Global Caramel Ingredient Market By Form (Solid, Granulated, and Liquid), By Application (Coloring, Topping, Flavoring, and Others), By End-Use (Bakery, Confectionery, Ice Cream & Desserts, Beverages, and Others) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Jul 2022

- Report ID: 61478

- Number of Pages: 361

- Format:

- keyboard_arrow_up

Caramel Ingredient Market Overview:

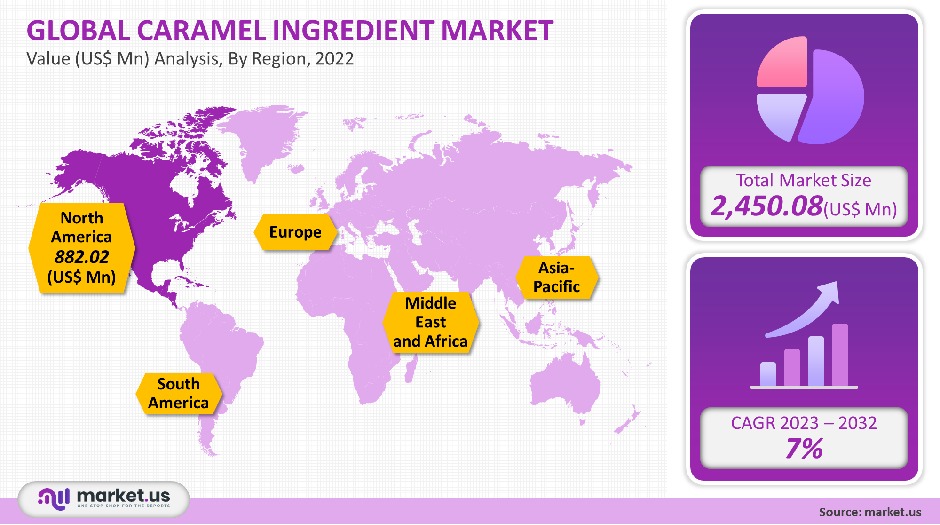

In 2021, the global caramel ingredients market was worth USD 2,450.08 million. It is predicted that this market will grow at 7% between 2023 and 2032.

Caramel can be used in confectionery products for flavoring, topping, coloring, coating, coloring, and filling. This market is driven primarily by a growing convenience food industry, an increase in disposable income, and widespread urbanization, particularly in developing countries.

Global Caramel Ingredient Market Scope:

Form analysis

Caramel ingredients can be classified by their form into three categories: liquid, solid, or granular. Due to their extensive use in the beverage industry (primarily sodas and colas), liquid ingredients dominate the market. It is used extensively in the manufacture of various alcoholic beverages, including whiskey, scotch, and dark rum.

Salted caramel porter is a popular fall beer. Every year, companies add new twists to the original recipe to offer consumers something different. In December 2018, Biggby Coffee teamed up to create the Salted Caramel Coffee Porter. The limited-edition version of this seasonal favorite was made available at selected retail locations across the U.S.

Because it has a longer shelf life than other forms, the granulated and powdered versions of the ingredient are expected to show the greatest growth. It is used extensively in baked goods and packaged foods as a flavoring and topping ingredient.

Application analysis

The market can be divided into flavoring, topping, and coloring based on its application. With a market share of over 35.0%, coloring dominated the market in 2021. The use of caramel ingredients in beverages and foods as coloring agents is a long-standing practice. Consumers place a lot more importance on appearance than flavor when choosing food or drinks.

Some of the most popular items that contain caramel are soft drinks, baked goods, and sauces. Recent studies have shown that certain caramel colorings may cause cancer. These findings have had a negative impact on consumer behavior and decision-making and could be a limiting factor in segment growth.

The toppings segment is expected to show the greatest growth, with an 8.1% CAGR between 2023 and 2032. Caramel toppings are a popular addition to many frozen desserts and baked goods. Dairy Queen added two new Blizzards to its 2019 fall menu. One of these was the Heath Caramel Brownie Blizzard. This frozen vanilla treat is available at Dairy Queen locations across the U.S. and includes brownie pieces, Hershey’s heath pieces, and a caramel topping.

End-Use analysis

The caramel ingredients market can be divided by end-use into confectionery and bakery, Ice cream, desserts, beverages, and others. In 2021, the confectionery segment was the dominant revenue source and it will continue to be so throughout the forecast period. Caramel is a classic ingredient in many confectionery products, and it will continue to be.

Confectionery manufacturers, large and small alike, are constantly coming up with interesting and new combinations to capitalize on the versatility of this ingredient. Quality Street, a well-known brand of chocolates, toffees, and sweets from Nestle, will debut a caramel brownie chocolate as part of its 2019 Christmas collection.

Dove, an American chocolate brand known as ‘Galaxy” in other countries will introduce a fall-inspired White Chocolate Caramel Apple variant in the autumn of 2019.

Кеу Маrkеt Ѕеgmеntѕ

By Form

- Solid

- Granulated

- Liquid

By Application

- Coloring

- Topping

- Flavoring

- Others

By End-Use

- Bakery

- Confectionery

- Ice Cream & Desserts

- Beverages

- Others

Market Dynamics:

Due to increasing consumer demand for confectionery and bakery products, caramel ingredients are gaining acceptance around the world. This ingredient is used in a variety of beverages, including syrups and powders in teas. Recognizing the many uses of this ingredient, large and small companies have sought to capitalize on ongoing food and consumer trends to stay ahead.

Some of the strategies for growth are attractive packaging solutions, product innovation, investments in marketing and promotion, collaborations in marketing and promotional, as well as collaborations with product manufacturers in other application segments, and capacity expansion in more markets.

The market is already well-established in North America and Europe. However, there are still opportunities for growth in the Asia Pacific and South America. The strong influence of Western-style diets in countries such as India, China, and Brazil has led to untapped potential in confectionery and bakery segments. This, combined with rising disposable incomes and changing lifestyles have created a diverse market that offers a huge opportunity for growth.

Companies can make a lot of money by catering to smaller but more lucrative markets, taking into account their preferences, buying habits, and tastes.

Recent years have seen the introduction of alternative caramel ingredients pose a threat to the market. The market has been facing a number of challenges over the past decade, including raising concerns about the dangers of caramel ingredients as a color agent. This has been exacerbated by consumers switching to healthier, lower-carb, and higher-sugar food choices. Many manufacturers are finding this a major roadblock.

A further obstacle to market growth will be the rising costs of caramel ingredients and other raw materials.

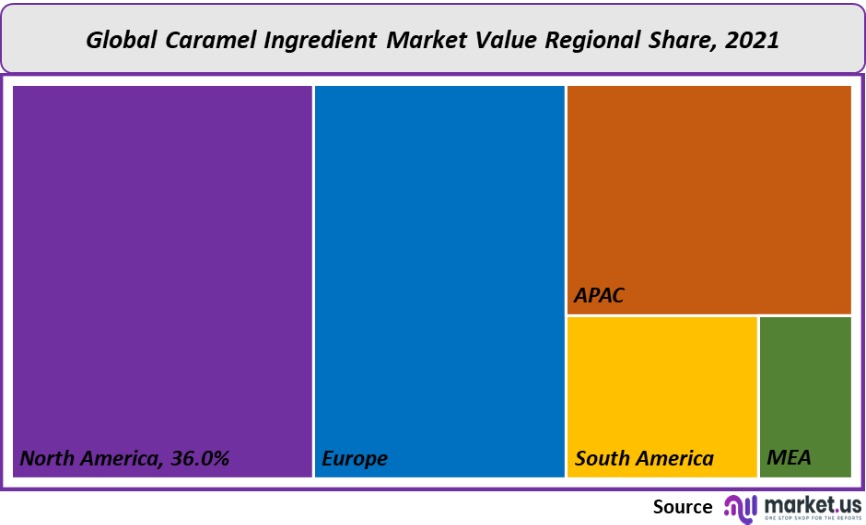

Regional Analysis

North America was the dominant market accounting for more than 36% of global revenues in 2021. These markets have experienced significant growth because caramel is becoming a more popular ingredient in many products, such as desserts, frozen and packed foods, confectionery, and bakery items. Companies have made innovation and seasonal favorites a key strategy to grow their businesses. This will ensure that Europe and North America remain at the forefront during the forecast period.

Mars Wrigley International Travel Retail will unveil its limited-edition M&M’s and Twix selections at the 2019 TFWA World Congress & Exhibition. M&M’s Crunchy Caramel and Twix Salted Caramel will provide something new and exciting to enhance your travel experience.

The Asia Pacific will be the region with the fastest growth rate for caramel ingredients. There is a 7.5% CAGR for the forecast period. There are many countries in the region including India, China, Indonesia, and Korea. To capitalize on the lucrative opportunities offered by rapid urbanization and rising disposable income, major global companies are expanding into this region.

Key Regions and Countries covered іn thе rероrt:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Market Share & Key Players Analysis:

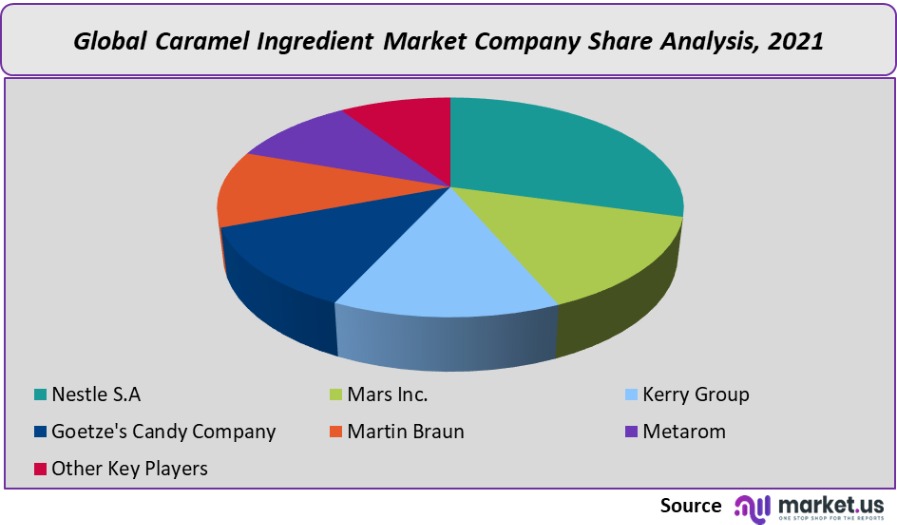

The market is dominated by Nestle S.A., Cargill, Inc., Mars Inc., Ferrero SpA, Kerry Group, Sensient Technologies Corporation, Frito-L, DDW The Color House, Goetze’s Candy Company Inc., Sethness-Roquette Caramel Color, Martin Braun, Haribo, Metarom. Confectioners are exploring a variety of uses for caramel.

Mars Corporation announced, for example, that a new Milky Way variety would be on the market in January 2020. Milky Way Salted Caramel Bars are a modern twist on the traditional candy bar. Milky Way Caramel Apple and Milky Way Simply Caramel are also available from the company.

Маrkеt Кеу Рlауеrѕ:

- Cargill

- Nestle S.A

- Mars Inc.

- Kerry Group

- Goetze’s Candy Company

- Martin Braun

- Metarom

- Other Key Players

For the Caramel Ingredient Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

Q: What is the size of the Caramel Ingredient market in 2021?A: The Caramel Ingredient market size is estimated to be US$ 2,450.08 million in 2021.

Q: What is the projected CAGR at which the Caramel Ingredient market is expected to grow at?A: The Caramel Ingredient market is expected to grow at a CAGR of 7% (2023-2032).

Q: List the segments encompassed in this report on the Caramel Ingredient market?A: Market.US has segmented the Caramel Ingredient market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Form, market has been segmented into Solid, Granulated, and Liquid. By Application, the market has been segmented into Coloring, Topping, Flavoring, and Others. By End Use, the market has been further divided into Bakery, Confectionery, Ice Cream & Desserts, Beverages, and Others.

Q: List the key industry players of the Caramel Ingredient market?A: Cargill Inc., Nestle S.A., Mars Inc., Kerry Group, Ferrero SpA, Sensient Technologies Corporation,Frito-L, Goetze's Candy Company Inc., DDW The Color House, Sethness-Roquette Caramel Color, Haribo, Martin Braun, Metarom and Other Key Players are engaged in the Caramel Ingredient market.

Q: Which region is more appealing for vendors employed in the Caramel Ingredient market?A: North America is accounted for the highest revenue share of 36%. Therefore, the Caramel Ingredient Technology industry in North America is expected to garner significant business opportunities over the forecast period.

Q: Name the key areas of business for Caramel Ingredient?A: U.S, Switzerland, Belgium, China, and Brazil are key areas of operation for Caramel Ingredient Market.

Q: Which segment accounts for the greatest market share in the Caramel Ingredient industry?A: With respect to the Caramel Ingredient industry, vendors can expect to leverage greater prospective business opportunities through the liquid segment, as this area of interest accounts for the largest market share.

![Caramel Ingredient Market Caramel Ingredient Market]()

- Cargill

- Nestlé S.A Company Profile

- Mars Inc.

- Kerry Group

- Goetze's Candy Company

- Martin Braun

- Metarom

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |