Global Aerosol Market By Material (Aluminum and Steel), By Type (Standard and Bag-In-Valve), By Application (Personal Care, Household, Automotive & Industrial, and Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Dec 2021

- Report ID: 63125

- Number of Pages: 220

- Format:

- keyboard_arrow_up

Aerosol Market Overview:

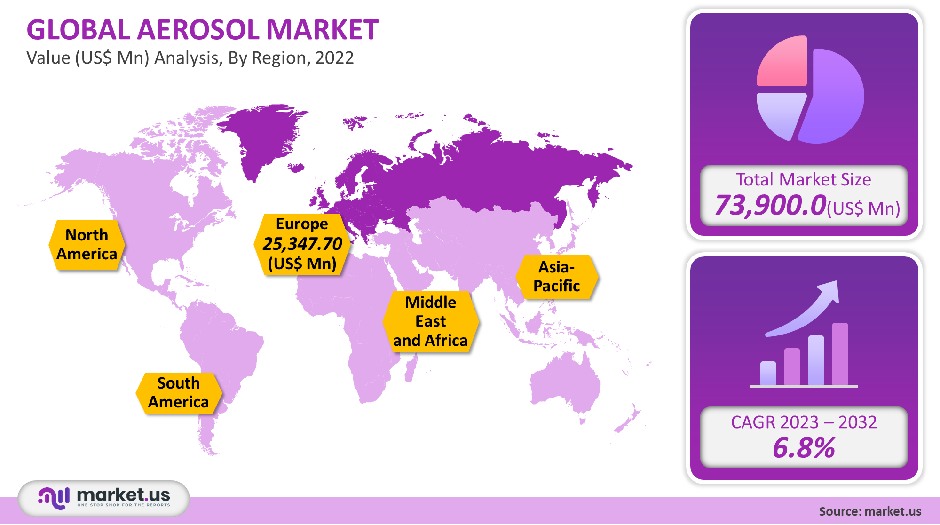

In 2021, the value of the global aerosol market was USD 73,900 million. Between 2023 to 2032, it is anticipated to increase at a CAGR of 6.8%.

The increased usage of personal care items including shaving cream, hairspray, deodorant, and body sprays is mostly to blame. Colloidal systems called aerosols are made up of liquid or solid particles suspended in a gas. The personal, medical, industrial, automotive, food, and paint industries all utilize these aerosols extensively.

Due to its simplicity of use and appealing design, aerosol-based packaging has drawn interest from several end-use sectors. Due to the fast urbanization and infrastructure development in emerging nations in the Asia Pacific, the demand for aerosol paints and home goods will continue to rise.

Global Aerosol Market Scope:

Material analysis

The global market can be divided into steel and aluminum. Aluminum material, which represented 61.1% of the total revenue in 2021, is expected to grow at a significant rate during the forecast period.

Aluminum is an eco-friendly material that can be recycled multiple times. It also provides strong packaging that enhances the product’s aesthetic appeal. These factors have contributed significantly to the segment’s growth. Aluminum prices have been on the rise globally over the last few years.

The final cost of aerosols is rising due to an increase in aluminum prices. Aerosol manufacturers will likely choose a lower-priced option due to this fact. This could hinder the growth of the aluminum segment over the next few years.

Due to its low weight, low cost, and high recyclability, the plastic material segment has seen significant demand over the last few years. The growth of this market will be impeded by a ban on plastic packaging in Europe.

Type analysis

In 2021, the standard segment was responsible for the highest revenue share at 83.1% and will continue to dominate the forecast period. The segment comprises both continuous and metering valves. Continuous valves are used for applications that require continuous spray. This segment is expected to grow due to the increasing use of these valves in technical products and food products.

For efficient dispensing of metered doses, metered valves are preferred. They can be used in pharmaceutical applications as well as air fresheners. Bag-in-valve refers to a packaging technique in which the bag containing the product is welded onto the valve.

The can and the bag contain the propellant. The propellant is placed between the bag and the can. This allows for the propellant to be completely separated from the product, which increases the integrity of the package. The propellant is used to disperse the aerosol in a bag-in valve aerosol. This can be done by simply squeezing the bag and pressing the spray button.

To preserve the purity of the product, cosmetic, medical, and food products are often packaged in aerosols with a bag-in valve. The valve bag offers almost 99.6% product dispersion. It is typically made from four-layer laminates which reduce the risk of oxidation.

The bag is also hermetically sealed with the product. These benefits are drawing many product manufacturers to the bag in the valve aerosol segment. This will drive the segment’s growth over the next few years.

Application analysis

In 2021, the personal care segment accounted for more than 42.2% of the market in volume. This segment is driven by growing demand for deodorants and hair care products. Due to changing lifestyles, increased consumer spending, and a greater emphasis on products that are gender-specific, the demand for personal care products in emerging economies is growing.

The rise in living standards and the emphasis on hygiene in developing countries are responsible for the rapid growth in the household segment. This has resulted in a rise in household products such as cleaners, disinfectants, and air fresheners. These products last longer if they are dispersed in smaller quantities.

Their use is further accelerated by this property. These products are also used in the industrial and automotive sectors. Spray paints and automotive cleaners are in high demand due to increased consumer awareness about vehicle appearance and maintenance.

Additionally, increased vehicle sales are positively impacting the demand for other products such as adhesives, sealants, and anti-fog agents. The growing demand for dry powder inhalers and metered-dose inhalers in North America is responsible for the growth of the medical market. This is expected to drive the demand for these inhalers in the future due to rising pollution.

Кеу Маrkеt Ѕеgmеntѕ

By Material

- Aluminum

- Steel

- Other Materials

By Type

- Standard

- Bag-In-Valve

By Application

- Household

- Plant Protection

- Insecticides

- Air Fresheners

- Disinfectants

- Other Households

- Personal Care

- Hair Spray

- Suncare

- Shaving Mousse/Foam

- Deodorants

- Other Personal Cares

- Automotive & Industrial

- Lubricants

- Greases

- Spray Oils

- Cleaners

- Food

- Whipped Cream

- Oils

- Edible Mousse

- Sprayable Flavours

- Paints

- Consumer

- Industrial

- Medical

- Topical Application

- Inhaler

- Other Medicals

Market Dynamics:

Market growth will also be boosted by the approval of aerosol cleaning products by the Environmental Protection Agency (EPA). Aerosol-based products have seen many innovations that improve consumer convenience and protect the environment.

Compressed gases are used to replace hydrocarbons in propellants. The bi-compartmental technology, which separates propellant from the product, has been developed. These steps will help propel market growth further.

Many food products are available, such as oil, whipped cream, and edible mousse. Aerosols are becoming more popular because of their ease of use. The high demand for bakery items such as cakes, cookies, pies, ice creams, and sundaes has led to a significant increase in whipped cream demand over the last few years. These include hot chocolate milkshakes, hot chocolate milkshakes, waffles, and cheesecakes. This will drive the global market’s growth in the coming years.

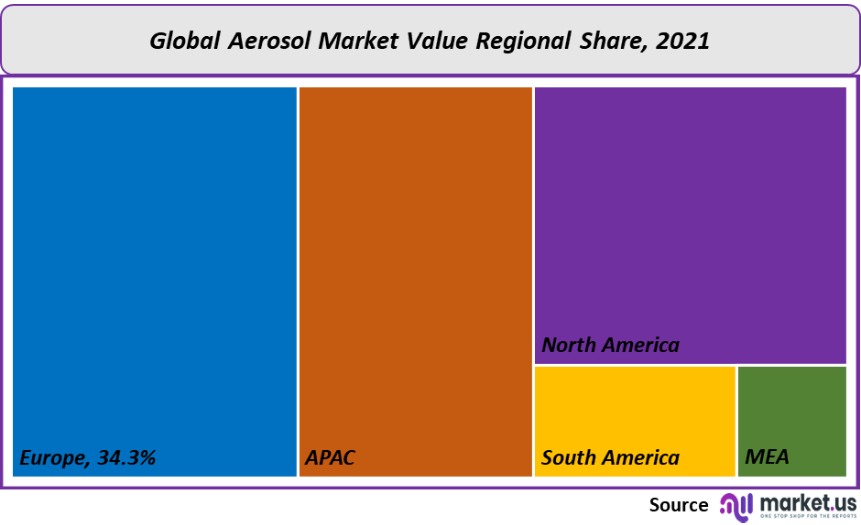

Regional Analysis

Europe held 34.3% of the world’s largest market share in volume terms in 2021. It is also the largest producer of aerosols. The large market share can be attributed mainly to the personal care sector. The region’s market growth is being driven by factors such as high cosmetics consumption and rapid growth of the fragrance sector.

Consumer spending is also increasing. Despite increasing personal care demand, Europe’s market growth is hampered by regulations regarding Volatile Organic Compounds emissions (VOCs), set by the European Commission (EC) and the Environmental Protection Agency (EPA). The region will overcome this problem with innovation in the near future.

Asia Pacific is one of the fastest-growing regions in terms of revenue and is expected to grow at a 9.1% CAGR over the forecast period. China and India have focused on encouraging favorable investments which will create lucrative growth opportunities over the forecast period.

The demand for aerosol products in the paints, personal care, and automotive sectors is increasing due to rising consumer spending in emerging Asian countries. Due to the high consumption of hair care products in countries like Saudi Arabia and UAE, Africa and the Middle East are expected to see significant growth during this forecast period.

Additionally, hypermarkets such as Carrefour and Lulu Hypermarket in Kuwait, Saudi Arabia, and the UAE have allowed for the retail distribution and sale of consumer products.

Key Regions and Countries covered іn thе rероrt:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

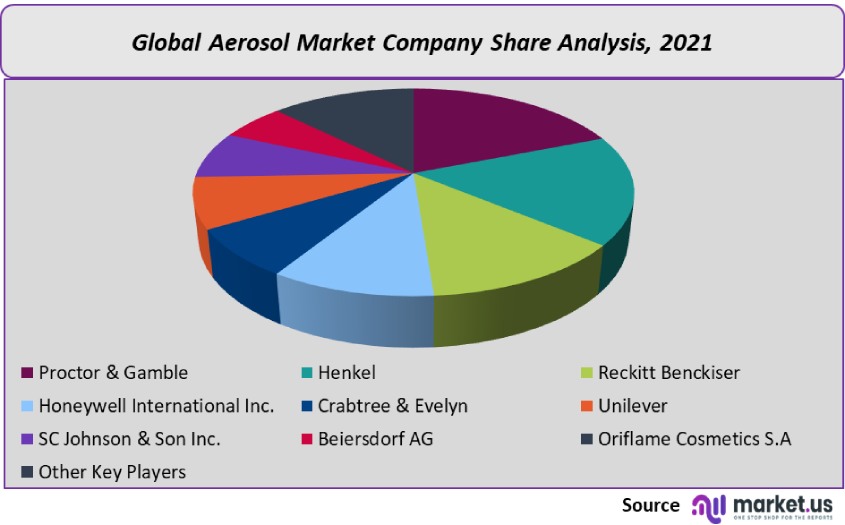

Market Share & Key Players Analysis:

Major companies in this market employ a variety of strategies, including mergers and acquisitions as well as new capacity expansions. Spray Products Corp., for example, purchased a new Ohio facility in May 2018. Lindal Group also opened its new, state-of-the-art facility in Columbus (Indiana).

Маrkеt Кеу Рlауеrѕ:

- Proctor & Gamble

- Henkel

- Reckitt Benckiser

- Honeywell International Inc.

- Crabtree & Evelyn

- Unilever

- SC Johnson & Son Inc.

- Beiersdorf AG

- Oriflame Cosmetics S.A

- Other Key Players

For the Aerosol Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

Q: What is the size of the Aerosol market in 2021?A: The Aerosol market size was US$ 73,900 million in 2021.

Q: What is the projected CAGR at which the Aerosol market is expected to grow at?A: The Aerosol market is expected to grow at a CAGR of 6.8% (2023-2032).

Q: List the segments encompassed in this report on the Aerosol market?A: Market.US has segmented the Aerosol market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Material, market has been segmented into Aluminium and Steel. By Type, market has been segmented into Standard and Bag-In-Valve. By Application, the market has been further divided into Personal Care, Household, Automotive & Industrial, Food, Paints, and Medical.

Q: List the key industry players of the Aerosol market?A: Proctor & Gamble, Henkel, Reckitt Benckiser, Honeywell International Inc., Crabtree & Evelyn, Unilever, SC Johnson & Son Inc., Beiersdorf AG, Oriflame Cosmetics S.A, and Other Key Players engaged in the Aerosol market.

Q: Which region is more appealing for vendors employed in the Aerosol market?A: Europe accounted for the highest revenue share of 34.3%. Therefore, the Aerosol industry in Europe is expected to garner significant business opportunities over the forecast period.

Q: Name the key areas of business for Aerosol?A: Germany, U.K., France, Italy, U.S., Canada, Mexico, China, India, Japan, Brazil, Saudi Arabia are key areas of operation for Aerosol Market.

Q: Which segment accounts for the greatest market share in the Aerosol industry?A: With respect to the Aerosol industry, vendors can expect to leverage greater prospective business opportunities through the Aluminum segment, as this area of interest accounts for the largest market share.

![Aerosol Market Aerosol Market]()

- Proctor & Gamble

- Henkel

- Reckitt Benckiser Group PLC Company Profile

- Honeywell International Inc.

- Crabtree & Evelyn

- Unilever Plc Company Profile

- SC Johnson & Son Inc.

- Beiersdorf AG

- Oriflame Cosmetics S.A

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |