Global 3D Printing Filament Market By Type (Metals, Plastics, and Ceramics), By Plastic Type (Polyethylene Terephthalate Glycol (PETG), Polylactic Acid (PLA), and Others), By Application (Automotive, Industrial, Healthcare, and Aerospace & Defense), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Jul 2022

- Report ID: 57221

- Number of Pages: 240

- Format:

- keyboard_arrow_up

3D Printing Filament Market Overview:

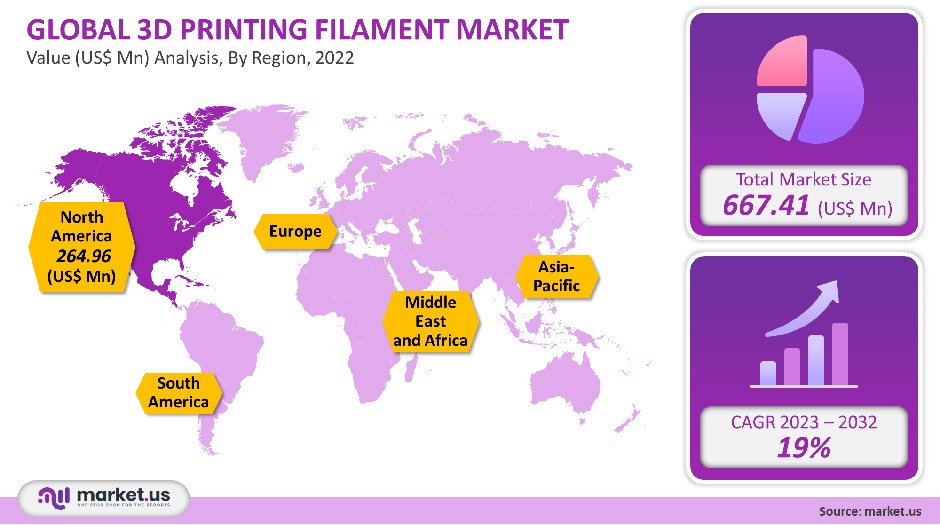

The global 3D printing filament market accounted for USD 667.41 million in 2021. It is expected to grow at a CAGR of 19% between 2023 to 2032.

3D printing filament demand is driven by increasing use in aerospace and defense for prototyping and design communication. Market growth is also being driven by the increasing need for high-quality print in automotive and industrial applications.

Global 3D Printing Filament Market Scope:

Type analysis

The plastics segment was the dominant market in 2021, accounting for 62% of the total revenue. It is projected to grow at a CAGR of 20.1% during the forecast period. Plastic-type 3D printing is a popular option due to its ease of manufacturing and ability to fuse on any surface. The product’s malleability makes it suitable for many applications, including space-aircrafts and motor vehicles. It can also be used in machining tools and educational models.

Metal-filled 3D printing filament is made from fine metal powders, like copper, brass, and bronze. These metals are attractive and can be used without a high-temperature extruder. Metal filaments also last longer than plastic filaments and are lighter than plastic. Producing metal filament for printing takes three to four times as much energy as printing with ceramics or plastics. This hinders the metal-based 3D printing filament market.

Ceramics are an alternative to metal-based 3D printing filaments and plastics. Ceramics are used for printing to create artistic figurines, models, and statues. It is also used extensively in biomedical to create custom implants, like 3D-bone substitutes. Complex parts and components can be difficult to produce using ceramics filament. It is also expensive and time-consuming to make. The market’s major players are therefore investing heavily in the research and development of new printing methods.

Composites, nylon, hybrid material, composites, nylon, aluminide (polyamide, aluminum powder), soluble, and many other materials are all used in 3D printing filament. For easy manufacturing and flexibility, these materials are often combined with plastics. This has led to the expansion of the market.

Plastic-type analysis

The Polylactic Acid segment led the market, accounting for more than 40.1% of the total revenue. This was due to its ease of printing and the fact that it does not require a heating platform when printing on the structure. Due to strict environmental regulations, Europe prefers the material’s biodegradability.

Acrylonitrile Butadiene Styrene is the most widely used 3D printing filament due to its flexibility and shock-resistant characteristics. It is used extensively in the manufacture of exterior parts (bumpers), for mobile phones and electronic appliances.

The market is growing rapidly because of the prominence of electronics producers such as the United States, China, South Korea, Hong Kong, and South Korea that use 3D filament printing to create electronic items.

PLA-type materials for 3D printing will be more popular as consumers become more aware of the importance of product sustainability. Other materials, such as Acrylonitrile Styrene Acrylate(ASA), Polyethylene TerephthalateGlycol (PETG), Polyethylene Terephthalate [PET], and others, have good chemical resistance and are expected to be used in aerospace, defense, and automotive sectors.

The demand for 3D printing is growing due to the increasing expenditure by space agencies worldwide on their space exploration programs. This allows for storage space reductions, cost savings, and the manufacturing of aerospace parts like aircraft structures and engine parts. The market is seeing positive growth due to sustainable 3D filaments like PLA from corn starch or plant-based 3D printing material.

Application analysis

Due to the high production of prototypes, the aerospace and defense segment had a 27.3% revenue share in 2021. The projected growth in additive manufacturing of aerospace components around the world for cost-effective solutions will drive demand for 3D printing filament.

The average component of an aerospace part and parts made using 3D printing technology are light. This reduces drag and lowers fuel costs. Factors such as environmental awareness and reductions in fuel costs and emissions are likely to reduce the environmental impact. This will lead to a rise in the need for 3D printed filament over the forecast period.

Due to the demand for stronger, lighter, stronger, and safer designs, the automotive segment will be a significant market share in 3D printing filament. In 2020, Tesla Inc., a giant in electric car manufacturing, used 3D printing to create its Model-Y rear underbody components.

Due to increased manufacturing of components like replacement parts and automotive spares as well as injector heads and wall panels, industrial and other manufacturing applications account for a fair portion of the market. The market is likely to see significant growth in components and parts like jigs and fixtures, robotics grippers, and sensor mounts, as well as other applications such as artwork and model designs.

Кеу Маrkеt Ѕеgmеntѕ

By Type

- Metals

- Plastics

- Ceramics

- Other Types

By Plastic Type

- Polyethylene Terephthalate Glycol (PETG)

- Polylactic Acid (PLA)

- Acrylonitrile Styrene Acrylate (ASA)

- Acrylonitrile Butadiene Styrene (ABS)

- Other Plastic Types

By Application

- Automotive

- Industrial

- Healthcare

- Aerospace & Defense

- Other Applications

Market Dynamics:

The main aim of 3D printing filament is to serve as a thermoplastic feedstock for the production of fused filament or fused-deposition modeling. The simultaneous printing of various materials using several filaments is what drives this sector. Due to the low cost and simplicity of using filaments, the market expansion is also achievable.

The market in the U.S. is projected to grow at a rate of 22.7% during the forecast period. There are growth opportunities in Defense and Aerospace component enhancements, as well as the adoption of eco-friendly parts. NASA (National Aeronautics and Space Administration) can produce space components and parts in minutes or hours using a 3D printer, while conventional manufacturing can take months to build them before they are sent into orbit.

The market is highly attracted to 3D printing filament innovation and research and development, such as multi-property material and bio-degradable 3D prints. The European countries have stricter environmental regulations that are expanding the market for bio-degradable filaments.

The usage of plastic 3D printing filaments is common due to their low cost and water resistance. Unlike conventional printing, plastic printing uses materials like composites, polyester, or other hybrid filaments. It produces prototypes for the aerospace, defense, automotive, industrial, and other application segments using fused filament manufacturing processes.

The market is seeing positive trends due to a variety of product development phases and trends in 3D printing filament. Major component producers in aerospace, defense, industrial, healthcare, and automotive are India, China, and South Korea. This will likely add to the market’s growth over the forecasted time.

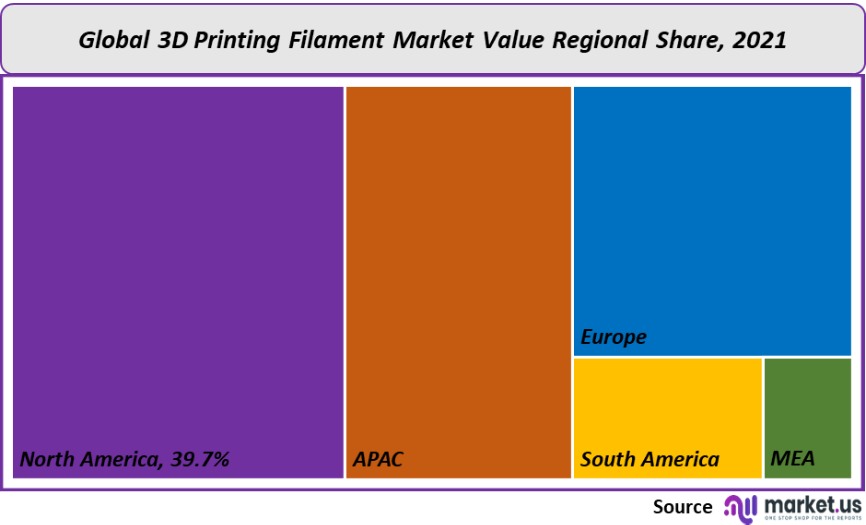

Regional Analysis

North America was the dominant market in 2021, accounting for more than 39.7% of the total revenue. The projected CAGR is 20%. The projected growth of the regional market will be supported by increased investment from the U.S. defense and aerospace sectors in manufacturing high-end designs for critical components like spacer panels, circuit boards, and spare parts.

The U.S. was North America’s largest consumer of 3D printer filament in 2021. The market is expected to benefit from the development of defense industry operations and the increase in the production of automobiles in the region.

The Asia Pacific market was second in revenue in 2021, due to the growing spending in the manufacturing sector, which includes the production of tools, fixtures, electronics, toys, and other items. The manufacturing time of the above products can be significantly reduced by 3D printers than the CNC machines.

The increasing production of automotive and aircraft components is driving Europe’s market growth to 18.3% during the forecast period. The market growth will be slowed by strict policies regarding the use of non-biodegradable materials like ABS and other high-performance polymers made from petroleum feedstock.

Key Regions and Countries covered іn thе rероrt:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

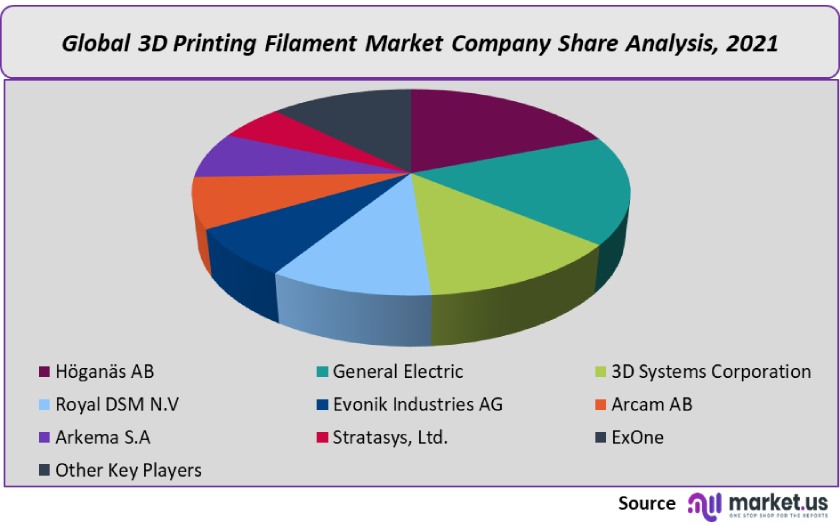

Market Share & Key Players Analysis:

Key players have a variety of market strategies, including investment, acquisition, and innovation. The key players are also expanding their capabilities to serve their respective markets. Due to the adoption of 3D filament printing technology, the market is competitive. This allows for higher product quality and faster production. This market is characterized by the presence of many application industries that concern with high lead times at low operation costs.

Маrkеt Кеу Рlауеrѕ:

- Höganäs AB

- General Electric

- 3D Systems Corporation

- Royal DSM N.V

- Evonik Industries AG

- Arcam AB

- Arkema S.A

- Stratasys, Ltd.

- ExOne

- Other Key Players

For the 3D Printing Filament Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

Q: What is the size of the 3D Printing Filament market in 2021?A: The 3D Printing Filament market size is US$ 667.41 million in 2021.

Q: What is the projected CAGR at which the 3D Printing Filament market is expected to grow at?A: The 3D Printing Filament market is expected to grow at a CAGR of 19% (2023-2032).

Q: List the segments encompassed in this report on the 3D Printing Filament market?A: Market.US has segmented the 3D Printing Filament market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Type, market has been segmented into Metals, Plastics, and Ceramics. By Plastic Type, market has been segmented into Polyethylene Terephthalate Glycol (PETG), Polylactic Acid (PLA), Acrylonitrile Styrene Acrylate (ASA), and Acrylonitrile Butadiene Styrene (ABS). By Application, the market has been further divided into Automotive, Industrial, Healthcare, and Aerospace & Defense.

Q: List the key industry players of the 3D Printing Filament market?A: Höganäs AB, General Electric, 3D Systems Corporation, Royal DSM N.V, Evonik Industries AG, Arcam AB, Arkema S.A, Stratasys, Ltd., ExOne, and Other Key Players engaged in the 3D Printing Filament market.

Q: Which region is more appealing for vendors employed in the 3D Printing Filament market?A: North America accounted for the highest revenue share of 39.7%. Therefore, the 3D Printing Filament industry in North America is expected to garner significant business opportunities over the forecast period.

Q: Name the key areas of business for 3D Printing Filament?A: U.S., Canada, Mexico, Germany, U.K., France, Italy, Spain, China, India, Japan, Brazil, Argentina, are key areas of operation for 3D Printing Filament Market.

Q: Which segment accounts for the greatest market share in the 3D Printing Filament industry?A: With respect to the 3D Printing Filament industry, vendors can expect to leverage greater prospective business opportunities through the plastics segment, as this area of interest accounts for the largest market share.

![3D Printing Filament Market 3D Printing Filament Market]()

- Höganäs AB

- General Electric

- 3D Systems Corporation

- Royal DSM N.V

- Evonik Industries AG

- Arcam AB

- Arkema S.A

- Stratasys, Ltd.

- ExOne

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |