Global Air Conditioning Systems Market by Type (Unitary, Rooftop, and PTAC), By Technology (Inverter, and Non-Inverter), By End-Use, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Apr 2022

- Report ID: 24695

- Number of Pages: 396

- Format:

- keyboard_arrow_up

Air Conditioning Systems Market Overview

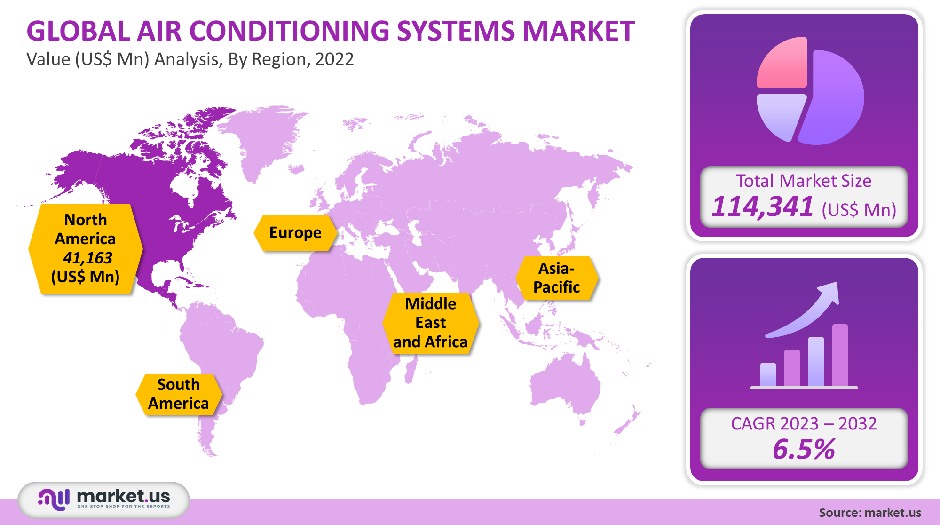

The global air conditioning system market was valued at USD 114.34 Billion in 2021. It is projected to grow at a 6.5% CAGR between 2023 and 2032.

Owing to lower consumer spending, the COVID-19 outbreak negatively affected the demand for air conditioners in 2021. However, the changing climate and increasing demand for commercial buildings will help the market recover and grow in 2021. In the forecast period, air conditioners will continue to be in high demand due to consumers’ increasing desire for convenience and comfort.

Global Air Conditioning Systems Market Scope:

Type Analysis

Unitary ACs represented 40.7% of 2021’s revenue and are predicted to see the highest growth in the forecast period. Unitary air conditioners are most commonly used in households. Unitary air conditioners will be in high demand due to the rising residential sector. Pairing a unitary AC with warm furnaces in the same conduit work in residential and commercial buildings is possible. This will increase the segment’s growth. Unitary ACs are not the only type segment. The Type segment also includes rooftop ACs and Packaged Terminal Air conditioners.

The segment of PTAC is expected to grow at a healthy CAGR of 6.3% between 2023-2032. The growing popularity of package terminal conditioners can be attributed to their increased adoption in the residential and hospitality sectors. PTACs enjoy technological advances like inverter technology, energy-efficient systems, and wireless connectivity.

Technology Analysis

From 2023-2032, the market for inverters is expected to grow by 8.1%. This is due inverter AC’s ability to regulate the speed and maintain temperature. The variable speed compressor can also be used to reduce energy consumption and save power. Other benefits like no temperature fluctuations or slow cooling and less noise than non-inverter ACs will also be a significant reason for the increased demand for inverter tech. The segment for non-inverters is expected to see moderate growth compared to its counterpart. This can be explained by higher energy consumption, fluctuating frequency, and shorter lifespan. However, this segment could benefit from the low cost of these air conditioning units to increase its market share.

End-Use Analysis

With rapid urbanization and growing demand for commercial spaces, the CAGR for the retail segment is expected to be 6.10% during the forecast period. AC units for commercial use require significant space. They are often located on the rooftops or atriums of large buildings like shopping centers, hotels, and big restaurants. AC is expected to be widely adopted in commercial markets by retrofitting and replacing units that reduce energy consumption. The mainstay segment of the market will remain residential, with vendors recording a 9.1% CAGR over the next seven years. Residential ACs are expected to experience healthy growth due to changes in climatic conditions. Many countries have experienced an increase in temperature in recent years due to climate change. Air conditioning systems have become more of a necessity rather than a luxury as a result of rising temperatures. Customers all over the globe are installing AC systems in their homes. This trend is expected to increase as the earth’s heat rises further.

Key Market Segments:

By Type

- Unitary

- Rooftop

- PTAC

By Technology

- Inverter

- Non-Inverter

By End-Use

- Residential

- Commercial

- Industrial

Market Dynamics:

Air conditioning systems are everywhere, from homes and shopping centers to commercial spaces and entertainment centers. AC systems played an important role in improving indoor air quality, especially in hot and dry areas. AC is still prevalent in developing countries. However, AC can be expensive and not as eco-friendly. The demand for AC will see bullish growth as the emerging market economy continues to boom.

Factors such as the growing construction and tourism industry are also expected to drive the market significantly.Over the forecast period, the demand for air conditioning systems is expected to rise due to increasing disposable incomes. Market growth is also anticipated to be positively impacted by consumers’ growing preference for energy-efficient products and the increasing popularity of portable systems. A rising population is expected to affect residential and commercial buildings positively. In GCC countries, construction spending is expected to rise significantly due to the expanding population of Gulf states. The rise is likely to stimulate growth in infrastructure and the building sector, including education and healthcare infrastructure to support communities. This is also expected to drive up demand for air conditioning systems.

Many governments across the globe are investing in air conditioning. Energy Efficiency Services Limited (EESL), is a joint venture of 4 Public Sector Enterprises which are under the administrative control of India’s Ministry of Power. They launched the Super-Efficient air conditioning program in February 2019. The program promoted energy-efficient technologies and helps to reduce energy consumption. The Ministry of Power in India hopes to achieve India’s Hydro-chlorofluorocarbons Phase-out Management Plan and Cooling Action Plan by 2032 with this program.

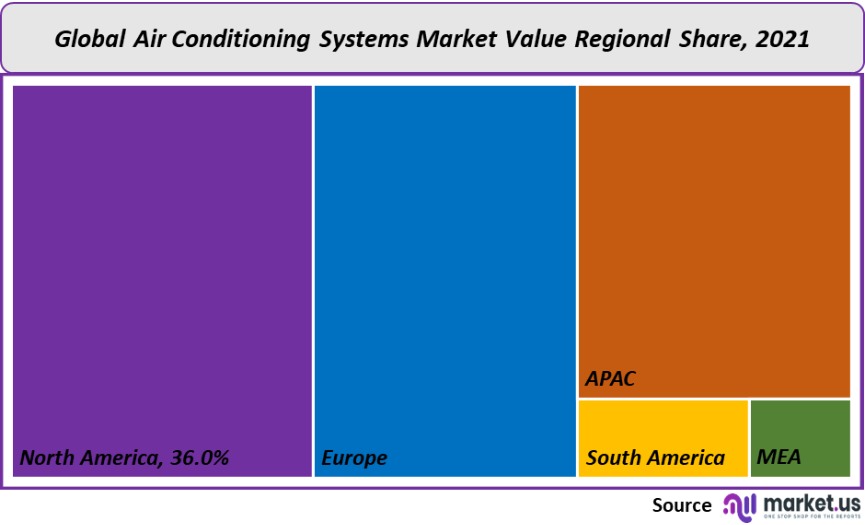

Regional Analysis

North America was responsible for 36% of the overall market revenue share in 2021. In the future, markets in North America will be able to grow alongside other developed regions in the world. Replacement sales primarily drive this growth. The market will also benefit from rising government promotions to increase the adoption of air conditioning systems that are energy-efficient to lower energy consumption.

Despite the global market experiencing a slump due to the pandemic of COVID-19, North America and Europe experienced steady growth in 2021. This is partly due to the strong demand for both regions during the fourth quarter of 2021. These markets were not affected as severely as the rest. The COVID-19 pandemic significantly impacted Africa and the Middle East as well, with more than 15% of air conditioning system demand for 2021. The economic impact of several countries in the Middle East due to travel restrictions on sales led to a decrease in sales.

The Asia Pacific region experienced a significant decline in AC demand as well because several economies suffered, this is due to lockdown in several countries because operations were shut down. In addition to this, China’s exports/ imports were affected due to travel/transportation restrictions.

Key Regions and Countries covered in the report:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

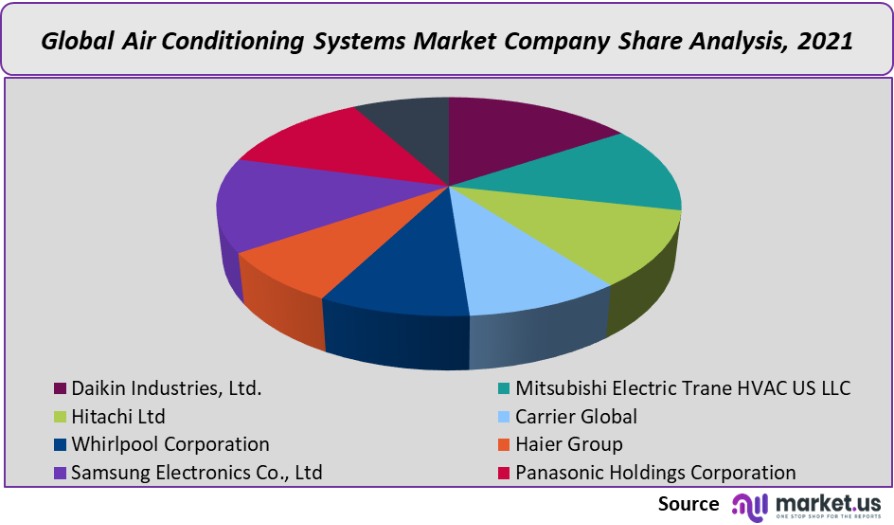

Market Share & Key Players Analysis:

Due to the presence of many established global players, this market is highly competitive. DAIKIN Industries Ltd., Whirlpool, Carrier Global, Hitachi Ltd., and Mitsubishi are some of the most prominent players in the market. These key players focused on growth strategies such as acquisitions, mergers, and collaborations to strengthen their market presence. Carrier global announced that it had purchased a controlling share in Giwee Group in June 2021.

Carrier was looking to expand its geographical footprint and strengthen their market position. Aside from acquisitions, market leaders also partner with local players to improve their products reach. Daikin Industries, Ltd., announced the creation of a joint venture, WASSHA Inc., in June 2020. Baridi Inc. emerged from the joint venture and provided air conditioning systems for Tanzanian citizens on a subscription model. Here are some of the most prominent global air conditioning systems market players.

Market Key Players:

- Daikin Industries, Ltd.

- Mitsubishi Electric Trane HVAC US LLC

- Hitachi Ltd

- Carrier Global

- Whirlpool Corporation

- Haier Group

- Samsung Electronics Co., Ltd

- Panasonic Holdings Corporation

- Electrolux AB

- Other Key Players

For the Global Air Conditioning Systems Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Market Size in 2022

114.34 Billion

Growth Rate

6.5%

Forecast Value in 2032

228.58 Billion

Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

What is the size of the air conditioning systems market in 2021?The air conditioning systems market size will be US$ 114,341 million in 2021.

What is the projected CAGR at which the air conditioning systems market is expected to grow at?The air conditioning systems market is expected to grow at a CAGR of 6.5% (2023-2032).

List the segments encompassed in this report on the air conditioning systems market?Market.US has segmented the air conditioning systems Market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By type, the market has been segmented into Unitary, Rooftop, and PTAC, By Technology market has been divided into Inverter, and Non-Inverter, By End-Use the market has been segmented into Residential, Commercial, and Industrial.

List the key industry players of the air conditioning systems market?Daikin Industries, Ltd., Mitsubishi Electric Trane HVAC US LLC, Hitachi Ltd, Carrier Global, Whirlpool Corporation, Haier Group, Samsung Electronics Co., Ltd, Panasonic Holdings Corporation. Electrolux AB, and Other Key Players are the key vendors in the air conditioning systems market.

Which region is more appealing for vendors employed in the air conditioning systems market?North America accounted for the highest revenue share of 36%. Therefore, North America's air conditioning systems industry is expected to garner significant business opportunities over the forecast period.

Name the key business areas for the air conditioning systems Market.The US, Canada, Mexico, China, Japan, Germany, France, UK, etc., are leading key areas of operation for the air conditioning systems Market.

Which segment accounts for the greatest air conditioning systems industry market share?With respect to the air conditioning systems industry, vendors can expect to leverage greater prospective business opportunities through the unitary ACs segment, as this area of interest accounts for the largest market share.

![Air Conditioning Systems Market Air Conditioning Systems Market]() Air Conditioning Systems MarketPublished date: Apr 2022add_shopping_cartBuy Now get_appDownload Sample

Air Conditioning Systems MarketPublished date: Apr 2022add_shopping_cartBuy Now get_appDownload Sample - Daikin Industries, Ltd.

- Mitsubishi Electric Trane HVAC US LLC

- Hitachi Ltd. Company Profile

- Carrier Global

- Whirlpool Corporation

- Haier Group

- Samsung Electronics Co., Ltd

- Panasonic Holdings Corporation

- Electrolux AB Company Profile

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |