Global Advanced Wound Care Market By Product Type (Moist, Active, and Antimicrobial), By Application (Acute Wounds and Chronic Wounds), By End-use (Hospitals, Home Healthcare, and Specialty Clinics), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Nov 2021

- Report ID: 16470

- Number of Pages: 320

- Format:

- keyboard_arrow_up

Advanced Wound Care Market Overview:

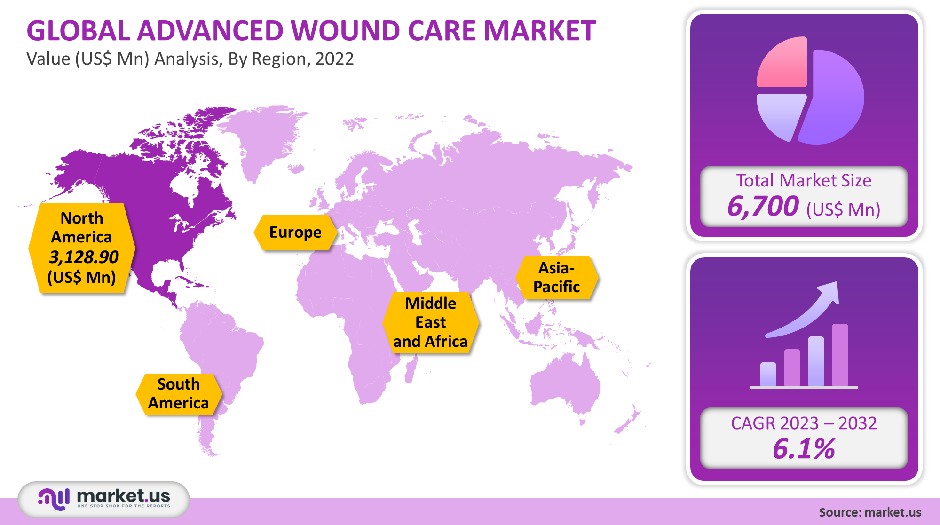

The global advanced wound care market accounted for USD 6,700 million in 2021. It is projected to grow at a CAGR of 6.1% between 2023 to 2032.

Due to the rising incidence of chronic diseases around the world, the demand for advanced wound care products has increased. Market growth will also be driven by the growing geriatric population. This is because the elderly have slow healing abilities.

According to WHO, the WHO estimates that the percentage of people 60 years and older was 9.8% in 2017. This number is projected to rise to 14.1% and 21.2% respectively by 2030 and 2050. The fastest-growing segment of the U.S. population is the elderly (>=65). According to the U.S. Census Bureau 2017 National Population Projections, nearly four out of four Americans will be older adults by 2060. This is expected to drive market growth.

Global Advanced Wound Care Market Scope:

Product type analysis

The segment of moist wound care dominated the advanced wound care market, accounting for the largest revenue share at 60% in 2021. This dominance can also be attributed to an increase in wound cases and an increased number of global surgeries.

According to Life Span Organization in 2018, approximately 500,000 open-heart surgeries were performed in the United States. According to AHA Journals, about 500,000 open-heart surgeries were performed in the U.S. in 2018.

The fastest CAGR is expected to be in the antimicrobial wound products segment, which will grow at 6.1% over the forecast period. These dressing covers can be used to reduce the bioburden in wound beds. For partial or full-thickness wounds such as those from surgical incisions or other chronic wounds, antimicrobial wound care is highly recommended. The forecast period will see an increase in patients with pressure ulcers and/or venous foot ulcers.

Application analysis

Acute wounds dominated the market for advanced care in wound care, with a revenue share of 60.79%. This segment is expected to grow at a significant rate during the forecast period. This is due to the increasing number of traumatic injuries, such as those caused by road accidents. The major driver of the segment is the increasing incidence of non-fatal injuries, such as road accidents, in the United States.

According to data from CDC, the 2015 incidence of nonfatal injury was 517,249. This increased to 540 in 2017. According to Brady United Organization, approximately 317 people are killed in gun violence every day in the U.S., and 212 of them survive. The segment will likely expand due to an increase in acute wounds.

The segment of chronic wounds is expected to grow at a 5.8% CAGR over the forecast period. The segment is expected to grow due to an increase in diabetic foot ulcers and venous pressure ulcers. According to Agency for Healthcare Research and Quality in the United States, pressure ulcers affect more than 2.5 million people each year.

According to NCBI, pressure ulcers can be seen in clinical settings anywhere from 4% to 38%. According to the American Diabetes Association, an estimated 34.2 million people had diabetes in 2018, which is 10.5% of all Americans. Market growth will be boosted by the expected rise in diabetic foot ulcer cases.

End-use analysis

In 2021, the hospital segment was the dominant market for advanced wound care. It held 46% of the total revenue. This segment’s growth can be attributed to the increase in surgical procedures and an increase in hospital admissions. According to the Australian Institute of Health and Welfare (AISW), the number of hospitalizations has increased in Australia.

In Australia, for example, 11.1 million people were admitted to hospital in 2019-2020. The market is expected to grow due to an increase in hospitalization rates and hospitals. The market is also being pushed by an increase in the number and quality of surgeries. According to Business Insider, South Korea is home to nearly one million plastic surgery procedures.

According to a similar source, nearly one-third of all women aged 19-29 have had plastic surgery. Consequently, an increase in surgeries could lead to greater use of advanced products for wound care. This may help propel advanced wound care market growth.

The home health segment will see the fastest CAGR at 6.1% over the forecast period. There was a rise in home healthcare products for advanced wound care during the COVID-19 epidemic. Advanced wound care products will be more popular due to an expected increase in the elderly population.

Chronic wounds are more common in the elderly. As a result, the body’s ability to heal wounds slows down. Wound Care Learning Network also states that pressure ulcers are more common in elderly people. The market may be able to grow if there is an increase in the elderly population.

Кеу Маrkеt Ѕеgmеntѕ

By Product Type

- Moist

- Active

- Antimicrobial

By Application

- Acute Wounds

- Chronic Wounds

By End-use

- Hospitals

- Home Healthcare

- Specialty Clinics

- Other End-uses

Market Dynamics:

Advanced wound care products can treat diabetic foot ulcers. Science Direct reports that diabetic foot ulcers can affect over 25% of diabetic patients and could lead to amputation in as many as 20% of them. Advanced wound care products will be more popular as a result of the rising number of diabetic patients. These products aid in moisture retention and rapid healing of wounds both internally and externally.

These products are also effective in treating surgical site infections due to their ability to absorb necrotic tissue. Healthcare professionals are more inclined to use advanced wound care products. This is expected to drive market growth in the forecast period.

The market for advanced wound treatment products will also be impacted by technological advances. Many of the most technologically advanced products in this area are expected to soon be commercialized. Nanoparticle-based wound healing and skin regeneration bioactive molecules are two examples.

These products maintain drug release and improve the therapeutic effects. The commercialization of gene therapy, which promotes wound healing by introducing healthy normal genes into cells, is also anticipated. The market for advanced wound treatment products is expected to grow with these advancements.

Advanced wound care is an essential part of healthcare but it was not in high demand due to the increase in COVID-19 patients. Hospitals have become overwhelmed with COVID-19 patients. Many countries have delayed elective surgery and other healthcare procedures due to this outbreak. The outbreak of COVID-19 also created huge opportunities for local producers.

The restrictions on international movement have disrupted the supply chain of the major players. Local players now have the opportunity to enter the market for advanced wound treatment and to meet the unmet needs of end-users.

With the introduction of vaccines and countries opening their borders internationally, the supply chain should improve during the post-pandemic period. The post-pandemic period will see moderate growth in the market for advanced wound treatment due to an increase in diabetic foot ulcers. Also, elective surgery is being delayed earlier.

Many companies are also looking to merge and acquire, launch new products, and expand their distribution network. Molnlycke, for example, announced in December 2021 the opening of a new U.K. distribution center. The post-pandemic period will see a boom in the market for advanced wound treatment.

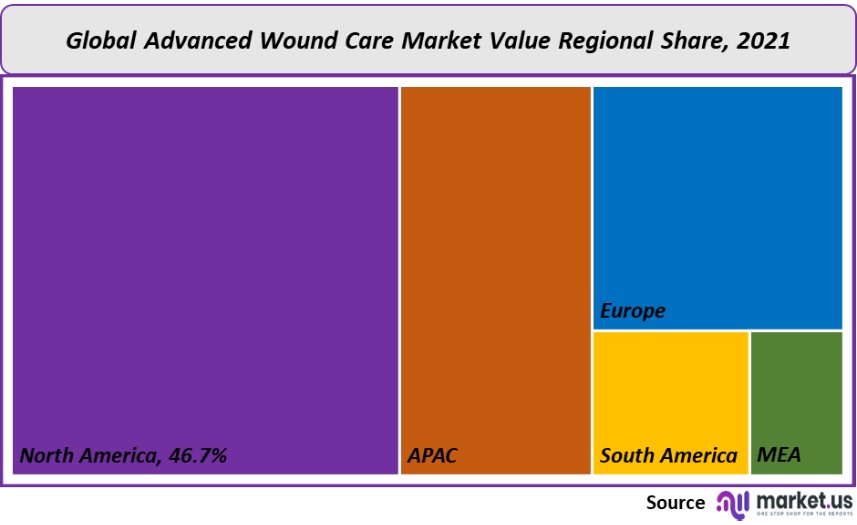

Regional Analysis

North America was the dominant market for advanced wound care, accounting for 46.7% of the total revenue in 2021. This dominance can also be attributed to the well-developed healthcare system and increased number of surgical procedures. According to the American Society of Plastic Surgeons in 2018, approximately 18 million Americans underwent minimally invasive cosmetic surgery.

Advanced wound care products are being increasingly used to prevent surgical site infection. The market is expected to grow due to an increase in accidents like road accidents, burns, or trauma events around the world. WHO (2018) predicts that each year in India, over 1,000,000 individuals suffer from moderate or severe burns. These factors will likely drive market growth over the forecast period.

The Asia Pacific market for advanced wound care will experience the highest CAGR at 6.0% during the forecast period. This is due to a rise in chronic diseases and an increase in the elderly population. According to the European Parliament Japan’s population over 65 is rapidly aging and Japan has 28.7%. In addition, the country’s elderly population will make up one-third of its population by 2036.

Geriatrics are at higher risk for various diseases and disabilities. This could increase the demand for wound care products. The market will also be helped by an increase in Medical Tourism. The Asia Pacific is expected to experience the fastest growth due to the factors mentioned above.

Key Regions and Countries covered іn thе rероrt:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Market Share & Key Players Analysis:

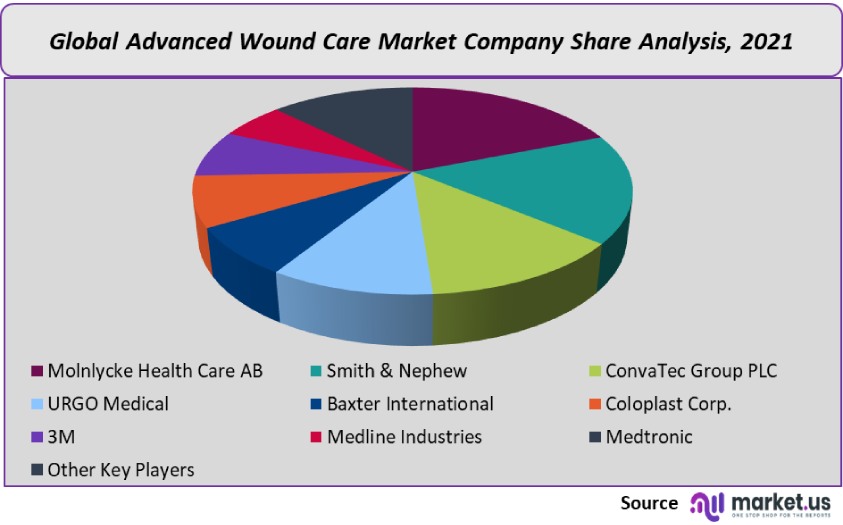

The advanced wound care market is fragmented due to the presence of many small and large players. Due to the many players in this market, competition in the market will increase in the future. To strengthen their product portfolios, top players often collaborate, launch new products, merge with other companies, or make acquisitions.

ConvaTec, for example, announced ConvaMax in January 2020. This super absorber dressing is used to treat wounds that are extremely exuding, such as leg ulcers and pressure ulcers.

Positive clinical outcomes for Integra Bilayer Wound Matrix were also reported by Integra LifeSciences in May 2020. Collagen and amniotic materials are included in the company’s portfolio of regenerative technologies. The corporation owns some of these items. The advanced wound care market is anticipated to expand over the course of the projected period thanks to different methods employed by top competitors.

Маrkеt Кеу Рlауеrѕ:

- Molnlycke Health Care AB

- Smith & Nephew

- ConvaTec Group PLC

- URGO Medical

- Baxter International

- Coloplast Corp.

- 3M

- Medline Industries

- Medtronic

- Other Key Players

For the Advanced Wound Care Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

Q: What is the size of the Advanced Wound Care market in 2021?A: The Advanced Wound Care market size was US$ 6,700 million in 2021.

Q: What is the projected CAGR at which the Advanced Wound Care market is expected to grow at?A: The Advanced Wound Care market is expected to grow at a CAGR of 6.1% (2023-2032).

Q: List the segments encompassed in this report on the Advanced Wound Care market?A: Market.US has segmented the Advanced Wound Care market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Product Type, market has been segmented into Moist, Antimicrobial, and Active. By Product Type, market has been segmented into Chronic Wounds and Acute Wounds. By End User, the market has been further divided into Hospitals, Specialty Clinics, and Home Healthcare.

Q: List the key industry players of the Advanced Wound Care market?A: Molnlycke Health Care AB, Smith & Nephew, ConvaTec Group PLC, URGO Medical, Baxter International, Coloplast Corp., 3M, Medline Industries, Medtronic, and Other Key Players engaged in the Advanced Wound Care market.

Q: Which region is more appealing for vendors employed in the Advanced Wound Care market?A: North America accounted for the highest revenue share of 46.7%. Therefore, the Advanced Wound Care industry in North America is expected to garner significant business opportunities over the forecast period.

Q: Name the key areas of business for Advanced Wound Care?A: The US, China, Japan, India, Brazil, Germany, UK, France, Italy, Spain, etc., are key areas of operation for Advanced Wound Care Market.

Q: Which segment accounts for the greatest market share in the Advanced Wound Care industry?A: With respect to the Advanced Wound Care industry, vendors can expect to leverage greater prospective business opportunities through the moist segment, as this area of interest accounts for the largest market share.

![Advanced Wound Care Market Advanced Wound Care Market]()

- Molnlycke Health Care AB

- Smith & Nephew

- ConvaTec Group PLC

- URGO Medical

- Baxter International Inc Company Profile

- Coloplast Corp.

- 3M Company Company Profile

- Medline Industries

- Medtronic

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |