Global Automotive Glass Market By Product Type , By Application, By End-Use , By Vehicle, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: May 2022

- Report ID: 62302

- Number of Pages: 229

- Format:

- keyboard_arrow_up

Automotive Glass Market Overview:

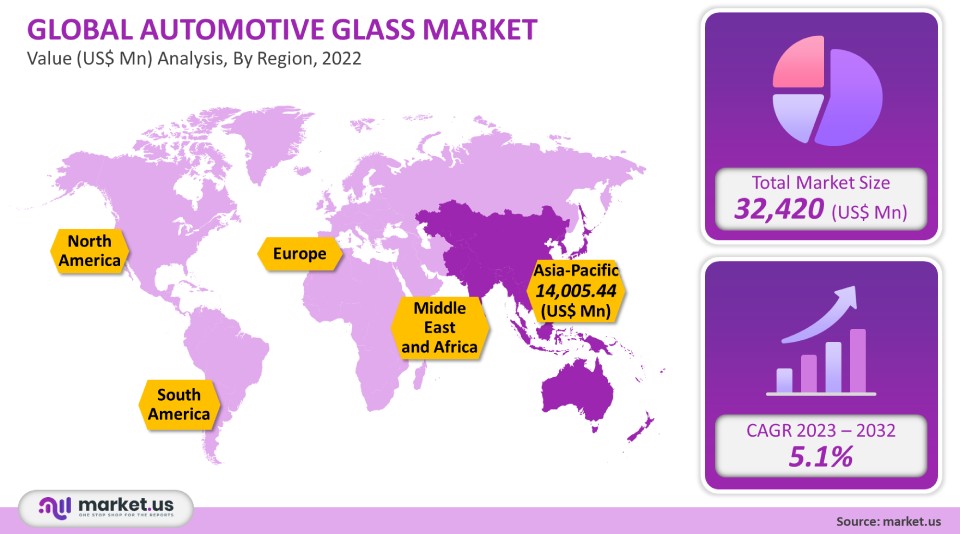

The global market for Automotive Glass was valued at USD 32,420 million in 2021 and will grow at a CAGR of 5.1% between 2023-2032.

The automotive industry is focusing more on lighter cars due to rising harmful emissions from vehicles having a bad impact on the environment. Glass penetration is also increasing. In the last two years, the production of cars has declined. However, it is projected to show an upward trend starting in the 2020’s second half. This growth can be attributed to the expansion of the automobile manufacturing sector in countries like India and China due to the rise in government initiatives regarding motor car regulations.

Global Automotive Glass Market Scope:

Product Type Analysis

Tempered automobile glass dominated this product category, with a volume share in 2021 of 63.5%. This large share can be attributed mainly to its low price, high strength, robustness, and cost. It offers a higher strength than a basic flotation and is less expensive than laminated automobile glass. This is why it is the most used type of glass in automotive.

The laminated automotive glass segment is expected to experience the highest revenue growth with a CAGR of over 4.6% for the forecast period. The structure comprises a PVB layer sandwiched between the two glass layers. It is commonly used for windscreens. Because it has a safety characteristic that prevents it from breaking or getting injured in an accident, the structure can be kept intact. It is also preferred for sunroofs. This segment is expected to grow. For panoramic sunroofs, companies like Tesla, Ferrari, Volvo, etc., laminated glass is used.

Application analysis

The windscreen was the largest market by revenue in 2021 and is expected to remain dominant through the forecast period. Windscreen plays an important role in vehicle structures. Automotive and glass manufacturers work together to create new technologies to improve the appearance and features of windshields. Segment growth will be driven by new types of windshields made with self-cleaning glass.

For many years, car manufacturers have preferred tempered windows for the sidelines of their vehicles. The volume growth of sideline segments is expected to exceed windscreen by the end of the forecast period. In the following years, the market will see increased utilization of tempered auto glass inside lights and the aftermarket. Glass in the aftermarket is growing because of the increasing number of road accidents. Manufacturers now use laminated glass as side windows to prevent serious injuries from accidents with heavy impacts.

The sunroof is expected to see the greatest CAGR over the forecast. This is due to the growing popularity of sunroofs in low-cost cars. Automotive manufacturers can lower the price of sunroofs by making use of lightweight, materials. The automotive glass market will grow in the years ahead as sunroofs become more popular.

End-Use analysis

Based on end-use, market segments include original equipment manufacturers and aftersales replacement glass (OEMs). Since most automotive glasses are used for vehicle production, OEM dominated the market volume-wise in 2021. The aftermarket market is driven by factors including the high use of older vehicles, the need for maintenance and upgrades, and increasing road accidents.

Expect substantial growth in OEM segments due to the establishment of new auto plants, particularly electric ones. In China, Tesla’s Shanghai factory, China, delivered its 15 first Model 3 cars in December 2019. The plant will be able to produce 150,000 Modern 3 cars annually in 2020, according to its plans. In March 2019, there will be a further increase in automotive production.

Vehicle Type Analysis

In 2021, passenger cars were the most popular vehicle type. They are expected to see a 5.2% CAGR) in terms of revenue during the forecast period. This can be attributed to changing consumer trends and a growing middle-class population.

The increase in transportation and construction activities is expected to cause a rapid rise in commercial vehicle production. To keep up with the rising demand, auto manufacturers must increase their production. By the BS-VI norms, VE Commercial Vehicles Ltd announced in October 2019 its investment in a new 150-acre Bhopal plant, in Madhya Pradesh. Since larger vehicles make it more profitable for manufacturers and dealers, as higher prices create higher profit margins, automotive manufacturers intend to increase production. In June 2019, GM announced a US$ 150.0 million investment for increasing the production of heavy-duty pickup trucks at the Flint Assembly Plant in Michigan. This will increase its capacity to produce 40 000 trucks per year. In the coming years, automotive glass could reap huge rewards from increased commercial vehicles.

Кеу Маrkеt Ѕеgmеntѕ:

By Product Type

- Laminated

- Tempered

- Others

By Application

- Windscreen

- Sidelite

- Backlite

- Sunroof

By End-Use

- Aftermarket Replacement (ARG)

- Original Equipment Manufacturer (OEM)

By Vehicle Type

- Heavy Commercial

- Passenger Car

- Light Commercial

Market Dynamics:

Technological advances in the automotive sector and continuous improvement in vehicle design have compelled market players to introduce innovative products for automotive makers. AIS presented its products to several new car models in 2018, including a 2.8mm backlit and solar green for the new Wagon R.Over the forecast, the automotive glass will experience a positive impact on demand due to the increased production of electric vehicles. Light-year, a Dutch manufacturer, launched the Lightyear One prototype, an electric car with five-meter solar cells below the roof. These panels are made from safety glasses and can be charged directly from sunlight.

The primary challenge for the market lies in the supply of the raw materials necessary to make glass. Energy utilization and raw materials account for a large part of the glass market’s cost structure. This has an impact on both glass production and prices. The price of sodium soda ash has increased steadily over the last few months due to its limited supply. Soda ash manufacturers are increasing their production capabilities to satisfy the demand from key markets, including automotive glass, industrial products, and chemicals.

A growing focus on fuel efficiency has increased the production of lightweight and electrical vehicles. This is expected to lead to a rise in demand for glass within the automotive industry over the next few years. Over the past few years, significant technological developments have occurred in the automotive sector. Despite the declining overall production of cars, the growing automotive production of electric and commercial vehicles will likely lead to an increase in demand for automotive glass. In the future, solar technology will become a key feature of electric cars. In 2019, a car company released its first prototype electric vehicle. The car has solar panels covering the roof and hood. According to the company’s claims, solar panels can charge the car battery with a range of up to 12 kilometers per hour. It is expected that the electric car will be sold by 2021.

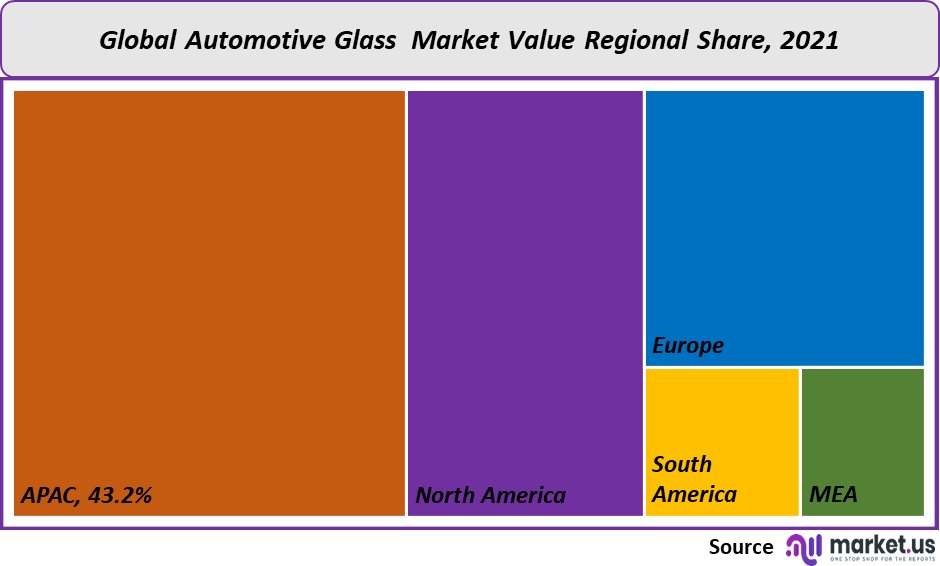

Regional Analysis:

The Asia Pacific was the dominant market for global automotive glasses in 2021, with a large share of the total revenue and volume. This can be explained by the region’s economic growth, increasing disposable income, and increased demand for luxury cars. In addition, rising investments in automotive manufacturing are driving regional growth in automotive glass.

China and India have witnessed a change in their consumer needs regarding vehicle styling, safety, and comfort. To meet this growing demand, manufacturers focus their efforts on improving efficiency. The Asia Pacific has witnessed a rising demand for luxury cars due to the changing lifestyles of consumers and their disposable income. This has positively impacted market growth through an increase in vehicle production with sun and moon roofs. North America’s auto glass market has experienced a substantial increase in commercial vehicle sales. This will likely play a significant part in propelling demand for automotive glasses over the forecast period. To offer differentiated products and increase profitability, manufacturers include value-added components such as solar control and de-icing & o-misting.

Continuous technological advancements have made it possible to use automotive glass in highly technical applications. Both car manufacturers and glass producers are expected to play key roles in driving the demand for automotive glasses in the US. In the next few years, technological advancement, high consumer disposable, and luxurious lifestyles will likely impact the demand. The U.S. has the largest automobile market in the world.

Key Regions and Countries covered іn thе rероrt:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

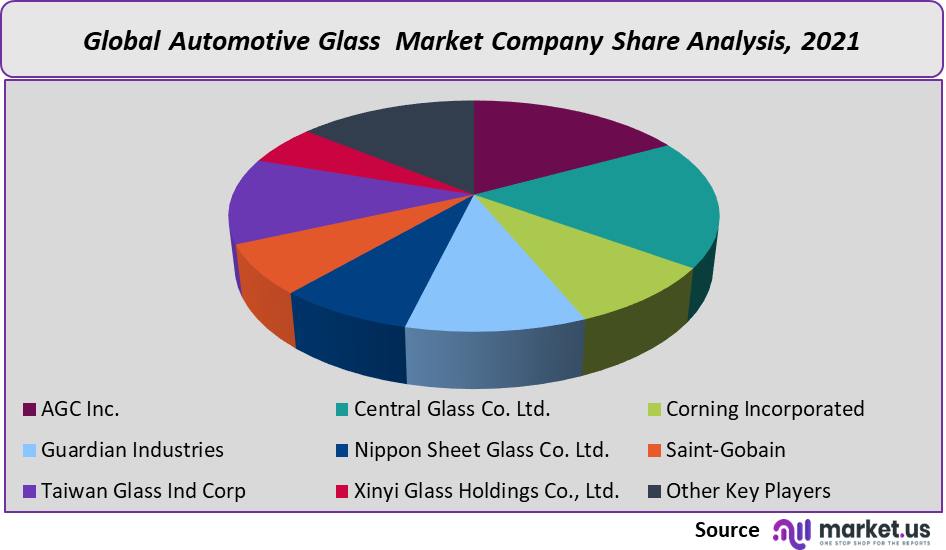

Market Share & Key Players Analysis:

The market heavily relies on suppliers, manufacturers, distributors, and manufacturers. Despite the numerous players in the sector, the market is relatively stable due to a few major. The leading manufacturers are constantly developing and implementing new strategies to grow their market share. Other than capacity expansion, mergers or acquisitions, new product developments, and new product development are some key strategies that key players use to gain a competitive advantage over others. Some major players are:

Маrkеt Кеу Рlауеrѕ:

- AGC Inc.

- Asahi Glass Co., Ltd.

- Central Glass Co., Ltd.

- Corning Incorporated

- Guardian Industries

- Fuyao Group

- Nippon Sheet Glass Co., Ltd

- Olimpia Auto Glass Inc

- Saint-Gobain

- Taiwan Glass Ind Corp

- Xinyi Glass Holdings Co., Ltd.

- Fuyao Glass Industry Group Co., Ltd.

- Other Key Players

Frequently Asked Questions (FAQ)

Q: What is the market size of the Automotive Glass market in 2021?The Automotive Glass market size was US$ 32,420 million in 2021.

Q: What is the projected CAGR at which the Automotive Glass market is expected to grow?The Automotive Glass market is expected to grow at a CAGR of 5.1% (2023-2032).

Q: List the segments encompassed in the Automotive Glass market report?Market.us has segmented the Automotive Glass market by geography (North America, Europe, APAC, South America, and the Middle East and Africa). The market has been segmented by Product Type into Tempered, Laminated, and Others. By Application, the market has been further divided into Windscreen, Backlite, Sidelite, and Sunroof. By End-Use, the market has been further divided into Original Equipment Manufacturers and Aftermarket Replacement. The market has been divided into passenger cars, Light Commercial, and Heavy Commercial.

Q: List the key industry players in the Automotive Glass market?AGC Inc., Central Glass Co. Ltd., Corning Incorporated, Guardian Industries, Nippon Sheet Glass Co. Ltd., Saint-Gobain, Taiwan Glass Ind Corp, Xinyi Glass Holdings Co., Ltd., NSG Group, Trösch Holding Ag, Magna international Inc., Gentex corporation and Other Key Players engaged in the Automotive Glass market.

Q: Which region is more appealing for vendors employed in the Automotive Glass market?APAC accounted for the highest revenue share at 43.2%. Therefore, the Automotive Glass industry in APAC is expected to garner significant business opportunities over the forecast period.

Q: Name the key areas of business for Automotive Glass?China, Japan, India, South Korea, the US, Canada, Mexico, and Others are key areas of operation for the Automotive Glass Market.

Q: Which segment accounts for the greatest market share in the Automotive Glass industry?Vendors can expect to leverage greater prospective business opportunities for the Automotive Glass industry through the Tempered segment, as this area of interest accounts for the largest market share.

![Automotive Glass Market Automotive Glass Market]()

- AGC Inc. Company Profile

- AGC Inc. Company Profile

- Central Glass Co., Ltd.

- Corning Incorporated

- Guardian Industries

- Fuyao Group

- Nippon Sheet Glass Co., Ltd

- Olimpia Auto Glass Inc

- Saint-Gobain

- Taiwan Glass Ind Corp

- Xinyi Glass Holdings Co., Ltd.

- Fuyao Glass Industry Group Co., Ltd.

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |