Global Device-as-a-Service Market By Offering (Hardware, Software, and Service), By Organization (Small & Medium Enterprise and Large Enterprise), By Device Type (Desktop, Laptop, Notebook, & Tablet, and Others), By Industry Vertical (Banking, Financial Services & Insurance (BFSI), and Other Industry Verticals), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Sep 2021

- Report ID: 73168

- Number of Pages: 397

- Format:

- keyboard_arrow_up

Device-as-a-Service Market Overview:

The global device-as a service market was worth USD 42,273.40 Million in 2021. It is anticipated to grow at a compound annual rate (CAGR of 37.2%) between 2023-2032.

Growing demand for subscription models that allow end-users to switch from an operating expense-based model to a capital expenditure-based one and access the most recent technology is responsible for the market’s promising growth prospects.

Market growth is expected to be driven by the increasing use of cloud services in developing nations. The market will also benefit from the increasing adoption of contact-based solutions and services by small and medium businesses. The market was positively affected by the COVID-19 pandemic.

Globally, the pandemic had a significant impact on work dynamics. Businesses were forced to prioritize the use of remote and cloud-based working methods to reduce the spread of COVID-19. The pandemic encouraged digital transformation and the adoption of multiple technologies, which boosted the adoption rate of the device-as-a-service (DaaS).

Global Device-as-a-Service Market Scope:

Offering analysis

The market can be divided into three segments based on the offering: hardware, software, or service. In 2020, the hardware segment was the dominant market and accounted for over 40% of the overall revenue share. This includes notebooks, desktops, tablets, and smartphones as well as peripherals.

This market is expected to grow due to the increasing interest in multiple types of hardware solutions, such as notebooks, laptops, and desktops all combined into one offering. It is also important to remember that IT infrastructure can quickly become outdated, and it is necessary to upgrade every few years. Small and medium businesses can lease hardware to upgrade their equipment and adopt the most recent technologies, without the need to buy them.

The highest expected growth rate for the service segment will be throughout the forecast period. Device-as-a-service includes maintenance and support. It includes a range of services that include deployment, installation, integration, maintenance, asset recovery, and repair according to the needs of the end-user.

These services can often be customized and optimized. Many managed service suppliers and value-added sellers have partnered with hardware vendors and manufacturers to offer device-as-a-service solutions. The enterprise’s smooth operation is ensured by the continuous services and support provided by electronic devices. This allows the end-user to choose their payment terms.

Organization analysis

The market can be divided into two segments based on its organization: small and medium enterprises and large enterprises. In 2020, the small and medium enterprise market accounted for more than 60% of revenue. Enterprises can use device-as-a-service to help them prioritize their investments. They can lease hardware and other services, instead of purchasing high-cost products. This model reduces costs and maximizes profit by keeping track of expenses each day. These and increasing awareness of the model are expected to drive growth in the segment.

Also, the small and medium business segment will grow at the highest CAGR of 38.0% between 2021-2028. IT leaders and owners of small and medium enterprises have many responsibilities, including managing inventories and avoiding hack attacks. Small and medium enterprises also prefer operating expenses over capital expenditure due to their cost- and flexibility advantages.

These factors have led to a high adoption rate of the device as-a-service model by small and medium enterprises. The COVID-19 pandemic accelerated digital transformation efforts and boosted the demand for the device as-a-service model in small and medium enterprises.

Device type analysis

The market was further divided by Industry Vertical into Banking, Financial Services and Insurance, Education institutions, Healthcare and Life Science, Public Sector, Government Offices, and Others. With a market share of more than 24%, the IT and telecom segment dominated in 2020. The vertical IT and telecoms include internet service providers, telecommunications companies, cable companies, and satellite companies.

High performance, reliability, security, and reliability of IT devices are essential for the basic operations of the sector. This segment also generates the highest demand for devices like desktops, laptops, and notebooks as well as tablets and smartphones. The industry is awash with software updates and related services, which has driven the adoption of the service-as-a–service model.

Over the forecast period, the IT and telecommunications segment will also grow at the highest rate of CAGR. This segment is expected to grow due to increased awareness of the DaaS model’s benefits and the shift to the OpEx model to lower investment in IT infrastructure. This industry has seen an increase in the use of IT assets due to the shift to remote work and homeschooling caused by the pandemic. Telecommunication companies are investing heavily in their resources and focusing on providing the best services to customers, which will increase the demand for DaaS over the forecast period.

Industry vertical analysis

The market was further divided by Industry Vertical into Banking, Financial Services and Insurance, Education institutions, Healthcare and Life Science, Public Sector, Government Offices, and Others. With a market share of more than 24%, the IT and telecom segment dominated in 2020. The vertical IT and telecoms include internet service providers, telecommunications companies, cable companies, and satellite companies.

High performance, reliability, security, and reliability of IT devices are essential for the basic operations of the sector. This segment also generates the highest demand for devices like desktops, laptops, and notebooks as well as tablets and smartphones. The industry is awash with software updates and related services, which has driven the adoption of the service-as-a–service model.

Over the forecast period, the IT and telecommunications segment will also grow at the highest rate of CAGR. This segment is expected to grow due to increased awareness of the DaaS model’s benefits and the shift to the OpEx model to lower investment in IT infrastructure. This industry has seen an increase in the use of IT assets due to the shift to remote work and homeschooling caused by the pandemic. Telecommunication companies are investing heavily in their resources and focusing on providing the best services to customers, which will increase the demand for DaaS over the forecast period.

Кеу Маrkеt Ѕеgmеntѕ

By Offering

- Hardware

- Software

- Service

By Organization

- Small & Medium Enterprise

- Large Enterprise

By Device Type

- Desktop

- Laptop, Notebook, & Tablet

- Smartphone & Peripheral

By Industry Vertical

- Banking, Financial Services & Insurance (BFSI)

- Educational Institution

- Healthcare & Life Science

- IT & Telecommunication

- Public Sector & Government Office

- Other Industry Verticals

Market Dynamics:

DaaS allows companies to upgrade and maintain their software and hardware in a timely manner. This helps reduce IT costs and increases productivity. A flexible device-as-a-service structure allows businesses to increase/ decrease their device count as well as provide additional services. These factors will drive the market during the forecast period.

Market growth has been accelerated by the adoption of the subscription model, which is characterized by higher policy compliance, user productivity, lower help desk spending, better policy compliance, and increased user productivity. The demand for DaaS is expected to rise due to the growth of the startup community. The market’s growth could be impeded by a lack of technical expertise or the adoption of CYOD policies.

Large and small-sized enterprises are increasingly using the device-as-a-service model. This allows them to rent hardware like laptops, desktops, and smartphones. They can also lease tablets with preconfigured software and services. This model will also be in demand due to the increased use of IoT. Other factors that will drive growth in the Device-as a Service market include technological advancements, increased penetration of high-speed networks,s, and advancements made in web services.

Regional Analysis

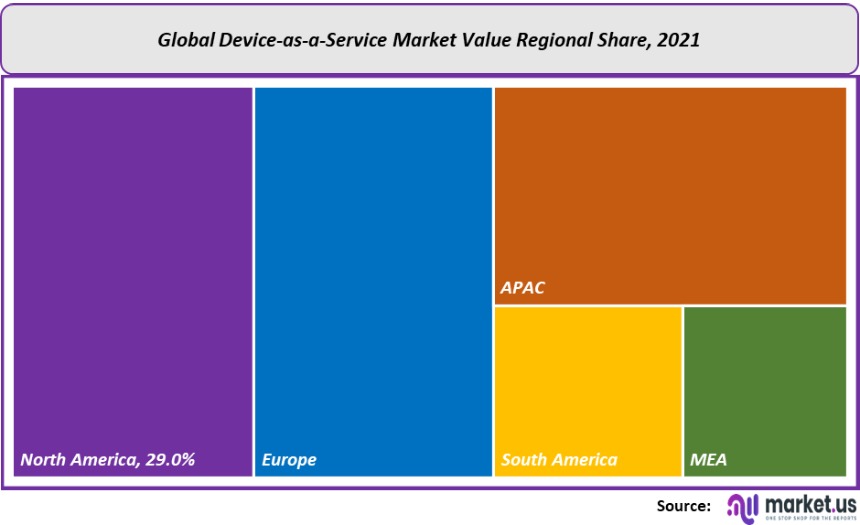

North America was responsible for 29% of the total revenue in 2020. North America was one of the first to adopt the most recent technologies, such as cloud computing and the Internet of Things. It also adopted new service models like device-as-a-service. In terms of regulations and government rules for startups and large businesses, the regional market is viable. These factors will drive market growth. The market is expected to grow due to rising IT and telecoms demand for device-as-a-service models and increasing demand for mobile devices across many industries.

Asia Pacific is projected to grow at the highest rate of CAGR during the forecast period. The Asia Pacific is home to some of the fastest-growing economies such as India, China, and Brazil. Expect to see a significant workforce in the IT and Telecommunications industry and large numbers of businesses increase demand for the device as-a-service model.

The market will be driven by the growing awareness of DaaS and the presence of many retail and life sciences organizations. It could be a positive sign that the market will grow due to the increasing penetration of the internet and the rapid growth of many industries in countries like China, India, and Japan.

Key Regions and Countries covered іn thе rероrt:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Market Share & Key Players Analysis:

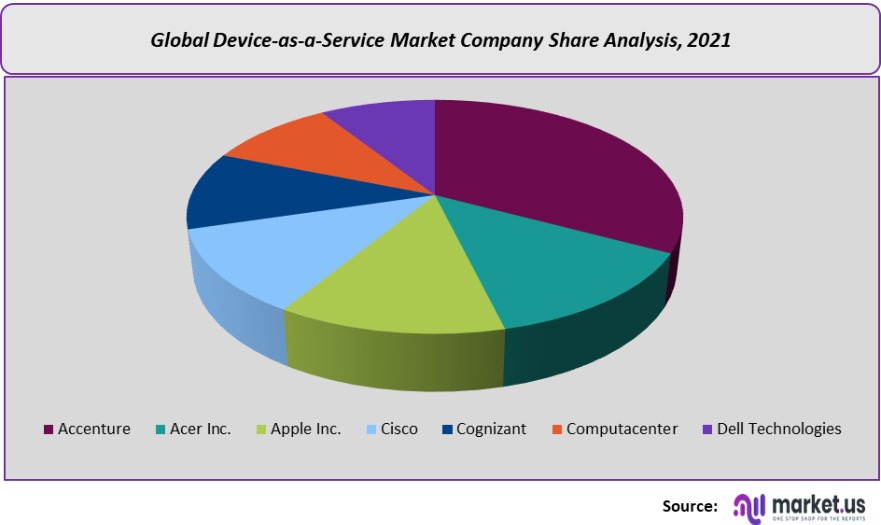

There are many market players in the market, such as Accenture, Cisco, Cognizant, Acer Inc., Computacenter, Intel Corporation, Hewlett Packard, Dell Technologies, and Lenovo. To cement their market position and grow further, these players pursue various strategies, including product development and launch, in hardware and software.

In the U.K., Lenovo launched device-as-a-service in 2021. This expansion has allowed Lenovo to offer a complete device portfolio that includes desktops, tablets, and workstations via a monthly service model. and are two of the most prominent players in the global device-as-a-service market.

Маrkеt Kеу Рlауеrѕ:

- Accenture

- Acer Inc.

- Apple Inc.

- Cisco

- Cognizant

- Computacenter

- Dell Technologies

- Intel Corporation

- Hewlett Packard

- Lenovo

- Other Key Players

For the Device-as-a-Service Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

Q: What is the Device-as-a-Service market size in 2021?A: The Device-as-a-Service market size is US$ 42,273.40 million in 2021.

Q: What is the CAGR for the Device-as-a-Service market?A: The Device-as-a-Service market is expected to grow at a CAGR of 37.2% during 2023-2032.

Q: What are the segments covered in the Device-as-a-Service market report?A: Market.US has segmented the Device-as-a-Service market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By offering, market has been segmented into Hardware, Software, and Service. By Industry Vertical, the market has been further divided into Banking, Financial Services and Insurance (BFSI), Educational Institution, Healthcare and Life Science, IT & Telecommunication, Public Sector and Government Office, and Other Industry Verticals.

Q: Who are the key players in the Device-as-a-Service market?A: Accenture, Cisco, Cognizant, Acer Inc., Computacenter, Intel Corporation, Hewlett Packard, Dell Technologies, Lenovo, and Other Key Players

Q: Which region is more attractive for vendors in the Device-as-a-Service market?A: North America will account the highest revenue share of 29.0% among the other regions. Therefore, the Device-as-a-Service market in North America is expected to garner significant business opportunities for the vendors during the forecast period.

Q: What are the key markets for Device-as-a-Service?A: Key markets for Device-as-a-Service are South Korea, Germany, and the US

Q: Which segment has the largest share in the Device-as-a-Service market?A: In the Device-as-a-Service market, vendors should focus on grabbing business opportunities from the hardware segment as it accounted for the largest market share in the base year.

![Device-as-a-Service Market Device-as-a-Service Market]()

- Accenture plc Company Profile

- Acer Inc.

- Apple Inc. Company Profile

- Cisco

- Cognizant

- Computacenter

- Dell Technologies

- Intel Corporation

- Hewlett Packard Enterprise Development LP Company Profile

- Lenovo Group Ltd Company Profile

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |