Global Advanced Analytics Market By Type (Big Data Analytics, Risk Analytics, Customer Analytics, Business Analytics, and Others Types), By Deployment Mode (Cloud and On-premise), By End-Use (BFSI, IT & Telecom, Healthcare, Military & Defense, and Other End-Uses), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Sep 2021

- Report ID: 26730

- Number of Pages: 289

- Format:

- keyboard_arrow_up

Advanced Analytics Market Overview:

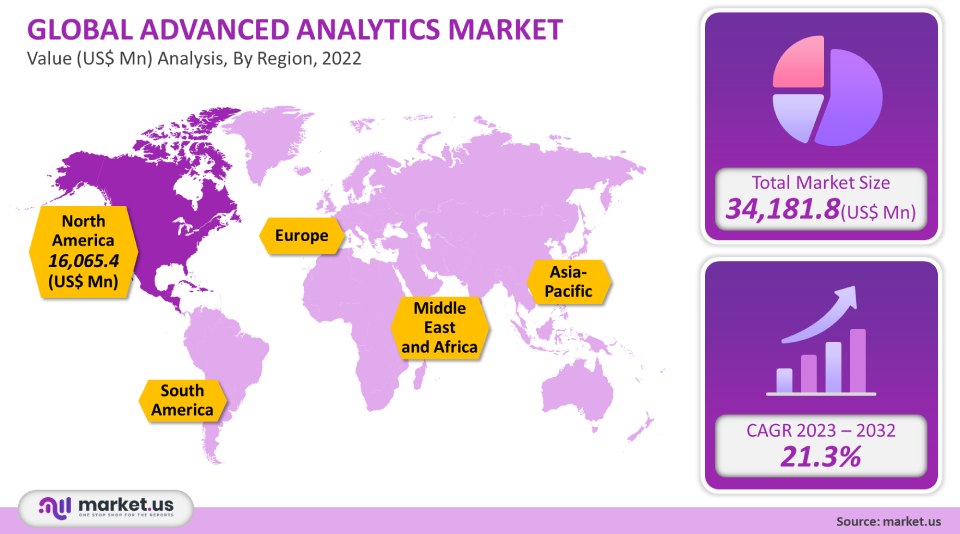

The global advanced analytics market was worth USD 34,181.8 million in 2021. This market will continue to grow at a CAGR, of 21.3% between 2022-2023.

The main factors driving the market growth are the development of artificial intelligence (AI), machine learning, to deliver personalized customer experiences, the growing popularity of online shopping, as well as the increased penetration of social networking platforms.

Global Advanced Analytics Market Analysis:

Type Analysis

Big data analytics accounted for 38% of the global market in 2021. This is due to the increasing use of social media platforms and the increase in virtual offices that can produce large volumes of data. SaaS-based big analytics makes automation much easier. Advanced analytical models can also be built using a self-service model. Cloud technology has been a hot topic in big data services, allowing them to invest more and get a competitive edge.

A notable CAGR is expected for the customer analytics sector at 21.1%. This is in keeping with the growing demand for better lead management, customer retention, and customer experience management. In the retail industry, customer analytics is used extensively to build personalized communications and marketing programs.

The segment has seen a rise in demand for an Omni channel experience by customers in the retail sector. Amazon and Walmart have both been successful in leveraging the social media benefits of various platforms such as YouTube and Facebook. It is expected that the segment will grow because of the increased focus on Omni channel services by increasing numbers of retail companies.

Deployment Mode Analysis

In 2021, the on-premise segment held a significant revenue share. On-premise deployments allow organizations greater flexibility and control to tailor their IT infrastructure. It also helps reduce internet dependency and protects business data against potential frauds and losses. These benefits will encourage large companies to opt for on-premise deployment.

Due to increasing concerns about frauds, such as account takeovers or new account frauds, many organizations in the BFSI sector prefer an on-premise model. These frauds are less likely to occur in organizations using the on-premise format, which is good news for segment growth.

The cloud segment will experience significant growth during the forecast period. Cloud solutions are expected to be in high demand because of the increasing penetration of Internet-of-Things and Cloud Computing. Advanced cloud analytics solutions are continuing to impact how organizations organize, use, and manage the data generated through their digital channels.

International Business Machines Corporation and Microsoft Corporation have been working together to develop customized solutions that will help companies make multi-cloud migrations easier. Microsoft Corporation offers, for instance, its big data analysis software through the Microsoft Azure service.

End-Use Analysis

BFSI accounted for a high revenue share in 2021. The continued adoption of advanced analytics, which can optimize processes, identify fraud, and handle data risks, has contributed to segment growth. In addition, the segment will see growth due to the increasing use of BI software, which allows for constant access to client databases, and secure transactions, as well as enhances the client experience. These solutions help financial institutions ensure greater operational efficiency, enhanced customer experiences, and unstructured data compliance.

In 2021, IT & telecom accounted for a moderate revenue share. The growing demand for collaboration tools, such as video conferencing or web conferencing, is responsible for the segment’s expansion. This sector is also using advanced analytical tools to prevent fraud like illegal access, authorization, cloning, and so on.

Telecom companies can also use big data analytics to create micro-segments that are specific to the customers they serve. This will allow them to personalize their offerings based on each customer’s needs, and to determine which customers are the most valuable.

Key Market Segments:

By Type

- Big Data Analytics

- Risk Analytics

- Customer Analytics

- Business Analytics

- Others Types

By Deployment Mode

- Cloud

- On-premise

By End-Use

- BFSI

- IT & Telecom

- Healthcare

- Military & Defense

- Other End-Uses

Market Dynamics:

Many companies used advanced analytics and AI to manage large, complex supply chains and interact with customers during the COVID-19 pandemic. The pandemic has increased the adoption of advanced technologies, such as data mining and artificial neural networks, across many businesses.

Businesses have been generating an exponential growth in data over the past few years. Numerous businesses draw Analysis from the collected data to make more accurate, better, and fact-based business decisions. This has resulted in a growing demand for advanced analytics for data management and strategic decision-making.

Additionally, big data developments have improved the assessment capabilities of data science professionals. Big data analytics can be used by enterprises to improve business processes, functions, and objectives. This allows organizations to meet stakeholder needs, manage data volumes and manage risks, increase administrative performance, improve process controls, and turn information into intelligence.

Market growth will be driven by the increasing adoption of advanced analytics tools, such as those that predict and forecast electricity consumption or traffic trend predictions. Advanced analytics for demand forecasting can assist organizations in making informed decisions and increasing their profitability. In recent years, large-scale investments have been made in big data analytics by government agencies as well as various industries like banking, manufacturing, and professional services.

A number of healthcare consultants and government decision-makers are working together to create real-time COVID-19 data and share geographic information in COVID-19-prone zones during the pandemic. Novartis International AG, for example, announced a collaboration in June 2021 with Hewlett Packard Enterprise, to increase the use of data sources, machine learning, and Geospatial Analytics, as well as expand access to technology in remote and underserved places.

Numerous healthcare institutes use advanced analytical tools to derive clinically significant outcomes through the investigational mine of Electronic Health Records. This could help improve patient care outcomes like patient safety and functional status. It also helps to reduce expenses.

Regional Analysis:

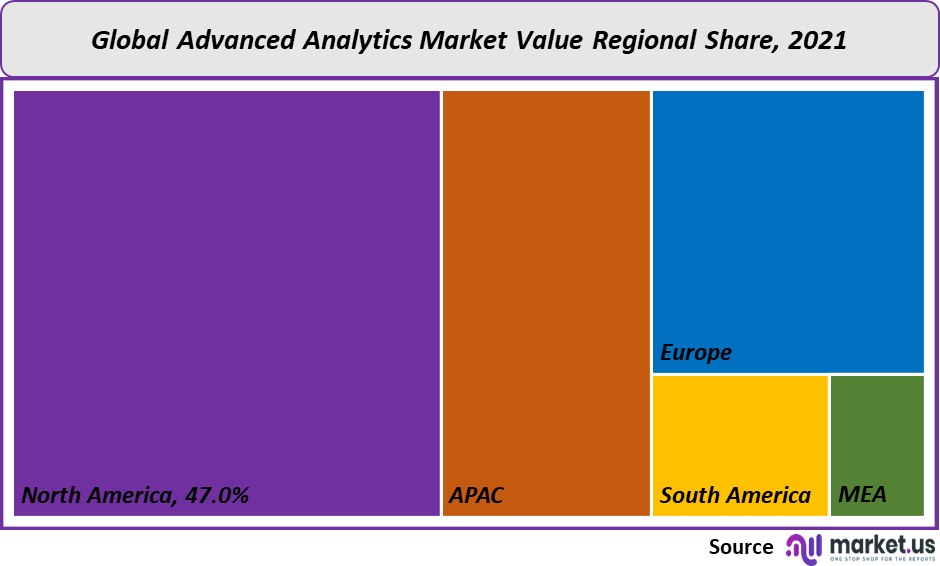

North America accounted for over 47.0% of global advanced analytics in 2021. This can be attributed both to the existence of supporting infrastructure for cutting-edge analytics, and the increased adoption of advanced technologies like AI and machine learning.

Microsoft Corporation announced, for example, a partnership with Consumer Value Store Health (CVS Health), which is a healthcare solution provider, in December 2021 to develop innovative solutions that help consumers improve their overall health. CVS Health would use Azure cognitive services like Computer Vision or Text Analytics for Health for automating tasks. Azure services would help CVS Health accelerate its digital transformation. They will allow the company to expand its multi-cloud presence by adding over 1,500 new business applications to its cloud.

Asia Pacific is expected to grow at a significant CAGR of 23.5% over the forecast period. The adoption of big data analytics tools in the region has driven the growth of this market. Numerous enterprises in the region are investing in customer analytics in order to improve their productivity and business efficiency.

Key Regions and Countries covered іn thе rероrt:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Market Share & Key Players Analysis:

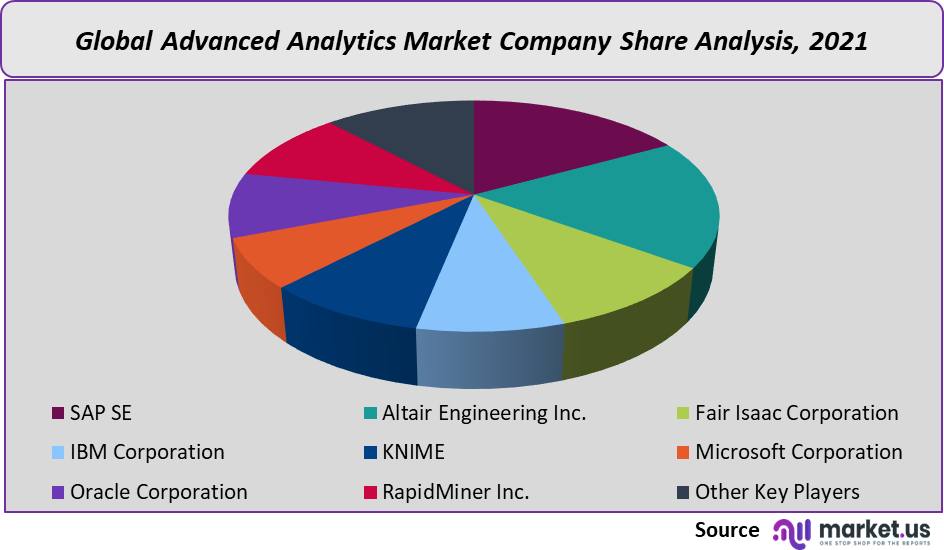

A handful of large players dominate this market. The market has seen a shift in recent years due to the rise of niche players providing industry-specific solutions. In order to improve their products, companies often engage in mergers, purchases, and partnerships. To acquire new customers, companies are constantly improving their products. RapidMiner, Inc., announced a partnership in February 2021 with Hivecell, an Edge-as-a-Service provider. The collaboration allows users to quickly build and operate models using streaming data at the edge. Hivecell’s users will now be able to integrate models built using the RapidMiner platform, enabling AI-optimized decisions wherever necessary.

Маrkеt Кеу Рlауеrѕ:

- SAP SE

- Altair Engineering Inc.

- Fair Isaac Corporation

- IBM Corporation

- KNIME

- Microsoft Corporation

- Oracle Corporation

- RapidMiner Inc.

- Other Key Players

For the Advanced Analytics Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

Q: What is the size of the Advanced Analytics market in 2021?The Advanced Analytics market size is US$ 34,181.8 million in 2021.

Q: What is the projected CAGR at which the Advanced Analytics market is expected to grow at?The Advanced Analytics market is expected to grow at a CAGR of 21.3% (2023-2032).

Q: List the segments encompassed in this report on the Advanced Analytics market?: Market.US has segmented the Advanced Analytics market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Type, the market has been segmented into Big Data Analytics, Risk Analytics, Customer Analytics, Business Analytics, and Others Types. By Deployment Mode, the market has been further divided into Cloud and On-premise. By End-Use, the market has been further divided into BFSI, IT & Telecom, Healthcare, Military & Defense, and Other End-Uses.

Q: List the key industry players of the Advanced Analytics market?SAP SE, Altair Engineering Inc., Fair Isaac Corporation, IBM Corporation, KNIME, Microsoft Corporation, Oracle Corporation, RapidMiner Inc., and Other Key Players are engaged in the Advanced Analytics market

Q: Which region is more appealing for vendors employed in the Advanced Analytics market?North America is expected to account for the highest revenue share of 47.0%. Therefore, the Advanced Analytics industry in North America is expected to garner significant business opportunities over the forecast period.

Q: Name the key areas of business for Advanced Analytics?The US, India, China, Canada, UK, Japan, & Germany are key areas of operation for the Advanced Analytics Market.

Q: Which segment accounts for the greatest market share in the Advanced Analytics industry?With respect to the Advanced Analytics industry, vendors can expect to leverage greater prospective business opportunities through the Big data analytics segment, as this area of interest accounts for the largest market share.

![Advanced Analytics Market Advanced Analytics Market]()

- SAP SE Company Profile

- Altair Engineering Inc.

- Fair Isaac Corporation

- IBM Corporation

- KNIME

- Microsoft Corporation Company Profile

- Oracle Corporation

- RapidMiner Inc.

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |