Global Drug Discovery Technologies Market By Type , By Application , By Region, and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2020-2029

- Published date: Dec 2021

- Report ID: 65414

- Number of Pages: 295

- Format:

- keyboard_arrow_up

Drug Discovery Informatics Market Overview

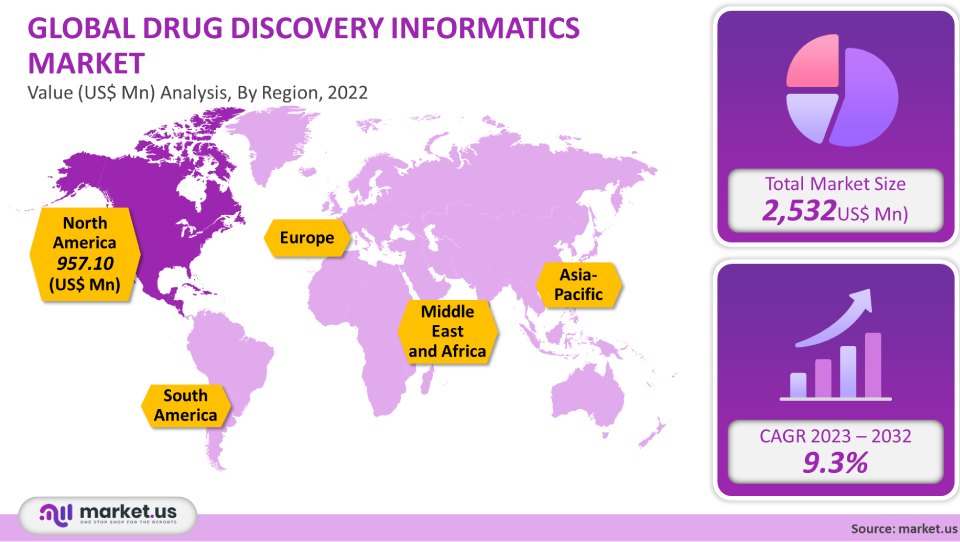

The global market of drug discovery information technology is estimated to be worth US$ 2.532 Billion by 2021 with a CAGR of 9.3% between 2023-2032. With the advancements in high-performance computing & web services, in-silico modeling tools, and the increasing volume of drug discovery data, the market for drug discovery informatics is poised to continue growing. The industry will be more competitive with the introduction of advanced drug discovery technology. This report gives a detailed analysis of the activities of drug discovery information technology market size, share, growth, key trends, major players, and other key factors.

Global Drug Discovery Informatics Market Scope:

Workflow Analysis

In 2021, discovery informatics held a dominant market share of 61.5%. This was due to a significant focus on developing precision medicines. Precision medicines are medical services that are tailored to each patient’s molecular and genetic profiles. PerkinElmer, Inc., is a company that provides discovery informatics services to enable analytics to speed up drug discovery

In several countries in the developing world, the government promotes the use of bioinformatics speeding up the discovery of medicine. In India, Drug Discovery Hackathon is a program that encourages rapid medicine discovery. It’s a training program designed to encourage the discovery, validation, and design of a molecule that will fight the Covid-19 viral infection. This is due to the increasing numbers of advanced drug candidates available to pharmaceutical and biotechnology Companies. These tools are used in clinical trial design for the most promising improvement in trial performance. In Jan 2020, artificial intelligence advancements in drug discovery companies entered a collaboration agreement.

Mode analysis

With a market share of 53.6%, the outsourced segment dominated in 2021. This market will grow steadily at a steady pace during the forecast period, due to increased partnerships between the pharmaceutical agent market and contract manufacturing and contract development organizations. CRO which creates report coverage on new drug entities is used by the sponsor and drug manufacturer to submit to the FDA. Partnering with a CRO that offers the same informatics solution is beneficial for pharmaceutical and biotechnology Companies. The pharmaceutical industry can monitor the progress of studies using the same informatics platform as their internal studies through the largest share platform. This helps companies save costs and maximize productivity. Pharmaceutical Market entities will reap the benefits of this platform. The biopharmaceutical industry has significantly contributed the market growth.

The fastest CAGR for the in-house modes segment is 9.73%. This is due largely to the growing adoption of informatics at large-scale companies in drug discovery. Its advantages include direct access and reformatting to vast amounts of information, eliminating lengthy data compilation, and combining cross-disciplinary information.

Services analysis

Sequence quantitative analysis platforms projected the highest share, with a revenue of 38.6% by 2021. This segment will maintain its dominant position and record the highest CAGR for the forecast period. Bioinformatics solutions are a wide range used for the development and maintenance of primary and secondary databases for nucleic acid, protein, and another biomolecule sequencing. Informatics software can be used for mining and warehouse genome sequencing. This is useful in identifying genes and targeted protein sequences, which will aid in the development of potential drug targets.

Additionally, basic drug discovery research demands the use of various databases in conjunction with sequence detailed analysis tools like CLUSTALW, BLAST, and FASTA. The segment growth is also being driven by the release of new and more advanced software. Certara released a (new version 19.6) D360 in July 2019 as a scientific information platform for drug discovery and development. The platform allows alignment, representation, and accurate analysis of small sections of proteins and sequences of peptides. The drug discovery market is broadly segmented into chemistry and biology services.

The informatics platform allows users to arrange peptides based on color code or property. Molecular modeling is becoming more popular due to its broad application in drug discovery. These tools allow for the simulation and modeling of biological target systems, as well as small molecules, to predict and understand their behavior at a molecular scale. These tools also reduce the additional cost of hit discovery, and hit-to-lead optimization, and speed up their use.

Key Market Segments

By Workflow

Discovery Informatics

Lead Generation

Identification, Validation, & Assay Development Informatics

Development Informatics

Lead Optimization

Phase IA

Phase IB/2

FHD Preparation

By Mode

Outsourced

In-house

By Services

Docking

Sequence Analysis Platforms

Molecular Modeling

Clinical Trial Data Management

Other Services

Market Dynamics:

Customers can also benefit from it by making crucial decisions regarding medicine safety and efficacy profiles. Informatics solutions are being increasingly adopted by companies in order to speed up the drug discovery process. Further, market growth strategies are being supported by Covid-19’s rapid drug discovery. To provide quick-track solutions, scientists used virtual screening to screen medicine from Drug Bank for the target identification of viral proteins and human ACE2 receptors. These studies were performed using in-silico tools to screen small molecules that could be used in drug discovery against Covid-19. Similar solutions and services are being developed by companies to assist drug development in Covid-19. The IBM Corporation visual molecular platform explorer explored a selection of generated molecules against the coronavirus in June 2020. The explorer allowed for open-source sharing and collaboration of AI-generated artifacts. This helped with the initial stages of optimal medicine design.

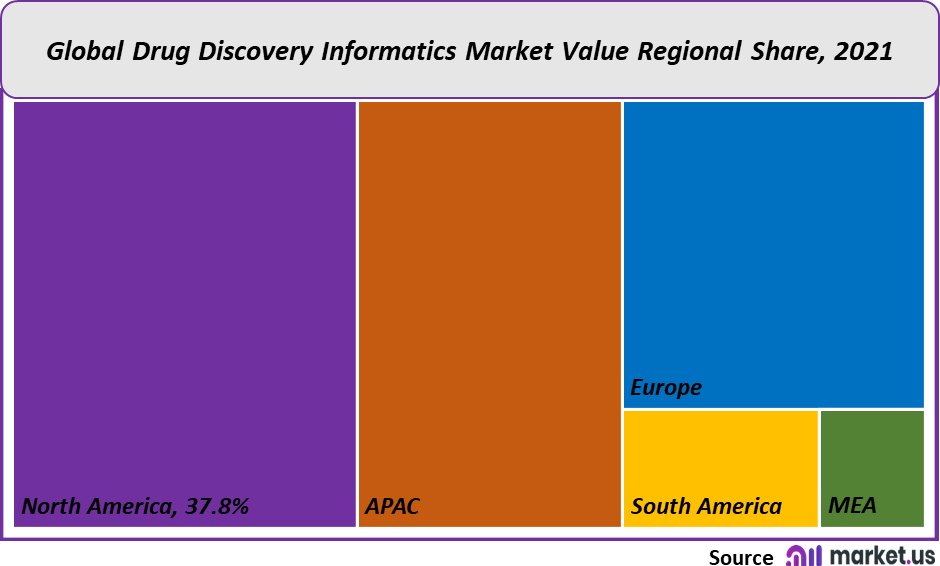

Regional Analysis

The North American region was the market leader with a 37.8% largest share in 2021. Growth in the major regions can be attributed to several additional major factors such as the high incidence and rapid growth adoption by people of new tools for R&D and prominent major additional market players. The region is also seeing an increased market fastest growth rate due to its focus on joint ventures. Atomwise Inc. launched a growing collection of joint venture companies, including virus Therapeutics and Organi Therapeutics in December 2020. It offers programs that span the spectrum of infectious disease, oncology, immunology, clotting disorder, and neuroscience. The Asia Pacific will be the fastest-growing segment market between 2023-2032. The growth of the global drug discovery services is the comprehensive analysis of the additional factors that drive and restrain the growth

Key Regions and Countries covered іn thе rероrt:

North America

US

Canada

Mexico

Europe

Germany

UK

France

Italy

Russia

Spain

Rest of Europe

APAC

China

Japan

South Korea

India

Rest of Asia-Pacific

South America

Brazil

Argentina

Rest of South America

MEA

GCC

South Africa

Israel

Rest of MEA

Market Share & Key Players Analysis:

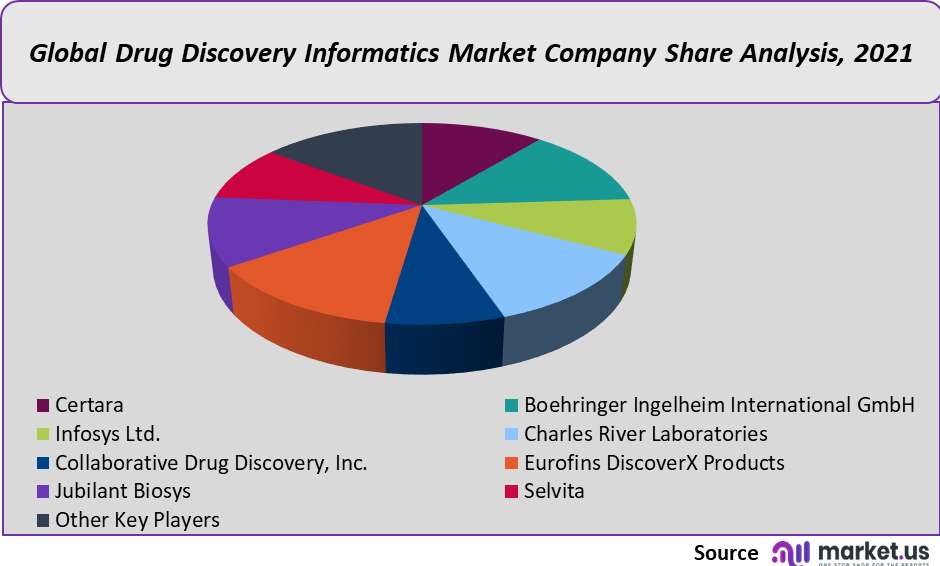

The Global Drug Discovery Informatics market is fragmented. With the rapid development of innovative generic drugs, key players are becoming more involved in partnerships with research institutes and companies. Charles River Laboratories International, Inc. partnered with Deciphex in March 2020. Patholytix Preclinical platform by Deciphex will improve pathologist productivity while delivering data quicker to clients. This enabled the company to increase its portfolio in the market. The following are key current industry trends in the global drug discovery informatics market. The prominent players in the global drug market include Infosys Ltd., Jubilant Biosys, etc.

Маrkеt Кеу Рlауеrѕ:

Boehringer Ingelheim International GmbH

Infosys Ltd.

Charles River Laboratories

Collaborative Drug Discovery, Inc.

Eurofins DiscoverX Products

Jubilant Biosys

Selvita

Other Key Players

For the Drug Discovery Technologies Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Market Size in 2022

2.532 Billion

Growth Rate

9.3%

Forecast Value in 2032

6.73 Billion

Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

What is the size of the Drug Discovery Informatics market in 2021?The Drug Discovery Informatics market size is US$ 2,532 million in 2021.

What is the projected CAGR at which the Drug Discovery Informatics market is expected to grow at?The Drug Discovery Informatics market is expected to grow at a CAGR of 9.3% (2023-2032).

List the segments encompassed in this report on the Drug Discovery Informatics market?Market.US has segmented the Drug Discovery Informatics market by geography (North America, Europe, APAC, South America, and the Middle East and Africa). By Workflow, the market has been segmented into Discovery Informatics and Development Informatics. By Mode, the market has been further divided into Outsourced, In-house. By Services, the market has been further divided into Sequence Analysis Platforms, Molecular Modeling, Docking, Clinical Trial Data Management, and Other Services.

List the key industry players of the Drug Discovery Informatics market?Certara, Boehringer Ingelheim International GmbH, Infosys Ltd., Charles River Laboratories, Collaborative Drug Discovery, Inc., Eurofins DiscoverX Products, Jubilant Biosys, Selvita, and Other Key Players engaged in the Drug Discovery Informatics market.

Which region is more appealing for vendors employed in the Drug Discovery Informatics market?North America accounted for the highest revenue share of 37.8%. Therefore, the Drug Discovery Informatics industry in North America is expected to garner significant business opportunities over the forecast period.

Name the key areas of business for Drug Discovery Informatics?The US, Canada, Mexico, China, Japan, India, and Others are key areas of operation for the Drug Discovery Informatics Market.

Which segment accounts for the greatest market share in the Drug Discovery Informatics industry?With respect to the Drug Discovery Informatics industry, vendors can expect to leverage greater prospective business opportunities through the discovery informatics segment, as this area of interest accounts for the largest market share.

![Drug Discovery Technologies Market Drug Discovery Technologies Market]() Drug Discovery Technologies MarketPublished date: Dec 2021add_shopping_cartBuy Now get_appDownload Sample

Drug Discovery Technologies MarketPublished date: Dec 2021add_shopping_cartBuy Now get_appDownload Sample - Certara

- Boehringer Ingelheim International GmbH

- Infosys Ltd.

- Charles River Laboratories

- Collaborative Drug Discovery, Inc.

- Eurofins DiscoverX Products

- Jubilant Biosys

- Selvita

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |