Global 5G Chipset Market By Frequency Type (mmWave, sub-6GHz, and sub-6GHz + mmWave), By Processing Node Type (7 nm, 10 nm and Other Processing Node Type), By Deployment Type (Smartphones/Tablets, Telecom Base Station Equipment, and Other Deployment Type) By Vertical (Manufacturing, Media & Entertainment and Other Verticals), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Dec 2021

- Report ID: 65622

- Number of Pages: 272

- Format:

- keyboard_arrow_up

5G Chip Market Overview:

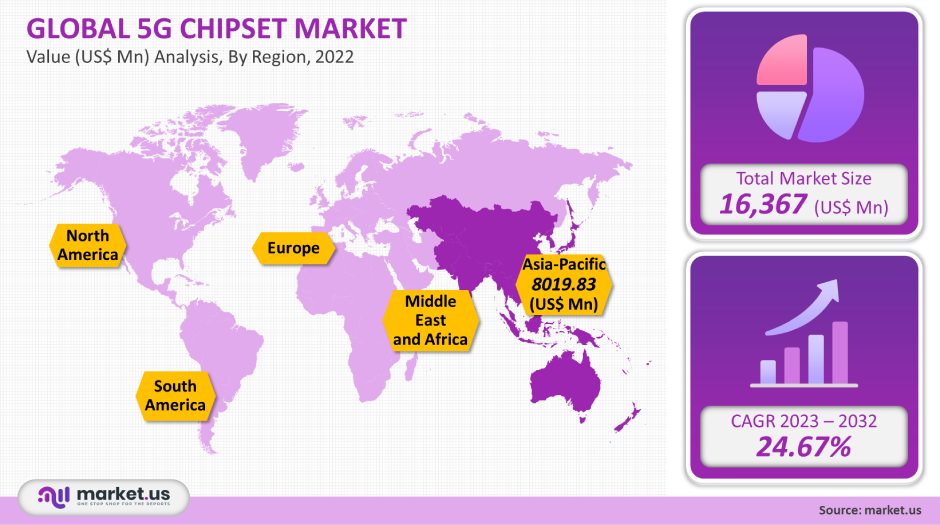

In 2021, the global 5G chip market was worth USD 16,367 million. It is projected to grow at a CAGR of 24.67% between 2022-2032.

The market is expected to grow due to the increasing demand for high-speed networks with low latency to enable mission-critical applications like Machine to Machine communication. A 5G chipset module is essential for 5G-enabled smartphones and laptops. It also serves as a component for routers and telecom base stations. The 5G chipset module enables users to connect to next-generation networks, and enjoy an enhanced experience.

Global 5G Chipset Market Analysis:

Frequency Type Analysis

With a market share of 63.0%, the sub-6GHz segment led the market in value. This can be attributed to the initial offering of 5G chipset parts that support the sub-6GHz frequency band by key market participants for smartphones, connected cars, and laptops. Sub-6GHz + mmWave is expected to see a notable CAGR during the forecast period. This is due to the continual introduction of modern chipset parts that can support both the sub-6GHz as well as mmWave bands within a single module.

The continued rollout of the Industrial Internet of Things and the increasing popularity of autonomous cars have prompted the demand for faster data networks and greater bandwidth. Accordingly, there will be an increase in the demand for chipsets that can support the mmWave spectrum over the forecast period. Many IoT gadgets will be installed over the next few years to keep up with the increasing use of smart home apps. This IoT device would need high-speed and high bandwidth connectivity in order to work seamlessly. The demand for a chipset capable of supporting 5G New Radio’s (NR) mmWave frequency carrier frequency will increase in the future, driving the mmWave market over the forecast period.

Processing Node Type Analysis

In 2021, the 7nm segment had a significant market value, due to key players’ initial focus on developing 5G chip components with a 7nm processor node. MediaTek Inc., Huawei Technologies Co. Ltd. and Intel Corporation are some of the market leaders who initially focus on developing 5G chipset parts with a 7nm processing Node. To support high frequencies, market players also focus on manufacturing the 7 nm- and 10 nm processing units of the chipset.

The modern communication networks will have to handle heavier loads, as they must simultaneously support multiple applications. This would mean that a new chipset must be developed with faster processing speeds. Accordingly, the segment of 10 nanometers is expected to see a substantial CAGR over the forecast. In order to create 5G chipsets, autonomous cars will become more common. This would mean that higher processing nodes are required in order to ensure seamless connectivity between vehicles.

Deployment Analysis

The smartphones/tablets segment in 2021, held a significant market share. This can be attributed to the increasing demand for 5G-enabled smartphones for online gaming and watching Ultra High Definition videos. There has been a significant demand for 5G chipsets across many devices and equipment including connected vehicles, smartphones/tablets, connected devices,s and broadband access gateway devices. The continued investment in next-generation network infrastructure has also increased the demand for next-generation chipset components. The telecom base station equipment segment was the second-largest in 2021.

Qualcomm Incorporated, Huawei Technologies Co. Ltd., and Intel Corporation have all been focusing on one 5G chipset that can both support standalone and non-standalone frequencies. Over the forecast period, the multimode segment will be driven by the growing demand to support multiple carrier frequencies. There is also a growing need to provide ultra-reliable connectivity for connected devices that are being continuously deployed across the energy and utilities, healthcare, and manufacturing industries. Accordingly, the connected device segment will experience significant growth during the forecast period.

Vertical Analysis

The IT and telecom segments had experienced large investments by prominent players in the development of 5G chipsets modules for telecom base stations, broadband gateway devices, as well as other communication devices that are responsible for the market dominance. There is a demand for next-generation chipsets in many industries, energy, and utilities, including manufacturing, media, entertainment, logistics, IT, transportation, telecom, and health care. The IT and telecom segments are expected to grow over the forecast period due to the increasing demand for high-speed connectivity for virtual meetings, and other corporate applications.

Manufacturing industry leaders have realized that digitization is necessary to improve overall productivity. They are automating their production lines through various digitalization solutions. There is also a growing need to establish wireless communication between all robots, sensors, actuators, and other devices. This is a critical part of manufacturing. Accordingly, the CAGR for the manufacturing segment will be the highest over the forecast period.

Key Market Segments:

By Frequency Type

- mmWave

- sub-6GHz

- sub-6GHz + mmWave

- By Processing Node Type

- 7 nm

- 10 nm

- Other Processing Node Type

By Deployment Type

- Smartphones/Tablets

- Telecom Base Station Equipment

- Connected Devices

- Broadband Access Gateway Devices

- Connected Vehicles

- Other Deployment Type

By Vertical

- Manufacturing

- Media & Entertainment

- Energy & Utilities

- IT & Telecom

- Healthcare

- Transportation & Logistics

- Other Verticals

Market Dynamics:

A number of top telecom operators around the world, including AT&T, Inc., etc. have been aggressively investing in 5G network infrastructure. This will provide their customers with high-speed connectivity. Nokia Corporation, for instance, reached a deal worth approximately US$ 2.4 B with three major China Telecom Corporation Limited, Chinese telecom operators, and China Mobile Limited in November 2021.

This agreement will enable them to deploy high-speed networks in China. This investment in the next-generation network infrastructure is expected to increase 5G-enabled device adoption around the globe. The forecast period will also see a rise in demand for the 5G chipset component. Market growth will also be driven by the increasing demand for high-speed chipset components in applications like Vehicle to Everything (V2X), as well as drone connectivity. Drone connectivity requires ultra-reliable, low-latency connectivity.

As many smart infrastructures, smart cities, and smart grid projects in various parts of the world are undertaken, the Internet of Things (IoT), continues to flourish. By 2032, the global IoT connection will exceed 3.2 billion. Numerous manufacturing companies have started to use IoT devices for monitoring machine performance in real-time to reduce downtime and improve operational efficiency. Over the forecast period, IoT devices are expected to increase in popularity and drive demand for 5G chipset modules.

The spread of COVID-19 in the world has caused a major slowdown in 5G chipset production. The spread of COVID-19 could lead to many supply chain participants moving production facilities out of China. According to data provided by China’s customs department, China’s first two months of 2020 saw a dramatic decline in exports of almost 16.3% compared with the previous year. The analysis also revealed that the Asia Pacific’s overall manufacturing sector is suffering from the COVID-19 outbreak.

Therefore, the region’s market for 5G chipsets is also being affected. Leading players such as Huawei Technologies Co. Ltd. and Samsung Electronics Co. Ltd. have reported a slowdown in 5G chip production and exports to the region. This indicates a decline in global demand for 5G processors. The decline in 5G chipset production, combined with temporary bans on trades between the U.S. and South Korea, will likely hinder the market’s growth over the next few years.

The adoption of the 5G components could be slowed by data security and privacy concerns. Global concerns over data security and privacy are growing. These concerns have been addressed by several governments who have drafted favorable policies and strict regulations in order to ensure information privacy and data security. The increasing trade tensions between the U.S.and China will also be expected to limit the growth of the 5G chipset market.

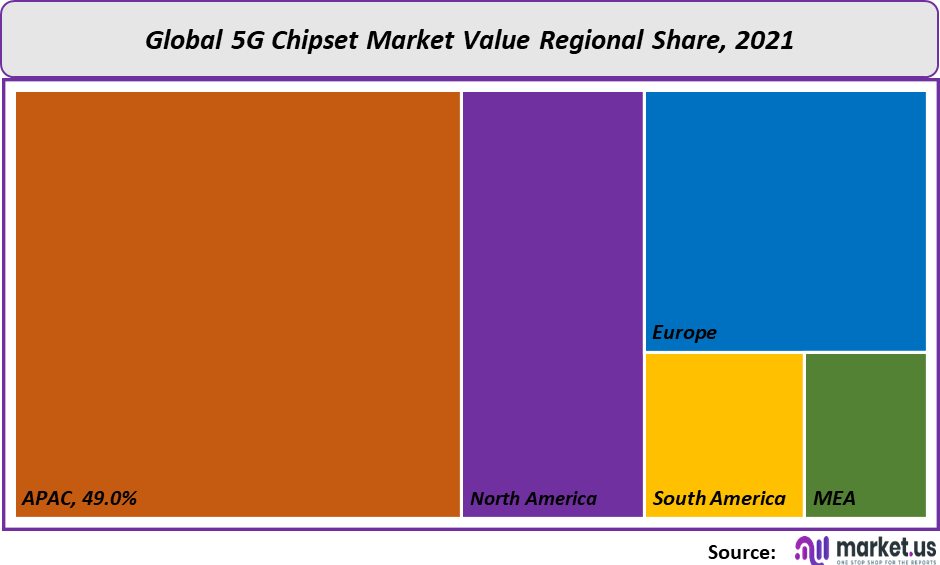

Regional Analysis:

Asia Pacific held a dominant position in the market, accounting for approximately 49.0% of it in 2021. This is due to the rapid growth in investment in 5G-enabled smartphones as well as base stations supporting 5G New Radio frequencies (NR). The key regional players, such as Samsung Electronics Co. Ltd. or Huawei Technologies Co. Ltd., are investing heavily in the development of 5G chipsets modules.

In the coming years, the rising demand for smart manufacturing in emerging countries like India and China will drive 5G chipset adoption. In the United States, the market is expected to gain a significant share over the coming years. The U.S. is seeing strong investments in building smart homes and deploying smart industries.

Consumers in the U.S. are increasingly turning to high-quality online gaming. A country that is embracing self-driving vehicles and smart transportation infrastructure is also emerging is the United States. All of these developments are expected to drive the U.S. demand for 5G chipset components.

Кеу Regions and Countries covered іn thе rероrt:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

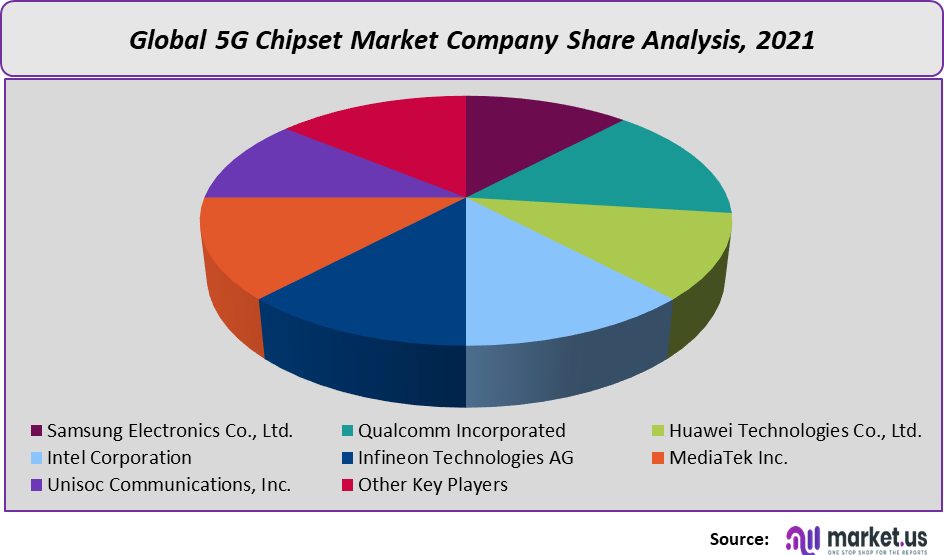

Key Companies & Market share Analysis:

To increase their market share for 5G chipsets in the market, key players have adopted a variety of strategies including new product development, strategic collaborations, and product development. Apple Inc. is one of the major smartphone manufacturers. They are now focusing their efforts on vertical integration to improve their product portfolios using 5G-enabled phones. Market leaders are determined to develop new and innovative products, expand their product portfolios and gain significant market share.

Key Market Players:

- Samsung Electronics Co., Ltd.

- Qualcomm Incorporated

- Huawei Technologies Co., Ltd.

- Intel Corporation

- Infineon Technologies AG

- MediaTek Inc.

- Unisoc Communications, Inc.

- Other Key Players

For the 5G Chipset Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

Q: What is the 5G Chipset market size in year 2021?The 5G Chipset market size was US$16,367 million in 2021.

Q: What is the CAGR for the 5G Chipset market?The 5G Chipset market is expected to grow at a CAGR of 24.67% during 2023-2032.

Q: What are the segments covered in the 5G Chipset market report?Market.US has segmented the 5G Chipset market by geography (North America, Europe, APAC, South America, and the Middle East and Africa). By Frequency Type, the market has been segmented into mmWave, sub-6GHz, and sub-6GHz + mmWave. By Processing Node, the market has been further divided into 7 nm, 10 nm and Other Processing Node Type. By Deployment Type , the market has been segmented into Smartphones/Tablets, Telecom Base Station Equipment, Connected Devices, Broadband Access Gateway Devices, Connected Vehicles and Other Deployment Type. By Vertical, the market has been segmented into Manufacturing, Media & Entertainment, Energy & Utilities, IT & Telecom, Healthcare, Transportation & Logistics and Other Verticals.

Q: Who are the key players in the 5G Chipset market?Samsung Electronics Co. Ltd., Qualcomm Incorporated, Huawei Technologies Co. Ltd., Intel Corporation, Infineon Technologies AG, MediaTek Inc., Unisoc Communications Inc. and Other Key Players are engaged in 5G Chipset Market.

Q: Which region is more attractive for vendors in the 5G Chipset market?APAC accounted for the largest revenue share of 49%, among the other regions. Therefore, APAC 5G Chipset market is expected to garner significant business opportunities for the vendors during the forecast period.

Q: What are the key markets for 5G Chipset?Key markets for 5G Chipset are the US, China, Japan, India, Brazil, Germany, UK, France, Italy, Spain, etc.

Q: Which segment has the largest share in the 5G Chipset market?In the 5G Chipset market, vendors should focus on grabbing business opportunities from the sub-6GHz segment as it accounted for the largest market share in the base year.

![5G Chipset Market 5G Chipset Market]()

- Samsung Electronics Co., Ltd.

- Qualcomm Incorporated

- Huawei Technologies Co., Ltd.

- Intel Corporation

- Infineon Technologies AG

- MediaTek Inc.

- Unisoc Communications, Inc.

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |