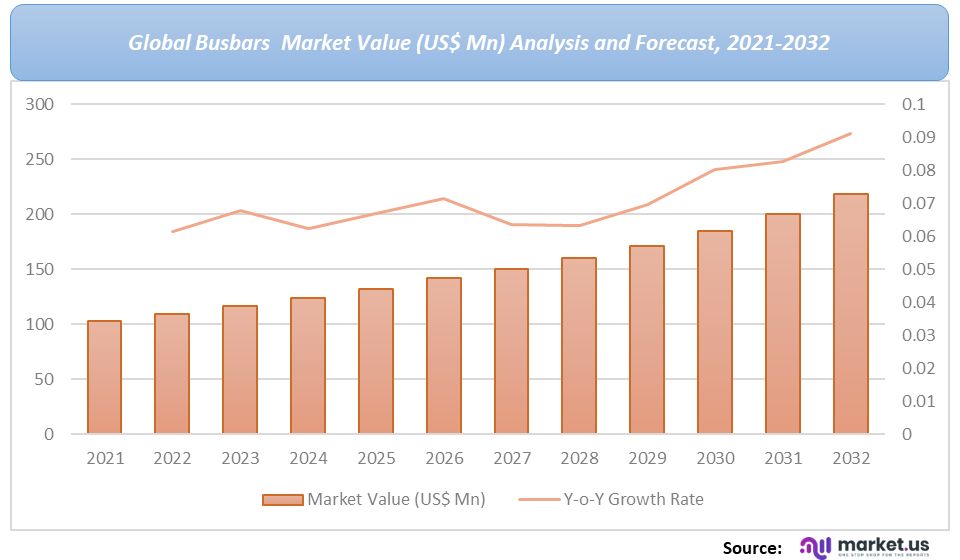

Global Busbars Market By Based on Conductor (Aluminum, Copper), Based on Power Rating (Low Power (Below 125 A), Medium Power (125 A–800 A), High Power (Above 800 A)), By Application (Residential, Commercial, Industrial) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Feb 2022

- Report ID: 76851

- Number of Pages: 318

- Format:

- keyboard_arrow_up

Global Busbars Market Introduction

Busbars, also known as bus bars, are strips of conductive materials used to collect and distribute electric power. Since busbars ground and conduct electricity simultaneously, they are often coated with materials that provide different conductivity limits and variations. They make the process of power distribution easier, flexible, and hassle-free. Additionally, they facilitate cost-efficient and fast installation services with no downtime. They also require few materials for installation as well as employ reusable and re-locatable plug-in outlets. As a result, they are extensively utilized across various verticals, including factories, data centers, retail facilities, hospitals, laboratories, universities, metros, and even railways. Flexible bus bars are made up of aluminum tubes supported by disc insulator strings on both sides with the gantries. Rigid bus bars are made up of aluminum tubes supported on post insulators.

The bus-bar size determines the maximum amount of current that can be safely carried. They are either flat strips or hollow tubes. These shapes will allow heat to dissipate more efficiently due to their high surface area to cross-sectional area ratio. Busbars have a compact design through which compressed flat conductors can pass through the enclosure. Due to the compact designs, busbars require lesser space than traditional cabling systems, and this is a major advantage when thousands of amperes of electricity need to be transmitted.

Detailed Segmentation–

The global busbars market is segmented based on – Conductor, Power Rating, End-Use, and Region.

Represented below is a detailed segmental description:Based on Conductor:

- Aluminum

- Copper

Based on Power Rating:

- Low Power (Below 125 A)

- Medium Power (125 A–800 A)

- High Power (Above 800 A)

Based on End-Use:

- Residential

- Commercial

- Industrial

Based on Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Market Dynamics

The global busbar market is primarily driven by the increasing demand for consistent and uninterruptable electric supply in the industrial and commercial sectors. Growing concerns about the reduction of energy losses in electric transmission and distribution activities, as well as greater awareness levels concerning the energy efficiency of a busbar over cabling owing to their cost-effectiveness, are major factors fueling the revenue growth of this target market. Factors such as fluctuations in the price of raw materials such as copper and aluminum and low-quality, cheap product offerings by competitors may restrain this market’s projected growth. Nonetheless, a surge in the development of smart, green cities, increasing solar power capacity, and even the surge in demand for High Voltage Direct Current (HVDC) transmission are elements expected to create lucrative opportunities for players in this market.

Based on Conductor, this market is bifurcated into Aluminum and Copper. Due to the high cost of raw materials, copper is the leading sub-segment in this industry regarding revenue. However, over the forecast period, the aluminum sub-segment is anticipated to expand with a higher CAGR. Aluminum has excellent conductivity and efficiency. Furthermore, compared to other materials, the energy loss during transmission is lower, resulting in a greater demand for aluminum.

Based on Power Rating, this market is categorized into Low Power (Below 125 A), Medium Power (125 A-800 A), and High Power (Above 800 A). The low-power busbar sub-segment will likely account for the highest revenue share over the projected timeline. Low-power busbar is in high demand for supplying electricity to light fixtures in both the commercial and industrial sectors. It is used in fake ceilings and technological floors as well. Compared to medium and high-power busbars, they are commonly employed in distribution panels and switchboards throughout utilities, industries, and residential applications, lending that sub-segment greater market penetration.

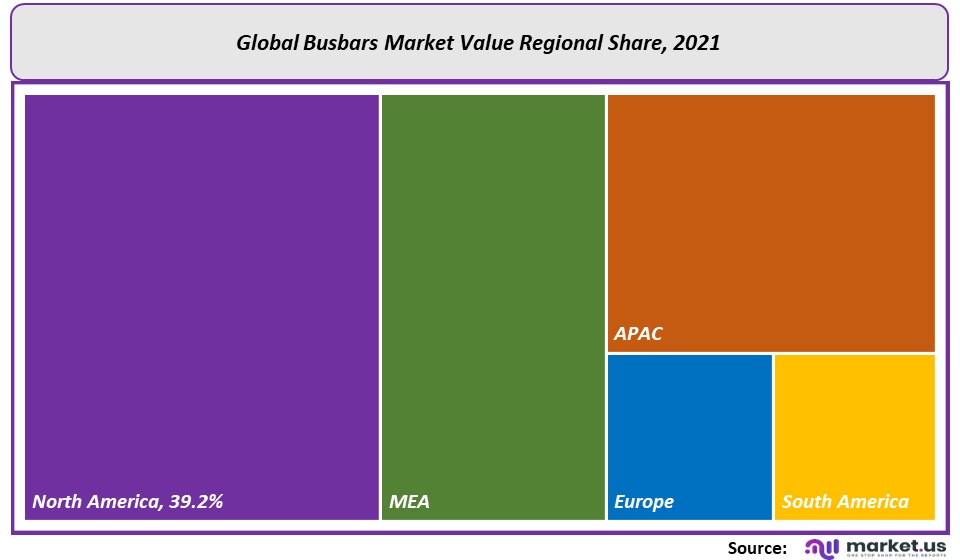

Based on regional analysis, the global busbar market is classified into – North America, Europe, Asia Pacific, and the Rest of the world. The global busbar market is predicted to develop at the fastest rate in the Asia Pacific. The Asia Pacific Busbar market will be driven by a growing focus on energy efficiency and increasing energy consumption levels due to urbanization and industrial growth in this region. The Asia Pacific region has the largest market for busbar trunking, owing to massive expenditures towards smart cities, green development, high-rise structures, and transit infrastructure, particularly in Southeast Asia.

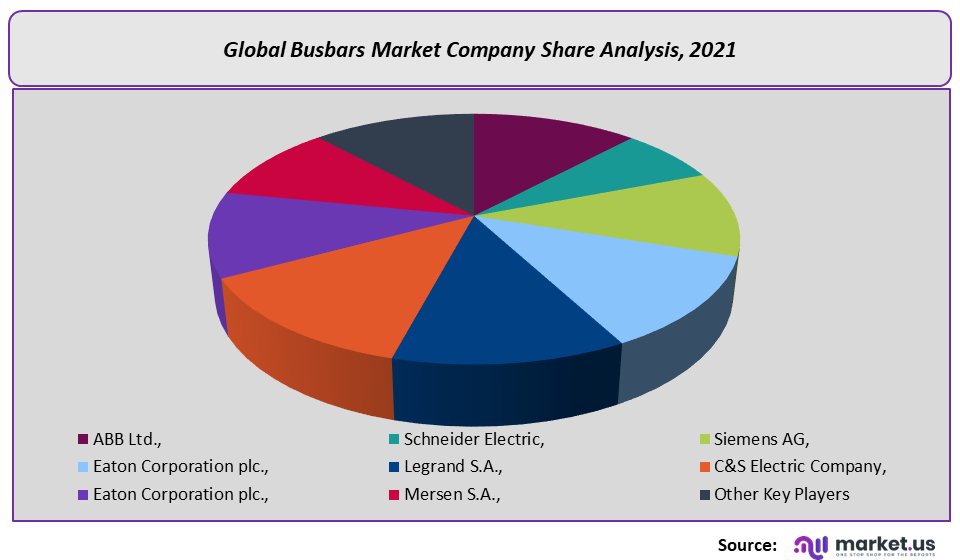

Competitive Landscape –

Some of the leading players in the busbar market include –

- ABB Ltd.

- Schneider Electric

- Siemens AG

- Eaton Corporation plc.

- Legrand S.A.

- C&S Electric Company

- Eaton Corporation plc.

- Mersen S.A.

- Schneider Electric SE

- CHINT Electric Co. Ltd.

- Rittal GMBH & CO. KG, among others.

Contracts & agreements were the most commonly adopted strategy by top industry players, constituting 37% of incremental developments between 2012-2016. It was followed by mergers & acquisitions, new product launches, and investments & expansion efforts.

Key developments –

2020:-

Siemens’ acquisition of C&S Electric India operations gets CCI approval. Siemens has an agreement to acquire 99% equity in New Delhi-based C&S Electric for around US$283 Mn

C&S Electric Ltd., one of India’s leading power equipment manufacturers and the Indian market leader for power busbar systems, earlier announced the acquisition of 100% equity of Etacom ISD BV through its subsidiary C&S Electric international BV2017:-

Molex LLC, a global manufacturer of complete interconnect solutions, announced the acquisition of certain assets of Triton Manufacturing Company Inc. The acquired Triton business specializes in fabricating flexible power cable assemblies and custom bus bars used in a wide range of current and heat transfer applications, including power transfer devices for computers, industrial electrical power distribution, transportation, as well as aerospace and telecommunications.For the Busbars Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

![Busbars Market Busbars Market]()

- ABB Ltd.

- Schneider Electric SE. Company Profile

- Siemens AG

- Eaton Corporation plc.

- Legrand S.A.

- C&S Electric Company

- Mersen S.A.

- Schneider Electric SE. Company Profile

- CHINT Electric Co. Ltd.

- Rittal GMBH & CO. KG, among others.

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |