Global 5G Infrastructure Market By Component (Services and Hardware), By Network Architecture (Standalone and Non-standalone), By Vertical (Residential, Enterprise/Corporate, Energy & Utility, Transportation & Logistics, and Other Verticals), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Apr 2022

- Report ID: 12024

- Number of Pages: 330

- Format:

- keyboard_arrow_up

5G Infrastructure Market Overview:

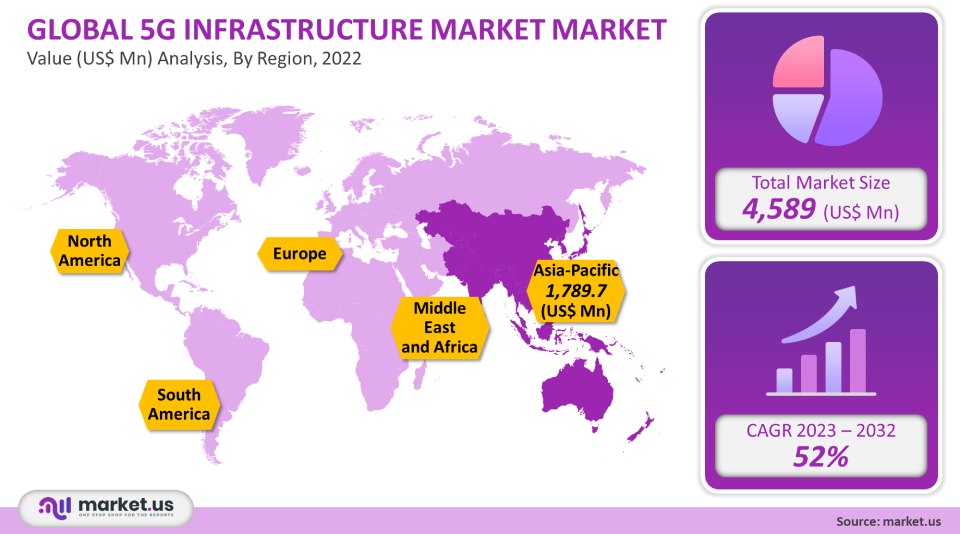

The valuation of global 5G Infrastructure market was USD 4,589 million in 2021. It is projected to grow at a CAGR of 52% between 2023 and 2032.

5G infrastructure consists mainly of Radio Access Networks (RAN), transport, core networks, and backhaul. The backhaul network and transport network include microwave antennas or fiber optics. The increasing demand for improved bandwidth connectivity having low latency for many vital applications, such as drone connectivity and vehicle-to-everything, is expected for the 5G infrastructure growth.

Global 5G Infrastructure Market Analysis:

Component Analysis

The hardware segment dominated the 5G infrastructure market with a market share of 50% in 2021. This is due to 5G RAN’s robust deployment with multiple small cells and microcells-base stations around the globe. To reduce infrastructure costs and simplify network complexities, network service providers are rapidly adopting virtual and centralized RAN. Software-defined Networking technology (SDN) will play an important part in the segment’s growth, from 2023 to 2032.

The forecast period will witness significant growth in the core network segment under hardware. The core network plays a vital role in handling network traffic as well as storing consumer data. Leading network providers are moving to cloud-based 5G networks in order to improve connectivity and offer smooth connectivity.

Ericsson and British Telecommunication PLC made an agreement to create a cloud-native mobile network core to support both standalone and multi-tenant networks. This will allow them to meet the high bandwidth requirements of consumers and enterprises.

Network Architecture Analysis

The global 5G infrastructure market was dominated by the non-standalone (NSA), network architecture. This is due in part to the global rollout of non-standalone networks. The non-standalone LTE network is usually deployed as part of the existing LTE infrastructure. Several top service providers like AT&T and Verizon Communication have developed a 5G NSA model for basic use, such as cloud-based AR/VR games and UHD videos.

Globally, the rapidly expanding industrial digitalization has created a new revenue stream to service providers. In order to maintain uninterrupted connectivity between devices, it is becoming more important to have high-frequency connectivity that is reliable and low in latency. In the transportation and logistics sector, there will be a growing demand for 5G infrastructure with minimum latency. The standalone segment’s growth is expected to be boosted by the rising demand for faster data speeds.

Vertical Analysis

The enterprise/corporate held a significant revenue share in 2021. This is due to the increasing demand for faster bandwidth, which can be used for seamless connectivity during cloud computing and for creating a smart workspace by offering enhanced connectivity to IoT devices.

5G infrastructure is being deployed in residential and consumer areas to facilitate seamless connectivity for smart home applications, Virtual Reality games, and other applications. The growth of the industrial sector is expected to be driven by the increasing demand for continuous communication among industrial applications. These industrial applications also include wireless cameras, autonomous guided vehicles (AGVs), cloud robots, and cloud/collaborative robotics.

Due to the urgent need to communicate quickly with first responders in emergency situations, 5G infrastructure is being deployed more widely across government and public safety agencies. Due to the ongoing pandemic, demand for next-generation high-speed networks is expected to increase, especially for healthcare applications. The demand for digital services, including telemedicine or remote patient monitoring, will not decrease even after the pandemic is over. This will ensure robust market growth.

High-speed internet connectivity is a growing requirement across all energy production and distribution applications. This will drive tremendous growth in the utility and energy sectors. In order to improve connectivity between containers/vessels, ships, and remote locations for effective monitoring, 5G technology will be a major driver in the transport and logistics sector.Key Market Segments:

By Component

- Services

- Hardware

By Network Architecture

- Standalone

- Non-standalone

By Vertical

- Residential

- Enterprise/Corporate

- Energy & Utility

- Transportation & Logistics

- Other Verticals

Market Dynamics:

Healthcare, particularly in developed countries, is now emphasizing remote diagnosis and surgeries for patients. The market for 5G infrastructure and next-generation technology is expected to grow in order to ensure remote patient surgeries are conducted with continuous data connectivity.

5G technology is expected to provide an improved user experience for a number of use cases, such as seamless video calling and Ultra-High Definition video (UHD) video. Multiple manufacturing plants are working together to implement technological changes in order to remain competitive in an increasingly competitive marketplace.

During the forecast period, the 5G infrastructure deployment will be boosted by the continuing emphasis on improving energy monitoring, management, and the need to have better control over distribution networks and energy generation. Because of the interruptions in trials and testing necessary to confirm the stability of 5G standalone networks and their processing performance, it is likely that the implementation of the 5G infrastructure will be delayed by the COVID-19 outbreak. Additional effects of the ongoing pandemic include the postponement by telecom regulatory authorities of their plans to auction the 5G spectrum, which adversely affected the market growth.

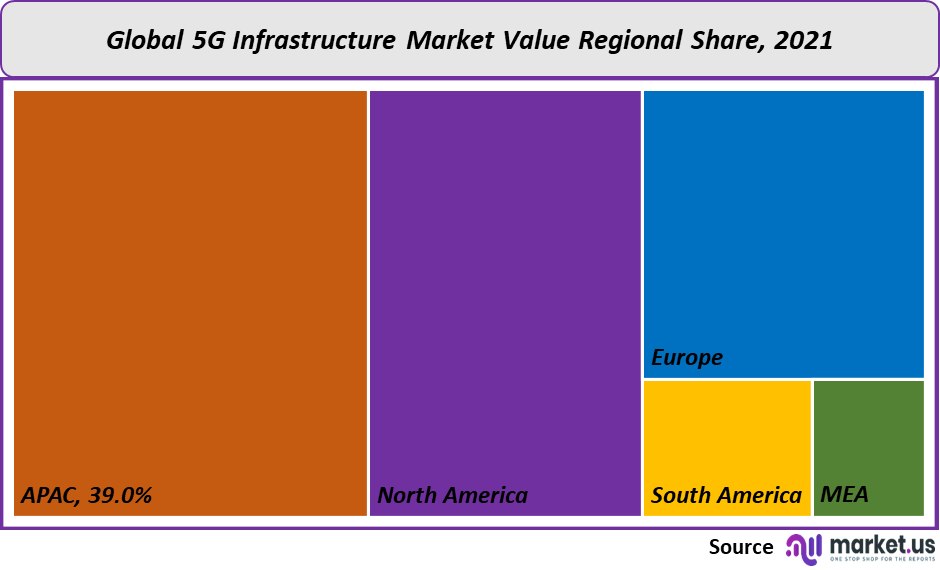

Regional Analysis:

The Asia Pacific dominated the market, with 39% of the total in 2021. This is due to the aggressive deployment by the major communication service providers of 5G New Radio Infrastructure. The market for the region is expected to grow strongly during the forecast period.

Large service providers like AT&T Inc. Sprint Corporation and T-Mobile are expected to increase the U.S. Market’s growth over the forecast period. It is expected that the number of investments made by the companies to deploy 5G infrastructure will boost the regional market growth. T-Mobile and Ericsson signed a US$3.5 billion agreement to support their 5G network infrastructure. Ericsson will provide hardware and software for 5G New Radio to T-Mobile in this agreement. T-Mobile can now offer high-speed Internet. The rising demand for high-speed internet to create autonomous factories will also increase the use of next-generation infrastructure.

Key Regions and Countries covered іn thе rероrt:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

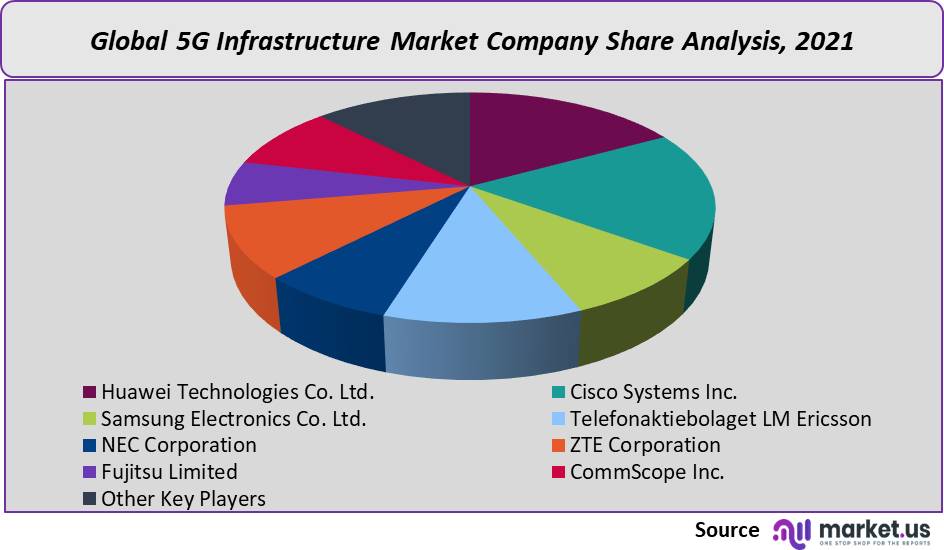

Market Share & Key Players Analysis:

In order to develop next-generation network infrastructure and get an early advantage, key players are seeking strategic partnerships with service provider partners. Telesat joined forces with ENCQOR 5G for pilots, trials, and demonstrations of 5G connectivity. These pilots were especially beneficial to rural industries in Canada.

Ericsson formed a partnership with Erillisverkot Group to provide 5G core network hardware solutions to mission-critical applications. The network’s next generation is expected to become operational in the middle of 2021.

Маrkеt Кеу Рlауеrѕ:

- Huawei Technologies Co. Ltd.

- Cisco Systems Inc.

- Samsung Electronics Co. Ltd.

- Telefonaktiebolaget LM Ericsson

- NEC Corporation

- ZTE Corporation

- Fujitsu Limited

- CommScope Inc.

- Other Key Players

For the 5G Infrastructure Market research study, the following years have been considered to estimate the market size:

Particular Scope Region - North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Historic Year 2013 to 2018 Estimated Year 2019 Forecast Year 2020 to 2027 Frequently Asked Questions (FAQ)

Q: What is the size of the 5G Infrastructure market in 2021?The 5G Infrastructure market size is US$ 4,589 million in 2021.

Q: What is the projected CAGR at which the 5G Infrastructure market is expected to grow at?The 5G Infrastructure market is expected to grow at a CAGR of 52% (2023-2032).

Q: List the segments encompassed in this report on the 5G Infrastructure market?Market.US has segmented the 5G Infrastructure market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Component, the market has been segmented into Services and Hardware. By Network Architecture, the market has been further divided into Standalone and Non-standalone. By Vertical, the market has been further divided into Residential, Enterprise/Corporate, Energy & Utility, Transportation & Logistics, and Other Verticals.

Q: List the key industry players of the 5G Infrastructure market?Huawei Technologies Co. Ltd., Cisco Systems Inc., Samsung Electronics Co. Ltd., Telefonaktiebolaget LM Ericsson, NEC Corporation, ZTE Corporation, Fujitsu Limited, CommScope Inc., and Other Key Players are engaged in the 5G Infrastructure market

Q: Which region is more appealing for vendors employed in the 5G Infrastructure market?APAC is expected to account for the highest revenue share of 39%. Therefore, the 5G Infrastructure industry in APAC is expected to garner significant business opportunities over the forecast period.

Q: Name the key areas of business for 5G Infrastructure?The US, India, China, Canada, UK, Japan, & Germany are key areas of operation for the 5G Infrastructure Market.

Q: Which segment accounts for the greatest market share in the 5G Infrastructure industry?With respect to the 5G Infrastructure industry, vendors can expect to leverage greater prospective business opportunities through the RFID segment, as this area of interest accounts for the largest market share.

![5G Infrastructure Market 5G Infrastructure Market]()

- Huawei Technologies Co. Ltd.

- Cisco Systems Inc.

- Samsung Electronics Co. Ltd.

- Telefonaktiebolaget LM Ericsson

- NEC Corporation

- ZTE Corporation

- Fujitsu Limited

- CommScope Inc.

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |