Global Aerospace Foam Market By Type (Polyethylene, Polyurethane, Metal, PET, Melamine, PVC, Polyimide, and Specialty High Performance), By Application (General Aviation, Military Aircraft, and Commercial Aviation), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Nov 2021

- Report ID: 19791

- Number of Pages: 204

- Format:

- keyboard_arrow_up

Aerospace Foam Market Overview:

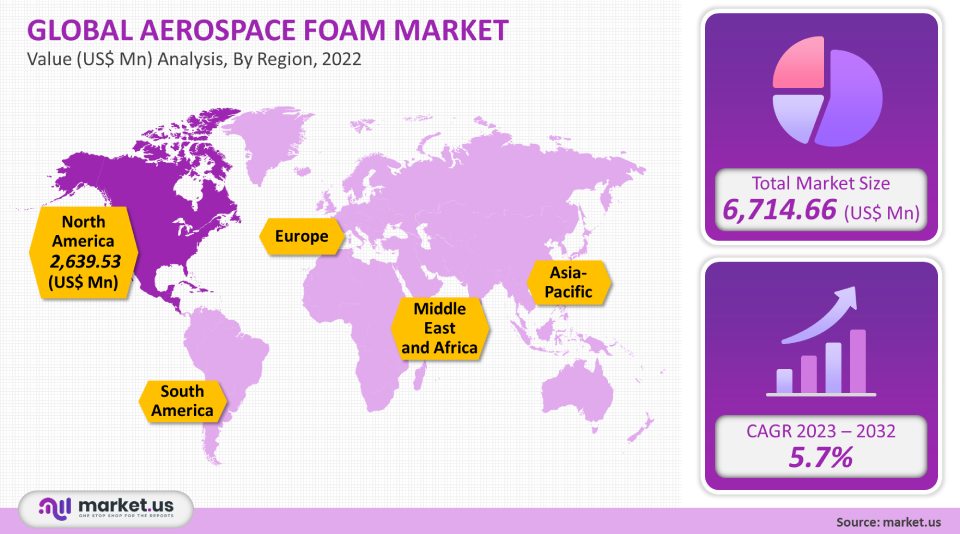

The market for aerospace foam was worth USD 6,714.66 million in 2021, and it is projected to increase at a CAGR of 5.7% annual growth rate between 2022-2032.

Global Aerospace Foam Market:

Type Analysis

Because of their lightweight and high rigidity, various polymer foams are being used more frequently in the airline industry. Due to their closed-cell structure, polyurethane foams have high rigidity, resistance to water, and fire resistance. The product meets the Boeing aerospace requirements BMS 8-133. This unique feature makes it a preferred type by aircraft manufacturers.

Polyimide foams can withstand extreme temperatures and are lightweight, durable, and non-flammable. They are used to insulate the equipment, fuselage, and air conditioning duct. This product is often used in composite structures of F110, F135, F-22, F-22, missile structures, sixth-generation engines, and F22 aircraft.

It can replace titanium metals with polyimide foams. They also have a lower weight and a higher fuel efficiency. Applications for polyimide foams in aircraft engines of the sixth and fifth generation are found mainly in high-temperature environments.

Application Analysis

According to the General Aviation Manufacturers Association (GAMA), there were over 440,000 general aviation aircraft worldwide in 2018. The bulkheads, fuselages, and wings are made of lightweight composites which include polymer foams.

North America’s general aviation market was led by polyurethane. The aerospace foam market is expected to be driven by the presence in North America of several general aviation companies, such as Quest Aircraft Company, Gulfstream Aerospace Corporation, Cirrus Designs Corporation, American Champion Aircraft, Maule Air Inc., Textron Aviation Inc., Piper Aircraft Inc., among others, over the forecast period.

Commercial aviation applications include scheduled and unscheduled commercial airlines. Non-scheduled airliners can also be classified as charter, business aviation, or air taxi. Commercial aircraft demand is expected to be driven primarily by their use in the interiors of aircraft, including thermal insulation, cushioning, and noise damping.

The increase in military expenditure is expected to fuel the demand for military planes. According to the Stockholm International Peace Research Institutes (SIPRI), Asia Pacific military spending is expected to rise from US$ 456,000 million in 2016 to US$ 609,000 million by 2022.

Key Market Segments:

Type

- Polyethylene

- Polyurethane

- Metal

- PET

- Melamine

- PVC

- Polyimide

- Specialty High Performance

Application

- General Aviation

- Military Aircraft

- Commercial Aviation

Market Dynamics:

Over the forecast period, the market is expected to grow due to increased demand for lightweight materials used in aircraft applications.

This can be due to the increasing demand for these foams in the aerospace industry, which is also influenced by the need to reduce aircraft weight and the rapid technological advancements that are being made to produce high-performance yet affordable polymer foams.

It is fragmented with several regional and global players having a significant revenue share. In the next few years, the market will grow because of the increased demand for lightweight aviation. Due to the presence of top airliner manufacturers, such as Lockheed Martin and Airbus, Bombardier, and Boeing, aerospace manufacturers in North America will experience significant growth.

Boeing predicts that South East Asia will need over 4,000 new planes in the next decade due to an expected increase in passenger traffic of 6.2% annually. Airline Original Equipment Manufacturers (OEMs), including Honeywell International Inc. and Embraer S.A., are setting up manufacturing facilities in South East Asian countries such as Singapore, to meet growing demand.

Due to the increased demand for next-generation commercial aircraft, in particular, due to the increase in passenger transport in the Asia Pacific and the Middle East, it is expected that there will be a strong drive to produce commercial aircraft.

According to IATA, global passenger traffic will grow at an average annual compounded rate of 3.6% from 2016-2036 to reach 7,800 million by 2036. Commercial aircraft will be added to this figure. Expect an increase in the number of passengers. traffic. The number of passengers flying every year continues to rise due to affordable tickets, frequent flights, and availability of routes. This is expected to have positive effects on the aerospace foam market.

An increase in passenger transport is directly linked to a higher per-capita income (GDP), and a higher level of global per capita income. India and China are the countries with the highest growth in air travel. This has resulted in a significant rise in new aircraft orders.

The number of passengers flying to and from the airport has increased by a staggering amount over the past ten years. It reached 3,500 million in 2021, an increase that was more than double what it was 10 years ago. Airline services have also grown in the past five years, as a result of the rise in air travel.

Aerospace is the fastest-growing segment of the polymer foam sector. Aerospace requires high-performance materials for rockets, satellites as well as missiles. Many polymer foams, such as polyethylene foam and melamine foam, are increasingly being used in aerospace because of their light weight and rigidity.The U.S. is the largest market for aerospace and defense. Demand is driven by Airbus and Boeing, which are major aircraft manufacturers. This market is dominated primarily by the commercial aviation industry and the construction of large cargo and passenger planes. The main goal of polymer foam is to make aircraft lighter and more efficient.

Lightweight materials are being increasingly used in aerospace and defense to improve aircraft’s environmental performance and cost-efficiency. In the aerospace industry, lightweight polymer foams with high strength are becoming more important. It is possible to replace traditional materials with lighter versions in order to make lightweight aircraft. This will increase fuel efficiency and decrease material consumption.

For commercial aircraft, materials used in aircraft interiors must adhere to strict fire safety regulations. Federal Aviation Administration (FAA), for instance, established guidelines for safety regarding flammability according to FAR 25.856. Numerous aviation-based international governing bodies, including the National Qualifications Authority (NQA), International Traffic in Arms Regulations(ITAR) and Aircraft Information Management Systems (AIMS), also set safety requirements for aircraft and structures.

In addition to the regulations framed by aviation governing agencies, certain commercial aircraft manufacturers like Boeing and Airbus have established their own safety requirements in Boeing Materials Specification. (BMS) among others. Aircraft materials manufacturers must comply with all regional regulations. These include the 65/65 heat emission standards for Ohio State University (OSU), European REACH regulation, and others.

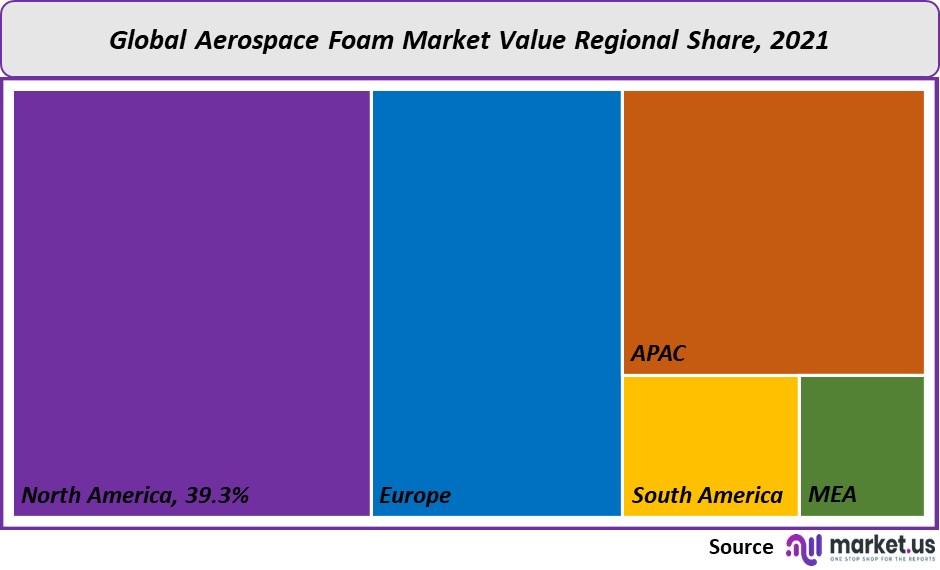

Regional Analysis:

North America represented 39.31% of revenue and was the largest market. Europe had a 27.57% market share in 2021. It was closely followed by North America. The Asia Pacific was third in terms of market share, with 22.17%. The markets of South America, the Middle East & Africa, accounted for 6.40% and 4.56%.

North America is expected to benefit from the current dominance, with the U.S. a key contributor to the market growth due to the nation’s growing manufacturing industry. The projected slowdown in North America’s market growth is due to the rapid expansion in manufacturing and industrialization in emerging nations like India and China.The U.S. had the largest demand for polymer foam in the aerospace industry in 2021 and this trend will likely continue during the forecast period. The country’s strong growth in commercial aviation has fueled the high demand for polymer foam in the aerospace sector. This is due to the significant and innovative role of US aircraft designers, manufacturers, and suppliers as well as service providers throughout the US and worldwide economies.

China, France, and Japan are the top destinations for U.S. exports of aerospace & defense products & services. Washington, California (Kansas), Arkansas, Kentucky, and Washington are the top exporters of aerospace and defense goods. This provides lucrative growth opportunities for the polymer foam industry.

Key Regions and Countries covered іn thе rероrt:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Market Share Analysis:

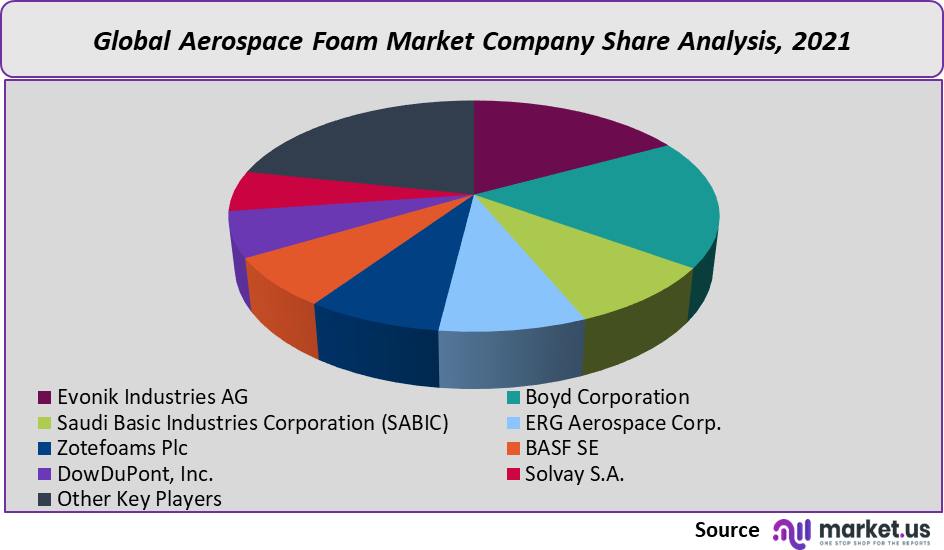

It is crucial that manufacturers contribute to the value chain in the highly competitive market by developing new products with proprietary methods.

Some of the most prominent companies have developed technologies for producing polymer foams for aerospace applications. Zotefoams has developed a unique Nitrogen Expansion technique for the production of polyethylene-based foams. Evonik SE, BASF SE, Zotefoams, and others are integrated horizontally in the value chain to gain a slight competitive advantage over their counterparts.

Key Market Players:

- Evonik Industries AG

- Boyd Corporation

- Saudi Basic Industries Corporation (SABIC)

- ERG Aerospace Corp.

- Zotefoams Plc

- BASF SE

- DowDuPont, Inc.

- Solvay S.A.

- Other Key Players

For the Aerospace Foam Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

Q: What is the size of the Aerospace Foam market in 2021?The Aerospace Foam market size was US$ 6,714.66 million in 2021.

Q: What is the projected CAGR at which the Aerospace Foam market is expected to grow at?The Aerospace Foam market is expected to grow at a CAGR of 5.7% (2023-2032).

Q: List the segments encompassed in this report on the Aerospace Foam market?Market.US has segmented the Aerospace Foam market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Type, market has been segmented into Polyethylene, Polyurethane, Metal, PET, Melamine, PVC, Polyimide, and Specialty High Performance. By Application, the market has been further divided into General Aviation, Military Aircraft, and Commercial Aviation.

Q: List the key industry players of the Aerospace Foam market?Evonik Industries AG, Boyd Corporation, Saudi Basic Industries Corporation (SABIC), ERG Aerospace Corp., Zotefoams Plc, BASF SE, DowDuPont, Inc., Solvay S.A., and Other Key Players engaged in the Aerospace Foam market.

Q: Which region is more appealing for vendors employed in the Aerospace Foam market?North America is accounted for the highest revenue share of 39.31%. Therefore, the Aerospace Foam industry in North America is expected to garner significant business opportunities over the forecast period.

Q: Name the key areas of business for Aerospace Foam?The U.S., Mexico, Canada, China, India, South Korea, & Germany are key areas of operation for Aerospace Foam Market.

Q: Which segment accounts for the greatest market share in the Aerospace Foam industry?With respect to the Aerospace Foam industry, vendors can expect to leverage greater prospective business opportunities through the polyurethane segment, as this area of interest accounts for the largest market share.

![Aerospace Foam Market Aerospace Foam Market]()

- Evonik Industries AG

- Boyd Corporation

- Saudi Basic Industries Corporation (SABIC)

- ERG Aerospace Corp.

- Zotefoams Plc

- BASF SE Company Profile

- DowDuPont, Inc.

- Solvay S.A.

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |