Global Airway Clearance System Market Device Type (Positive Expiratory Pressure (PEP), Flutter Mucus Clearance Device, Other Device Types) By Application (Cystic Fibrosis, Neuromuscular, Bronchiectasis and Other Applications) By End Use (Hospitals & Clinics, Home Care Settings, Ambulatory Surgical Centers and Other End-Uses) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Apr 2022

- Report ID: 30071

- Number of Pages: 275

- Format:

- keyboard_arrow_up

Airway Clearance System Market Overview:

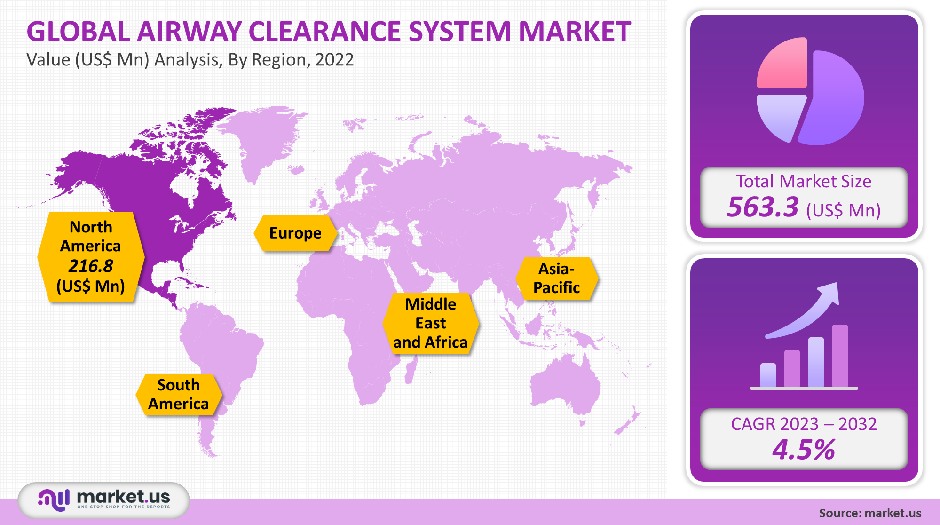

Global Airway Clearance System Market was worth USD 563.3 Million in 2021. It is projected to rise at a compound annual rate CAGR of exactly 4.5% between 2023 and 2032.

This market is driven by the increasing acceptance of airway clearance systems for cystic fibrosis, chronic bronchitis, and chronic obstructive pulmonary disease (COPD).

Global Airway Clearance System Market Scope:

Device Type Analysis

Patients going through excess mucus formation in their lungs can benefit long-term by using airway clearance systems. They allow facilitating pulmonary mucus clearing and lung expansion. These devices can be used to treat pulmonary atelectasis, lung expansion therapy, and mobilize lung secretions.

The market share for airway clearance devices was held by Flutter Mucus Clearance Devices in 2021. It is expected that this segment will grow the fastest over the forecast age. This device is used to clear excess mucous in bronchiectasis cystic Fibrosis, and other diseases related to excessive production of mucous. The U.S. Food and Drug Administration (FDA) regulates Flutter Mucus Clearance as a class II device.

The market shares for positive expiratory pressure called (PEP), which was over 25% in 2021, was second. The PEP improves the promotes mucus and collateral ventilation clearing by preventing the airway from closing. The PEP is the second most popular device after the flutter mucus clearing device. It is considered to be used by both adults and children, by using the pressure masks

Application Analysis

Market expansion is expected to be driven by the acceptance of airway clearance devices for the action of neuromuscular, Cystic Fibrosis, and bronchiectasis. These devices allow for clear excess mucus and lung expansion allowing patients to breathe properly.

With the rising commonness of cystic Fibrosis worldwide, it is likely that there will be an increase in the use of various kinds of airway clearing devices. In 2021, Cystic Fibrosis dominated the market in terms of revenue, as a result of its rising prevalence.

The Cystic Fibrosis Basis estimates more than 3,000 Americans have cystic fibrosis, while approximately 1,000 people are diagnosed each year. This market is expected to grow rapidly due to its rising prevalence and awareness about early diagnosis.

Patients with Bronchiectasis chronic sputum production and coughing need a prescription for PEP therapy or other airway clearing techniques. This segment is predicted to grow the fastest over the forecast age. Bronchiectasis refers to the permanent expansion and swelling of the airways.

Although it was once considered an orphan disease or rare condition, its prevalence is increasing worldwide. The incidence of bronchiectasis in Europe has increased by 40.5% over 10 years, according to a 2020 report by the Europe PMC.

End-Use Analysis

The major market share was held by the home health care sector in 2021, and it is expected to continue leading the market over the forecast age. The goal of home health care is to help individuals recover quicker and live more independently.

2021 was the biggest year for airway clearance systems. This segment is experiencing significant growth due to its need for cost-effective, quick, and comfortable treatment and diagnosis. According to the Centers for Medicare Services & Medicaid’s Office of the Actuary, almost US$ 103 billion was spent in the U.S. on home healthcare in 2021. This figure is projected to rise to US$ 173 billion in 2032.

This segment is driven by the availability of many treatment options for COPD, cystic fibrosis, and neuromuscular patients. The Hospitals and Clinics segment will grow steadily over the forecast age due to a wider range of services like medications, antivirals, and vaccinations. Due to better access to healthcare services, hospitals and clinics are the second-highest revenue-generating segment.

Hospitals and medical practices are often partnered with insurance companies to provide faster reimbursement, resulting in higher patient footfall.

Outpatient surgery centers are also called Ambulatory Surgery Centers (ASC). ASCs allow patients to have fewer resistant bacteria than the hospital. This reduces the chance of getting infected. ACS are also more cost-effective, efficient, and convenient, which results in better patient satisfaction.

Key Market Segments

Device Type

- Positive Expiratory Pressure (PEP)

- Flutter Mucus Clearance Device

- High-Frequency Chest Wall Oscillation (HFCWO)

- Intrapulmonary Percussive Ventilation (IPV)

- Other Device Types

Application

- Cystic Fibrosis

- Neuromuscular

- Bronchiectasis

- Other Applications

End-Use

- Hospitals & Clinics

- Home Care Settings

- Ambulatory Surgical Centers

- Other End-Uses

Market Dynamics:

The market is expected to grow because of the favorable insurance coverage provided by both the government and private companies that cover the use of this airway clearance system in respiratory diseases. This is especially true in developed countries. Hill-Rom and Electromed, Inc. offer both effective treatment and easy reimbursement.

Market growth is expected to be driven by rising patient awareness and the creation of a platform for COPD patients. For example, November is designated as National COPD Month worldwide. The COPD Foundation works with many respiratory healthcare organizations throughout the month to offer a variety of in-person and online activities to increase exposure.

Market growth will be driven by the increasing number of product updates from prominent medical device manufacturers over the forecast age. Microsoft, Great Ormond Street Hospital, and University College London collaborated on Project Fizzyo to make cystic fibrosis treatment more fun for children. The innovative technology used in this project allows for the gamification of the treatment.

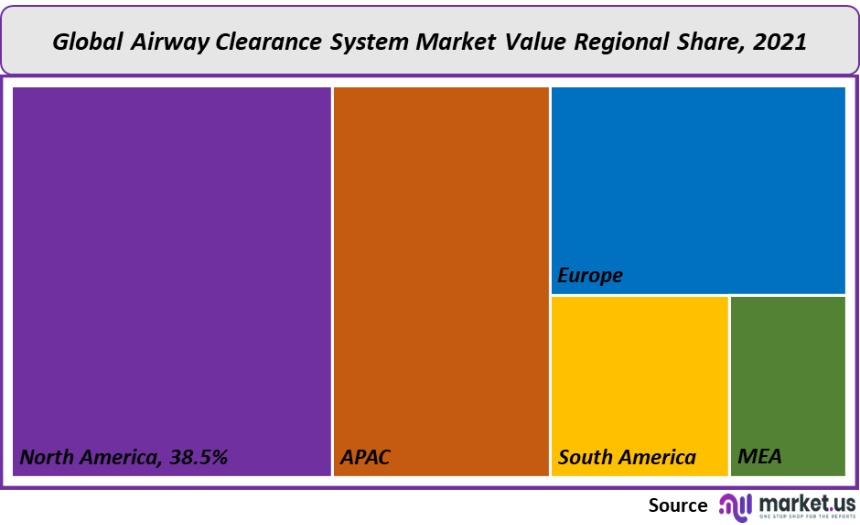

Regional Analysis

In 2021, North America was the region with the highest revenue share. The request for an airway clearance system will rise due to the increased collaboration between key players in improving their product portfolios and ensuring quality standards.

The growth is expected to be driven by increasing levels of air pollution and tobacco smoke exposure, which can trigger respiratory disorders. The growth is expected to be boosted by strict practice guidelines, such as those developed by the Anesthesiologists (the American Society) along with increasing government initiatives. The ASA’s guidelines for managing difficult airways deliver evidence-based interventions.

The Asia Pacific is expected to experience the fastest development during the forecast age. This is due to technological innovations and growing market penetration of key players as well as expansion of their supply network.

The WHO estimates that Japan has around 3 million asthma patients, with 30% suffering from moderate asthma and 7% suffering from severe asthma. The region’s growth will be fueled by increasing production commercial R&D and approvals.

Key Regions and Countries covered in the report:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

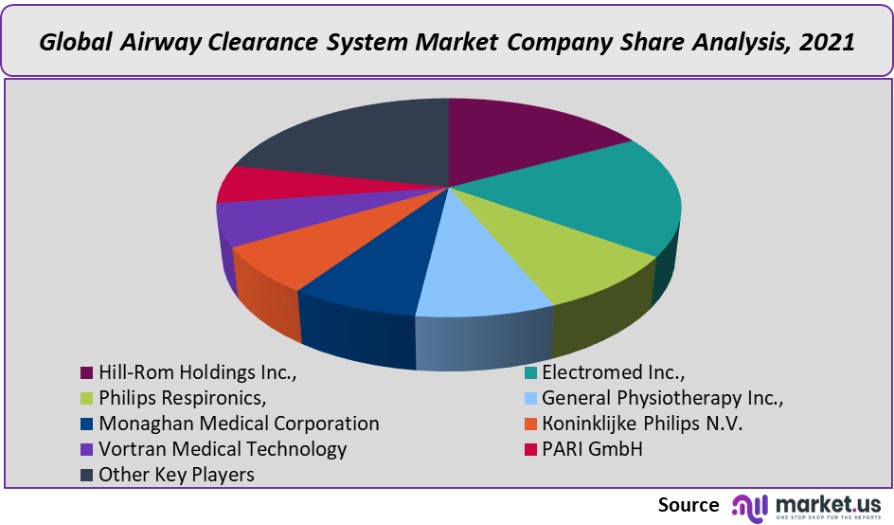

Market Share & Key Players Analysis:

To increase market share, most companies engage in strategic acquisitions. In August 2019, Hill-Rom, Inc. bought Breathe Technologies. The acquisition was a strategic decision by the former to enter noninvasive ventilation in order to offer a higher growth rate and higher-margin businesses.

Airway clearance system market players focus on developing new products that meet changing patient needs. Sunovion, for COPD treatment, launched the Lonhala Magnair U.S. inhalation solution in April 2021. PARI Pharma GmbH developed the eFlow technology for this inhalation product. Monaghan Medical Corporation upgraded the AeroChamber Plus flow-Vu product and added a mask to it.

To increase market penetration, the companies have partnered with distributor partners. In August 2019, Electromed, Inc. formed a partnership with two distributors of home medical equipment to sell SmartVest in the U.S. This partnership will generate its primary revenue from homecare through a direct sales channel for airway clearance systems.

The market leaders in airway clearance systems are, Hill-Rom Holdings Inc., Electromed Inc., Philips Respironics, General Physiotherapy Inc., Моnаghаn Меdісаl Соrроrаtіоn, Коnіnklіјkе Рhіlірѕ N.V., Vоrtrаn Меdісаl Тесhnоlоgy, PARI GmbH. and Other key players.

The market leaders in Airway Clearance System are as follows,

Market Key Players:

- Hill-Rom Holdings Inc.

- Electromed Inc.

- Philips Respironics

- General Physiotherapy Inc.

- Моnаghаn Меdісаl Соrроrаtіоn

- Коnіnklіјkе Рhіlірѕ N.V.

- Vоrtrаn Меdісаl Тесhnоlоgy

- PARI GmbH

- Other Key Players

For the Airway Clearance Systems Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

Q: What is the size of the Airway Clearance System market in 2021?A: The Airway Clearance System market is estimated to be valued US$ 563.3 million in 2021.

Q: What is the projected CAGR at which the Airway Clearance System market is expected to grow?A: The Airway Clearance System market is expected to grow at a CAGR of 4.5% (2023-2032).

Q: List the segments encompassed in this report on the Airway Clearance System market?A: Market.US has segmented the global Airway Clearance System Market Value (US$ Mn) Analysis by Region, 2022 market by geographic has segmented into (North America, Europe, APAC, South America, and Middle East and Africa). Device Type has segmented into (Positive Expiratory Pressure (PEP), Flutter Mucus Clearance Device, High Frequency Chest Wall Oscillation (HFCWO), Intrapulmonary Percussive Ventilation (IPV), Other Device Types) By Application has segmented into (Cystic Fibrosis, Neuromuscular, Bronchiectasis and Other Applications) By End Use has segmented into (Hospitals & Clinics, Home Care Settings, Ambulatory Surgical Centers and Other End-Uses)

Q: List the key industry players of the Airway Clearance System market?A: Hill-Rom Holdings Inc., Electromed Inc., Philips Respironics, General Physiotherapy Inc., Моnаghаn Меdісаl Соrроrаtіоn, Коnіnklіјkе Рhіlірѕ N.V., Vоrtrаn Меdісаl Тесhnоlоgy, PARI GmbH. and Other key players are the key vendors in the Airway Clearance System market.

Q: Which region is more appealing for vendors employed in the Airway Clearance System market?A: North America is expected to account for the highest revenue share of 38.5%. Therefore, North America’s Airway Clearance System industry is expected to garner significant business opportunities over the forecast age.

Q: Name the key areas of business for Airway Clearance System market?A: Key Markets of The US, Mexico, Canada, China, Japan, Germany, UK, Spain, France, etc. are key areas of operation for the Airway Clearance System market.

Q: Which segment accounts for the greatest market share in the Airway Clearance System industry?A: Concerning the Airway Clearance System industry, vendors can expect to leverage greater prospective business opportunities through the Positive Expiratory Pressure (PEP) segment, as this area of interest accounts for the largest market share.

![Airway Clearance System Market Airway Clearance System Market]() Airway Clearance System MarketPublished date: Apr 2022add_shopping_cartBuy Now get_appDownload Sample

Airway Clearance System MarketPublished date: Apr 2022add_shopping_cartBuy Now get_appDownload Sample - Hill-Rom Holdings Inc.

- Electromed Inc.

- Philips Respironics

- General Physiotherapy Inc.

- Моnаghаn Меdісаl Соrроrаtіоn

- Коnіnklіјkе Рhіlірѕ N.V.

- Vоrtrаn Меdісаl Тесhnоlоgy

- PARI GmbH

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |