Global Digital Therapeutics Market By Type (Diabetes, Obesity, CVD, Respiratory Diseases, Smoking Cessation, CNS Diseases, and Other Applications), By End-User (Patients, Providers, Payers, Employers, and Other End-Users), By Region, and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2023-2032

- Published date: Jul 2022

- Report ID: 61023

- Number of Pages: 396

- Format:

- keyboard_arrow_up

Digital Therapeutics Market Overview

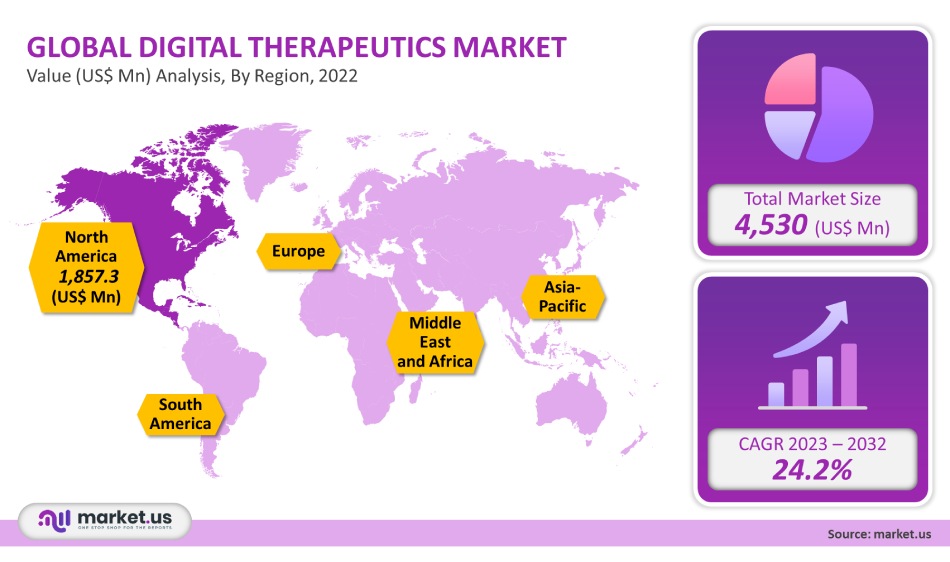

The global market for digital therapeutics was worth USD 4,530 million in 2021. It is expected to grow at a 24.2% CAGR from 2022 to 2032.

The market will be driven by increasing smartphone adoption in developing and developed countries, the profitability of the digital health technologies for patients and providers, and the demand for integrated healthcare systems and patient-centric care. Kepios estimates that there were 4,270 million internet users worldwide in April 2021. This is more than 60% of the world’s population. This number is expected to increase as people become more aware of smart health tracking. The COVID-19 pandemic and supportive regulatory initiatives will also fuel the market.

Global Digital Therapeutics Market Scope:

Application Analysis

In 2021, the diabetes application segment accounted for more than 28.5% of global revenue. The growing prevalence of diabetes and other chronic illnesses drives segment growth. Healthcare providers can use digital therapeutics to help them assess their patients and tailor the treatment plan for each patient. The CDC estimates that nearly 34.2 million people will have diabetes in 2020. 10.5% of these people lived in the United States. In 2021, the obesity segment was the second largest, owing to an increasing number of obese individuals worldwide. The market is expected to grow rapidly as digital therapeutics offer cost-effective treatments for many chronic diseases.

CVDs, smoking cessation, and obesity are anticipated to show major growth rates during the coming years. Market growth is driven by the increasing use of digital therapeutic products to manage respiratory diseases. These include Hailie by Adherium and Respiroby Amiko. Propeller by Propeller Health, BreatheSmart, Cohero Health, Propeller by Propeller Health, and CareTRx from Teva. Digital therapeutics can transform the treatment of COPD and asthma. Poor medication compliance is a significant problem when treating respiratory disorders. This problem can be solved quickly with digital therapeutic solutions.

End-Use Analysis

The global market can be divided into providers, patients, payers, and employers based on end-users. With more than 33.0% of global revenue in 2021, the patient segment accounted for the largest portion of the market. This was due to patients’ increased use of digital therapeutic solutions. The primary users of therapeutic programs and applications for healthcare are patients. Digital therapeutics are becoming more popular due to the increasing number of chronic illnesses.

The growth of the end-user segment of providers can be attributed to more providers using digital therapeutics to deliver and support therapies that have been clinically proven outside of a healthcare setting. This also ensures reliable patient engagement. The segment also shows significant growth potential as payers are increasingly interested in digital therapeutics. Payers should encourage employees to adopt business models that promote compliance, enhance efficacy, and reduce costs.

Key Market Segments:

By Application

- Diabetes

- Obesity

- CVD

- Respiratory Diseases

- Smoking Cessation

- CNS Diseases

- Other Applications

By End-User

- Patients

- Providers

- Payers

- Employers

- Other End-Users

Market Dynamics:

The market was significantly affected by the COVID-19 pandemic. The demand for digital healthcare solutions that are accessible and convenient is a major driver of COVID. According to the FDA’s April 2020 guidelines, digital health therapeutic devices will be allowed for use for mental disorders for as long as the pandemic lasts. Providers can commercialize their solutions as long as they do not cause an undue public emergency. Over the forecast period, there will be more regulatory initiatives that will drive standardization and R&D.

Software Pre-Cert Pilot Program, for example, is part of the FDA’s Digital Health Innovation Action Plan. It is designed to provide more efficient regulatory oversight for Software-based Medical Devices. This program is designed to provide efficient regulatory oversight that enables organizations to build trust in their ability to develop high-quality SaMD products. According to the CDC’s National Centre for Chronic Disease Prevention and Health Promotion, 6 out of 10 Americans have a chronic condition. And 4 out of 10 people have two or more chronic conditions. The country’s leading causes of disability and death are cancer, heart disease, diabetes, chronic kidney disease, and chronic lung disease. Chronic diseases can be caused by poor nutrition, smoking, alcoholism, lack of exercise, and poor nutrition. Healthcare costs can be impacted exponentially because most chronic diseases are not a single entity and patients often have co-morbidities. Smartphone ownership is essential for improving global connectivity, both economically and socially. The growth of the market is directly affected by smartphone penetration.

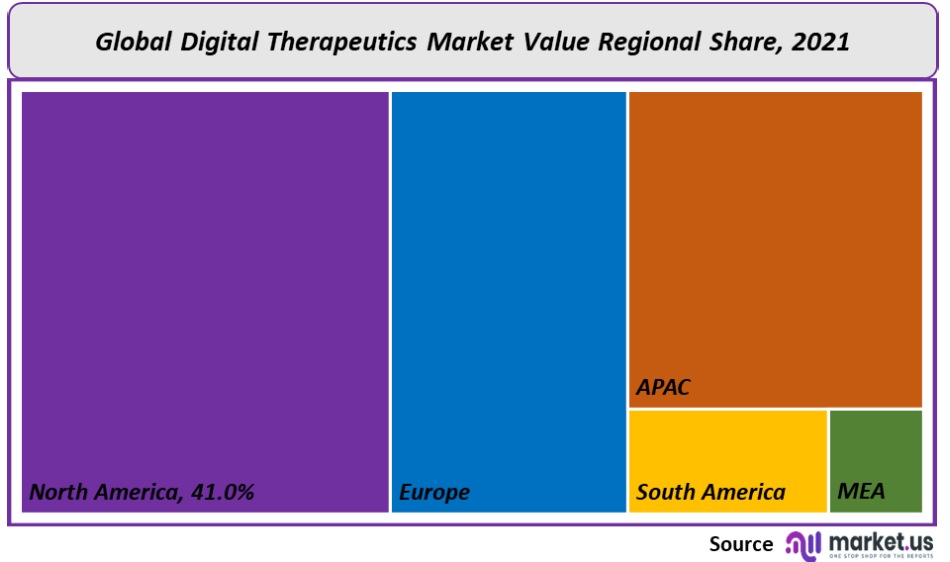

Regional Analysis

The global market is divided by geography into North America and the Asia Pacific, Europe, and Latin America, as well as Europe and Latin America. The largest share, more than 41%, was held by North America in 2021. This can be attributed to various factors, such as the increased use of digital healthcare products and favorable reimbursement schemes that focus on improving quality of life through better tracking & diagnosis. The market will be driven by an increase in chronic diseases and geriatric populations. Proteus Digital Health, Inc., Omada Health, Inc., WellDoc, Inc., and Livongo Health, Inc. are some of the key players in this market.

These companies are most often based in the U.S., adding to their global dominance. The fastest-growing region in the future is the Asia Pacific. This is due to increased demand for quality healthcare, increased smartphone penetration, and better internet access. Market growth will also be accelerated by the expected increase in demand for personal care products and related services due to increased government spending on health.

Key Regions and Countries Covered in the Report:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

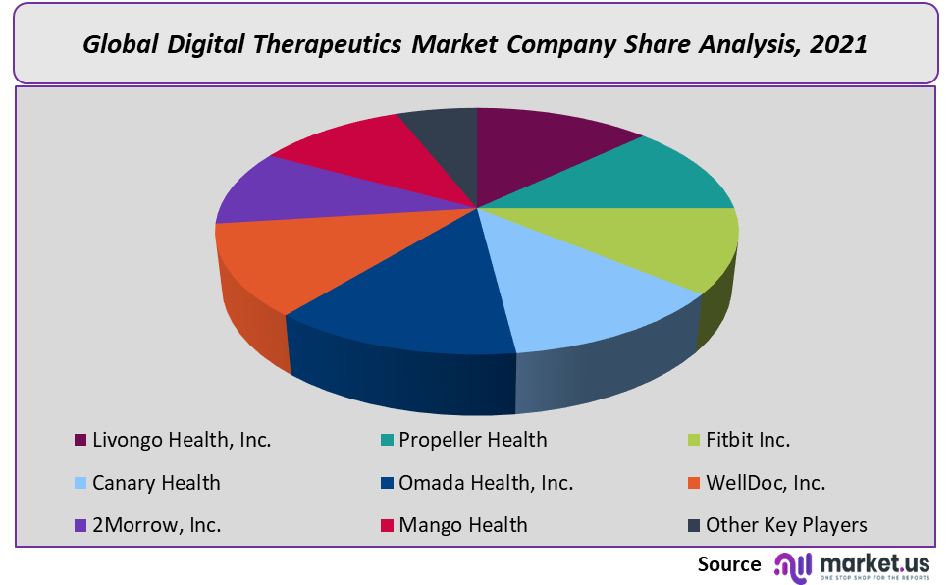

Market Share & Key Players Analysis:

There are many small and large businesses operating in the industry. This market is competitive and dominated mainly by key players who focus on innovative strategies such as mergers and acquisitions. They also aim to penetrate the market, create partnerships, and increase revenues through distribution agreements. Teladoc, for example, expanded its partnership with National Labor Alliance in December 2021 to offer its full range of virtual care products. These services covered specialty care, general, expert, mental health, virtual primary and chronic care programs, and specialist care. The following are some of the major digital therapeutics players in the global market.

Market Key Players:

- Livongo Health, Inc.

- Propeller Health

- Fitbit Inc.

- Canary Health

- Omada Health, Inc.

- WellDoc, Inc.

- 2Morrow, Inc.

- Mango Health

- Noom, Inc.

- Pear Therapeutics

- Other Key Players

For the Digital Therapeutics Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

Q: What is the size of the digital therapeutics market in 2021?The Digital Therapeutics market size is US$ 4,530 million in 2021.

Q: What is the projected CAGR at which the digital therapeutics market is expected to grow at?The digital therapeutics market is expected to grow at a CAGR of 24.2% (2023-2032).

Q: List the segments encompassed in this report on digital therapeutics?Market.US has segmented the digital therapeutics market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). The market has been segmented by Type (Diabetes, Obesity, CVD, Respiratory Diseases, Smoking Cessation, CNS Diseases, and Other Applications), By End-User (Patients, Providers, Payers, Employers, and Other End-Users.

Q: List the key industry players of the digital therapeutics market?Livongo Health, Inc., Propeller Health, Fitbit Inc., Canary Health, Omada Health, Inc., WellDoc, Inc., 2Morrow, Inc., Mango Health, and Other Key Players are the key vendors in the Digital Therapeutics market.

Q: Which region is more appealing for vendors employed in the digital therapeutics market?North America accounted for the highest revenue share of 41%. Therefore, the digital therapeutics industry in North America is expected to garner significant business opportunities over the forecast period.dd

Q: Name the key areas of business for the digital therapeutics Market?The US, Canada, Mexico, Germany, France, Japan & South Korea are key areas of operation for the digital therapeutics market.

Q: Which segment accounts for the greatest market share in the digital therapeutics industry?With respect to the digital therapeutics industry, vendors can expect to leverage greater prospective business opportunities through the diabetes applications segment, as this area of interest accounts for the largest market share.

![Digital Therapeutics Market Digital Therapeutics Market]()

- Livongo Health, Inc.

- Propeller Health

- Fitbit Inc.

- Canary Health

- Omada Health, Inc.

- WellDoc, Inc.

- 2Morrow, Inc.

- Mango Health

- Noom, Inc.

- Pear Therapeutics

- Other Key Players

- Nestlé S.A Company Profile

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |