Global Adhesives and Sealants Market By Product (Silicone, Acrylic, Epoxy, Polyurethanes, and Other Products), By Application (Construction, Packaging, Consumers, Automotive, and Other Applications), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: May 2021

- Report ID: 22060

- Number of Pages: 257

- Format:

- keyboard_arrow_up

Adhesives and Sealants Market Overview:

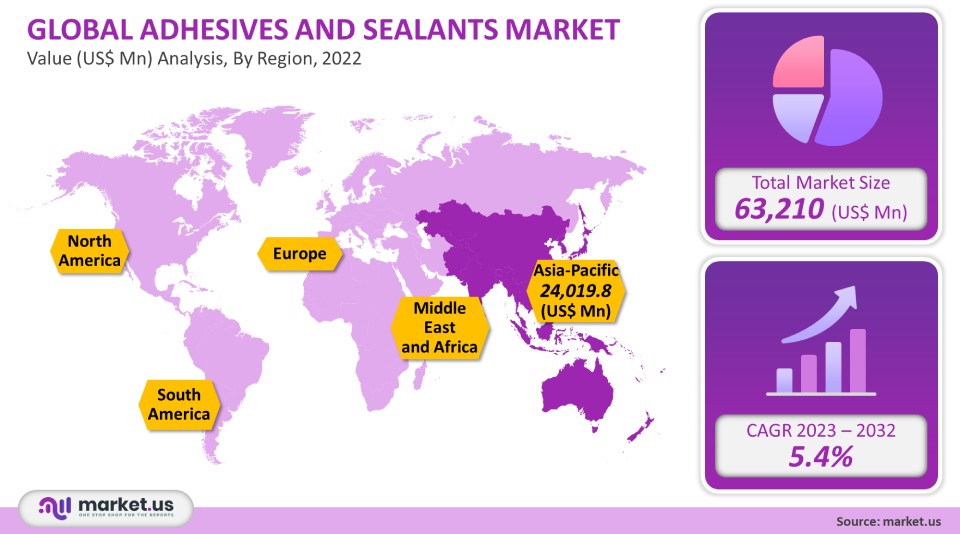

The market for Adhesives and Sealants in the world was valued at USD 63,210 million in 2021. This market is projected to experience a CAGR of 5.4% from 2023 through 2032.

Material consumption patterns are changing. Highly durable materials are replacing aluminum, metal, and paper. This will have an impact on packaging demand over the revenue forecast period.

Global Adhesives and Sealants Market Analysis:

Product Analysis

The silicone segment commanded the largest share in 2021. The segment is projected to grow due to increasing construction activities and investments in the infrastructure space. This segment will benefit from the construction of research facilities, chemical processing plants, museum concert halls, stadiums bridges, and medical buildings.

These polyurethane adhesive products have superior properties, such as high abrasion, quick curing, & chemical resistance, and excellent tensile strength to various substrates like rubber, plastic, metal, and wood. These products are often based on reactive technology and include polymers that contain urethane linkages. These materials are solid, have low viscosity, and require less time to cure the adhesive.

Epoxy-based products can adhere to a variety of materials. The nature of crosslinking polymers determines their superior properties. They offer high resistance to chemicals and environmental conditions, high-temperature resistance, and strong bonding on a wide range of substrates. These adhesives are generally made from reactive technology.

Application Analysis

The paper and packaging industry held a significant revenue share in 2021. Flexible packaging is expected to open new market opportunities for the largest market players in the future. The demand for packaging products was positively affected by the sudden increase in healthcare spending. In the year 2019 water-based technology led the adhesives market accounting for nearly 50% of the volume.

There are many market opportunities for the building and construction segment. This segment of the adhesives & sealants market growth in terms of revenue growth is seeing rapid technological & architectural innovations. In order to meet transitioning standards & specifications, airports and other transportation routes are being transformed.

The global market is expected to see a rise in demand for products that are used in the production of the electronics industry and electrical components. China is a world leader in producing electronic and electrical components. In the future, investments in emerging technologies like 5G or IoT will boost the Chinese electronics, construction industry, furniture industry, and automotive industries.

KEY MARKET SEGMENTATION:

By Product

- Silicone

- Acrylic

- Epoxy

- Polyurethanes

- Other Products

By Application

- Construction

- Packaging

- Consumers

- Automotive

- Other Applications

Market Dynamics:

In the U.S., there will be a steady demand for packaging products from food & beverages. This is also expected to be the main driver of the market. This is expected to lead to long-term market growth. At an estimated 5% CAGR, the U.S. adhesives market’s paper and packaging segment are expected to be the fastest-growing segment. This will occur between the forecast period 2023-2032. The increasing demand for bio-based products is expected to lead to an expansion of the paper and packaging segment.

The COVID-19 epidemic had an impact on adhesive and sealant product demand in the U.S. According to the government report, U.S. GDP decreased by 3.7% between 2019 and 2020 due to a decline in manufacturing output from end-use sectors such as building & Construction, the Automotive sector & Packaging, Transportation, and Consumer.

Regional Analysis:

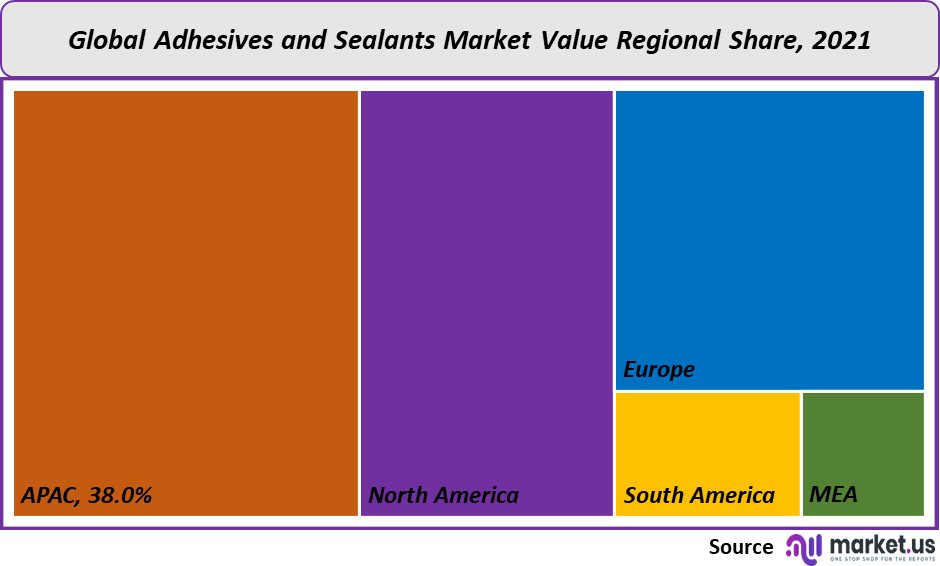

The Asia Pacific dominated this regional market size and held 38% of the global revenue’s largest share in 2021. The COVID-19 pandemic had a major impact on many industries including textile, packaging industry construction, and automotive. This also affected export trade. According to data from government agencies, India and China saw their textile trade decline over the past year.

The infrastructural growth in Central & South America is expected to be fueled by government-led initiatives for economic recovery. The forecast period is expected to see growth in the construction sector in Colombia, Peru, and Argentina. This will fuel demand for adhesives & glues in Central & South America. One example is the rise in construction and related activities in Peru, which can be attributed to the country’s economic growth factor.

3M Company is the Middle East’s key trend growth engine. Over the forecast period, the GCC region’s growing construction activity will likely fuel the demand for adhesives & sealants market share. GCC countries have had poor performance in the housing sector. This was due to the drop in oil prices, and the economic slowdown. However, the future performance of the construction industry will be boosted by investments in transport infrastructure, residential construction, and energy.

Key Regions and Countries covered іn thе rероrt:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Saudi Arabia

- Israel

- Rest of MEA

Market Share & Key Players Analysis:

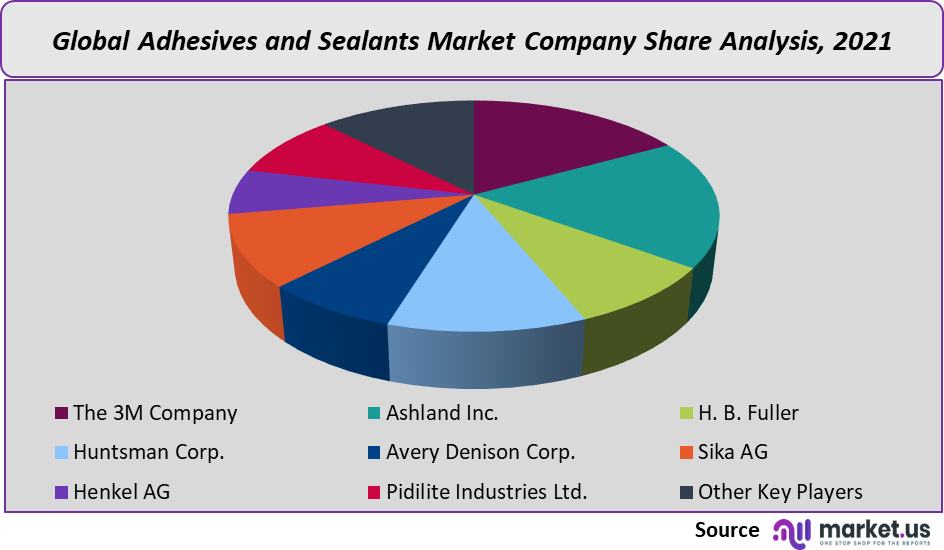

The presence of large and small producers in the global adhesives & sealing market is a key factor. They are both local and international. Diverse obstacles were encountered at different levels of the value chain, including shortages of raw materials & labor and the halting or resumption of industrial production.

Many companies suffered significant losses in 2020 as a result of low demand for adhesives. In addition, manufacturing operations in the end-use sectors were stopped by national lockdowns and other restrictions.

Маrkеt Кеу Рlауеrѕ:

- The 3M Company

- Ashland Inc.

- H.B. Fuller Company

- Huntsman International LLC

- Henkel AG & Co. KGaA

- Eastman Chemical Company

- LORD Corporation

- Arkema S.A.

- Avery Dennison Corporation

- RPM International Inc.

- Permabond LLC

- Sika AG

- Jowat SE

- Dow Inc.

- Wacker Chemie AG

- Pidilite Industries Ltd.

- Other major players

Frequently Asked Questions (FAQ)

Whаt іѕ thе ѕіzе оf thе Аdhеѕіvеѕ аnd Ѕеаlаntѕ mаrkеt іn 2021?Тhе Аdhеѕіvеѕ аnd Ѕеаlаntѕ mаrkеt ѕіzе іѕ UЅ$ 63,210 mіllіоn іn 2021.

Whаt іѕ thе рrојесtеd САGR аt whісh thе Аdhеѕіvеѕ аnd Ѕеаlаntѕ mаrkеt іѕ ехресtеd tо grоw аt?Тhе Аdhеѕіvеѕ аnd Ѕеаlаntѕ mаrkеt іѕ ехресtеd tо grоw аt а САGR оf 5.4% (2023-2032).

Lіѕt thе ѕеgmеntѕ еnсоmраѕѕеd іn thіѕ rероrt оn thе Аdhеѕіvеѕ аnd Ѕеаlаntѕ mаrkеt?Маrkеt.us hаѕ ѕеgmеntеd thе Аdhеѕіvеѕ аnd Ѕеаlаntѕ mаrkеt bу gеоgrарhіс (Nоrth Аmеrіса, Еurоре, АРАС, Ѕоuth Аmеrіса, аnd Міddlе Еаѕt аnd Аfrіса). Ву Рrоduсt, thе mаrkеt hаѕ bееn ѕеgmеntеd іntо Ѕіlісоnе, Асrуlіс, Ероху, Роlуurеthаnеѕ, аnd Оthеr Рrоduсtѕ. Ву Аррlісаtіоn, thе mаrkеt hаѕ bееn furthеr dіvіdеd іntо Соnѕtruсtіоn, Расkаgіng, Соnѕumеrѕ, Аutоmоtіvе, аnd Оthеr Аррlісаtіоnѕ.

Lіѕt thе kеу рlауеrѕ оf thе Аdhеѕіvеѕ аnd Ѕеаlаntѕ mаrkеt?Тhе 3М Соmраnу, Аѕhlаnd Іnс., H.B. Fuller Company, Huntsman Corporation, Eastman Chemical Company, Аvеrу Dеnіѕоn Соrр., Ѕіkа АG, Неnkеl АG, Wacker Chemie AG, Arkema Group, Ріdіlіtе Іnduѕtrіеѕ Ltd., аnd Оthеr major companies аrе еngаgеd іn thе Ѕmаrt Аntеnnа mаrkеt.

Whісh rеgіоn іѕ mоrе арреаlіng fоr vеndоrѕ еmрlоуеd іn thе Аdhеѕіvеѕ аnd Ѕеаlаntѕ mаrkеt?АРАС іѕ ехресtеd tо ассоunt fоr thе hіghеѕt rеvеnuе ѕhаrе оf 38%. Тhеrеfоrе, thе Аdhеѕіvеѕ аnd Ѕеаlаntѕ іnduѕtrу іn АРАС іѕ ехресtеd tо gаrnеr ѕіgnіfісаnt buѕіnеѕѕ орроrtunіtіеѕ оvеr thе fоrесаѕt реrіоd.

Nаmе thе kеу аrеаѕ оf buѕіnеѕѕ fоr Аdhеѕіvеѕ аnd Ѕеаlаntѕ?Тhе UЅ, Іndіа, Сhіnа, Саnаdа, UК, Јараn, & Gеrmаnу аrе kеу аrеаѕ оf ореrаtіоn fоr thе Аdhеѕіvеѕ аnd Ѕеаlаntѕ Маrkеt.

Whісh ѕеgmеnt ассоuntѕ fоr thе largest mаrkеt ѕhаrе іn thе Аdhеѕіvеѕ аnd Ѕеаlаntѕ іnduѕtrу?Wіth rеѕресt tо thе Аdhеѕіvеѕ аnd Ѕеаlаntѕ іnduѕtrу, vеndоrѕ саn ехресt tо lеvеrаgе grеаtеr рrоѕресtіvе buѕіnеѕѕ орроrtunіtіеѕ and provides a competitive landscape thrоugh thе Ѕіlісоnе ѕеgmеnt, аѕ thіѕ аrеа оf іntеrеѕt ассоuntѕ fоr thе lаrgеѕt mаrkеt ѕhаrе.

![Adhesives and Sealants Market Adhesives and Sealants Market]() Adhesives and Sealants MarketPublished date: May 2021add_shopping_cartBuy Now get_appDownload Sample

Adhesives and Sealants MarketPublished date: May 2021add_shopping_cartBuy Now get_appDownload Sample - The 3M Company

- Ashland Inc.

- H.B. Fuller Company

- Huntsman International LLC

- Henkel AG & Co. KGaA

- Eastman Chemical Company

- LORD Corporation

- Arkema S.A.

- Avery Dennison Corporation

- RPM International Inc. Company Profile

- Permabond LLC

- Sika AG

- Jowat SE

- Dow Inc.

- Wacker Chemie AG

- Pidilite Industries Ltd.

- Other major players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |