N.V. Bekaert S.A. Company Profile

N.V. Bekaert S.A.

Manufacturing Industry

- Type

Public

- Headquarters

Belgium

- Founded

1880

- Key Management

Mr. Oswald Schmid (CEO)

- Revenue

~5,089.1 (2021)

- Headcount

~27,000 (2021)

- Website

Business Description

N.V. Bekaert S.A. offers coating solutions and steel wire products. The company was founded by Leo Leander Bekaert in 1880. It is located in Zwevegem, Belgium. The company runs in the given segments including Rubber Reinforcement, Steel Wire Solutions, Specialty Business, and Bridon Bekaert Ropes Group.

Key Financials

Revenue (US$ Mn):

- US$ 5,089 Mn was N.V. Bekaert S.A’s annual revenue in 2021, a 9.85% increase from 2020 figures

- N.V. Bekaert S.A indexed a -4.28% decrease in annual revenues from 2019, amounting to US$ 4,633 Mn in 2020

- N.V. Bekaert S.A generated total revenue of US$ 4,840 Mn in 2019

- Annual revenue of US$ 4,924 Mn was indexed by Microsoft Corporation in 2018

Operating Income (US$ Mn):

- US$ 542 Mn was the operating income generated by N.V. Bekaert S.A in 2021

- N.V. Bekaert S.A’s operating income for 2020 was US$ 289 Mn, a 58.14% increase from 2019

- From 2018’s operating incomes, N.V. Bekaert S.A registered an 18.2% increase in 2019, amounting to US$ 183 Mn

- An operating income of US$ 154 Mn was generated in 2018 by N.V. Bekaert S.A

Net Income (US$ Mn):

- N.V. Bekaert S.A’s net income for 2021 was US$ 501 Mn, a 201.93% increase from 2020

- The net income generated by N.V. Bekaert S.A in 2020 was US$ 166 Mn

- At a 0.22% increase, N.V. Bekaert S.A’s net income of US$ 46 Mn was indexed in 2019

- N.V. Bekaert S.A generated a net income of US$ 46 Mn in 2018

Operating Margin %:

- 10% was N.V. Bekaert S.A’s operating margin in 2021, a 58.06% increase from 2020 figures

- N.V. Bekaert S.A indexed a 63.16% increase in operating margins from 2019, amounting to 6% in 2020

- N.V. Bekaert S.A generated an operating margin of 4% in 2019

- An operating margin of 3% was indexed by N.V. Bekaert S.A in 2018

Gross Margin %:

- 18% was the gross margin generated by N.V. Bekaert S.A in 2021

- N.V. Bekaert S.A’s gross margin for 2020 was 15%, a 21.31% increase from 2019

- From 2018’s gross margins, N.V. Bekaert S.A registered a 0% decrease in 2019, amounting to 12%

- A gross margin of 12% was generated in 2018 by N.V. Bekaert S.A

SWOT Analysis

Strengths

R&D is the focus

Bekaert invests heavily in technology that will help develop products that are more energy efficient. The Bekaert Asia R&D Center is located in Jiangyin in China. The Technology Center is located in Deerlijk in Belgium. The company employs over 450 R&D experts who work together with suppliers and customers to create, implement, update, and protect future technologies. The company had more than 1,800 patents at the end of FY2020. In FY2020, 28 patent applications were filed.

The company spent EUR52.3million on R&D in FY2020. This was 1.3% of its revenue. The company’s engineering department is focused on the standardization and optimization of production processes and machinery. Combining innovative solutions with new equipment, the equipment improves performance in many areas including product quality, flexibility, and energy consumption. Bekaert is currently focusing on creating a sustainable operating model that allows them to focus on the development of innovative equipment for new products and new processes.

Bekaert’s Research and Innovation department houses the core technology domains of Bekaert, which include physical metallurgy and corrosion & metallic coatings as well as fatigue & mechanical performance and organic coats. It also works on data modeling and sensor technologies.

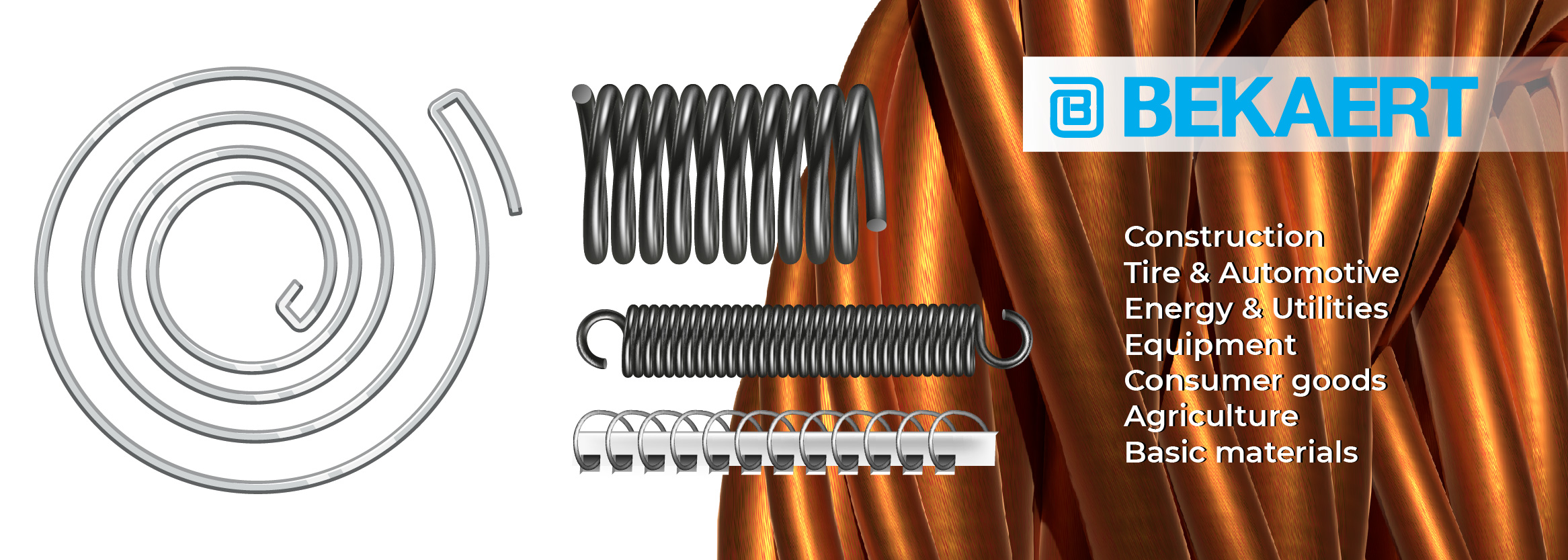

Diverse End Markets

Bekaert has a wide range of end markets. This helps to reduce the risk associated with being too dependent on one or a few sectors. It offers a variety of steel wire transformations and coating technologies, including tire cords, heating cords, steel fiber, welded film, fencing products, and wire for kitchen utensils.

It provides services to the following industries: Automotive, Energy Utilities, Construction, Consumer Goods, Agriculture, Equipment, and Basic Materials. These sectors made up 45.2%, 19.4%, and 2.7% of the company’s total revenue in FY2020

Established Partnerships

Bekaert forms partnerships with universities and research centers to promote open innovation in various research areas. It invests in venture capital funds and early-stage companies that can create new business models. The company expanded its international cooperation programs in FY2020 with technology clusters, academic institutions, and research partners.

The company’s academic partnerships are mainly focused on metallic coatings and physical metallurgy. They also model and use special laboratory analysis techniques. Among its key partners are the University of Antwerp and the University of Leuven. The University of Ghent, University of Brussels. CRM Group, University of Prague. Tsinghua University. Nanjing University.

Get this premium content