Global Affective Computing Market By Product Type (Inorganic Pigments and Organic Pigments), By Application (Plastics, Inks, and Coatings), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Dec 2021

- Report ID: 62463

- Number of Pages: 314

- Format:

- keyboard_arrow_up

Affective Computing Market Overview:

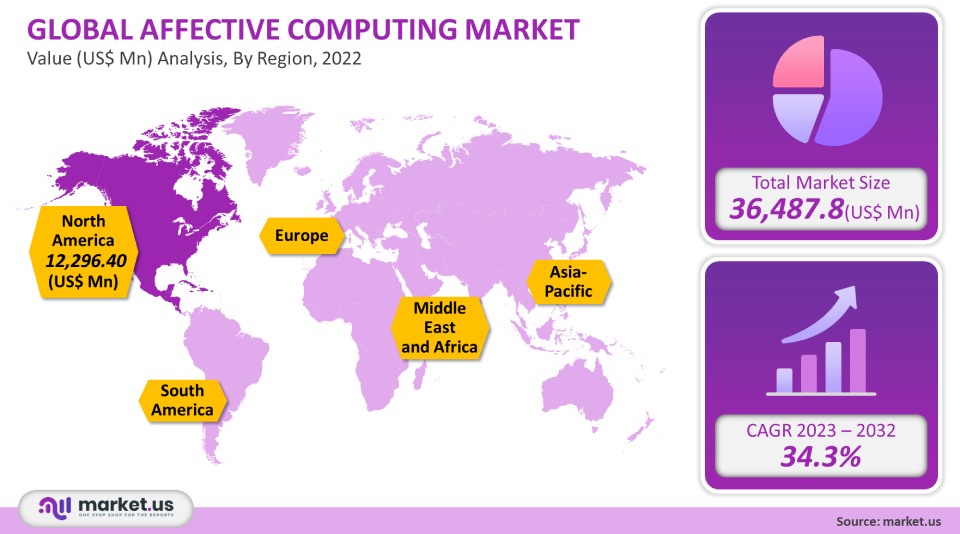

Global affective computing market was worth USD 36,487.8 million in 2021. It is projected to grow at a 34.3% compound annual growth rate (CAGR), between 2023 to 2032.

The market is expected to grow due to technological advances and the increasing adoption of electronic devices. Affective computing is a method that allows a computer to detect non-verbal emotions, such as gestures, movements, or other behaviors, and then react in real-time. Market growth is driven by the growing need for enhanced security across industries and the desire for virtual assistants that can spot fraudulent behavior. This market growth is also being driven by the increasing use of affective computing in security applications such as voice-activated fingerprints to restrict access to authorized users.

Global Affective Computing Market Scope:

Technology analysis

In 2021, the market for affective computing was dominated by the touch-based segment, accounting for more than half of all revenue. Implementing effective computing solutions requires touch-based technologies. To capture facial expressions or physical gestures, a full-fledged solution will typically require hardware components such as storage devices, cameras, sensors, and cameras. The device may require users to touch the device or use the controller to perform certain gestures. Gyroscopes and accelerometers are the most popular touch-based or gesture-based technologies used to detect or monitor human movements. As the market advances, the touch-based segment will see significant growth.

As hygiene awareness increases, the demand for touchless sensing will grow the fastest. New growth opportunities are expected for the touchless segment due to the growing demand for touchless sensor-based biometric solutions, as well as the continual rollout of smartphones with the most advanced controlling and tracking functions. The current slow growth of the touchless market is due to high switching costs and user resistance. However, the COVID-19 pandemic has begun to open the door for touchless affective computing solutions.

Software analysis

In 2021, the speech recognition segment was dominant and earned a more than 27.1% revenue share. Speech recognition is used to interpret emotions using inputs. The system includes speech segmentation, voice activity detector, signal pre-processing for future extraction, emotional categorization, and statistical analysis of emotional frequency. It can detect speech emotions in real-time for many applications such as online learning. Due to continued advancements in AI-and ML-based techniques, and the integration of personal assistants with connected devices, the demand for speech recognition software will continue to grow.

The segment of facial recognition is expected to experience the most growth during the forecast period. Facial recognition is safe and has gained wide acceptance in the last few years. Face recognition uses a connected camera, or a digital camera, to identify faces in captured images. The images are then compared with the database images. Particularly in airports, authorities are using facial recognition to verify the identity of travelers. To locate the person being targeted, law enforcement agencies use facial recognition to scan faces captured by surveillance cameras. Over the forecast period, the market is expected to grow due to the growing demand for high levels of safety and security. Facial recognition technology will be able to provide that.

Hardware analysis

In 2021, the sensors segment was dominant in the market and represented a 36.3% revenue share. Sensors are capable of detecting changes in the environment and providing a consistent output. Sensors are essential components because they can interpret, recognize, process, and simulate human emotions. Sensors are used in many areas, including flood and water level monitoring, traffic control, animal tracking, environmental monitoring, and precision agriculture. The sensors market will grow due to technological advances, increased adoption of electronic devices, advancements in automation, and a growing preference for IoT.

Over the forecast period, camera sales are expected to grow significantly. Cameras can be found in public buildings and commercial establishments. They are also used for affective computing. There are lucrative opportunities for growth in the cameras segment due to the increasing stakeholder and policy support for smart cities initiatives, and the subsequent demand for urban surveillance technologies and advanced technologies. The cameras segment growth is expected to be aided by growing public safety and security concerns, IP camera popularity, as well as law enforcement agencies’ use of covert cameras, have both expanded. Vendors in this market will also benefit from the continued adoption of new technologies such as IoT and big data AI.

End-use analysis

In 2021, the healthcare segment was dominant and accounted for nearly 19.7% of the market’s revenue. Healthcare companies are investing heavily in innovation, primarily focusing on advanced patient monitoring tools that use facial recognition to monitor patients. One of the most well-known healthcare organizations is Empatica. It provides wearable affective computing gadgets that may be applied to healthcare. To track patients’ emotions in real-time, speech, facial, and body gestures are used to interpret their emotions. Some medical systems can also include empathic and voice assistances that help to eliminate negative emotions and improve patients’ moods. Market growth is expected to be driven by the increasing adoption of affective computing solutions for healthcare applications.

As industry leaders adopt new methods to implement next-generation mobility, the automotive segment will see significant growth. The development of biometric apps, such as voice/gesture recognition and driver monitoring for autonomous driving, is not slowing down. This partnership will also enhance future vehicle mobility. Market growth will be driven by the increasing emphasis on vehicle safety and security, and the adoption of advanced technologies such as AI, cloud connectivity, and other factors.

Кеу Маrkеt Ѕеgmеntѕ:

By Technology

- Touchless

- Touch-based

By Software

- Analytics Software

- Gesture Recognition

- Enterprise Software

- Speech Recognition

- Facial Recognition

By Hardware

- Cameras

- Storage Devices & Processors

- Sensors

- Other Hardware

By End-use

- Automotive

- IT & Telecom

- BFSI

- Healthcare

- Government

- Retail & E-commerce

- Media & Entertainment

- Other End-uses

Market Dynamics:

Affective computing can also be called emotional artificial intelligence. This technology allows for interaction between people and computers. The computer responds to the user’s stimuli by sensing them. A computational device powered by emotional artificial intelligence, for example, can analyze the facial movements of students studying a topic and determine if they are having difficulty understanding it. It will then redirect them to the relevant resources that will help them understand the topic.

A variety of ancillary devices such as cameras and sensors can be used to gather inputs. These inputs include facial and physical gestures. The data is fed to different algorithms to analyze the user’s emotions. To facilitate effective interactions, users can be addressed with the appropriate IT systems and devices. Affective computing has many applications in a variety of industries to analyze and gauge customers’ subconscious feedback.

Personalization can also be done using affective computing, which allows for the changing of music, temperature, and lighting according to the user’s mood. Gentle, for example, add gestures, emotions, or other forms of communication that can be tracked by people with speech impairments or any other impairment. The adoption of affective computing is also being encouraged by the increasing deployment of robots. In the future, affective computing will be driven by the increasing adoption of artificial intelligence (AI), among other applications.

Affective computing is being driven by the continued rollout and availability of high-resolution cameras, as well as machine learning (ML), and other factors such as the availability of high-speed internet networks and high-resolution cameras. High-speed internet connections are crucial for effective computing. They allow for real-time interaction between dual high-resolution cameras that capture emotions and human gestures, as well as the machine intelligence models that analyze these feelings. Recognition of gestures is a popular feature that has been used by smartphone manufacturers to include high-resolution cameras in their smartphones. This has allowed smartphone manufacturers to use the high-resolution cameras in their smartphones to detect emotions and then react and respond accordingly.

Many companies have decided to stop employees from attending biometric meetings due to the COVID-19 pandemic. There are many technologies that could potentially decrease physical interactions, which has created opportunities. Companies are slowly resuming business operations at their locations as lockdowns have ended in many parts of the globe. Companies are keen to adopt gestures, speech, and facial recognition software at this point. This is not only for attendance but also to replace all applications that use biometric parameters. Airports could use a voice-based or gesture-based biometric system to obtain boarding passes. In the aftermath of the COVID-19 pandemic, enterprises will be adopting affective computing to facilitate touchless interactions at a rapid rate and on priority.

The market’s growth will be impeded by issues such as technological compatibility and high implementation fees. Companies are currently trying to understand customer behavior and how it affects decision-making. However, the majority of the data is collected in complex lab environments. Companies are having difficulties retrieving the decisions from this accumulated data. This is why they are focusing on these issues while developing models for affective computing. High development costs are common for various types of affective computing such as gesture recognition and wearable computing. This is a significant barrier to market growth. Solution providers are focusing more on technology partnerships to bridge the gap and expand the product portfolio.

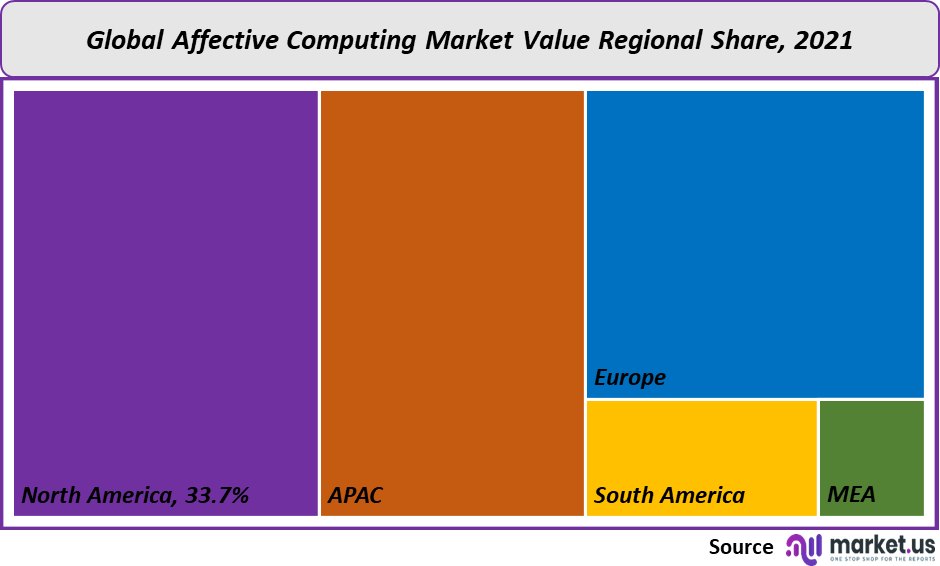

Regional Analysis:

North America was the dominant market in 2021, accounting for over 33.7% of the total revenue. Some of the most active research organizations in North America are involved in developing highly advanced computing devices. It is also a major adopter of AI-based next-generation technologies. The region has been continually improving its infrastructure with AI to make it suitable for affective computing. Another factor driving the regional market growth is the increasing use of robotics. There are many technologically advanced, established companies in the region as well as startups like Eyeris, Kairos, and Affectiva that offer effective computing solutions to meet the changing needs of customers.

The Asia Pacific will be the fastest-growing regional market during the forecast period, due to the increased adoption of new technologies in the region. The Asia Pacific is home to emerging economies such as India, China, and others. Many countries in the region have taken various initiatives to create electronic IDs for their citizens. Initiatives such as the UIDAI in India or the eKTP in Indonesia are creating new opportunities to adopt affective computing. Major market players are looking to expand their presence in the Asia Pacific due to the increasing popularity of smartwatches in China and smart wearable devices. Law enforcement agencies are using affective computing extensively for their investigation purposes. In April 2018, the Indian police used facial recognition technology in New Delhi, India’s capital, to find missing or kidnapped children.

Key Regions and Countries covered іn thе rероrt:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

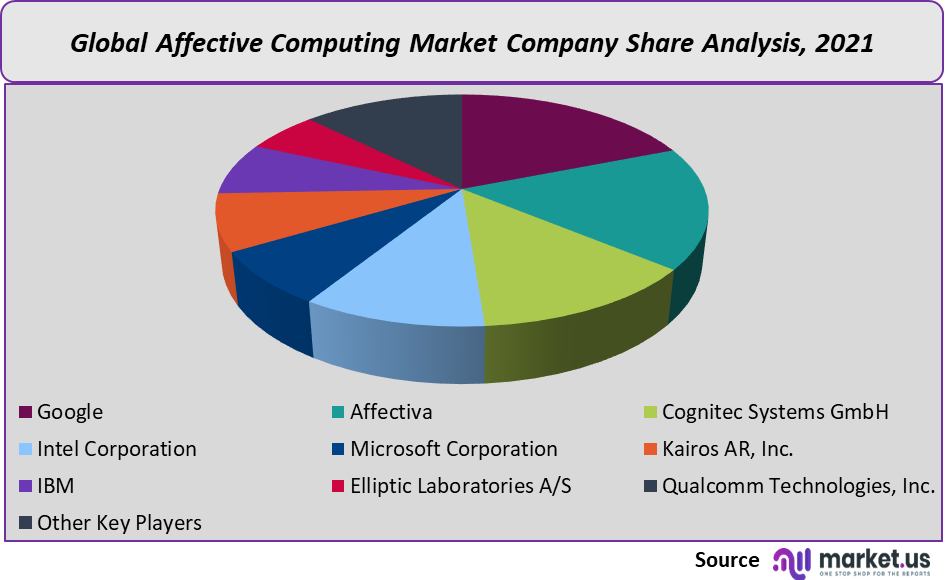

Market Share & Key Players Analysis:

Technology and the software industry are highly fragmented, with many players holding significant market shares. Affectiva and Cognitec Systems GmbH are key market players. To increase their market, share and drive organic growth, all market players invest aggressively in research and development. They are also actively involved in product development to expand and strengthen their product and service portfolios and acquire new customers to validate their technology.

To develop innovative products and compete with their competitors, companies are placing a lot of emphasis on strategic partnerships and mergers & acquisitions. In May 2020, Microsoft and Sony Semiconductor Solutions joined forces to develop smart camera solutions that enable AI-powered video analytics, smart cameras, and easier access for their customers. To extract useful information from images taken with smart cameras or other devices, the partnership will see both companies embed Microsoft Azure AI capabilities onto the intelligent vision sensor IMX500 of Sony Semiconductor Solution.

Маrkеt Кеу Рlауеrѕ:

- Affectiva

- Cognitec Systems GmbH

- Intel Corporation

- Microsoft Corporation

- Kairos AR, Inc.

- IBM

- Elliptic Laboratories A/S

- Qualcomm Technologies, Inc.

- Other Key Players

For the Affective Computing Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

Q: What is the size of the Affective Computing market in 2021?The Affective Computing market size was US$ 36,487.8 million in 2021.

Q: What is the projected CAGR at which the Affective Computing market is expected to grow at?The Affective Computing market is expected to grow at a CAGR of 34.3% (2023-2032).

Q: List the segments encompassed in this report on the Affective Computing market?Market.US has segmented the Affective Computing market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Technology, market has been segmented into Touchless and Touch-based. By Software, market has been segmented into Analytics Software, Gesture Recognition, Enterprise Software, Speech Recognition, and Facial Recognition. By Hardware, market has been segmented into Cameras, Storage Devices & Processors, and Sensors. By End User, the market has been further divided into Automotive, IT & Telecom, BFSI, Healthcare, Government, Retail & E-commerce, and Media & Entertainment.

Q: List the key industry players of the Affective Computing market?Google, Affectiva, Cognitec Systems GmbH, Intel Corporation, Microsoft Corporation, Kairos AR, Inc., IBM, Elliptic Laboratories A/S, Qualcomm Technologies, Inc., and Other Key Players engaged in the Affective Computing market.

Q: Which region is more appealing for vendors employed in the Affective Computing market?North America accounted for the highest revenue share of 33.7%. Therefore, the Affective Computing industry in North America is expected to garner significant business opportunities over the forecast period.

Q: Name the key areas of business for Affective Computing?The U.S., Canada, Germany, The U.K., China, India, Japan, and Brazil, are key areas of operation for Affective Computing Market.

Q: Which segment accounts for the greatest market share in the Affective Computing industry?With respect to the Affective Computing industry, vendors can expect to leverage greater prospective business opportunities through the Touch-based segment, as this area of interest accounts for the largest market share.

![Affective Computing Market Affective Computing Market]()

- Affectiva

- Cognitec Systems GmbH

- Intel Corporation

- Microsoft Corporation Company Profile

- Kairos AR, Inc.

- International Business Machines Corporation Company Profile

- Elliptic Laboratories A/S

- Qualcomm Technologies, Inc.

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |