Global Aerospace Lubricant Market By Product (Hydraulic Fluid, Gas Turbine Oil, and Piston Engine Oil), By End-Use (Civil, Space, and Defense), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Jul 2022

- Report ID: 61350

- Number of Pages: 369

- Format:

- keyboard_arrow_up

Aerospace Lubricant Market Overview:

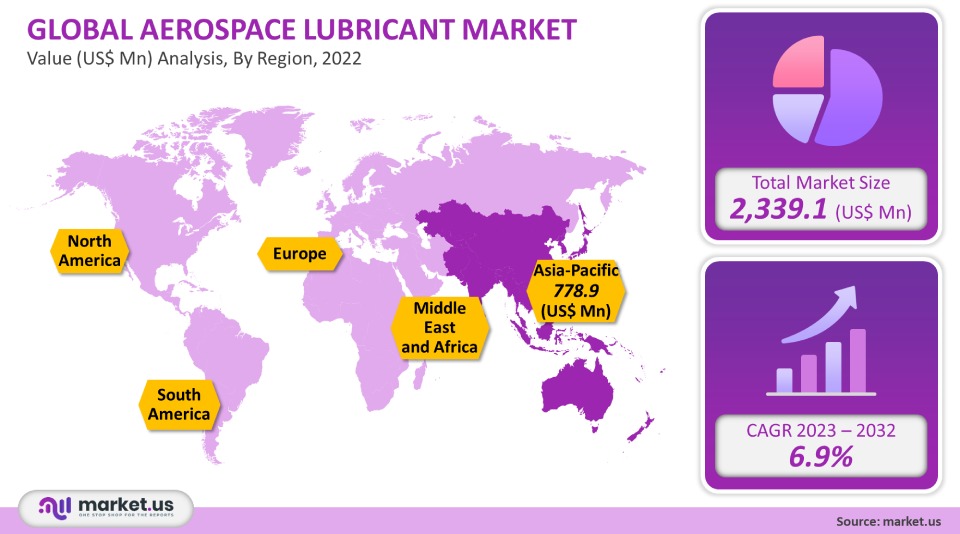

The 2021 global market for Aerospace Lubricant was valued at USD 2,339.1 million. This market is expected to grow at a compound annual growth rate of 6.9% between 2023-2032.

Over the forecast period, the global aerospace lubricant industry will be driven by increasing air traffic in both developed and developing economies, such as the U.S., UK, India, and China.

Global Aerospace Lubricant Market Analysis:

Product Analysis

Gas turbine oils are chosen based on the needs of the engine. Gas turbine oil is a fuel that provides thrust and cools the engine efficiently. It helps prevent corrosion, rust, and sludge from forming while the engine runs. All these factors contribute to fuel efficiency.

The use of gas turbine engines in aircraft has been a common demand. These lubricants are required to ensure the smooth operation of high-tear engine components. Reduced engine temperature, increased reliability, lower operating cost, and longer engine life are all benefits of gas turbine oils.

Pistons account for nearly half of an engine’s friction. Any improvements in this section will directly impact fuel efficiency. In order to improve efficiency, turbocharging, and increase outputs, piston manufacturers rely on technological innovation. Piston engine oil reduces friction and acts as a sealant and coolant. Over the forecast period, this product segment will grow at a 5.9% CAGR.

Hydraulic oil held a significant share in 2021. Hydraulic fluids can be used at increasing temperatures and pressures to provide thermal stability, long life, high anti-wear characteristics, resistance against the flow, and constant viscosity, regardless of temperature.

Formulators of hydraulic lubricants for the aerospace industry optimize their products to meet both military and commercial aircraft’s operational requirements. These fluids perform well in high-temperature conditions and provide excellent oxidation and chemical resistance. They also maintain constant friction.

Over the forecast period, other segments made of greases or compounds will experience significant growth. Grease is high in viscosity at the beginning and has the ability to impart the characteristics of an oil-lubricated bear. Its viscosity drops to approximately the same level as the base oil after shear. It has excellent structural stability and resistance to water wash.

End-Use Analysis

Civil was the most important end-use. In the forecast period, there will be an increase in air traffic from countries like China and India. Expect to see growth in end-user segments due to lower airfares and higher living standards across developing countries.

With a CAGR rate of 5.2% in the forecast period, defense will be the fastest-growing end-use segment. The main driving force is likely to be increasing defense expenditures and defense in countries like the U.S. and China. High-performance lubricants for extreme conditions are expected to be in high demand. Technology up-gradation will also provide lucrative opportunities for industry players.

During 2023-2032, commercial aerospace spending will be driven by strong economic growth, rising per capita disposable earnings, and strong economic growth in developing regions like the Asia Pacific, Latin America, and the Middle East. Because of the fast-paced lifestyle and strict corporate-oriented work profile, consumers prefer saving time and traveling in comfort. This has led to a rise in demand for airlines, which is a better option than other modes.

Key Market Segments:

By Product

- Hydraulic Fluid

- Gas Turbine Oil

- Piston Engine Oil

By End-Use

- Civil

- Space

- Defense

Market Dynamics:

North America suffered a slowdown in growth, but the Middle East, Africa, and Asia saw significant growth, with an increase in revenue per passenger-km year over year. Because of the reduction in friction between two coated surfaces, aviation lubricants increase the efficiency of the engines. This results in greater distance covered with the same amount of fuel.

Market dynamics are expected to be positively affected by regulations such as mandating the use of group III oil for primary base stocks. The high viscosity index of group III oil and its low sulfur content result in higher performance.

The forecast period will see an increase in aviation lubricant consumption due to increased defense spending, particularly by countries like the U.S.A, Russia, China, and India. The U.S. defense budget is approximately equal to that of the next 14 countries. The West is losing some of its competitive edges due to the advent of new technologies.

Russia modernizing its armored combat vehicles and China developing a ballistic missile system will likely help meet demand. The U.S. & NATO allies are spending less on war, but the overall balance of defense spending is shifting.

Southeast Asian countries are enhancing their defense capabilities to protect their assets. This is done by replacing and modernizing aging fleets. After that, there’s a period where they experience sustained growth. The availability of defense-specific high technology is increasing, resulting in a leveling technological field for all countries. This will make it difficult for governments to keep up with technological advancements.

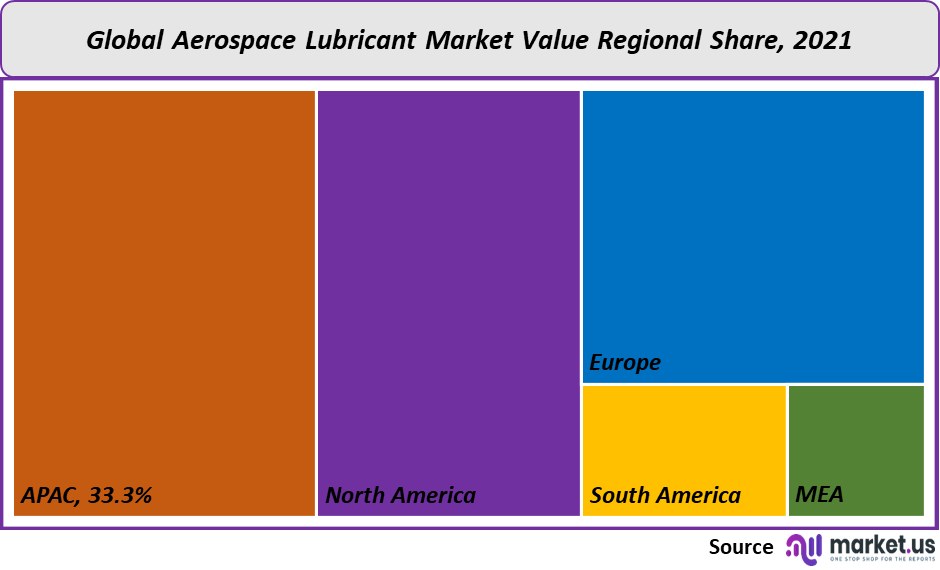

Regional Analysis:

The Asia Pacific was the largest market for Aerospace lubricants in the world. It accounted for 33.3% revenue share in 2021. The growth in the Asia Pacific is mainly due to an increasing middle-class population base in China and India as well as Thailand and Malaysia. Because of the region’s economic growth, more people can fly to the region for both business and leisure. In addition to the increased employment and development in cities, urbanization has resulted in a greater capacity with initiatives like Airbus. Due to the decrease in travel time and decreasing fares, there are more direct airport connections within the Asia Pacific. Demand will rise due to the increasing number of space programs, and related initiatives, particularly in India, over the forecast period.

Future drivers include tourism and Oman’s high growth in the services sector. Central and South America will also be the fastest-growing segments, with a CAGR of more than 5.3% from 2023 through 2032.

As a result of the rapid advancements in mobility in emerging economies such as India, Japan, Korea, and Mexico, there has been a significant increase in demand for aviation lubricants over the past decade. Due to the rising disposable income of the consumer in developing countries, tourism is gaining prominence. This has led to a rise in demand for high-performance aerosol lubricants throughout the Asia Pacific and Central/South America.

Key Regions and Countries covered іn thе rероrt:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Market Share & Key Players Analysis:

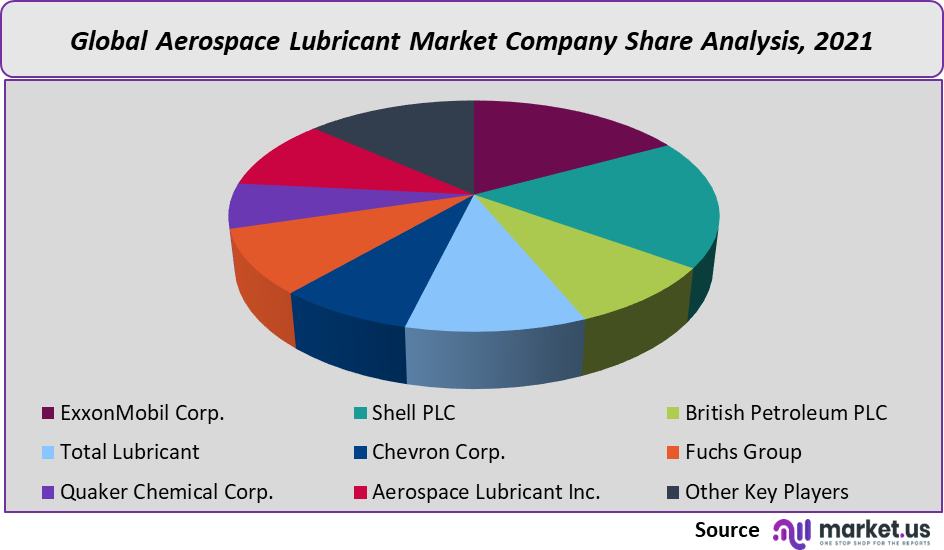

The presence of a few manufacturers means that the global aerospace lubricant industry share is well-consolidated. ExxonMobil, Shell, Total Lubricant, British Petroleum, Chevron Corporation, and Fuchs Group, are some of the key players in this industry.

Fuchs Lubrications is one example of a company that has integrated to become a supplier. This allows them to distribute their Aerospace Lubricant directly to end-users. This allows these companies to directly cater to customers, thereby negotiating on undesirable issues that may otherwise arise from dealings with distributors and suppliers. These companies also have a major advantage in terms of logistics cost reductions, since their supply chains are local.

Маrkеt Кеу Рlауеrѕ:

- ExxonMobil Corp.

- Shell PLC

- British Petroleum PLC

- Total Lubricant

- Chevron Corp.

- Fuchs Group

- Quaker Chemical Corp.

- Aerospace Lubricant Inc.

- Other Key Players

For the Aerospace Lubricant Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

Q: What is the size of the Aerospace Lubricant market in 2021?The Aerospace Lubricant market size is US$ 2,339.1 million in 2021.

Q: What is the projected CAGR at which the Aerospace Lubricant market is expected to grow at?The Aerospace Lubricant market is expected to grow at a CAGR of 6.9% (2023-2032).

Q: List the segments encompassed in this report on the Aerospace Lubricant market?Market.US has segmented the Aerospace Lubricant market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Product, the market has been segmented into Hydraulic Fluid, Gas Turbine Oil, and Piston Engine Oil. By End-Use, the market has been further divided into Civil, Space, and Defense.

Q: List the key industry players of the Aerospace Lubricant market?ExxonMobil Corp., Shell PLC, British Petroleum PLC, Total Lubricant, Chevron Corp., Fuchs Group, Quaker Chemical Corp., Aerospace Lubricant Inc., Other Key Players are engaged in the Aerospace Lubricant market

Q: Which region is more appealing for vendors employed in the Aerospace Lubricant market?APAC is expected to account for the highest revenue share of 33.3%. Therefore, the Aerospace Lubricant industry in APAC is expected to garner significant business opportunities over the forecast period.

Q: Name the key areas of business for Aerospace Lubricant?The US, Canada, UK, Japan, Mexico, India, China & Germany are key areas of operation for the Aerospace Lubricant Market.

Q: Which segment accounts for the greatest market share in the Aerospace Lubricant industry?With respect to the Aerospace Lubricant industry, vendors can expect to leverage greater prospective business opportunities through the Gas Turbine Oil segment, as this area of interest accounts for the largest market share.

![Aerospace Lubricant Market Aerospace Lubricant Market]()

- ExxonMobil Corp.

- Shell PLC

- British Petroleum PLC

- Total Lubricant

- Chevron Corporation Company Profile

- Fuchs Group

- Quaker Chemical Corp.

- Aerospace Lubricant Inc.

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |