Global Active Pharmaceutical Ingredient Market By Type of Synthesis, By API Type, By Type of Manufacturer, By Application By Region and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022–2032

- Published date: Apr 2022

- Report ID: 22857

- Number of Pages: 354

- Format:

- keyboard_arrow_up

Active Pharmaceutical Ingredients Market Overview:

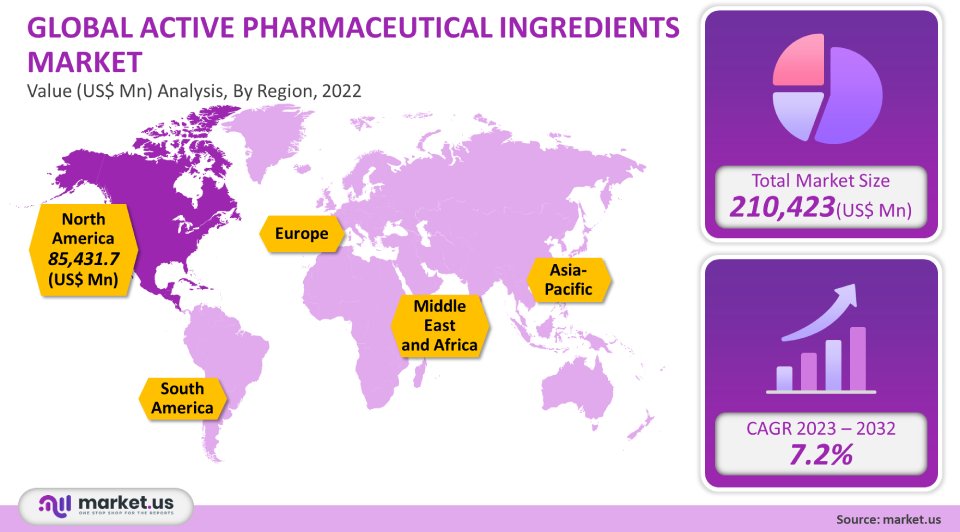

The Active Pharmaceutical Ingredient Market is projected to reach a valuation of USD 359.13 Bn by 2032 at a compound annual growth rate (CAGR) of 6.8%, from USD 174.17 Bn in 2021 during 2022-32.

This growth rate is due to advancements in active pharmaceutical ingredients (API) manufacturing as well as the increasing prevalence of chronic infectious

cardiovascular diseases such as cancer and cardiovascular disease. As per the U.S.FDA,158 drug patents approximately expire in 2021, the largest market share outlook analysis opportunity for generic pharmaceuticals.

In 2020 the largest revenue share of 40.5% dominated the API CDMO market and accounted for the traditional active pharmaceutical ingredient segment. The Competitive landscape analyses the competitive strategic window. CDMO market is the new trend of application in active pharmaceutical ingredients. Biopharmaceutical industries are the largest investments in biotechnology.

Global Active Pharmaceutical Ingredients Market Scope:

Types of Manufacturer Analysis

In 2021, the captive API commercial segment’s largest revenue market report share was 60.7%. Due to easy access to raw materials and large investments made by major key players in high-end manufacturing facilities, it is expected to grow significantly over the next years. Recent developments and initiatives by major key players indicate that they focus more on in-house manufacturing than outsourcing. Novartis, for example, announced in 2019 the acquisition of a France-based CDMO, Cell for Cure to produce molecules in-house. Cell for Cure was previously a contract manufacturing organization to Cell for Cure. CDMO market is the new trend of application in active pharmaceutical ingredients.

Outsourcing is booming thanks to top biopharmaceutical companies. Players looking to outsource API production are attracted by the low manufacturing cost in China and India. This cost-effective option allows biotech companies to increase their profits and accelerate the commercial segment growth rate by outsourcing manufacturing to developing nations. The Competitive landscape analyses the competitive strategic window.

Type Analysis

In 2021, innovative APIs accounted for 67.9% of the market. This is due to government regulations and increasing R&D efforts for novel drug development. Many innovative product segment features have been developed as a result of extensive research and will be launched in the forecast period. New entrants will drive the market growth rate.

Personalized medicines will be more in demand as a result of the rising impact of demand for high-potency sources of API compounds such as HPAPI. ADCs, for example, leverage the specificity and ability of antibody-drug conjugate product segments to kill cancer cells. These cells attach themselves to the antibody using linker advanced technology trends. These advanced ADCs will drive this market, and most pharmaceutical and biotechnology companies are pursuing such programs.

Generic API drugs have significantly increased in popularity due to their patent expiry. Due to the acceptance of OTC medications and high unmet clinical trial needs, the generic drug market size in India and Brazil is expected to grow rapidly.Types of Synthesis Analysis

In 2021, the synthetic ingredients segment API commercial segment growth rate was responsible for 71.8% of the total largest revenue market share outlook Analysis. This can be attributed to easier protocols and the higher availability of raw materials for synthesizing these molecules. In the next few years, many synthetic ingredients segment molecules will be granted patent landscape. This is expected to increase steady growth rate opportunities.

The biotech segment is forecast to grow at 6.7% CAGR during the forecast period. This is due to factors like the increased impact of demand for biopharmaceuticals as well as the improved molecular efficiency of these molecules. The biotech segment sector’s annual growth rate can also be attributed to high investments in biotechnology and biopharmaceutical. This allows for the development of new molecules to aid in the treatment and prevention of infectious chronic infectious diseases like cancer.

Recombinant protein is widely used in gene sequencing, particularly to create antibodies within cells. Recombinant proteins are used extensively in targeted therapies. These proteins are crucial in developing and applying new treatments such as cell therapy. Investors are making investments in protein manufacturing plants. There are only a few players in this field, meaning there is an insufficient steady supply chain to meet current and future advanced technology snapshot needs.

Application Analysis

In 2021, the largest revenue market share Analysis from cardiovascular chronic diseases accounted for 21.1%. This is due in part to the rising prevalence of targeting infectious diseases all over the globe. Two of the many organizations working to raise awareness about cardiovascular disease are the World Heart Federation (WHO) and World Stroke Organization (WSO). The National Cholesterol Educational Program, a government initiative, aims to increase awareness about cholesterol-related chronic diseases. Due to the increasing prevalence of cardiovascular disease and increased awareness, this commercial synthetic segment will continue growing. This will lead to an increase in demand for APIs that treat cardiology drugs during the forecast period.

The forecast period will see an increase in the number of oncologists at more than 9.1%. Changes in lifestyles and an increase in cancer incidence are two of the Current market forces. Metabolic disorders are becoming more common due to sedentary lifestyles. In most countries, hormonal imbalance is a major market player problem. These disorders may include thyroid problems and sex hormone imbalance. Hypothyroidism can be treated with Levothyroxine, a well-known API. There are many options available for hormonal therapy. This therapy can be used to help women who are pregnant or men who have just finished cancer treatment. It can also be used to promote a proper annual growth rate in children. The market growth rate is expected to be driven by hormone-dependent aging issues.

Кеу Маrkеt Ѕеgmеntѕ:

By Type of Synthesis

- Synthetic Segment

- Biotech Segment

- Vaccines

- Recombinant Proteins

- Monoclonal Antibodies

By Type

- Innovative APIs

- Generic APIs

By Type of Manufacturer

- Captive APIs

- Merchant APIs

By Application

- Oncology Segment

- Cardiovascular Diseases

- Ophthalmology

- CNS and Neurology

- Other Applications

Market Dynamics:

The global APIs market was positively affected by the COVID-19 pandemic. The pharmaceutical industry was a major market player.

of treatment for COVID-19 symptoms, such as high fever, cough, cold, and high fever. The active pharmaceutical ingredients market saw growth due to the popularity of the pharma sector during the pandemic. A variety of well-respected pharmaceutical and biopharmaceutical firms, along with new startups, came forward to develop therapies to fight the virus after the World Health Organization declared the COVID-19 pandemic an outbreak.

High capital is required for the production of APIs. This is due to the need for extremely detailed protocols. Therefore, outsourcing various APIs is possible. Pharmaceutical companies also benefit from outsourcing API production because it eliminates the need to invest in expensive manufacturing capacity units and the labor force. Outsourcing is, therefore, more cost-efficient. Companies can outsource strategically to increase their productivity by focusing on core competencies.

Market growth is supported by favorable government policies and changes in geopolitical circumstances. Due to COVID-19’s impact on steady supply chain disruption, the supply of the API market is experiencing huge changes. Due to geopolitical circumstances and the desire to decrease China’s dependence on API products segment feature, India is preferred to China in exporting API. Many countries have also developed plans to encourage the production of API and given incentives.

Highly Potent Active Medicinal Ingredients (HPAPIs) are a sign of a significant shift in the way pharmaceutical companies use small molecules to develop new medicines. A new pipeline of drugs that are more effective and require lower doses of HPAPIs has been created. The rising demand for HPAPIs can be attributed to their competitive advantages. They require a lower therapeutic dosage, have the ability to bind to specific receptors, and are highly efficient. Small molecules have always dominated the supply of the API market. The application segment of the action is the leading in oncology.

Regional Analysis:

North America had a 40.6% largest revenue market share analysis in 2021, and it is expected to continue its lead during the forecast period. This is due to rising exchange rates of cancer and other lifestyle-induced illnesses, which stimulates Pharmaceutical R&D Investment and thereby boosts the market.

Asia Pacific will experience the fastest CAGR at 8.4% over the forecast period. The Asia Pacific is fortunate to have economies like India and China that can produce APIs at lower costs. The market size is expected to grow due to rising healthcare spending in the product segment by region.

Europe is forecast to experience significant growth over the forecast period. The market size will be driven by an increase in research funding and the local presence of key players and market participants in the commercial segment by region. Due to increased investments, the number of European companies in the pharmaceutical fortune business rapid expansions is increasing.

Key Regions and Countries covered іn thе rероrt:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Market Share & Key Players Analysis:

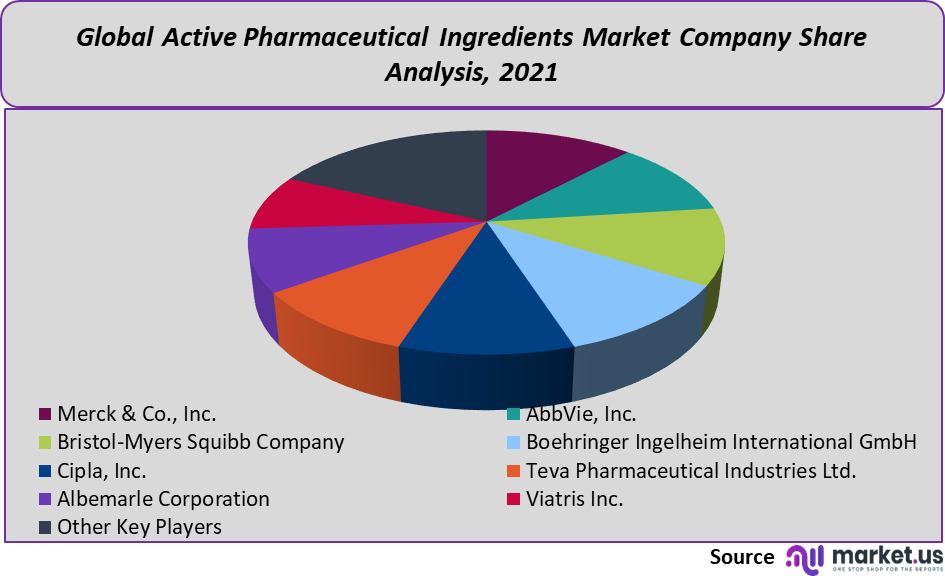

High complexity is the market for highly potent active pharmaceutical ingredients. The market for active Teva pharmaceutical ingredients is complex. There will be a blockbuster drug patent expiration and increased outsourcing activities due to high manufacturing costs. Stringent regulations regarding the production of APIs will also help to keep the level of competition high during the forecast period.

To maintain their market size position, many key advantage players are focused on the launch of new product segment features. Teva pharmaceutical companies and MEDinCell were approved by the U.S FDA in 2021 for a new medication to treat schizophrenia. Legal issues also slow down the establishment of new sources of API facilities. In 2020, for example, Dr. Reddy’s Laboratories as well as Eli Lilly and Company had to deal with problems with the U.S. FDA regarding their API plants. Because of the capital requirements, it is hard to enter the market without being a major player. The following are some of the most prominent key advantages players in the global highly potent active pharmaceutical ingredient

Маrkеt Кеу Рlауеrѕ:

- Merck & Co., Inc.

- AbbVie, Inc.

- Bristol-Myers Squibb Company

- Boehringer Ingelheim International GmbH

- Cipla, Inc.

- Teva Pharmaceutical Industries Ltd.

- Albemarle Corporation

- Viatris Inc.

- Other Key Players

For the Active Pharmaceutical Ingredients Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

What is the size of the active pharmaceutical ingredients market in 2021?The Active pharmaceutical ingredients market size is US$ 210,423 million in 2021.

What is the projected CAGR at which the Active pharmaceutical ingredients market is expected to grow at?The Active pharmaceutical ingredients market is expected to grow at a CAGR of 7.2% (2023-2032).

List the segments encompassed in this report on the Active pharmaceutical ingredients market?Market.US has segmented the Active pharmaceutical ingredients market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Type of Synthesis, the market has been segmented into Synthetic and Biotech. By Type of Manufacturer, the market has been further divided into Captive APIs and Merchant APIs. By Type, the market has been further divided into Innovative APIs and Generic APIs. By application, the market has been further divided into Cardiovascular Diseases, Ophthalmology, CNS and Neurology, Oncology, and Other Applications.

List the key industry players of the Active pharmaceutical ingredients market?Merck & Co., Inc., AbbVie, Inc., Bristol-Myers Squibb Company, Boehringer Ingelheim International GmbH, Cipla, Inc., Teva Pharmaceutical Industries Ltd., Albemarle Corporation, Viatris Inc., and Other Key Players engaged in the Active Pharmaceutical Ingredients Market.

Which region is more appealing for vendors employed in the Active pharmaceutical ingredients market?North America is expected to account for the highest revenue share of 40.6%. Therefore, the Active pharmaceutical ingredients industry in North America is expected to garner significant business opportunities over the forecast period.

Name the key areas of business for Active pharmaceutical ingredients?The US, Canada, UK, India, China, Japan, & Germany are key areas of operation for the Active pharmaceutical ingredients Market.

Which segment accounts for the greatest market share in the active pharmaceutical ingredients industry?With respect to the Active pharmaceutical ingredients industry, vendors can expect to leverage greater prospective business opportunities through the innovative APIs segment, as this area of interest accounts for the largest market share.

![Active Pharmaceutical Ingredient Market Active Pharmaceutical Ingredient Market]() Active Pharmaceutical Ingredient MarketPublished date: Apr 2022add_shopping_cartBuy Now get_appDownload Sample

Active Pharmaceutical Ingredient MarketPublished date: Apr 2022add_shopping_cartBuy Now get_appDownload Sample - Merck & Co., Inc.

- AbbVie, Inc.

- Bristol-Myers Squibb Company

- Boehringer Ingelheim International GmbH

- Cipla, Inc.

- Teva Pharmaceutical Industries Ltd. Company Profile

- Albemarle Corporation Company Profile

- Viatris Inc.

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |