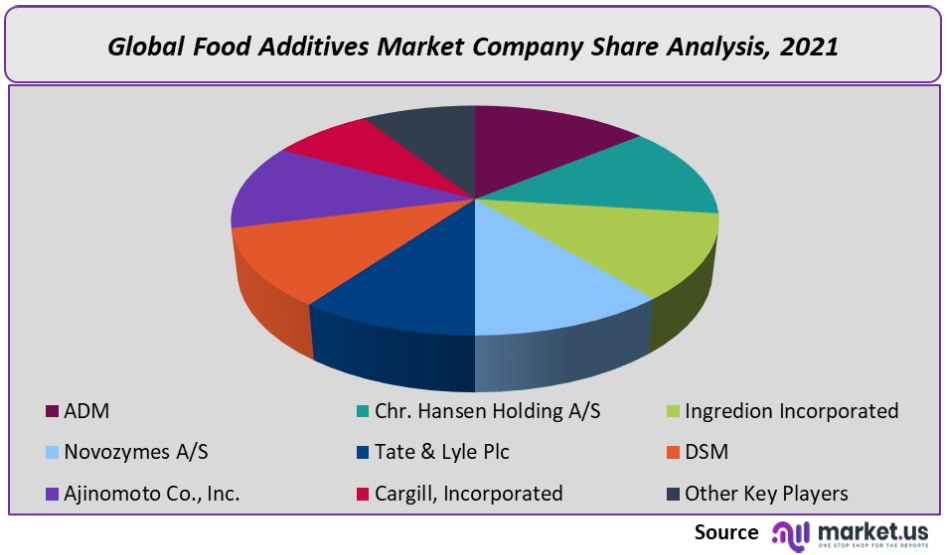

Market Share & Key Players Analysis:

Ingredion, Tate & Lyle PLC, Cargill, Incorporated, ADM, Ingredion, and Tate & Lyle PLC, DuPont, are all market players that engage in continuous research and development to create differentiated products and gain a competitive edge. Kerry, for example, opened a new tasting facility in Irapuato (Mexico) in June 2021. This will help the company to position itself in Mexico and provide local customers with innovative solutions for flavor and enhancers. Players use strategies like mergers & acquisitions or capacity expansions for their business growth. Tate & Lyle purchased Sweet Green Fields in December 2020. This stevia solution business has research & development and production facilities in China. This acquisition is expected to improve the company’s position in the clean-label sweetener market in China and the Asia Pacific.

Market Key Players:

- ADM

- Hansen Holding A/S

- Ingredion Incorporated

- Novozymes A/S

- Tate & Lyle Plc

- DSM

- Ajinomoto Co., Inc.

- Cargill, Incorporated

- Other Key Players

For the Food Additives Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

What is the size of the Food Additives market in 2021?The Food Additives market size is US$ 103,131 million in 2021.

What is the projected CAGR at which the Food Additives market is expected to grow at?The Food Additives market is expected to grow at a CAGR of 5.0% (2023-2032).

List the segments encompassed in this report on the Food Additives market?Market.US has segmented the Food Additives Market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By product, the market has been segmented into Flavors & Enhancers, Sweeteners, Enzymes, Emulsifiers, Shelf-life stabilizers, Fat Replacers, Prebiotics, Probiotics, Dietary Fibers, Others), By Source Natural and Synthetic; by application, the market has been segmented into Bakery & Confectionery, Beverages, Convenience Foods, Dairy & Frozen Desserts, Spices, Condiments, Sauces & Dressings, Others.

List the key industry players of the Food Additives market?ADM, Chr. Hansen Holding A/S, Ingredion Incorporated, Novozymes A/S, Tate & Lyle Plc, DSM, Ajinomoto Co., Inc., Cargill, Incorporated, Other Key Players are the key vendors in the Food Additives market.

Which region is more appealing for vendors employed in the Food Additives market?APAC accounted for the highest revenue share of 32%. Therefore, the Food Additives industry in APAC is expected to garner significant business opportunities over the forecast period.

Name the key areas of business for the Food Additives Market.The US, Canada, Mexico, Italy, Japan, Germany, France, UK, etc., are leading key areas of operation for Food Additives Market.

Which segment accounts for the greatest market share in the Food Additives industry?With respect to the Food Additives industry, vendors can expect to leverage greater prospective business opportunities through the bakery and confectionery segment, as this area of interest accounts for the largest market share.

![Food Additives Market Food Additives Market]()

- ADM

- Hansen Holding A/S

- Ingredion Incorporated

- Novozymes A/S

- Tate & Lyle Plc

- DSM

- Ajinomoto Co., Inc.

- Cargill, Incorporated

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |