Global High-Temperature Coating Market By Product Type (Acrylic, Epoxy, Polyether sulfone, and Other Product Type), By Technology (Waterborne, Powder, and Other Technologies) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Jul 2022

- Report ID: 59917

- Number of Pages: 385

- Format:

- keyboard_arrow_up

High-Temperature Coating Market Overview:

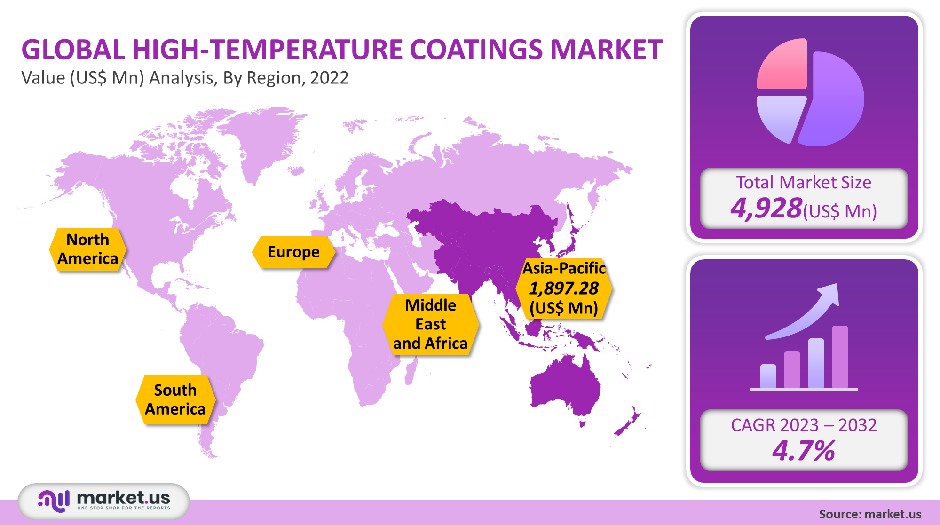

In 2021, the global High-Temperature Coating Market was worth USD 4,928 million. It is expected to register a CAGR growth of 4.7% in the coming years.

Due to increasing product demand in various end-use industries like metal processing and bakeware, as well as building and construction, the industry is expected to experience moderate growth over the coming years.

These products offer protection against corrosion from prolonged equipment use in high temperatures and fire. Because it provides protection for steel structures and other building components, fireproofing is an important part of the construction industry.

Global High-Temperature Coating Market Scope:

Product Type Analysis

Acrylic was the most popular product segment, accounting for more than 24.6% of total volume in 2021. Acrylic-based products are being used in many industries due to their high penetration. Another factor that has contributed to the increased acceptance of the products in various industries is the low volatile organic compound (VOC), content in the product formulation.

Polyether sulfone is predicted to be the fastest-growing segment in terms of volume over the next few decades. It is expected to be worth more than USD 470.0 million in 2024. The product’s physical properties, such as its enhanced metal adhesion and transparency, as well as long-term thermal stability, have led to a rise in product demand. These characteristics have led to increased product usage in many areas, including construction, marine, and automotive refinishes.

Epoxy was the second-largest segment in 2021 due to its durability and chemically resistive characteristics. This segment is forecast to grow at a CAGR exceeding 5.4% in terms both of revenue and volume over the forecast period. The majority of epoxy-based products are used in corrosion-resistant applications such as automobiles, boats, and steel pipes. These items are often exposed to high temperatures. Because epoxy-based coatings are compatible with many color formulations and solvent-free ingredients, demand is growing for these products.

Technology Analysis

In 2021, waterborne technology accounted for more than 74.8% of the total volume. The shift towards non-solvent-based technology has led to an increase in the use of waterborne and powder-based products across various industries. Over the next few decades, waterborne technology will be in high demand due to its low VOC and minimal environmental impact.

Powder coatings will be the fastest-growing formulation technology in terms both of volume and revenue by 2024. This segment is expected to see 95.6 kilotons of demand by 2024. Coating manufacturers have been forced to switch to powder-based products due to stringent environmental regulations pertaining to solvent-based products. This technology has major benefits, including higher utilization rates and easier application. These are expected to drive segment demand in the forecast period.

Маrkеt Ѕеgmеntѕ:

By Product Type

- Acrylic

- Epoxy

- Polyether sulfone

- Other Product Type

By Technology

- Waterborne

- Powder

- Other Technologies

Market Dynamics:

However, market penetration in this sector will be limited by a lack of coordination between building codes from different countries. Coating manufacturers can increase their investment in R&D projects by ensuring that there are no differences in the regulatory rules. The Underwriters Laboratories, (UL), is a major regulatory agency. They have issued guidelines and standards to conduct application testing on coatings.

Other regulatory and government agencies, such as ASTM and ANSI, ISO, and NFPA, regulate the formulation and testing of coating ingredients. Numerous revisions have been made to safety standards to include flame retardant inorganic substances in coating materials after incidents like building collapses and workplace injuries from the fire. Due to their superior resistance to high temperatures, silicon, phosphorus, and halogen-based products are now of great importance.

Regional Analysis

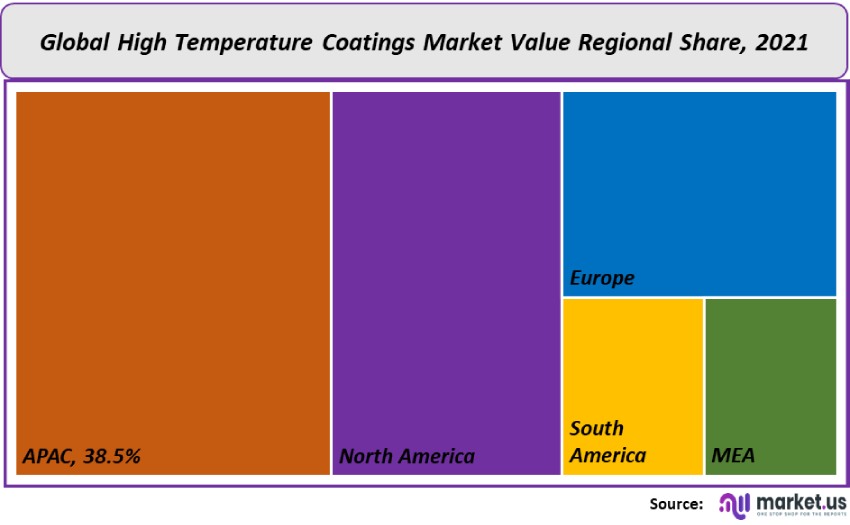

The Asia Pacific accounted for more than 38.5% of the global market’s total volume in 2021. Product demand is expected to rise due to significant growth in the construction and automotive industries, especially in China, India, and Japan.

In 2021, Europe was responsible for more than 32.3% of global revenue. The region’s market penetration will be limited by the slow growth in many end-use industries such as construction and oil and gas in the EU-27. The region will likely lose its share of the global market over the next few decades.

North America’s market is expected to grow at a moderate CAGR (or 4.1%) in terms of revenue during the forecast period. The region’s industrial growth has been aided by widespread product adoption in key end-use industries such as electronics, automotive, energy, and construction. The region’s product demand will be influenced by the renewal of reforms that incorporate environmentally-friendly and thermally efficient materials.

Кеу Regions and Countries covered іn thе rероrt:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Market Share & Key Players Analysis:

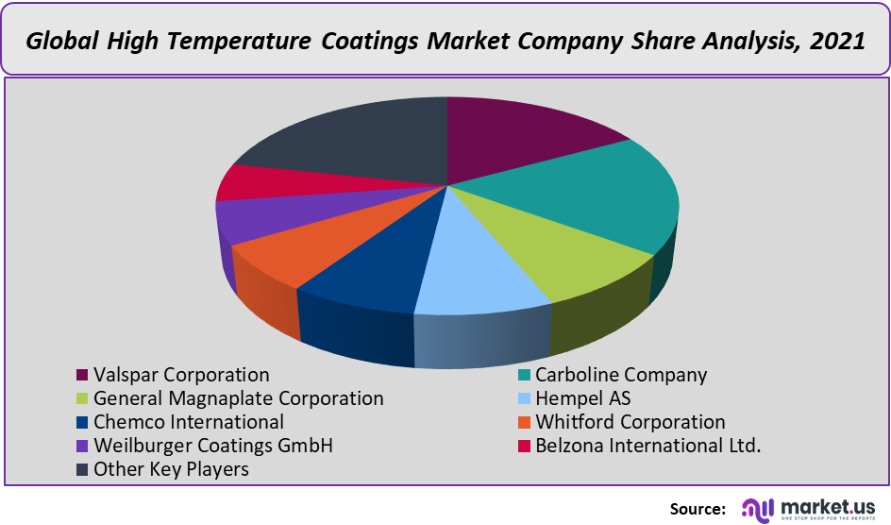

Due to the presence of large multinational corporations like PPG Industries and Sherwin-Williams as well as Jotun AS and Akzo Nobel NV, the global market is somewhat fragmented. These industry players have adopted key strategies such as long-term partnerships with raw material suppliers in order to gain economies of scale and then offer products at lower prices than their competitors.

The global industry also includes Valspar Corporation, Carboline Company, General Magnaplate Corporation, Hempel AS, and Chemco International.

Маrkеt Кеу Рlауеrѕ:

- Valspar Corporation

- Carboline Company

- General Magnaplate Corporation

- Hempel AS

- Chemco International

- Whitford Corporation

- Weilburger Coatings GmbH

- Belzona International Ltd.

- Aremco Products Inc.

- Other Key Players

For the High-Temperature Coating Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

What is the High-Temperature Coating Market size in 2021?The High-Temperature Coating Market size is US$ 4,928 million in 2021.

What is the CAGR for the high-temperature coatings Market?The High-Temperature Coating Market is expected to grow at a CAGR of 4.7% during 2023-2032.

What are the segments covered in the High-Temperature Coating Market report?Market.US has segmented the Global High-Temperature Coating Market Value (US$ Mn) Analysis by Region, 2022 market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Product Type, market has been segmented into Acrylic, Epoxy, Polyether sulfone, and Other Product Type. By Technology, market has been further divided into Waterborne, Powder, and Other Technology.

Who are the key players in the high-temperature coatings Market?Valspar Corporation, Carboline Company, General Magnaplate Corporation, Hempel AS, Chemco International, Whitford Corporation, Weilburger Coatings GmbH, Belzona International Ltd., Other Key Players are the key vendors in the high Temperature Coatings market

Which region is more attractive for vendors in the high-temperature coatings Market?APAC accounted for the highest revenue share of 38.5% among the other regions. Therefore, the High-Temperature Coating Market in APAC is expected to garner significant business opportunities for the vendors during the forecast period.

What are the key markets for high-temperature coatings?Key markets for high-temperature coatings are the U.S., U.K., China, Japan, Brazil, and Russia.

Which segment has the largest share in the high-temperature coatings Market?In the high-temperature coatings Market, vendors should focus on grabbing business opportunities from the Waterborne Technology segment as it accounted for the largest market share in the base year.

![High-Temperature Coating Market High-Temperature Coating Market]() High-Temperature Coating MarketPublished date: Jul 2022add_shopping_cartBuy Now get_appDownload Sample

High-Temperature Coating MarketPublished date: Jul 2022add_shopping_cartBuy Now get_appDownload Sample - Valspar Corporation

- Carboline Company

- General Magnaplate Corporation

- Hempel AS

- Chemco International

- Whitford Corporation

- Weilburger Coatings GmbH

- Belzona International Ltd.

- Aremco Products Inc.

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |