Global Blockchain Technology Market By Type (Private Cloud, Public Cloud, and Hybrid Cloud), By Component, By Application, By Enterprise, By End-Users, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Dec 2021

- Report ID: 62692

- Number of Pages: 294

- Format:

- keyboard_arrow_up

Blockchain Technology Market Overview:

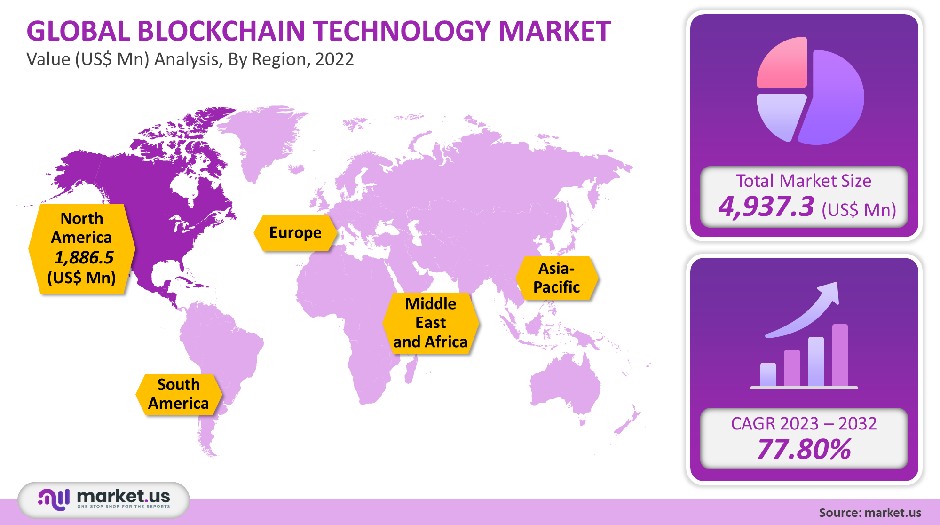

The global blockchain technology market size was valued at USD 4,937.3 million in 2021. It is projected to grow at a CAGR of 77.80% between 2023 to 2032.

Venture capital funding is a key factor in the growth of the blockchain technology market. Several blockchain technology providers have raised funding from strategic as well as institutional investors. This funding was used for blockchain technology market expansion and organizational development. New opportunities are expected to arise from the legalization of cryptocurrency in El Salvador and Ukraine.

Blockchain technology market divided into public blockchain, private blockchain, consortium blockchain.

Global Blockchain Technology Market Scope:

Type Analysis

The global blockchain technology market can be divided into three types: public cloud, hybrid cloud, and private cloud. In 2021, the public cloud segment dominated the market, which accounted for over 61.03% of global revenue. A public cloud blockchain is a multi-tenant environment in which computing space is shared among several clients.

Many government agencies around the globe are currently integrating cloud technology with their existing systems. The public cloud is highly sought after because it offers cost-competitiveness for enterprises. The private cloud segment will also see significant growth during the forecast period. Private cloud services are a type of service that provides dedicated resources and infrastructure to organizations.

Private cloud services allow companies to reverse transactions at cost-effective transaction speeds. This is another prime factor expected to boost the growth of the segment. The increasing adoption of private clouds also drives the segment’s growth by small and medium enterprises.

Component Analysis

The components of this market can be divided into three segments: application & solution, infrastructure & protocols, and middleware. In 2021, the infrastructure & protocol segment was the dominant market and accounted for more than 63.4% of global revenue. This segment growth is driven by the growing demand for protocols and standards such as Ethereum, Openchain, and Hyperledger. Users seek protocols because they allow them to securely and reliably share information across crypto networks. The benefits of infrastructure and protocols are driving the segment’s growth.

Over the forecast period, the fastest growth rate in the middleware segment will be recorded. Developers can build more efficient applications with middleware. Middleware is used primarily in the healthcare sector to automate the authentication of clinical data. The segment growth is expected to be driven by increasing investments in healthcare. The segment’s growth is also driven by Middleware tools that track laboratory performance metrics.

Application Analysis

By applications, the market can be divided into three categories: digital identity segment, exchanges, payments, and Supply chain management. Digital identity is expected to grow at the fastest CAGR rate during the forecast period. In 2021, the payments segment was the dominant market and accounted for more than 45.12% of global revenue.

For payment, acceptance of cryptocurrency by companies, like Paypal and Xbox, is expected to drive market growth. Regulatory acceptance is one of the more challenging aspects of upgrading payment solutions.

Blockchain technology companies gaining popularity in the payment sector, which drives segment growth. Blockchain technology increases the efficiency of payment systems, reduces operating costs, and provides transparency. Blockchain technology reduces the need to have a middleman for payment processing. This is another major factor that drives segment growth. Companies that offer digital identity have begun to partner with blockchain technology providers. Through the cooperation, the Cloud-Edge Identity Wallet from Sphericity GmbH and the previous company’s blockchain technology were combined. The organization can strengthen its position in the market thanks to this combination.

Enterprise Size Analysis

In 2021, the most significant enterprise size segment was large enterprises. It was the dominant segment in the blockchain market and accounted for more than 69.31% of global revenue. Large enterprises in various sectors such as healthcare, finance, and insurance are making more efforts to digitize their offerings. This is driving demand for blockchain systems.

BBVA and Intesa Sanpaolo are some large enterprises that use blockchain technology. They have enough capital and other necessary assets to adopt any new technology available in the market. Over the forecast period, the Small & Medium Enterprise (SME) segment is anticipated to grow at the fastest CAGR. The scaling of small and medium enterprises is difficult for them, as they have to finance, process payments, and select ancillary services essential for global expansion.

Small business segments are increasingly looking for blockchain-based storage solutions that allow them to securely store their data and do so at a low cost. They can use blockchain technology to reduce the costs of exchanging and subsidizing accounts. Blockchain technology allows small and medium business entities to streamline their supply chains through secure, safe information exchanges and smart contract implementations.

End-Use Analysis

Blockchain technology is used by financial services to manage financial transactions that take place within business services. In 2021, the financial services market dominated and accounted for more than 39.31% of global revenue. The demand for blockchain technology in financial services is growing because it allows for secure and efficient transactions. This vertical will likely adopt blockchain technology due to its compatibility with industry ecosystems, rising market-related cryptocurrencies, rapid transactions, initial coin offerings, and lower total cost of ownership. The healthcare segment will experience the fastest growth over the forecast period.

Blockchain technology is being adopted in healthcare because of increasing consumer data regulations. Due to increasing data theft incidents and breaches, governments worldwide are adopting strict regulations to protect consumer information. GDPR is designed to protect EU citizens against data breaches and privacy. These regulations have prompted companies around the world to invest in data security. The COVID-19 pandemic, which has seen a rise in demand for blockchain systems for digitalization in the healthcare sector, has also created the need to use blockchain technology. In contrast to the COVID-19 impact analysis, the influence and popularity of digitalization have grown rapidly to promote contactless payment.

For enhancing the customer experience, the different business entities and government initiatives are concentrating on the deployment of numerous innovative technologies.

Key Market Segments

By Type

- Private Cloud

- Public Cloud

- Hybrid Cloud

By Component

- Infrastructure & Protocols

- Application & Solution

- Middleware

By Application

- Exchanges

- Digital Identity

- Smart Contracts

- Payments

- Supply Chain Management

- Other Applications

By Enterprise Size

- Small & Medium Enterprises

- Large Enterprises

By End-User

- Government

- Financial Services

- Media & Entertainment

- Transportation & Logistics

- Healthcare

- Retail

- Travel

- Other End-uses

Market Dynamics:

Blockchain technology Market growth will be driven by the increasing number of strategic initiatives in decentralized finance. The legalization of cryptocurrency encourages investors and businesses to invest in the market for blockchain technology. It also encourages market players to invest more in blockchain technology to increase their competitive advantage. The companies’ efforts are expected to increase the efficiency and effectiveness of blockchain technology in the near future. DeFi, a new financial technology that uses blockchain, reduces banks’ control over financial services. Square, a payment company, announced that it would launch a Defi business using bitcoin.

The company expects this initiative to strengthen its market position. Market growth is expected to be driven by accepting cryptocurrency in countries as a form of payment by companies such as PayPal or Xbox. Many restaurants have partnered with blockchain solutions providers to offer cryptocurrency-based payments to customers. Across cryptocurrency networks, customers demand protocols as they enable them to share information reliably and securely. Bakkt Holdings, LLC, a digital asset marketplace, announced in August 2021 its partnership with Quiznos, Quick-service Restaurant (QSR), to launch its pilot physical location. The pilot allowed Quiznos customers to use bitcoin to pay at selected locations.

Many companies are working to integrate AI (AI) capabilities with blockchain to improve their offerings and create new market opportunities. Signzy Technologies Private Ltd., a RegTech startup, announced its partnership with Primechain Technologies. Primechain Technologies is a blockchain technology provider. This partnership was intended to develop AI-enabled smart bank solutions for the banking sector and financial institutions. This smart banking solution combined AI and blockchain technologies to digitize and automate back-office functions.

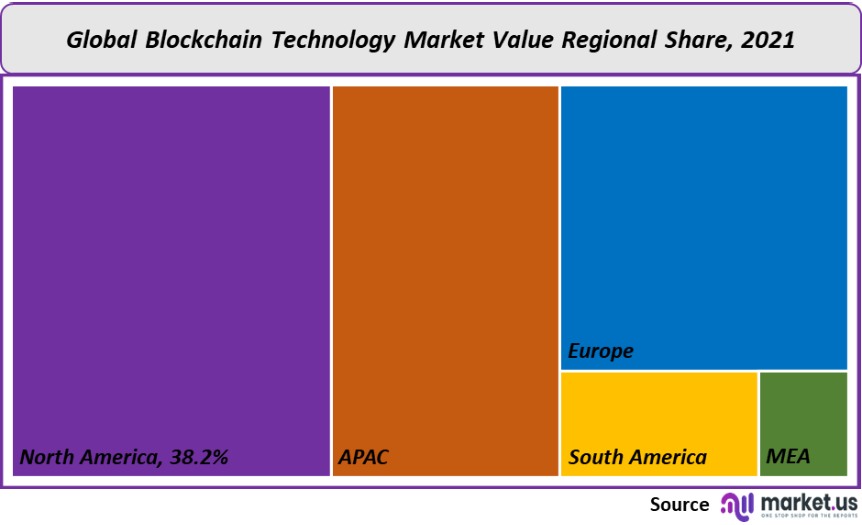

Regional Analysis

In 2021, North America dominated the global market share and accounted for more than 38.2% of global revenue. The increasing adoption of blockchain technology drives regional markets’ annual growth rate. BFSI, government, and retail implement smart contracts, payment solutions and wallet solutions, and digital identity identification solutions. This is driving the blockchain technology demand. The region’s market growth is accelerated by rising cryptocurrency use among North Americans.

The market for the Asia Pacific is expected, on the other hand, to grow at the fastest rate of CAGR during the forecast period. Governments have promoted the market for blockchain technology in countries like India, Japan, China, and China. This is due to the many benefits of blockchain technology, including increased transparency and efficiency for multiple industries. South Korea’s government announced US$ 891 million in blockchain development projects investments.

Key Regions and Countries covered іn thе rероrt:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

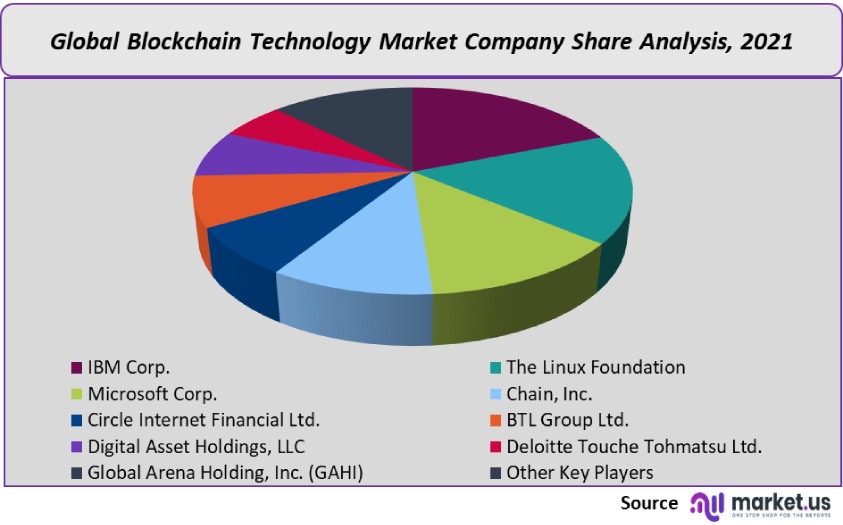

Market Share & Key Players Analysis:

The market’s competitive landscape is highly fragmented. Market players focus on strategies such as mergers or acquisitions to strengthen their market position. Circle Internet Financial Limited acquired SeedInvest, an equity crowdfunding blockchain platform. This acquisition created a token market allowing investors and individuals to interact through the open cryptocurrency infrastructure. Market players are also focusing on improving their product offerings to meet customer satisfaction and remain competitive.

Market players are increasing their research and development investment to improve their product offerings. Companies are also working with universities worldwide to support academic research and technical development in cryptocurrency and blockchain technology.

Market Key Players:

- IBM Corporation

- The Linux Foundation

- Microsoft Corp.

- Chain, Inc.

- Circle Internet Financial Ltd.

- Earthport Plc

- BitFury Group Ltd

- Deloitte Touche Tohmatsu Limited

- BTL Group Ltd.

- Digital Asset Holdings, LLC

- Deloitte Touche Tohmatsu Ltd.

- Global Arena Holding, Inc. (GAHI)

- Other Key Players

For the Blockchain Technology Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

What is the size of the Blockchain Technology market in 2021?The Blockchain Technology market size is US$ 4,937.3 million in 2021.

What is the projected CAGR at which the Blockchain Technology market is expected to grow at?The Blockchain Technology market is expected to grow at a CAGR of 77.80% (2023-2032).

List the segments encompassed in this report on the Blockchain Technology market?Market.US has segmented the Blockchain Technology market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Type, the market has been segmented into Private Cloud, Public Cloud, and Hybrid Cloud. By Component, the market has been segmented into Infrastructure & Protocol, Application & Solution, and Middleware. basis of Application, the market has been segmented into Exchanges, Digital Identity, Smart Contracts, Payments, and Supply Chain Management. By Enterprise Size, the market has been segmented into Small & Medium Enterprises and Large Enterprises. By End User, the market has been further divided into Government, Financial Services, Media & Entertainment, Transportation & Logistics, Healthcare, Retail, and Travel.

List the key industry players of the Blockchain Technology market?IBM Corporation, The Linux Foundation, Microsoft Corp., Chain, Inc., Circle Internet Financial Ltd., BTL Group Ltd., Digital Asset Holdings, LLC, Deloitte Touche Tohmatsu Limited, Digital Asset Holdings LLC, Earthport Plc, Chain Inc., Blockchain Tech Ltd, BitFury Group Ltd, Global Arena Holding, Inc. (GAHI), and Other Blockchain Technology Market Key Vendors engaged in the Blockchain Technology market.

Which region is more appealing for vendors employed in the Blockchain Technology market?North America accounted for the highest revenue share of 38.21%. Therefore, the Blockchain Technology industry in North America is expected to garner significant business opportunities over the forecast period.

Name the key areas of business for Blockchain Technology?The US, China, Japan, India, Brazil, Germany, UK, France, Italy, Spain, etc., are key areas of operation for the Blockchain Technology Market.

Which segment accounts for the greatest market share in the Blockchain Technology industry?With respect to the Blockchain Technology industry, vendors can expect to leverage greater prospective business opportunities through the public cloud segment, as this area of interest accounts for the largest share.

![Blockchain Technology Market Blockchain Technology Market]() Blockchain Technology MarketPublished date: Dec 2021add_shopping_cartBuy Now get_appDownload Sample

Blockchain Technology MarketPublished date: Dec 2021add_shopping_cartBuy Now get_appDownload Sample - IBM Corporation

- The Linux Foundation

- Microsoft Corp.

- Chain, Inc.

- Circle Internet Financial Ltd.

- Earthport Plc

- BitFury Group Ltd

- Deloitte Touche Tohmatsu Limited

- BTL Group Ltd.

- Digital Asset Holdings, LLC

- Deloitte Touche Tohmatsu Ltd.

- Global Arena Holding, Inc. (GAHI)

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |