Global Dental Services Market By Type (Dental Implants, Orthodontics, Periodontics, Endodontics, Cosmetic Dentistry, Laser Dentistry, Dentures, Oral & Maxillofacial Surgery, Other Type), By End-Use (Hospitals and Dental Clinics), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2023-2032

- Published date: Jul 2022

- Report ID: 60995

- Number of Pages: 259

- Format:

- keyboard_arrow_up

Dental Services Market Overview

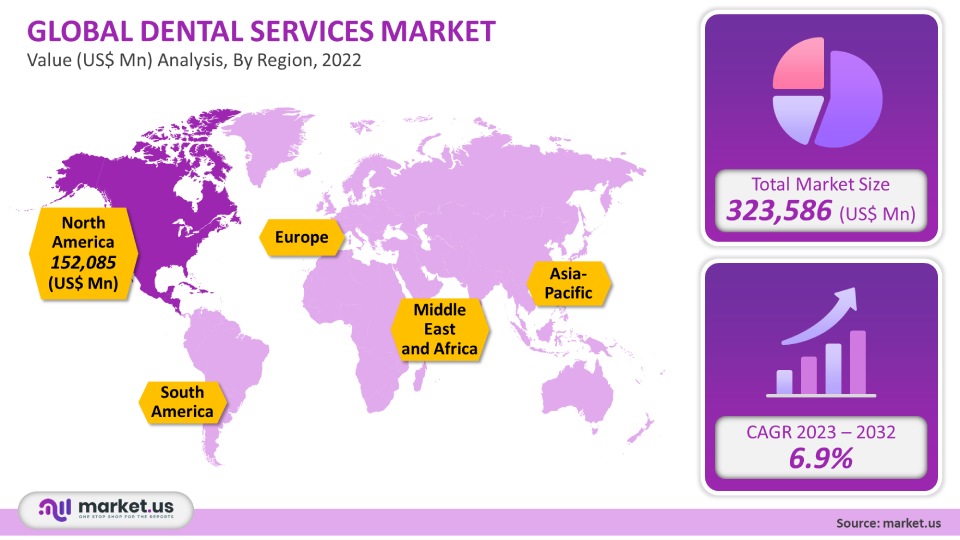

The global market for dental services was worth USD 323,586 million in 2021. It is projected to grow at a 6.9% CAGR between 2023 and 2032.

Dental services are provided by dentists or dental professionals and cover diagnosing, preventing, and treating all dental disorders. The market’s growth is due to a growing awareness of dentistry and other periodontal diseases. Technological advances in dentistry and high demand for laser and cosmetic dentistry exist. The dental care industry has been severely affected by the ongoing COVID-19 epidemic. Many countries have closed their dental practices due to strict social distancing guidelines.

Global Dental Services Market Scope:

Type Analysis

Dental implants dominated the market in 2021. It held a 23% revenue share. The dental implant is a sophisticated oral procedure that offers patients functionally and aesthetically feasible options for tooth restoration. The American Association of Oral and Maxillofacial Surgery (AAOMS) estimates that around 70% of adults between 35 and 44 have lost at most one permanent tooth due to decay, disease, or accident. Implant demand is increasing. Research and development in dental implants have increased over the last few years. They are expected to continue expanding in the future with improved biomaterials, surface modifications, and implant designs. Due to the increasing use of cosmetic dentistry, the segment will see the greatest growth between 2023 and 2032. Cosmetic dental procedures include teeth bleaching to remove discolorations and staining. Patients also prefer veneers, inlays, and ontolays, composite bonding, and crowns to enhance their oral appearance.

End-Use Analysis

The dental clinic segment dominated the market in 2021, with a revenue share of 66.0%. It is expected to grow at the fastest pace between 2023 and 2032. Because of the availability of specialists, most dental patients choose private clinics. Their owners own more than 80% of dental practices. Globally, the number of independent dental practices is increasing. This trend will continue over the next few years due to cost efficiency, availability of specialists, and technologically advanced equipment. The initial phase of the COVID-19 pandemic caused many problems in the dental care market. Dentists were at high risk of spreading infection. During the initial phase, no dental clinics were operating. The practices are now operating as normal. Dental professionals need to be aware of the latest guidelines that must be followed to prevent the spread of the virus.

Key Market Segments:

By Type

- Dental Implants

- Orthodontics

- Periodontics

- Endodontics

- Cosmetic Dentistry

- Laser Dentistry

- Dentures

- Oral & Maxillofacial Surgery

- Other Type

By End-Use

- Hospitals

- Dental Clinics

Market Dynamics:

The American Dental Association’s Health Policy Institute (HPI) data shows that the dental sector was at a halt due to COVID-19. This is because dental practices were only allowed to treat emergency cases during the initial stages of the pandemic. The ADA or American Dental Association issued general guidance in March 2020 to delay elective dental procedures. The ADA stated that routine cleanings, radiographs, and cosmetic procedures could delay the following procedures. Oral examinations, pain management, routine cleanings, radiographs, and orthodontic treatments. Dental emergencies included tooth fractures, abnormal tissue biopsies, oral bleeding, facial trauma, pain management, and dental or facial trauma.

Recommendations from dentists have been instrumental in driving demand for different dental services. The shift in marketing efforts to market the practices includes online advertising campaigns, free dental camps, and education programs. Dental equipment manufacturers have been encouraged to invest in R&D to create and capitalize on new technologies due to the many unmet needs in the area of oral care. More patients will be able to access services as more innovative products are introduced in the future. The launch of TeleDentistry in the United States by Pacific Dental Services (PDS), an international dental support company, was announced in April 2020. The COVID-19 pandemic continues, putting pressure on hospitals and urgent care centers. TeleDentistry platform launch is expected to make a positive difference in the community.

The steady increase in disposable incomes has resulted from the global economic boom and rapid urbanization. The per capita healthcare spending is expected to rise in the coming years. Market growth is expected to be aided by the millennial population’s rising health and wellness consciousness.

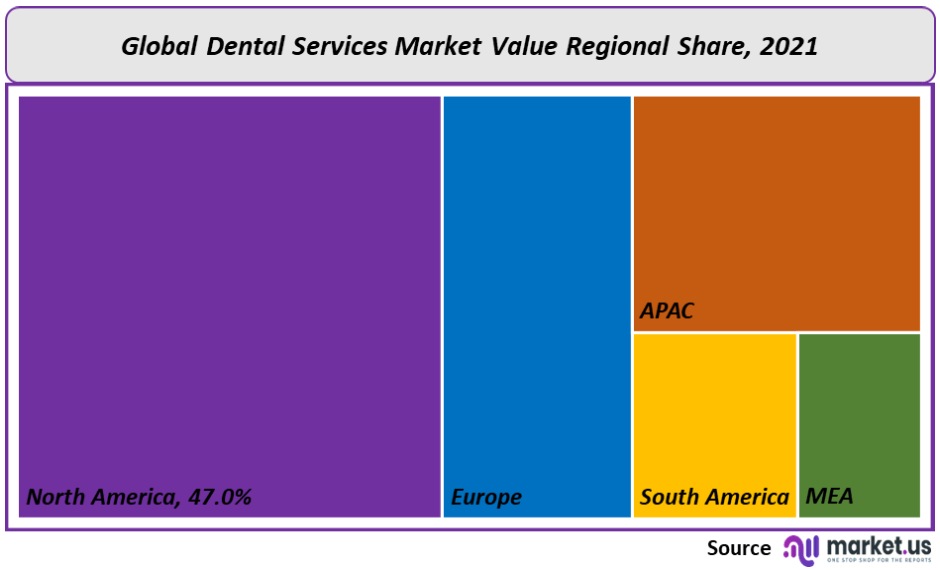

Regional Analysis

North America was the dominant market in 2021, with a revenue share of 47.0%. This is due to factors such as preventive care for oral hygiene and the existence of independent clinics, increasing R&D in dentistry, and rising disposable income. Market growth is likely to be aided by the increasing government funding of dental programs. As patients tend to spend less out-of-pocket, the U.S. federal funding of Medicare & Medicaid will likely increase the demand for oral care services.

The Asia Pacific is expected to experience the fastest growth between 2023 and 2032. This is due to the increasing number of dental clinics, growing dental tourism, increased R&D in manufacturing, and growing awareness about oral health. Most of the Asia Pacific dental practices are private. Modern technology is transforming the healthcare infrastructure of Asia Pacific. Many companies and governments from countries like India and China are taking initiatives to increase awareness about dental care. My Dental Plan, for example, announced in June 2021 that it would open 4,000 additional clinics and expand its reach to 250 more cities by 2021.

Key Regions and Countries covered in the report:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

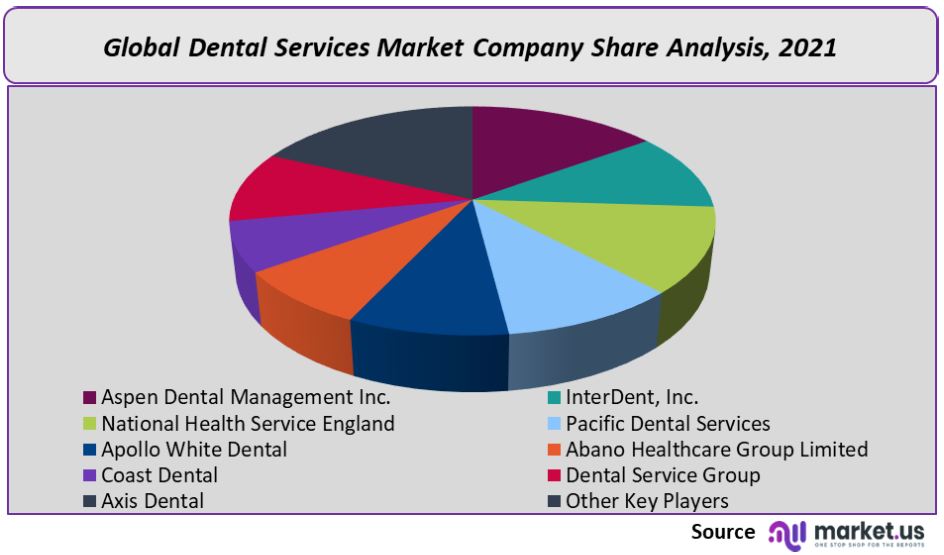

Market Share & Key Players Analysis:

Many countries closed their dental practices due to social distancing guidelines imposed in the initial phase of the COVID-19 pandemic. The business has suffered from the decline of the dental care industry. Service providers are now looking for innovative ways to improve patient care. Aspen Dental’s digital check-in platform was launched in June 2020. It is now available at their 820 offices across 41 states. Patients will be able to manage their dental appointments conveniently through this platform.

The expansion of geographic markets is another factor that dental care practices use to increase their market share. According to the July 2021 article, the UK Dental Group intends to open 400 franchise clinics in the country within three years. Patients will be discouraged from traveling abroad to receive dental treatment, and the waiting times at these additional clinics should reduce. These clinics will also offer home services for those with limited mobility. The clinics will be able to provide high-quality dental care to more people by extending their reach across the U.K.

Market Key Players:

- Aspen Dental Management Inc.

- InterDent, Inc.

- National Health Service England

- Pacific Dental Services Apollo White Dental

- Abano Healthcare Group Limited

- Coast Dental

- Dental Service Group

- Axis Dental

- Other Key Players

For the Dental Services Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

Q: What is the size of the Dental Services market in 2021?The Dental Services market size is US$ 323,586 million in 2021.

Q: What is the projected CAGR at which the Dental Services market is expected to grow at?The Dental Services market is expected to grow at a CAGR of 6.9% (2023-2032).

Q: List the segments encompassed in this report on the Dental Services market?Market.US has segmented the Dental Services Market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By type, the market has been segmented into Dental Implants, Orthodontics, Periodontics, Endodontics, Cosmetic Dentistry, Laser Dentistry, Dentures, Oral & Maxillofacial Surgery, Other Type and the end-use market has been segmented into Hospitals and Dental Clinics.

Q: List the key industry players of the Dental Services market?Aspen Dental Management Inc., InterDent, Inc., National Health Service England, Pacific Dental Services, Apollo White Dental, Abano Healthcare Group Limited, Coast Dental, Dental Service Group, Axis Dental, Other Key Players are the key vendors in the Dental Services market.

Q: Which region is more appealing for vendors employed in the Dental Services market?North America accounted for the highest revenue share of 47%. Therefore, the Dental Services industry in North America is expected to garner significant business opportunities over the forecast period.

Q: Name the key areas of business for the Dental Services Market.The US, Canada, China, Japan, Germany, France, UK, etc., are leading key areas of operation for Dental Services Market.

Q: Which segment accounts for the greatest market share in the Dental Services industry?With respect to the Dental Services industry, vendors can expect to leverage greater prospective business opportunities through the dental implants segment, as this area of interest accounts for the largest market share.

![Dental Services Market Dental Services Market]()

- Aspen Dental Management Inc.

- InterDent, Inc.

- National Health Service England

- Pacific Dental Services Apollo White Dental

- Abano Healthcare Group Limited

- Coast Dental

- Dental Service Group

- Axis Dental

- Other Key Players

- Nestlé S.A Company Profile

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |