Global Active Electronic Components Market By Product Type (Semiconductor Devices, Transistors, Diodes, and Other Product Types), By End-User (Consumer Electronics, Automotive, Networking & Telecommunication, and Other End-Users), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Dec 2021

- Report ID: 65145

- Number of Pages: 322

- Format:

- keyboard_arrow_up

Active Electronic Components Market Overview:

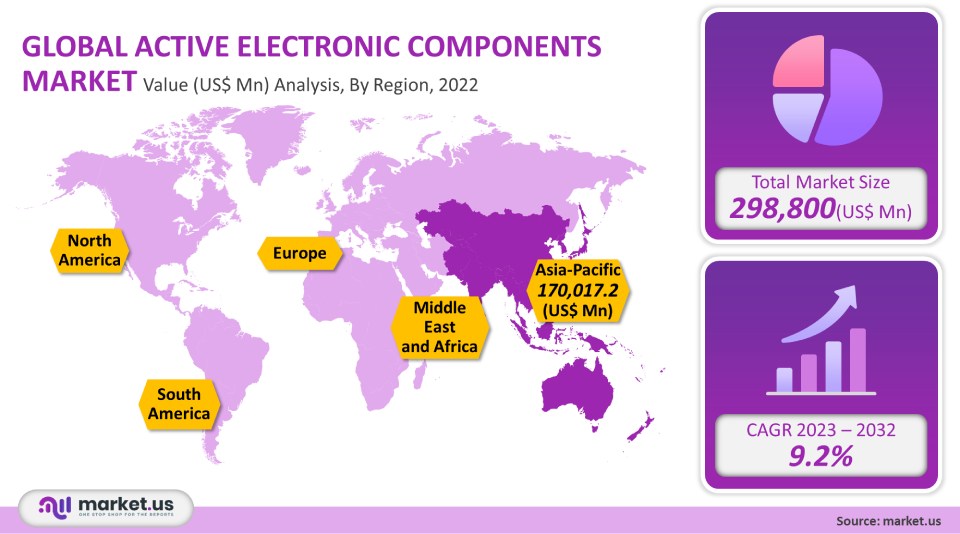

Global active electronic components market was valued at USD 298,800 million in 2021. It is expected to increase at a CAGR of 9.2% between 2022 and 2032.

The major driving factor in the market is the rapidly increasing demand for consumer electronics devices such as smartphones or laptops. The essential components of telecom equipment, and other networking devices, are active electronic components. They require an energy source to complete their assigned tasks. Telecom operators in emerging countries like India have been able to implement next-generation 5G network infrastructure because of the growing demand for bandwidth and low latency. This will increase product adoption and boost the demand for IT and telecom equipment.

Global Active Electronic Components Market Scope:

Product Type Analysis

The semiconductor devices segment had the highest revenue share at 61.3% in 2021 and will continue to grow at the fastest CAGR between 2023 and 2032. This segment’s growth can be attributed to the widespread adoption of semiconductor devices in a variety of applications, including home appliances, mobile phones, and network equipment. The prevailing trend towards miniaturization and the development of energy-efficient systems have had a positive effect on the demand for semiconductor components and related parts.

Smartphones have seen a huge rise in demand over the last few years, particularly in emerging economies. With the introduction of 5 G-enabled smartphones and the growing demand for telecom equipment and car automation systems, the demand for 5G chipsets has been steadily increasing in developed countries. The increasing production of 5G chipsets suggests that the IC segment will experience strong growth over the forecast period. The IC segment will experience a surge in product demand due to the increasing investments made by market players like Intel Corporation and Infineon Technologies AG in high-processing microchips.

End-user Analysis:

In 2021, the consumer electronics segment accounted for more than 33.8% of the global market’s revenue. This segment is forecast to grow at a faster CAGR of over 9.8% during the forecast period. This is due to the growing demand for semiconductor devices in various consumer devices such as smartphones, digital cameras and set-top boxes (STB), mobile devices, gaming devices, etc. In particular, in residential and office automation segments, there is a growing demand for networking devices such as modems and repeaters. The demand for IT hardware and network devices is increasing, which will lead to an increase in the use of active electronics components.

Popular OEMs, including Waymo, Ford Motor Company, Tesla, Inc., and Volkswagen Group, are deploying autonomous systems into their new vehicles due to rising consumer interest in these vehicles. These systems are expected to drive up automotive product consumption. The adoption of connected technology for remote patient monitoring, in conjunction with the increased demand for medical equipment, is expected to increase product usage in this segment.

Кеу Маrkеt Ѕеgmеntѕ:

By Product Type

- Semiconductor Devices

- Transistors

- Diodes

- Other Product Types

By End-User

- Consumer Electronics

- Automotive

- Networking & Telecommunication

- Other End-Users

Market Dynamics:

The global COVID-19 pandemic had a significant impact on passive and interconnecting electronics components manufacturing industries. Many COVID-19 cases were reported in countries such as China, Germany, and the U.S. as well as South Korea. This forced government to place restrictions such as locking down cities that are most affected, closing international borders to trade and allowing employees to work from home. The temporary closure of international borders and production facilities caused a significant drop in exports and production of electronic components. This had a major impact on overall market growth for Q1 and Q2 2020.

The automotive industry is becoming more automated. This has led to a greater demand for electronic devices such as driver assistance systems and DC to AC converters. These devices are also used in telematics and Global Positioning Systems (GPS). These devices are used extensively in Electric Vehicles and autonomous cars. Accordingly, electric car adoption is expected to grow over the forecast period due to the increasing demand. The manufacturing industry is changing rapidly with the advent of connected technology.

Manufacturing facilities can increase productivity and operational efficiency through the use of connected devices. They also make it easier to operate and reduce downtime. Many manufacturing companies have begun to embrace digitalization as a way to improve their operations through remote monitoring. Market growth is expected to be driven by the increasing deployment of connected devices in manufacturing facilities.

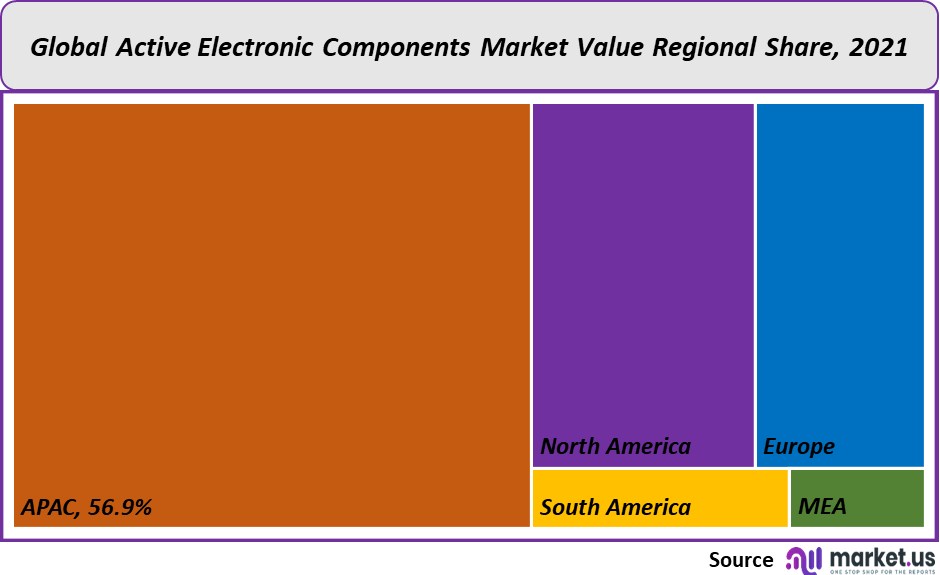

Regional Analysis:

Asia Pacific had the largest revenue share at over 56.9% in 2021 and will likely experience the fastest CAGR between 2023-2032. APAC’s market growth is due to the large consumer electronics industry in the region. It houses some of the world’s most prominent consumer electronics companies, including Samsung Electronics Co. Ltd., BBK Electronics (including brands like Oppo, Realme, and Vivo), as well as BBK electronics. In emerging countries like India, China, and South Africa, there is a significant increase in demand for industrial automation systems such as Supervisory Control and Data Acquisition and Programmable Logic Controllers. This will increase the region’s product demand.

North America will be the second-largest regional market in the next few years. Due to the growing popularity of connected cars in America, major telecom companies, like Verizon Inc. and AT&T Inc. are investing large amounts in 5G network infrastructure. The next-generation 5G mobile network will provide seamless connectivity for vehicles connected to infrastructures throughout the country. The U.S. government has also invested heavily in the development of smart cities throughout the country. The 5G network infrastructure deployment is expected to drive market growth by increasing the number of installations of telecom equipment and another networking device.

Key Regions and Countries covered іn thе rероrt:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Market Share & Key Players Analysis:

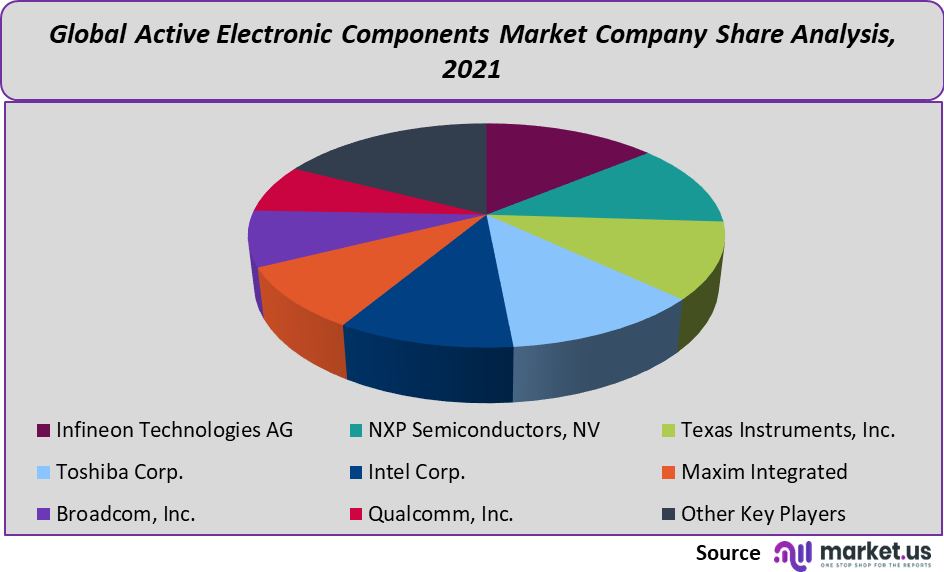

To gain significant market share and increase their profitability, key players are keen to launch new products. NXP Semiconductors N.V. launched a secure, fine-ranging chipset called SR100T in 2019. This chipset was designed to deliver high-quality positioning performance on next-generation Ultra-Wide Band (UWB-enabled) mobile devices. Some players are now focusing on mergers or acquisitions to increase their market share. Infineon Technologies AG purchased Cypress Semiconductor Corp. in 2019 to expand its product range and strengthen its market position. The following are some of the most prominent players in active electronic components markets worldwide:

Маrkеt Кеу Рlауеrѕ:

- Infineon Technologies AG

- NXP Semiconductors, NV

- Texas Instruments, Inc.

- Toshiba Corp.

- Intel Corp.

- Maxim Integrated

- Broadcom, Inc.

- Qualcomm, Inc.

- Analog Devices, Inc.

- Advanced Micro Devices

- Microchip Technology, Inc.

- Monolithic Power Systems, Inc.

- Other Key Players

For the Active Electronic Components Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

Q: What is the size of the active electronic components market in 2021?The Active electronic components market size is US$ 298,800 million in 2021.

Q: What is the projected CAGR at which the Active electronic components market is expected to grow at?The Active electronic components market is expected to grow at a CAGR of 9.2% (2023-2032).

Q: List the segments encompassed in this report on the Active electronic components market?Market.US has segmented the Active electronic components market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Product Type, the market has been segmented into Semiconductor Devices, Diodes, Transistors, and Other Product Types. By End-User, the market has been further divided into Consumer Electronics, Networking & Telecommunication, Automotive, and Other End-Users.

Q: List the key industry players of the Active electronic components market?Infineon Technologies AG, NXP Semiconductors, NV, Texas Instruments, Inc., Toshiba Corp., Intel Corp., Maxim Integrated, Broadcom, Inc., Qualcomm, Inc., and Other Key Players engaged in the Active Electronic Components market.

Q: Which region is more appealing for vendors employed in the Active electronic components market?APAC is expected to account for the highest revenue share of 56.9%. Therefore, the Active electronic components industry in APAC is expected to garner significant business opportunities over the forecast period.

Q: Name the key areas of business for Active electronic components?India, China, The US, Canada, UK, Japan, & Germany are key areas of operation for the Active electronic components Market.

Q: Which segment accounts for the greatest market share in the Active electronic components industry?With respect to the Active electronic components industry, vendors can expect to leverage greater prospective business opportunities through the semiconductor segment, as this area of interest accounts for the largest market share.

![Active Electronic Components Market Active Electronic Components Market]() Active Electronic Components MarketPublished date: Dec 2021add_shopping_cartBuy Now get_appDownload Sample

Active Electronic Components MarketPublished date: Dec 2021add_shopping_cartBuy Now get_appDownload Sample - Infineon Technologies AG

- NXP Semiconductors, NV

- Texas Instruments, Inc.

- Toshiba Corp.

- Intel Corp.

- Maxim Integrated

- Broadcom, Inc.

- Qualcomm, Inc.

- Analog Devices, Inc.

- Advanced Micro Devices

- Microchip Technology, Inc.

- Monolithic Power Systems, Inc.

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |