Global Eubiotics Market By Product (Probiotics, Organic Acids, Prebiotics, Enzymes, and Phytogenic), By Application (Gut Health, Yield, Immunity, and Other Applications), By End-Use (Cattle Feed, Aquatic Feed, Swine Feed, Poultry Feed, and Other End-Uses), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2023-2032

- Published date: Jul 2022

- Report ID: 59591

- Number of Pages: 356

- Format:

- keyboard_arrow_up

Eubiotics Market Overview:

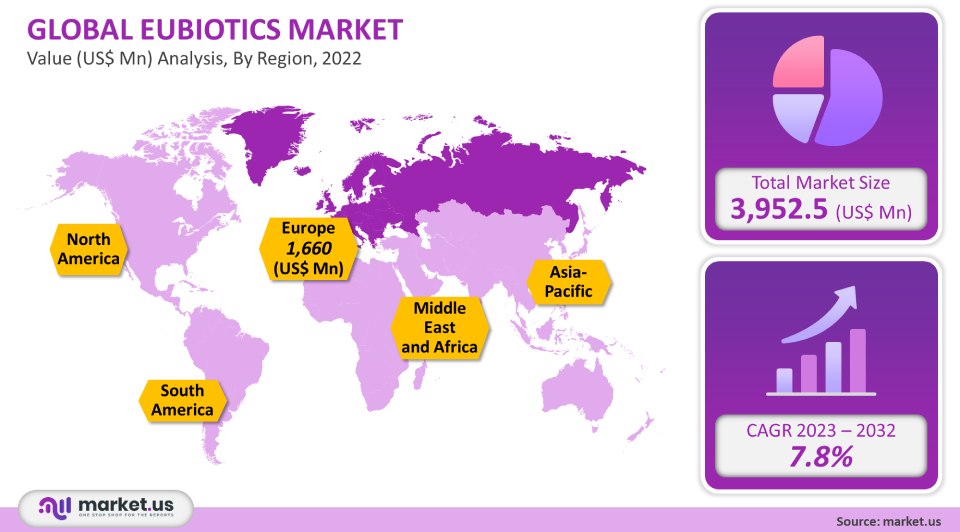

The global Eubiotics industry was valued at USD 3,952.5 million in 2021. This market is projected to grow at a 7.8% CAGR, from 2023 through 2032.

Favorable regulatory situations, such as banning the use of antibiotics or increasing meat consumption worldwide, are expected to drive demand. With long-standing, and well-established players enjoying significant market share, the market is highly competitive. In order to produce affordable and cost-effective products, companies invest heavily in R&D. Lack of sufficient players in many countries, particularly in the Middle East, opens up ample opportunities for new players to enter the market and establish a strong foothold.

Global Eubiotics Market Analysis:

Product Analysis

Probiotics market dominated with a large revenue share of more than 42% in 2021. This is due to increasing awareness about the use of probiotics as animal feed and ongoing R&D efforts to create efficient products. Market demand is expected to increase due to the numerous uses probiotics have in animal applications, including immune development and maintenance of gut health.

Additionally, organic acids were second in the global market share. These acids are used for forage and as grain preservatives in animal nutrition. These acids inhibit the growth of mold and bacterial pathogens. They also help to improve feed utilization. They can be used in aquaculture, poultry, and pig farming. Organic acids can be used to improve feed quality and hygiene. These attributes are expected to drive organic acid segment growth in the forecast period.

Propionic acids saw high growth in both demand and consumption. The majority of propionic acids produced are used as preservatives for food for human consumption, as well as for animal feed. They are most effective as a feed additive and growth promoter for food animals, particularly poultry and pig.

Application Analysis

Gut health applications held a significant market share. Its high market share can be attributed to the increasing prevalence of gut problems in animals and an increased desire for preventive healthcare. Eubiotic products increase intestinal microbiota production, which in turn improves digestion and the immune system. Gut health is possible with products such as essential oils, prebiotics, organic acids, and others. These products can be used in combination or as an individual to obtain better results.

Eubiotics are used in domestic animals to increase performance and improve health. The product’s effectiveness is dependent on its antimicrobial and gut flora effects. Gut health enhancers include fructo-oligosaccharide, mannan-oligosaccharide, beta-glucan, probiotics, and prebiotics.Eubiotics improve the immune system of animals. While the immune system only accounts for a small percentage of total nutritional needs in an animal, activating it is a major challenge that has a significant effect on nutrition status. Low immunity levels can make animals more vulnerable to viruses, infections, and bacteria that could lead to death. Therefore, it is crucial to boost and develop immunity in both growing and newborn animals.

End Use Analysis

The market was dominated by the poultry segment in 2021. This high market share can be attributed to the increasing consumption and demand for poultry, duck, turkey, as well as boilers. Because of its low price, low-fat content, and fewer religious & cultural restrictions, chicken meat is popular.

The growing demand for pork has forced pork producers to produce high-quality, disease-free meat products that can be consumed by humans. The demand for feed additives has increased. Eubiotic ingredients can be used as dietary supplements or additives in swine food. They are known to improve the health and growth of animals, their gut health, and reproductive health. They also help to improve animal health and decrease the animals’ mortality rates.

Due to the increased demand for meat and other dairy products, there will be a rise in demand for eubiotics. There is a rising demand for dairy products, such as milk, butter, and cheese. This has led to the need for large-scale improvement in the efficiency of dairy farms and the use of high-quality nutritive feed. The bovine feed should contain eubiotic ingredients to increase productivity and milk production. The demand for animal feed will rise due to increased beef consumption.

Key Market Segments:

By Product

- Probiotics

- Organic Acids

- Prebiotics

- Enzymes

- Phytogenic

By Application

- Gut Health

- Yield

- Immunity

- Other Applications

By End-Use

- Cattle Feed

- Aquatic Feed

- Swine Feed

- Poultry Feed

- Other End-Uses

Market Dynamics:

Eubiotics are made and distributed by distributors, feed mills, or pre-mixers. Companies involved in the manufacturing of eubiotics can either sell their products directly to their customers or to integrated feed producers. In either case, the eubiotics reach livestock producers. The chemical synthesis or fermentation process is used to make eubiotics like organic acids. Chemical synthesis is the preferred process for animal feed applications, such as silage or feed additives.

The factors that influence Eubiotics’ prices include raw material availability and agro-climatic conditions. Because of the price-sensitive buyers, manufacturers have to compete with each other on pricing. To maintain a competitive edge in the market, manufacturers invest heavily in process innovation and low-cost material procurement. In addition, prices will moderately rise due to the rapid growth of end-use products such as pharmaceuticals and feed, along with increased production of eubiotics that is likely to bridge the gap between demand and supply.

Probiotics and prebiotics are important parts of the value chain in the nutraceuticals market. India and China, both developing countries, are well-positioned in this market due to their technological advancements, low labor costs, and the abundance of raw materials from upscale production. Key players from developing economies are working together to create an efficient manufacturing process and a strong supply network for low-cost product manufacturing. This allows them to offer products at comparatively lower prices.

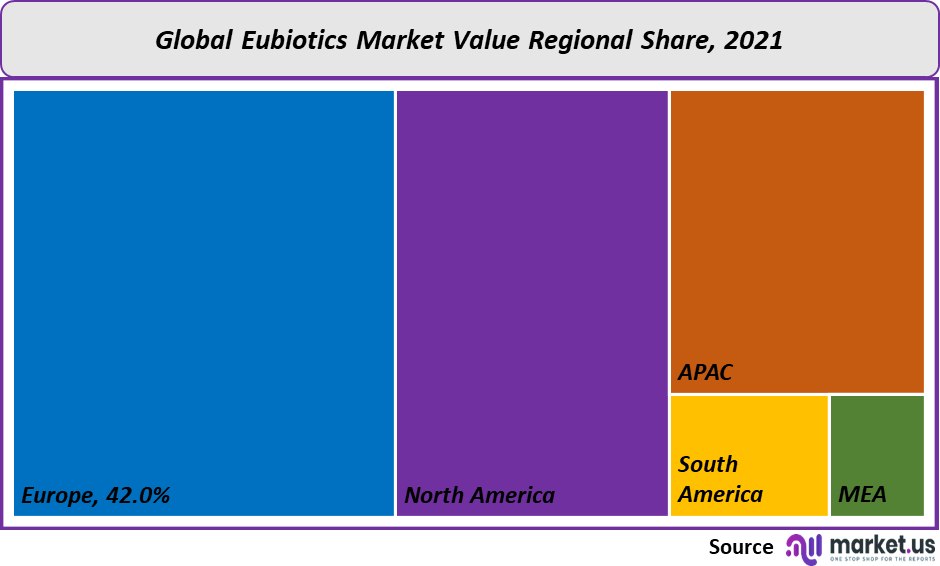

Regional Analysis:

Europe held a dominant position in the global market, accounting for 42% of the total revenue in 2021. This is due to increasing demand for processed foods, such as meat, and increasing livestock production. Italy, France, Germany, and other countries have witnessed a sharp rise in meat consumption in recent years. This has encouraged producers to source high-quality, disease-free animal products.

The region of North America can see a significant rise in product demand because of rising animal product demand and the fast-growing animal feed industry. The U.S. and Mexico are experiencing a rising demand for meat and other meat products. This has increased awareness of animal health and has helped to increase the use of animal feed products.The Asia Pacific is one of the fastest-growing markets in the world. The increasing consumption of meat and meat products has led to a greater need for animal health and hygiene. This has prompted the demand to feed additives. The region’s demand for animal feed and supplements is being driven by the rising consumption of beef and pork in Japan, China, and India.

Key Regions and Countries covered іn thе rероrt:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Market Share & Key Players Analysis:

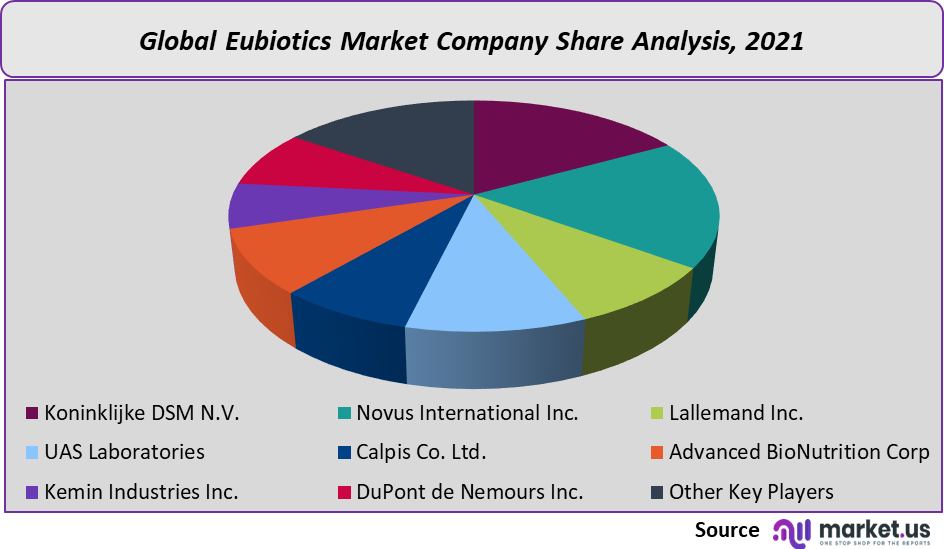

Due to the many players operating in the market, fragmentation has been called for. The majority of market share is held by market leaders, small-scale manufacturers, traders, and operators on local or national markets. Manufacturers are focused on improving their product ranges in order to be more competitive than other market players. These factors include supply chain, distribution channel, and technology.

Маrkеt Кеу Рlауеrѕ:

- Koninklijke DSM N.V.

- Novus International Inc.

- Lallemand Inc.

- UAS Laboratories

- Calpis Co. Ltd.

- Advanced BioNutrition Corp

- Kemin Industries Inc.

- DuPont de Nemours Inc.

- Other Key Players

For the Eubiotics Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

What is the size of the Eubiotics market in 2021?The Eubiotics market size is US$ 3,952.5 million in 2021.

What is the projected CAGR at which the Eubiotics market is expected to grow at?The Eubiotics market is expected to grow at a CAGR of 7.8% (2023-2032).

List the segments encompassed in this report on the Eubiotics market?Market.US has segmented the Eubiotics market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Product, the market has been segmented into Probiotics, Organic Acids, Prebiotics, Enzymes, and Phytogenic. By Application, the market has been further divided into Gut Health, Yield, Immunity, and Other Applications. By End-Use, the market has been further divided into Cattle Feed, Aquatic Feed, Swine Feed, Poultry Feed, and Other End-Uses.

List the key industry players of the Eubiotics market?Koninklijke DSM N.V., Novus International Inc., Lallemand Inc., UAS Laboratories, Calpis Co. Ltd., Advanced BioNutrition Corp, Kemin Industries Inc., DuPont de Nemours Inc., and Other Key Players are engaged in the Eubiotics market.

Which region is more appealing for vendors employed in the Eubiotics market?Europe is expected to account for the highest revenue share of 42%. Therefore, the Eubiotics industry in Europe is expected to garner significant business opportunities over the forecast period.

Name the key areas of business for Eubiotics?The US, India, China, Canada, UK, Japan, & Germany are key areas of operation for the Eubiotics Market.

Which segment accounts for the greatest market share in the Eubiotics industry?With respect to the Eubiotics industry, vendors can expect to leverage greater prospective business opportunities through the conventional segment, as this area of interest accounts for the largest market share.

![Eubiotics Market Eubiotics Market]()

- Koninklijke DSM N.V.

- Novus International Inc.

- Lallemand Inc.

- UAS Laboratories

- Calpis Co. Ltd.

- Advanced BioNutrition Corp

- Kemin Industries Inc.

- DuPont de Nemours Inc.

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |